Energy Storage

FranklinWH Energy Storage Inc.

Energy Storage

Dr. Josef Daniel-Ivad

Energy Storage

TRC Companies

Sitetracker, the global leader in complete Asset Lifecycle Management, announced that Enersense, a leading lifecycle partner for customers operating in energy transmission and production, industrial energy transition and telecommunications services across Finland and the Baltics, has selected Sitetracker to digitize and scale its operations. The implementation enabled Enersense to replace legacy systems, standardize workflows, and support their ability to deliver services with short lead times and high process precision. The first phase of implementation is already supporting Finland’s 5G and rapidly expanding fiber-to-the-home (FTTH) initiatives.

Before Sitetracker, Enersense relied on spreadsheets and email to manage project execution, resulting in limited visibility into project milestones, asset tracking, and field performance. As 5G and FTTH deployment accelerated, these manual processes created operational bottlenecks, slowed invoicing, and hindered communication with customers and contractors.

By implementing Sitetracker, Enersense now gains:

“Sitetracker gives us the transparency and agility needed to manage complex network rollouts efficiently,” said Miika Erola, EVP at Enersense Connectivity. “With a single platform for project and field data, we can ensure our teams are aligned, customers are informed, and resources are deployed where they have the greatest impact. This is a major step toward supporting Finland’s digital and energy transition goals.”

Enersense’s broader digital transformation aims to increase efficiency and transparency across its operations. Sitetracker’s scalability and integration capabilities are helping the company streamline IT systems, eliminate redundant tools, and drive performance.

“Enersense is a great example of how forward-thinking companies are modernizing infrastructure delivery to accelerate the energy and digital transition,” said Giuseppe Incitti, CEO of Sitetracker. “By moving to a centralized, intelligent platform, Enersense is setting a new standard for operational excellence in telecommunications and energy connectivity.”

Sitetracker | https://www.sitetracker.com/

Verdek, LLC ("Verdek"), an end-to-end electric vehicle (EV) charging infrastructure provider, announced that it has been awarded Sourcewell Contract #021825-VRK for EVSE sales, installation, products, and related services. The cooperative contract enables eligible public-sector and nonprofit organizations to procure EV charging solutions through a competitively solicited contract.

The contract includes DC fast charging solutions (24–200+ kW, including high-power-charging-ready configurations), Level 2 AC chargers (7.7–19.2 kW), and comprehensive services such as site survey and feasibility, design and engineering, procurement enablement, utility coordination and incentives, turnkey installation, and ongoing operations, warranty, and service level agreements (SLAs).

On December 10, 2025, Verdek and Sourcewell formally formed the partnership at a Contract Launch event held at Sourcewell's headquarters in Staples, Minnesota. Senior officials from both organizations attended to align go-to-market execution, contract adoption objectives, and near-term customer enablement priorities.

Sourcewell Participating Entities include thousands of public agencies across the United States and Canada, spanning government agencies, municipalities, higher education, K–12 education, nonprofit and tribal entities, and other public agencies. In addition, pursuant to 10 U.S.C. § 2679, eligible United States Department of Defense authorized installations may access Sourcewell's awarded cooperative purchasing master agreements through intergovernmental support agreements. Verdek was selected through Sourcewell's competitive RFP #021825 process. Sourcewell's Proposal Opening Record for the solicitation lists 86 proposer responses received.

"Being awarded the Sourcewell contract is a major milestone for Verdek and an important signal of trust in our ability to deliver turnkey charging infrastructure at scale," said Guy Mannino, CEO of Verdek. "Public agencies and institutions need speed, compliance, and accountability when they deploy EV charging. This contract gives them a streamlined path to procure proven hardware and expert services—backed by Verdek's nationwide delivery model."

"Sourcewell is excited to continue to offer public agencies charging solutions through our Electric Vehicle Supply Equipment with Related Services category". – Mike Domin Associate Director of Cooperative Contracts – Fleet.

Sourcewell | https://www.sourcewell-mn.gov/cooperative-purchasing/021825-VRK

Verdek | www.verdek.com

TotalEnergies and Google have signed a 21-year Power Purchase Agreement (PPA) to supply Google with a total volume of 1 TWh (equivalent to 20 MW) of certified renewable power from the Citra Energies solar plant in the northern Kedah province. The solar farm, which is scheduled to enter construction in early 2026, will support Google’s data center operations in Malaysia. The Malaysian Energy Commission awarded the project to TotalEnergies (49%) and its local partner MK Land (51%) in August 2023, as part of Malaysia’s Corporate Green Power Programme (CGPP).

The agreement reflects Google’s strategy of enabling new, clean energy to the grid systems where they operate, and builds upon the PPA announced by TotalEnergies in November to supply renewable power to Google’s data centers in the United States.

“We’re thrilled to build on our collaboration with TotalEnergies in Malaysia. This agreement is a key part of our strategy to make meaningful investments that benefit the economies where we operate. By enabling this new clean capacity, we are supporting local growth of the electricity system hosting our infrastructure”, said Giorgio Fortunato, Head of Clean Energy & Power, Asia Pacific, Google.

“We are delighted to strengthen our collaboration with Google through this agreement to supply renewable electricity to their new data center in Malaysia”, said Sophie Chevalier, Senior Vice President Flexible Power & Integration at TotalEnergies. “This PPA illustrates our Company’s ability to offer competitive power solutions tailored to the needs of major tech groups, both in mature markets, such as the United States and Europe, and in emerging countries like Malaysia. It also contributes to achieving our target of 12% profitability in the power sector.”

The PPA will take effect upon the project’s Financial Close, expected in the first quarter of 2026.

TotalEnergies’ tailored PPA solutions for its clients

The PPA with Google follows similar contracts signed by TotalEnergies with companies such as Data4, STMicroelectronics, Saint-Gobain, Air Liquide, Amazon, LyondellBasell, Merck, Microsoft, Orange and Sasol, and provides a further illustration of TotalEnergies’ ability to develop innovative solutions by leveraging its diverse asset portfolio to support its customers’ decarbonization efforts.

TotalEnergies and electricity

TotalEnergies is building a competitive portfolio that combines renewables (solar, onshore wind, offshore wind) and flexible assets (CCGT, storage) to deliver clean firm power to its customers. As of the end of October 2025, TotalEnergies has more than 32 GW of installed gross renewable electricity generation capacity and aims to reach 35 GW by the end of 2025, and more than 100 TWh of net electricity production by 2030.

TotalEnergies | https://totalenergies.com/

Leap, a leading platform for building and scaling virtual power plants (VPPs), and Enel North America, a clean energy leader in the US and Canada, announced a new partnership to connect more commercial and industrial (C&I) distributed energy resources (DERs) to utility demand response programs nationwide. Together, Enel and Leap will leverage C&I capacity already installed on the grid to help balance energy demand in real time in Enel’s extensive utility network while adding valuable revenue for Leap’s C&I partner base.

The collaboration will begin with three utility programs Enel manages in Washington, Arizona, and the Tennessee Valley and will expand over time to additional markets across the country.

Enel, the world leader in demand response and one of the largest VPP aggregators in North America, also serves as an exclusive partner to utilities across the United States to develop and manage demand response programs. Partnering with Leap enables Enel to quickly enroll more capacity into the demand response programs it administers, while providing C&I customers with new opportunities to earn revenue for supporting grid reliability.

For Leap, the partnership marks a wider expansion into vertically integrated utility markets, extending the reach of its automated platform and offering its technology partners additional revenue opportunities for the C&I resources they sell and manage.

“At a time of surging energy demand from data centers, electrification, and extreme weather events, it’s essential that we tap into the flexible capacity already available on the grid to maintain resiliency and keep energy costs down,” said Jason Michaels, CEO of Leap. “Working with Enel, one of the global leaders of the energy transition, allows our partners to access new markets through Leap’s automated platform, enabling more commercial customers to get rewarded for providing fast, cost-effective support to the grid.”

Leap | leap.energy

Enel North America | enelnorthamerica.com

Nelson Family Vineyards in Mendocino County, California, is powering 100% of its operations with renewable energy following the installation of a floating solar system on an irrigation pond. The innovative project enables the 74-year-old, 1,800-acre family-run farm to operate entirely on clean energy without taking any agricultural land out of production.

Together with an existing solar system on the roof of the winery, the floating photovoltaic (FPV) system is expected to generate around 200,000kWh of electricity per year—enough to power the winery, agricultural pumps, tasting room, shop, and 12 on-site homes. This is projected to save Nelson Family Vineyards an estimated $90,000 annually, significantly reducing operating costs while also supporting its commitment to sustainable operation.

“With the cost of grid electricity rising so sharply, becoming energy independent will have a major and immediate impact on our operation. This investment will save us a tremendous amount of money year after year,” says Tyler Nelson, the owner of Nelson Family Vineyards. “Best of all, because the system floats on a pond, it does not take a single acre of land out of production. That means our full 1,800 acres can be used solely for what matters most—agriculture and supporting wildlife habitat.”

Real-World Research Platform for UC Davis

The FPV installation will also serve as a key field site for a comprehensive U.S. study on the ecological impacts of FPV technology. Scientists from the UC Davis Wild Energy Center will use the system to examine how FPV systems influence water quality, aquatic species, microclimates, and biodiversity in an agricultural setting.

A major focus of the study will be to determine whether shading from the floating solar panels can help control invasive zooplankton (water fleas) and aquatic weeds that frequently clog the vineyard’s high-efficiency drip irrigation filters—an issue that requires hourly maintenance during peak season. By limiting sunlight, the panels are expected to slow the growth of the water fleas and aquatic weeds, reducing both labor-intensive maintenance and chemical use.

Dr. Elliott Steele, Postdoctoral Researcher at the UC Davis Wild Energy Center, comments: "In conjunction with deploying a new floating solar installation, Nelson’s Family Vineyards has enabled important ecological research on its property. By providing site access to researchers from the UC Davis Wild Energy Center, the vineyard is supporting studies on how floating solar interacts with wildlife and water quality, helping advance our understanding of how floating solar can expand responsibly."

.jpeg)

The floating solar system was designed and installed by Noria Energy, a Sausalito-based renewable energy specialist and an affiliate company of Sunrock Distributed Generation. Sunrock Distributed Generation is a leading platform for commercial distributed energy solutions. It is dedicated to helping operations of all sizes to unlock the benefits of solar and energy storage solutions with no upfront costs by providing Power Purchase Agreements and Energy Services Agreements.

“It’s been a privilege working with the Nelson Family and UC Davis to help the winery save money, achieve energy self-sufficiency, and conserve natural resources,” says Noria Energy’s President, Ron Stimmel. “This project demonstrates how FPV technology can turn underutilized water surfaces into reliable, highly productive power sources, enabling growers to improve both the sustainability and efficiency of their operations while keeping farmland fully productive.”

Nelson Family Vineyards | https://www.nelsonfamilyvineyards.com/

Capital Good Fund announced the statewide expansion of its Pennsylvania BRIGHT solar leasing program, made possible through a $3.2 million investment from Candide Group’s Afterglow Climate Justice Fund.

Since 2024, Pennsylvania BRIGHT has made solar energy affordable and accessible to families historically left out of the transition to affordable renewable energy options. Through leasing, homeowners can install panels and secure monthly savings on energy bills without the burden of maintenance responsibilities. As a mission-driven organization, Capital Good Fund is well-positioned to offer customer-friendly lease terms, including no minimum credit score requirement and no hidden fees. The program is now open to any household earning under $165,000 annually or located in Low-Income, Disadvantaged Communities (LIDACs).

"Afterglow is proud to support the Pennsylvania BRIGHT residential program. Projects like Pennsylvania BRIGHT are critical for ensuring all communities can participate in a just climate transition,” noted Neal Parikh, Co-Managing Director Climate Justice Fund at Candide Group. “The savings these projects will generate ensure that Pennsylvania residents spend less of their income on energy bills. Capital Good Fund’s work in increasing access to affordable clean energy alternatives is a critical solution to rising energy costs affecting households across the US.”

The statewide expansion comes at a pivotal time for clean energy adoption. The Federal Residential Clean Energy Tax Credit will be discontinued after December 31, 2025, but Pennsylvania BRIGHT allows low- and moderate-income (LMI) homeowners to benefit from solar energy savings even after the federal tax credit ends. “Expanding Pennsylvania BRIGHT statewide is a milestone for energy equity,” said Andy Posner, Founder and CEO of Capital Good Fund. “At a time when energy costs are putting real pressure on working families, this program proves solar can be a powerful tool, opening doors so more Americans can save money and secure energy independence.”

With support from Leon Lowenstein Foundation, The Pittsburgh Foundation, The Heinz Endowments, Henry L. Hillman Foundation, and BQuest Foundation, Capital Good Fund launched pilot programs in Southwest and Southeast Pennsylvania last summer. The Southeast program is powered by local partnerships with Philadelphia Green Capital Corporation (PGCC) and the Philadelphia Energy Authority (PEA), which operates Solarize Greater Philadelphia. Through Solarize Greater Philadelphia, participating installers will offer job opportunities and workforce training within the very same LMI communities where the solar systems are being leased.

“Pennsylvania BRIGHT makes it possible for LMI homeowners to reduce costs using clean, affordable solar energy,” said Maryrose Myrtetus, Executive Director of the Philadelphia Green Capital Corp. “Even though federal tax credits for residential installations expire later this year, solar leases are providing clear benefits. Pennsylvania BRIGHT removes upfront costs and credit barriers. By partnering with Solarize Greater Philadelphia, we’re making it possible for homeowners of all income levels to access savings and stability.”

Pennsylvania BRIGHT has already helped over 60 households lower energy bills and build resilience across the Commonwealth. Trevor Southworth, 33, of Millvale, had panels installed earlier this year. “It’s an investment in my house and my neighborhood,” he said, noting that the process has been transparent, affordable, and easy. Mark Gorman, 74, of Pittsburgh, saw his solar system go live this spring. “We have three grandchildren, and we want to send a message that there is another way,” he said. “Programs like Pennsylvania BRIGHT help bridge the gap so everyone can be part of the clean energy transition.”

Interested residents can check their eligibility and get started by filling out an inquiry form.

Capital Good Fund | https://capitalgoodfund.org/

Homerun Resources Inc. (TSXV: HMR) (OTCQB: HMRFF) ("Homerun" or the "Company") is pleased to announce that road improvement works benefiting the Company's planned silica processing and solar glass industrial hub in Santa Maria Eterna, in the Municipality of Belmonte, State of Bahia, Brazil, are firmly underway.

The Santa Maria Eterna road project, connecting BA-274 and BA-982 and providing direct access to BR-101, the principal federal highway in the region, is being funded primarily by the Federal Government of Brazil through the Ministry of Transport, via the Union budget, with the State of Bahia acting as the executing entity. Recent field photographs provided to the Company show grading, compaction, material placement and water-truck operations along the Santa Maria Eterna corridor, confirming that road improvement activities have commenced on the segments that form the main logistics route to Homerun's Santa Maria Eterna silica project.

Figure 1 & 2. Road construction underway along BA-982 SME District

The 2026 draft federal budget (PLOA 2026) includes a specific road construction line item, "BA-274 (Santa Maria Eterna) - Entr. BA-275(A) (Itapebi)", under code 1C09 - Construction of road section, within the Ministry of Transport's investment program, with an allocated amount of R$15 million. This classification indicates that the initiative is financed predominantly with federal fiscal-budget resources ("recursos próprios" of the federal treasury). While this BA-274 / BA-275 - Santa Maria Eterna item is not described in public documents as being exclusively or formally dedicated to Homerun's future solar glass plant, the route directly services the Santa Maria Eterna district and is highly supportive of the Company's long-term industrial development plans.

EXECUTION OF INFRASTRUCTURE COMMITMENTS UNDER THE MOU

As disclosed on May 13th, 2025 (News here), Homerun is party to a memorandum of understanding ("MoU") with CBPM (Bahia's state geological service and mineral assets company), Bahia state government entities, the Municipality of Belmonte and Bahiagás to advance the development of a silica processing plant and a large-scale solar glass factory in Santa Maria Eterna. Local municipal decrees and coverage of this MoU reference obligations that include land for the industrial site, as well as commitments to improve infrastructure and logistics access to the district, which implicitly encompasses road access to BR-101. This comes after Homerun's December 15th news release stating the Municipality of Belmonte's commitment and allocation of funding to the paving of approximately 5km of road connecting Santa Maria Eterna to BR-101, the main federal highway in the region.

The commencement of construction on the BA-274 / BA-982 connection is an important early demonstration of this institutional support. The works now underway materially improve all-weather access between Santa Maria Eterna and BR-101, reduce future haulage risk and logistics costs for potential silica and solar glass operations, and visibly anchor the region's transition toward an industrial hub based on high-purity silica and advanced glass manufacturing.

Homerun | www.homerunenergy.com

Alternative Energies Nov 25, 2025

Modernizing the electric grid involves more than upgrading control systems with sophisticated software—it requires embedding sensors and automated controls across the entire system. It's not only the digital brains that manage the network but also ....

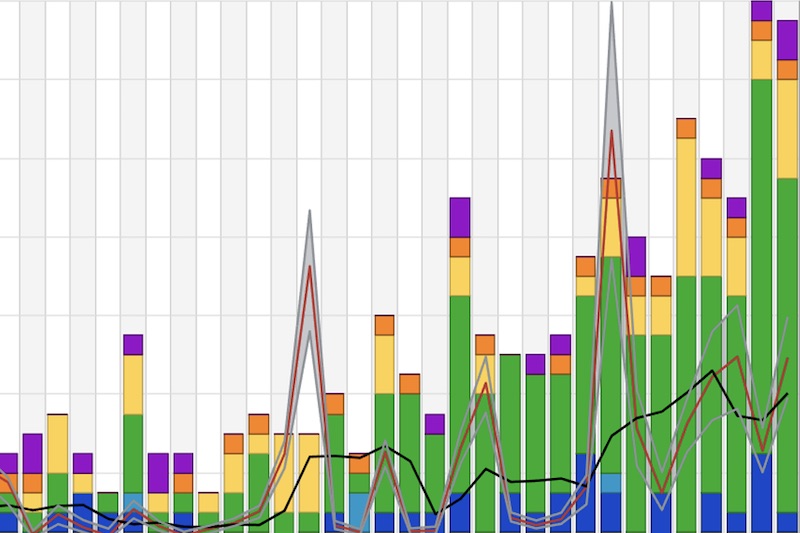

The solar industry’s rapid evolution is a story of innovation, fierce competition, and dramatic exits. As countries move toward decarbonization and grow the share of renewable energy in the total energy mix, the commercial solar panel sector has se....

Utility-scale solar plants are under mounting pressure to deliver maximum energy output while meeting strict performance guarantees. This pressure is reshaping the role of irradiance monitoring, where precision now directly affects a project's financ....

The pressures solar developers face are growing as fast as the demand for the sites they’re racing to build. Renewable energy installation will likely continue its unprecedented trajectory, having averaged 28 percent annual expansion in the la....

Wind power has been a highly successful ....

As wind turbines keep growing taller and....

2024 finally marked the return to a "normal" consumer auto market. After four years of turmoil, car buyers no longer face inventory shortages or long waits for their preferred vehicles. While many factors contributed to the auto market i....

The conversation around energy often centers on grid reliability, skyrocketing generation demand, backup power, and consumer savings. Residential Battery Energy Storage Systems (BESS) have become known for their ability to provide backup power and ma....

As the United States retreats from its investment in the energy transition, Canada and other countries are stepping up their efforts to invest in and grow their energy storage industries. Despite this changing market dynamic, rechargeable zinc batter....

Modernizing the electric grid involves more than upgrading control systems with sophisticated software—it requires embedding sensors and automated controls across the entire system. It's not only the digital brains that manage the network but also ....

It is no secret that the current administration harbors hostility toward renewable energy. From tariffs to tax breaks, it seems that everywhere you turn there’s a new hurdle or wall threatening to slow or erase the major gains the industry has made....

After months of debate in Congress, the One Big Beautiful Bill Act (OBBBA) was finally signed into law. With the goal of restructuring and simplifying federal incentive programs while reducing long-term costs, the OBBBA comes with several updates and....