Energy Storage

Craig Tropea

Solar

Jonathan Lwowski

Solar

Steve Macshane, CESSWI

Meteomatics, the weather intelligence and technology company that enables the world’s leading companies to accurately forecast the weather’s impact on business, released Part 1 of its two-part 2025 Weather Data Trends in Energy Report. The inaugural report reveals that more than half (51%) of energy leaders say their company’s weather forecasts are not highly accurate (under 80% accuracy). This leaves gaps in their ability to properly manage weather’s growing influence over their operations, especially extreme weather events–which nearly every energy company (93%) has been impacted by.

Meteomatics’ 2025 Weather Data Trends in Energy Report explores how senior energy leaders–from utilities and grid operators to energy traders–are using weather data to make critical business decisions and optimize operations. The report shines a light on the current state of the weather data energy companies rely on, including its accuracy, reliability and timeliness, and leaders’ ability to understand and take action on the data. The new report also reveals companies’ future investments in weather data and forecasting tools.

“The ability for energy companies and traders to accurately forecast the weather can mean the difference between a profitable energy investment or a loss, and whether energy companies can meet the demand of their customers or not,” said Martin Fengler, CEO of Meteomatics. “It’s more than simply having weather data–energy companies and traders need data that is accurate, timely and actionable. Without it, they run the risk of losing customers, opportunities and workers and making uninformed decisions that can impact their bottom line.”

According to the new two-part report, based on research conducted by market research firm Dynata, on behalf of Meteomatics, the majority of energy companies (69%) are only optimizing their operations for weather on a weekly basis–or less. The research reveals that issues arise not only from energy companies not integrating weather into their operations frequently enough–but also from a lack of accuracy. When asked their top challenges with current weather data, 43% of energy leaders say they lack accuracy, reliability, resolution, 40% are experiencing inefficient data delivery and 33% say their data is too complex and hard-to understand.

Additional findings of the report include:

● Hurricanes, floods and heatwaves pose the largest threat to energy companies. Companies name hurricanes (44%), floods (43%) and heatwaves (35%) as the extreme weather events with the largest impact on businesses. For energy utilities and grid operator executives specifically, 68% say extreme weather events are causing fluctuations in energy production.

● AI can help companies make sense of their weather data. Many energy leaders feel their weather data is not actionable (24%) enough, and 85% have high hopes that AI and machine learning (ML) can help. Leaders also say that visualizations and animations of weather data and mobile access to weather insights (81%) would make their weather data more actionable.

● Energy leaders continue to grow reliant on weather and climate data, despite current challenges. A majority of energy leaders say their reliance on weather data (67%) and longer-term climate data (69%) data will grow by more than 5% over the next 3-5 years. And not only will their reliance on this data grow, but their investment will as well. Every company surveyed plans to increase their spend on weather data services–with 33% revealing they plan to increase spending by 21% or more.

Meteomatics’ 2025 Weather Data Trends in Energy Report is based on responses from 272 senior level energy executives across grid operations, utilities and energy trading, in the U.S. Part 1 of the report can be found here.

Meteomatics | https://www.meteomatics.com/

Solestial, Inc. ("Solestial"), the solar energy company for space, announced a significant milestone with the closing of its $17M Series A funding round led by AE Ventures. The round welcomed new investors Crosscut Ventures, Zeon Ventures, and Mitsubishi Electric Corporation's ME Innovation Fund (general partner: Global Brain Corporation), with participation from existing investors Airbus Ventures, General Purpose Venture Capital, Industrious Ventures, Stellar Ventures, and Techstars.

The Series A funding enables Solestial to continue scaling its manufacturing capacity of silicon photovoltaics to 1 megawatt per year, a rate comparable to the estimated annual manufacturing capacity of all US and EU III-V space solar companies combined.

Alongside the raise, Solestial also announced the appointment of Margo de Naray as Chief Executive Officer. De Naray, formerly Senior VP & GM of Space Products and Services at Astra, brings 20 years of extensive commercial and operations management experience in growth and high-tech environments. Founding CEO, Stanislau Herasimenka, will assume the role of Chief Technology Officer to focus on advancing the company's product roadmap and rapidly scaling operations technology.

"We are thrilled to welcome Margo to lead Solestial into its next chapter," said Herasimenka. "This transition allows me to continue developing our cutting-edge technology, while Margo brings additional strategic leadership and operational experience to deliver at scale."

De Naray joins Solestial amid strong momentum. "We're seeing tremendous market demand, and we are focused on delivering high-quality products," she said. "We're hiring, scaling production, and qualifying our technology, which is already deployed on multiple missions in space."

"Space solar is a critical bottleneck in a rapidly growing industry with an ever-expanding set of missions—from national security to lunar exploration," said Beckett Jackson, Partner at AE Ventures. "Solestial is uniquely positioned to serve spacecraft manufacturers with mass production of a lightweight, radiation-hardened solution at lower cost and a fraction of the lead time of the current standard."

The only space solar manufacturer with demonstrated ability to self-heal radiation damage, Solestial offers spacecraft manufacturers the ability to significantly reduce cost and weight without sacrificing energy needs or performance.

"Solestial continues to revolutionize low-cost, lightweight solar power for space. Stan's continued focus on the technical breadth of Solestial products and Margo's new addition as a leader of the team are the ingredients to unlock the next phases growth and success," said Mat Costes, Partner at Airbus Ventures. "We are also thrilled to welcome new investors and see investors from the seed round returning, collectively signifying what we all know—the market applications for this technology are robust, fast accelerating, and Solestial is ready to meet market demand."

"Our colleagues at Mitsubishi Electric Corporation have been working with Solestial for a number of years to evaluate the potential of Solestial's technologies," said Komi Matsubara, Executive Officer (Associate), Vice President, Business Innovation at Mitsubishi Electric Corporation. "We see tremendous potential in Solestial's technology and are pleased to deepen the relationship and support their development."

With strong customer demand, Solestial has prioritized scaling production. Since opening its Tempe, Arizona manufacturing facility in 2023, the company has added square footage each year, more than doubled its workforce, and delivered commercial products to dozens of companies.

Solestial | https://solestial.com/

Mitsubishi Electric Corporation | www.mitsubishielectric.com

*U.S. dollar amounts are translated from yen at the rate of ¥151 = U.S. $1, the approximate rate on the Tokyo Foreign Exchange Market on March 31, 2024.

Boviet Solar Technology Co. Ltd. ("the Company" or "Boviet Solar"), a leading global solar energy technology company specializing in monocrystalline PV cells and its premium Gamma Series Monofacial and Vega Series Bifacial PV modules, proudly announces that its PV module manufacturing facility in Greenville, North Carolina, USA, has received ETL certification from Intertek, a Nationally Recognized Testing Laboratory (NRTL).

The ETL certification confirms that Boviet Solar's PV modules manufactured at the Greenville facility meet the stringent safety and performance requirements of UL 61730 and CAN/CSA C22.2 No. 61730 standards essential for the U.S. and Canadian solar markets.

"Achieving ETL certification for our U.S. facility is a significant milestone in our journey to serve the North American solar market with domestically manufactured, certified, and safe PV modules," said Peter VanNiekerk, Quality Manager, Boviet Solar Greenville PV Module Factory. "It reinforces our commitment to delivering not only high-performing but also fully compliant solar products to our partners and customers."

"This certification is a testament to the quality of our manufacturing processes and our team's attention to detail," added Sienna Cen, President of Boviet Solar USA. "It enables our Greenville facility to ship certified modules for immediate use in utility, commercial, and residential solar projects across North America."

The ETL mark, issued by Intertek, verifies that a product has been independently tested and meets the applicable safety standards required in North America. For PV modules, this includes:

ETL certification is a critical credential that enhances Boviet Solar's bankability, credibility, and readiness for large-scale project deployment in regulated markets.

Boviet Solar | www.bovietsolar.com

Avonlea Lithium, a subsidiary of Avonlea Environmental Technologies, announces the resounding success of its Advanced Chemical Cavitation Extraction of Lithium (ACCELi) Cavitek pilot plant in Northeast, Pennsylvania. After one month of continuous operation, the innovative mineral extraction system has exceeded performance expectations, marking a transformative milestone for domestic lithium and critical mineral production in the United States.

Unprecedented Results from Cutting-Edge Technology

Located at Kendra II’s Springville WMG 123 Facility, the ACCELi Cavitek pilot plant processed thousands of litres of wastewater brine daily from the Marcellus Shale Formation’s natural gas operations. Utilizing proprietary hydrodynamic cavitation technology, the system efficiently extracts lithium, strontium, magnesium, calcium, and barium from brine that would otherwise be discarded. Initial data indicates recovery rates and product purity appear excellent, with detailed results to be published following independent verification by Montrose Environmental Solutions.

A National Strategic Opportunity

The Marcellus Shale Formation holds lithium-rich brine capable of meeting up to 40% of current U.S. lithium demand. Avonlea’s ACCELi technology positions Pennsylvania as a cornerstone of America’s clean energy transition, offering a scalable solution to reduce reliance on foreign mineral imports.

“This pilot demonstrates the ACCELi system’s ability to deliver commercially viable, environmentally responsible mineral extraction,” said Douglas Brett, President of Avonlea Environmental Technologies. “The results not only validate our technology but also underscore the potential for Pennsylvania to lead in critical mineral innovation.”

Ken Scavone of Kendra II added, “This process is a cheaper and greener way to handle getting rid of produced water,” highlighting the dual environmental and economic benefits of the ACCELi approach.

Next Steps

Avonlea and Kendra II have agreed in principle to enter into an arrangement to work together to develop this opportunity across Pennsylvania and to evaluate other opportunities in Texas. Avonlea plans to build out the ACCELi lithium modular commercial-scale processing equipment in Pennsylvania centralizing US operations there.

Avonlea Environmental Technologies | https://avonlea.tech/

Li-Cycle Holdings Corp. (OTCQX: LICYF) (“Li-Cycle” or the “Company”), a leading global lithium-ion battery resource recovery company, announced that the Company and its subsidiaries in North America (collectively, the “Li-Cycle Group”) have sought and obtained from the Ontario Superior Court of Justice (the “Court”) an order (the "Initial Order") providing them with creditor protection pursuant to Canada’s Companies' Creditors Arrangement Act (the "CCAA"). As part of the Initial Order, the Court ordered, among other things, a stay of proceedings in favor of the Li-Cycle Group for an initial period to and including May 22, 2025 (the "Stay Period") and the appointment of Alvarez & Marsal Canada Inc. as monitor of the Li-Cycle Group during the CCAA proceedings (in such capacity, the "Monitor") to assist the Company with its restructuring efforts and to report to the Court.

The Company’s U.S. subsidiaries (including Li-Cycle Inc., which owns the Company’s Spokes in Arizona, Alabama and New York, and Li-Cycle North America Hub, Inc., which owns the Company’s Rochester Hub project) have commenced proceedings before the United States Bankruptcy Court for the Southern District of New York (the “U.S. Bankruptcy Court”) under Chapter 15 of the U.S. Bankruptcy Code (“Chapter 15 Proceedings”) for recognition of the CCAA proceedings as a “foreign main proceeding.” The U.S. Bankruptcy Court has imposed a broad stay, for the benefit of the Company’s U.S. subsidiaries, barring the commencement of legal action, the enforcement of remedies, any act to obtain possession of their property in the United States or to exercise control over such property, and other similar conduct.

As part of the CCAA proceedings, the Li-Cycle Group expects to conduct a court-supervised sale and investment solicitation process (the “SISP”), which will be a continuation of its previously disclosed efforts to seek buyers for its business or its assets.

The Li-Cycle Group has entered into a term sheet with an affiliate of Glencore Canada Corporation (“Glencore”), the Company's largest secured creditor, for a DIP Facility. The DIP Facility consists of a credit facility of up to a maximum principal amount of $10.5 million which is expected to be used to finance Li-Cycle’s working capital requirements, including for the continued operation of its Germany Spoke, and to implement the restructuring contemplated in the CCAA proceedings, such as the pursuit of the SISP. The DIP Facility remains subject to approval by the CCAA Court.

Additionally, the Li-Cycle Group has entered into an equity and asset “stalking horse” purchase agreement (the “Stalking Horse Agreement”) with Glencore. Glencore has agreed to a “stalking horse” credit bid for at least $40 million for certain of Li-Cycle’s subsidiaries and assets, including its Arizona Spoke, Alabama Spoke, New York Spoke, Germany Spoke, Rochester Hub project, and its intellectual property, as well as assumption of certain of its liabilities. The Stalking Horse Agreement remains subject to approval by the CCAA Court.

The Company’s Germany Spoke is expected to have sufficient working capital (including through the DIP Facility) to continue operating during the CCAA proceedings. Li-Cycle is undertaking efforts to wind down certain of its European subsidiaries, with the exception of its operating businesses in Switzerland and Germany. The Company will also be winding down its subsidiaries in Asia.

As a result of the CCAA Proceedings, an event of default has occurred under Li-Cycle’s loan agreement with the U.S. Department of Energy (“DOE”). Li-Cycle has not drawn down any funds under the DOE loan facility, as the Company has not satisfied the conditions precedent for the first advance.

The CCAA Proceedings have also caused an event of default under the Company’s convertible notes, which are held by Glencore and Wood River Capital, LLC (“Wood River Capital”). Wood River Capital now would have, in the absence of the stay of proceedings, the right to require the redemption of its convertible notes. The event of default under the Company’s convertible notes held by Glencore has resulted in an automatic acceleration such that the principal, interest and any make-whole premium due thereunder have become immediately due and payable.

As previously disclosed, the Company has been actively reducing its cost structure and seeking financing and strategic alternatives to fund its business. However, following a thorough review and after careful consideration of all available alternatives and in consultation with legal and financial advisors, the Company’s Board of Directors, following receipt of the recommendation of the Company’s Special Committee of independent directors, determined that it was in the best interests of the Company to commence the CCAA proceedings, with a view to pursuing the SISP and implementing one or more transactions with respect to its business and assets.

The Company’s Board of Directors and management will remain responsible for the day-to-day operations of the Company under the general oversight of the Monitor during the CCAA proceedings.

The Initial Order provides the Company with, among other things, relief from certain reporting obligations under securities legislation. As a result of the commencement of Chapter 15 Proceedings, the Company will no longer qualify to trade on the OTCQX Best Market and will be moved to the OTC Pink Markets effective May 15, 2025.

At the “comeback” hearing before the CCAA Court on May 22, 2025, the Li-Cycle Group intends to seek, among other things, approval of the DIP Facility, the SISP and the Stalking Horse Agreement as a “stalking horse” credit bid in the SISP and an extension of the Stay Period until a subsequent date to be determined.

Additional information regarding the CCAA proceedings is available on the Monitor’s website at https://www.alvarezandmarsal.com/LiCycle, or by calling Alvarez & Marsal at 1-844-864-9548, or by emailing at [email protected]. Documents relating to the restructuring process such as the Initial Order, the Monitor's reports to the Court, as well as other Court orders and documents shall also be published and made available on the Monitor's website.

Li-Cycle | https://li-cycle.com/

The National Oceanic and Atmospheric Administration (NOAA) estimates that in 2024 alone, the United States experienced 27 weather- and climate-related billion-dollar disaster events, with losses totaling $182.7 billion. Severe convective storms — a category that includes hazards such as high wind, extreme hail, and tornadoes — were responsible for 17 of those 27 events, resulting in an estimated $46.8 billion in combined damages.

Given the increasing frequency and severity of damaging convective storm events, it is important for clean energy project stakeholders to understand not only how hail forms but also how climate scientists predict hailstorms to change in the coming decades.

© Robert / stock.adobe.com

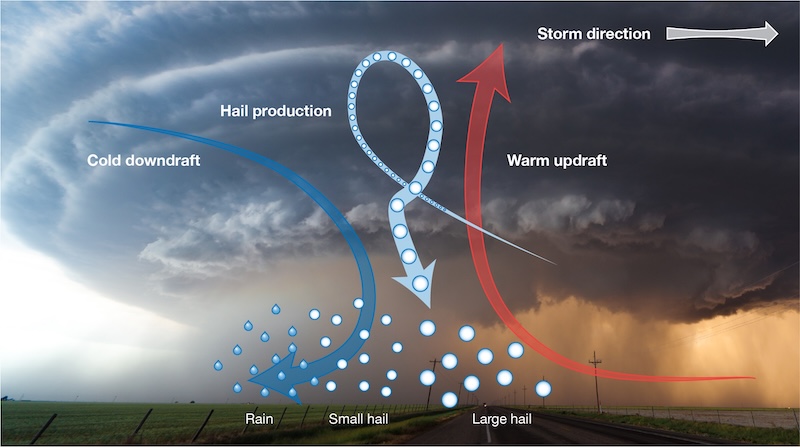

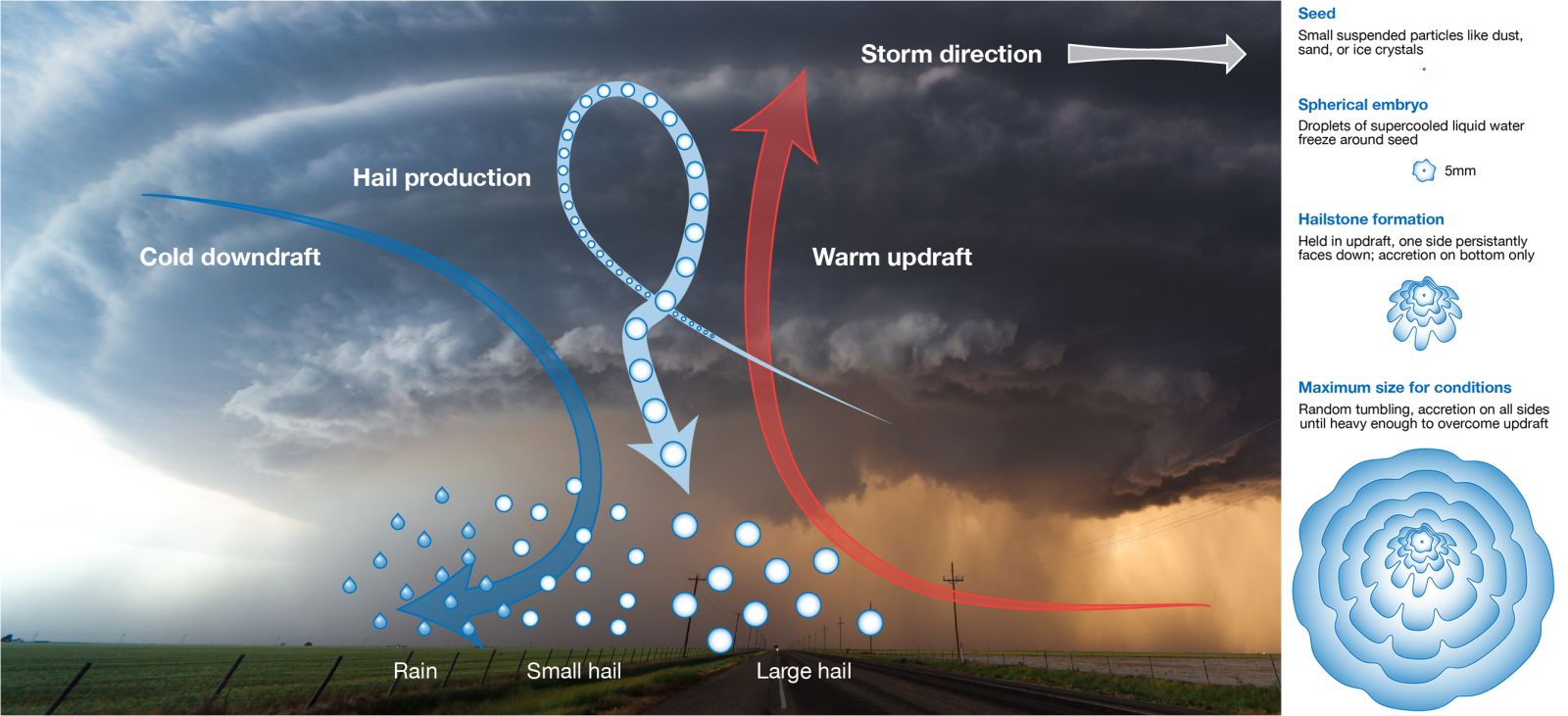

Hailstone formation and growth

The World Meteorological Organization defines a hailstone as any particle of ice larger than 5 mm in diameter generated within a convective thunderstorm. Generally, hail-producing convective storms develop when some mechanism — perhaps a large-scale meteorological phenomenon such as a weather front or even a physical geographic feature like a mountain range — forces large volumes of air to move vertically upward into an unstable layer of the atmosphere.

In the meteorological context, unstable refers to a state where the relative temperature of a pocket of air (typically referred to as an air parcel) is warmer and thus less dense than its surroundings. This concept of atmospheric instability is fundamental to severe thunderstorm generation, as it helps drive the hail generation process by supplying the necessary moisture content to the upper levels of the troposphere.

When these unstable conditions occur, the warm air parcel ascends on its own without the need for additional forcing from large-scale features. Conceptually, the air pocket behaves much like a hot-air balloon, which will rise freely after a propane burner heats the interior air and increases its buoyancy.

As parcels of warm air ascend, water vapor cools and condenses into the small water droplets that contribute to cloud formation. Even after the parcel reaches a subfreezing layer characterized by temperatures in the 0°C to -20°C range, some water droplets exist in supercooled liquid form, a key ingredient for hailstone creation and growth.

As this supercooled liquid water chaotically collides with ice-nucleating particles — which are small particles of sand, dust, or ice suspended in the atmosphere — it freezes, and the hailstones grow larger. This growth process can take various forms, significantly impacting the eventual density and physical characteristics of the resulting hailstones.

Dry growth occurs when temperatures are well below freezing and any remaining supercooled water droplets freeze immediately upon contact with a growing hail embryo, which traps tiny bubbles of air within the stone, leading to cloudy-looking, lower-density hail. Alternatively, wet growth occurs when temperatures are just below freezing, and water droplets that collide with a hail embryo first spread over its surface and freeze slowly, allowing air bubbles to escape, which creates a very transparent and dense layer of ice around the hailstone.

These growth processes are directly linked to hail density, meaning they are critical for understanding the ballistic-impact damage potential associated with falling hailstones.

Modeling hail in a future climate

Meteorologists have extensively investigated how the size of hail and the frequency of hail events are influenced by potential changes in the key factors that contribute to hail formation and growth during severe thunderstorms. These factors include variations in total moisture content and the microscale properties of cloud physics.

Given that every 1°C of anthropogenic warming is expected to coincide with a 7 percent increase in atmospheric water vapor content, convective instability is projected to increase over much of the United States by the end of the century. Moreover, higher moisture content would also add to the supercooled water available to a storm in the primary hail growth region, potentially leading to larger, denser hailstones.

It is likely that these effects will be counteracted, at least slightly, by deeper layers of warm air near the Earth’s surface, increasing the degree to which hail melts as it falls to the ground. However, larger hailstones have a greater mass and fall at a faster rate than smaller ones. Therefore, larger hailstones would be less impacted by this potential increase in melting.

An increase in moisture content not only provides potential for greater availability of supercooled water but also allows for greater energy release through the condensation process. More energy release would further the positive feedback loop that is atmospheric instability and add to the potential for more frequent and stronger severe thunderstorms.

Transitioning from understanding how these atmospheric ingredients may change in a future climate into actual predictions of hail frequency and severity presents a problem: If we only model the important hail creation variables, we are only predicting environments favorable for hailstorms and not hail occurrence directly.

To get around this issue, some climate scientists have begun predicting the future landscape of severe weather using a tactic known as dynamical downscaling, which utilizes the output from a global climate model as the input to short-term regional weather models that predict our weather patterns on a day-to-day basis. In this way, climate modelers can allow storms to initiate based on a set of predicted starting conditions, rather than relying solely on an ingredients-based modeling approach.

Such studies predict that by the end of the century, the number of >20 mm summertime hail days in the western United States may increase by up to 6 days per month but decrease by 3 to 5 days per month east of the Rockies, where hail risk is generally greatest. Increases in days with significantly severe hail events (>50 mm) are expected to increase over the same time scale, potentially by 2 days per month in the Central Plains states.

Changes to severe convective storm meteorology are not an insurmountable barrier to clean energy project development activities. By continuing to innovate, industry stakeholders can develop creative solutions that mitigate severe weather risk. Moreover, by better understanding the complex meteorological systems that generate these events, we can pave the path to a more resilient future where we are better prepared to deal with severe convective storms and extreme hail events.

Denis Weaver is the staff meteorologist for VDE Americas, a technical advisory firm that has supported the financing of over $15 billion in clean energy assets and is a leading expert in hail risk intelligence and loss prevention.

VDE Americas | www.vde-americas.com

Offshore wind developer US Wind has entered memoranda of understanding with Maryland Department of Natural Resources (DNR) and Delaware Department of Natural Resources and Environmental Control (DNREC) in which the company has proposed $20 million in support to local fishermen.

According to a press release, the agreements with the states were developed in response to watermen feedback as US Wind continues to pursue a project off Sussex and Worcester Counties. The Trump Administration’s reversal of a Biden-era push for offshore wind has left the future of the project uncertain.

$13.5 million of the $20 million proposal would go to the following in Maryland:

-Grants for fishing businesses in the harbor to continue the offloading of catch and ice services;

-30 years of funding for West Ocean City Harbor maintenance, such as dredging requested each year by the community, dock and shore stabilization

-Substantial money for gear development, marketing of local seafood, fishing business development, and incentives for new commercial fishermen.

In addition to the separate Resilience Funds, $5.4 million of the proposed payments would be distributed as claims-based compensation for commercial and for-hire recreational fishermen who can demonstrate US Wind’s projects impacts their revenue, according to the company. The proposal also includes over $1 million is upgraded navigation and safety equipment for local vessels operating near the windfarms.

US Wind is still pursuing a facility in the West Ocean City Harbor to serve as their main location to plan and coordinate offshore wind turbine maintenance and service. Under the new MOU with Maryland, it will only use one of the two properties they have optioned in West Ocean City.

US Wind | https://uswindinc.com/

Energy Storage May 15, 2025

Natural disasters including hurricanes, severe storms, winter storms, wildfires and heat waves are becoming more frequent and severe, causing widespread power outages across the United States. Between 2000 and 2023, 80 percent of U.S. power outages w....

Building codes and minimum building standards such as ASCE 7, Eurocode, and the National Building Code of Canada, are used to calculate the maximum forces a building may encounter. These forces result from wind, snow and seismic activity. For wind up....

The National Oceanic and Atmospheric Administration (NOAA) estimates that in 2024 alone, the United States experienced 27 weather- and climate-related billion-dollar disaster events, with losses totaling $182.7 billion. Severe convective storms — a....

As the world transitions to clean energy, one of the biggest challenges facing the solar industry isn’t technology or financing — It’s labor. The demand for skilled workers to install and maintain solar infrastructure far exceeds supply, threat....

At the first RE+ Microgrids event in New....

Ensuring the reliability and efficiency ....

Natural disasters including hurricanes, severe storms, winter storms, wildfires and heat waves are becoming more frequent and severe, causing widespread power outages across the United States. Between 2000 and 2023, 80 percent of U.S. power outages w....

The geospatial sector has long worked behind the scenes, enabling technological advancements. However, with the rise of artificial intelligence (AI) and digital twins, it is now playing a vital role in the modernization of energy grids. These innovat....

Businesses and communities have long relied on centralized power grids, but as energy demand increases and reliability becomes less certain, many are looking for alternatives. More companies are adopting microgrids and virtual power plants (VPPs), cr....

How can one know the climate impact of a purchase or investment? Clean energy production is about climate mitigation, but how can one know the climate impact of a purchase or investment? Many investors and buyers want to understand how t....

There is no question that weather events place enormous stress on the country’s power grids. Nowhere is this more clearly on display than in the renewable energy market, including the turbulent conditions of the offshore wind industry. As....

Hydrogen peroxide (H2O2) is well known as a household disinfectant, but in its concentrated forms, it has a powerful second life as a clean and efficient propellant used in space applications. When decomposed, H2O2 breaks down into oxygen and wa....