A Green Hydrogen Case Study: Maximizing climate returns with levelized cost of carbon abatement

How can one know the climate impact of a purchase or investment?

Clean energy production is about climate mitigation, but how can one know the climate impact of a purchase or investment? Many investors and buyers want to understand how to compare and rank energy and abatement options across different geographies and markets.

Hydrogen is a particularly complicated case. Its appeal is clear: it stores chemical energy, emits no greenhouse gases when used alone, and already supports vital sectors like fuels and fertilizers. Yet, widespread adoption of clean hydrogen has been slow amid market uncertainties. In the United States, updated guidance for the 45V tax credit under the Inflation Reduction Act seeks to spur low-carbon hydrogen production. In Japan and Europe, new mandates (like FitFor55), emerging markets (like the GX-ETS and GX League), and new funding will drive decisions around hydrogen investment and production. These developments arrive amid rising electricity costs, infrastructure challenges, and the pending COP30 negotiations.

Addressing key questions with LCCA

Where does hydrogen fit? Which production methods make sense in specific regions or for specific applications? And what are the real climate benefits relative to the costs?

Levelized Cost of Carbon Abatement (LCCA) evaluates different energy and climate abatement pathways, including power (renewables, nuclear, natural gas with CCS), clean fuels (SAF, e-fuels, biomethanol), and clean commodities (fertilizer, clean cement, green steel). A recent report focused on various hydrogen production methods alongside other decarbonization strategies for site-specific conditions. By comparing costs and potential emissions savings in specific locations, LCCA clarifies when and where hydrogen delivers the most benefit.

While success stories exist for all energy and climate technologies, large-scale deployment often hinges on site-specific conditions — feedstocks, energy sources, and regulatory policies. Small pilot projects test feasibility, uncover risks, and offer lessons before significant capital is committed.

A project in a desert may benefit from low-cost solar electricity to power electrolyzers but may suffer from lack of infrastructure or market access. Another project in a windy corridor might capitalize on abundant wind resources but face higher capital costs.

Market-aligning policies such as 45V tax credits can reduce some financial risk. However, these incentives vary by region as well (e.g., the value of the credit is closely tied to local power and electrolyzer performance) and the evolving political landscape still carries risks for project developers. Understanding key nuances, like 45V’s additional guidance around limits of using nuclear power potential impacts of upstream methane leakage, helps stakeholders rank investment opportunities when paired with robust, quantitative analysis.

In this context, the secret of treasure hunting is knowing where to dig and how deep.

A company’s decarbonization plan must factor in energy use, process requirements, and how solutions like clean hydrogen might displace higher-emissions fuels. That’s where location-specific analysis becomes critical — especially for long-term decisions.

Estimating cost per ton abated

Decarbonization options — from fuel switching to retrofitting power plants — differ in up-front capital, operational costs, and greenhouse gas reductions. Using LCCA can help integrate and compare these elements by calculating the cost per ton of avoided GHG emissions. This enables decision-makers to evaluate hydrogen on equal footing with alternatives like renewable power purchase agreements, biogas, or sustainable aviation fuels.

For hydrogen, the LCCA hinges on hydrogen cost (capital expenditures, operating expenses, net present value) and the emissions abatement delivered relative to the status quo. With this approach, stakeholders can pinpoint “lowest-hanging fruit,” such as sites that have low-cost, clean energy, where local policies enhance feasibility to reduce costs, or find applications that deliver the largest climate benefit

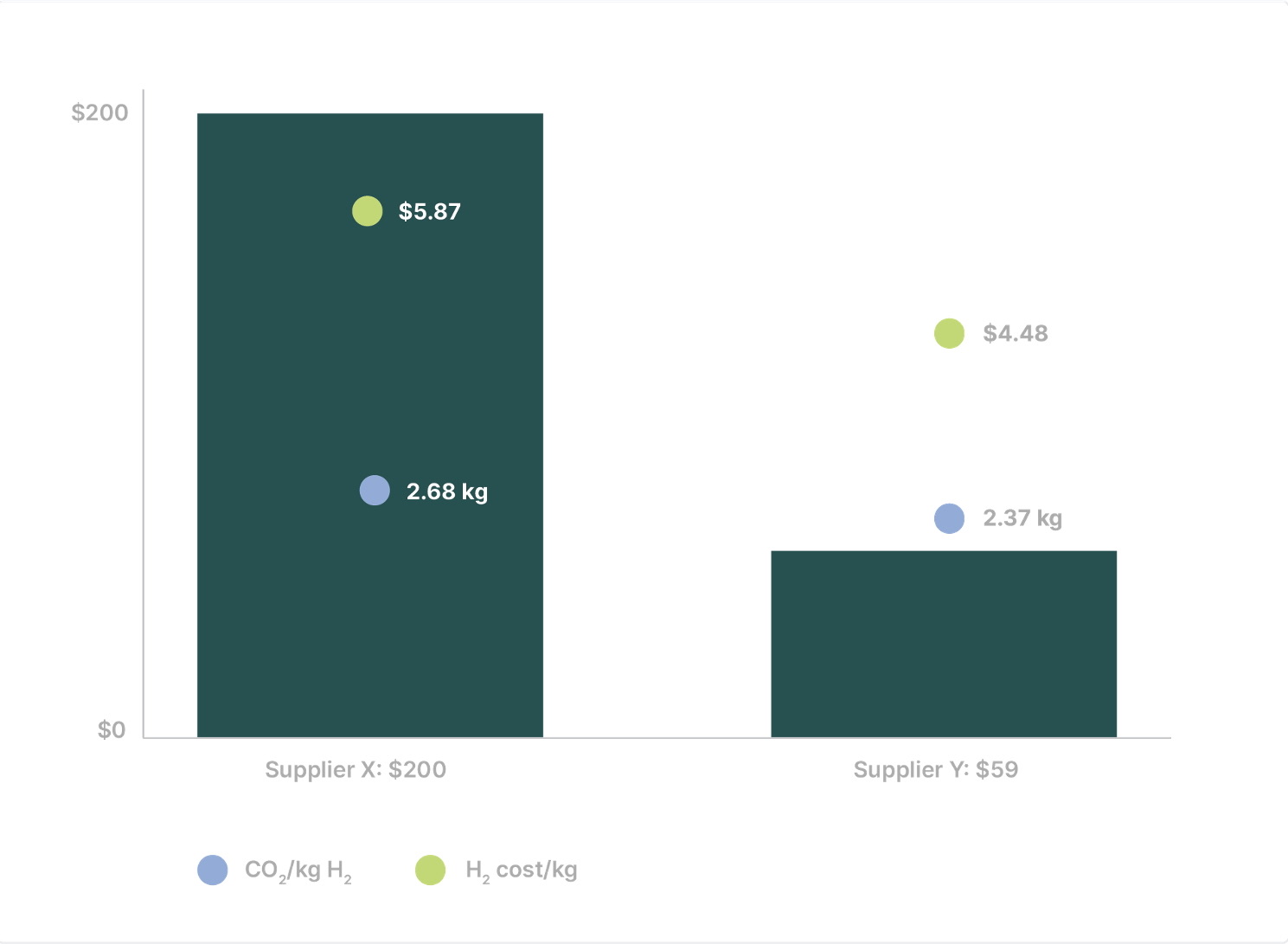

Cost, in US$, per ton of abated emissions (source Carbon Direct)

As a simple example, let’s compare two electrolyzer suppliers of hydrogen for a unique client that uses periodic excess electricity. Hydrogen is being provided for a non-critical (~98 percent reliable) application. The graph shows cost, in $US, per ton of abated emissions. Supplier Y is the better e due to fast ramp-up and ramp-down rates despite lower overall efficiency. Note: CO2 = carbon dioxide, H2 = hydrogen, kg = kilograms.

A practical lens for decision-makers

Effective decarbonization calls for cross-sector collaboration, specialized market intelligence, and technical expertise. Investors and policy makers seek ways to both maximize climate benefit and minimize cost while building working energy systems. Even organizations with in-house capabilities can find it challenging to navigate overlapping subsidies, policies, and regulatory frameworks.

The LCCA approach simplifies these complexities, enabling an “apples-to-apples” assessment across industries like construction, petrochemicals, and freight transport. Because no single technology will solve all climate challenges, highlighting the best-fit opportunities and clarifying associated trade-offs with LCCA analysis empowers decision-makers to invest finite resources for maximum impact. Against this backdrop, hydrogen can play a transformative role where it makes economic and environmental sense. Combining targeted analysis with forward-looking policies and capital discipline will be essential to unlocking hydrogen’s potential — one region, one ton of carbon abatement, and one smart project at a time.

Nicki Stuckert, PhD is Senior Decarbonization Engineer at Carbon Direct. Nicki focuses on realistic pathways toward industrial decarbonization with Hydrogen, and carbon capture systems. She received her PhD at the University of Michigan with a focus on hydrogen storage and direct air capture. She spent nine years in industrial gas research and development commercializing these technologies from initial concept to full deployment. Her past years have been spent as a technology expert focusing on hydrogen storage/transportation and decarbonized production methods including carbon capture and storage, electrolysis, and pyrolysis.

Dr. Julio Friedmann is Chief Scientist at Carbon Direct, and one of the most widely known experts in the U.S. on carbon management, hydrogen, and industrial decarbonization. Dr. Friedmann served as Principal Deputy Assistant Secretary for the Office of Fossil Energy at the Department of Energy where he was responsible for DOE’s R&D program in advanced fossil energy systems and carbon capture, use, and storage (CCUS). More recently, he was a Senior Research Scholar at the Center on Global Energy Policy at Columbia, where he developed the LCCA methodology.

Carbon Direct | www.carbon-direct.com

Author: Nicki Stuckert, PhD and Julio Friedmann, PhD

Volume: 2025 July/August