Energy Storage

FranklinWH Energy Storage Inc.

Energy Storage

Dr. Josef Daniel-Ivad

Energy Storage

TRC Companies

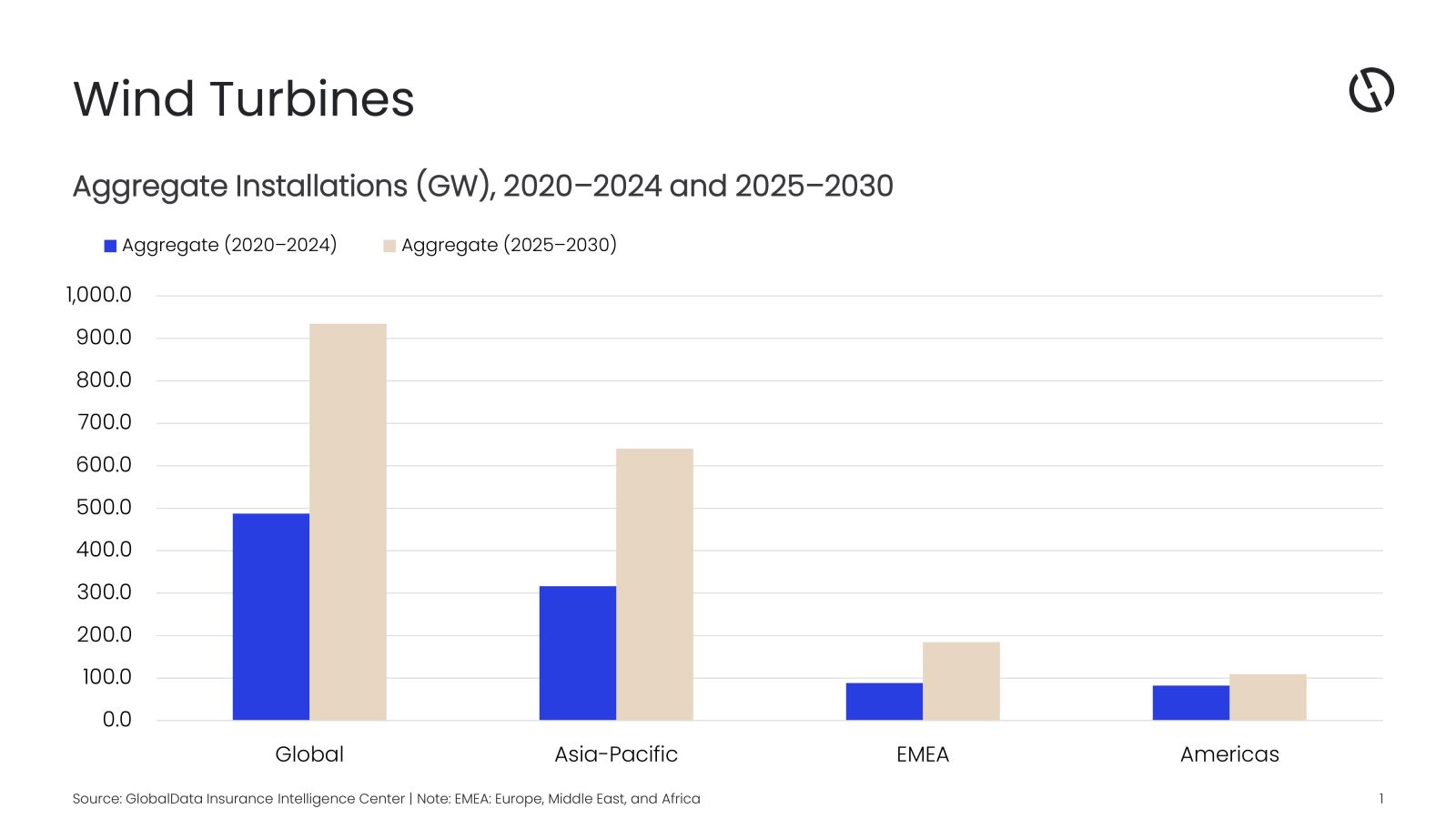

The global wind‑energy market is entering its strongest growth phase to date, driven by accelerating national decarbonization targets, energy‑security needs and long‑term industrial strategies. The aggregate installations are expected to reach 934.6GW in 2030, forecasts GlobalData, a leading intelligence and productivity platform.

GlobalData’s latest report, “Wind Turbines Market Size, Share and Trends Analysis by Technology, Installed Capacity, Generation, Key Players and Forecast, 2024–2030,” reveals global annual wind‑turbine installations totalled 115.3GW in 2024. Onshore wind accounted for 91.8% of installations, with offshore wind representing the remaining 8.2%.

Bhavana Sri Pullagura, Senior Power Analyst at GlobalData, comments: “The Asia-Pacific (APAC) region leads the global wind turbine market, accounting for the largest share of annual installations and possessing the most advanced manufacturing capabilities for turbines, components, and offshore technologies. APAC's dominance is primarily driven by China's extensive onshore and offshore development, India's rapidly growing domestic manufacturing and auction-driven expansion, and the emerging offshore projects in Japan and Australia.”

Europe, the Middle East, and Africa (EMEA) represents the second-largest market. Europe serves as the regional anchor, bolstered by binding climate mandates under the EU Green Deal, the revised Renewable Energy Directive III, and a strong offshore wind trajectory led by countries in the North Sea.

The Middle East and North Africa are advancing utility-scale renewable energy projects through government-backed procurements and decarbonization initiatives, while certain areas of Sub-Saharan Africa are gradually unlocking wind projects with the help of international financing and regional power pool initiatives.

The Americas ranks as the third-largest market, with the US leading the way, where the Inflation Reduction Act (IRA) has stimulated clean energy manufacturing, repowering activities, and the development of an emerging offshore wind supply chain.

Pullagura adds: “Market share leadership is increasingly concentrated among China's major original equipment manufacturers (OEMs), supported by cost-efficient manufacturing and unmatched domestic deployment volumes. Meanwhile, European and US manufacturers remain competitive through advanced offshore technology, digital optimization, and robust service portfolios. The current trends such as turbine upscaling, hybrid project integration, and supply chain localization are transforming how and where turbines are produced and deployed.”

The global wind turbine market is on the brink of a new era of accelerated growth, fuelled by increasing clean energy commitments, rapid technological advancements, and more resilient manufacturing ecosystems.

Pullagura concludes: “With Chinese OEMs leading global capacity additions and Western manufacturers driving innovation in offshore and digital turbine platforms, the industry is entering its most competitive and transformative phase to date. As nations ramp up wind deployment to meet climate targets and ensure long-term energy independence, the global wind turbine market is expected to grow significantly, reinforcing wind power's role as a cornerstone of the world’s renewable energy future.”

GlobalData | https://www.globaldata.com/

The American Council on Renewable Energy (ACORE) issued the following statement from ACORE President and CEO Ray Long in response to the Department of the Interior’s action to halt fully permitted offshore wind construction projects:

"Americans expect their government and private sector to work together to ensure that the lights stay on and their electric bills are affordable. The five East Coast offshore wind projects that have been paused should be a total success story: $28 billion in committed private sector capital, expanded port infrastructure, support for domestic shipbuilding, and 10,000 good-paying local jobs—all to support a more robust, affordable, reliable, and secure electricity resource base for decades to come. Given skyrocketing electricity demand forecasts and consumers' clear concerns about affordability, projects like these need to get over the finish line to give people confidence that government and the private sector can still deliver on big things. Unfortunately, actions like this send the opposite message at exactly the wrong time."

ACORE | http://www.acore.org

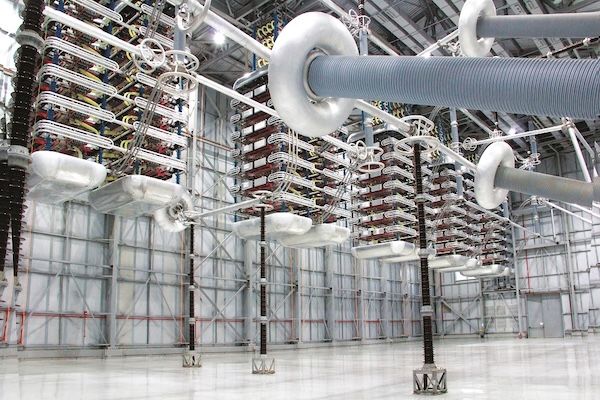

GE Vernova Inc. (NYSE: GEV) announced that its Electrification Systems business has been awarded a contract by Power Grid Corporation of India Limited (POWERGRID), India’s national transmission utility, to refurbish the Chandrapur back-to-back High Voltage Direct Current (HVDC) link—a key 1,000 MW interconnection between the country’s western and southern grid systems. This marks GE Vernova’s first HVDC refurbishment contract in India.

Modernizing a vital interconnection between West and South India

The 1,000 MW back-to-back HVDC link plays a pivotal role in balancing regional power flows between India’s western and southern regions. Originally commissioned in the late 1990s, the link enables bi-directional energy transfer between fossil-rich and hydro-rich zones—improving dispatch efficiency and conserving regional energy reserves.

Under the new contract, GE Vernova will upgrade both 500 MW converter stations at each end - Chandrapur (Western region) to Ramagundam (Southern region) - modernizing the HVDC control and protection systems and replacing the legacy converter valves with advanced technology manufactured at GE Vernova’s facilities in India.

“This landmark contract reinforces our long-standing relationship with POWERGRID and our commitment to India’s grid modernization,” said Johan Bindele, Leader of GE Vernova’s Grid Systems Integration business and teams. “Refurbishing this HVDC link with next-generation controls and digital capabilities will not only enhance its reliability but also strengthen India’s efforts toward a secure and sustainable power system.”

Extending grid life, improving stability

Refurbishment of HVDC systems involves upgrading essential components such as converter valves, automation systems, and grid protection infrastructure, all while ensuring minimal operational disruption. The modernization is expected to extend the asset’s lifespan, enhance energy efficiency, and improve grid flexibility to handle growing renewable penetration.

Investments in refurbishment offer utilities a cost-effective way to strengthen infrastructure resilience—preserving prior capital investments while aligning with today’s energy transition needs.

Supporting India’s energy goals

India’s ambitious goal to reach 500 GW of non-fossil capacity by 2030 relies on robust, flexible transmission infrastructure. HVDC systems are essential to move large volumes of renewable power efficiently across long distances.

Refurbishing this strategic inter-regional corridor will help unlock that potential—enabling cleaner energy flows, improving system reliability, and contributing to India's long-term energy security.

GE Vernova | https://www.gevernova.com/

BorderPlex Digital Assets (BorderPlex) announced the launch of Project Green, a market process to source up to 500 MW of renewable energy generation capacity by 2028 and scaling to a total of 1 GW of renewable energy generation capacity by 2032 to support economic growth and development in southern New Mexico.

Project Green would create one of the largest arrays of renewable energy generation infrastructure in the State of New Mexico. Project Green will evaluate solar and other renewable energy resources, including wind, geothermal, and hybrid configurations that can support long-term reliability and performance.

BorderPlex expects to issue a Request for Information (RFI) by Jan. 16, 2026 to gather market input from qualified developers and partners, followed by a Request for Proposal (RFP) for select solutions.

“Project Green is a priority initiative to advance renewable power as part of a portfolio-based approach to power generation and storage that delivers infrastructure affordability and reliability,” BorderPlex Digital Assets said in a statement. “BorderPlex Digital Assets believes in the power of ‘and’ – by utilizing advanced technologies, we can build infrastructure for economic growth AND deliver sustainable environmental outcomes. Project Green reflects a disciplined, pragmatic approach to incorporating renewable energy in a way that supports long-term reliability and the substantial power needs of the growth economy.”

Project Green is aligned with BorderPlex’s commitments under its Memorandum of Understanding with the State of New Mexico, dated Feb. 25, 2025, which contemplates the development of reliable, low-carbon electricity generation as part of a broader portfolio of power resources supporting critical infrastructure and long-term economic growth.

The renewable generation capacity evaluated through Project Green may support a range of potential offtake solutions, including new on-campus demand, micro-grid configurations, and delivery to broader market or utility partners, subject to applicable approvals. By evaluating multiple delivery profiles and commercial structures, Project Green is designed to enhance overall system affordability, resilience, and reliability while maximizing the long-term value of new generation resources for the State of New Mexico.

The project is evaluating off-site solutions across solar, wind, geothermal and hybrid technologies capable of delivering large scale power to the Project’s defined point of delivery, subject to required permits and approvals. Project Green’s objective is to deliver affordable, renewable energy that supports the citizens of the State of New Mexico’s environmental and economic goals.

The RFI will be used to assess technical feasibility, development timelines, delivery profiles, and commercial structures. RFI feedback will inform the final structure and scope of the subsequent RFP and ultimate solution selection.

Interested parties can register at https://projectgreennm.com/ to receive updates and access RFI materials when released.

BorderPlex Digital Assets | https://www.borderplexdigital.com/

A subsidiary of Glenfarne Group , LLC (“Glenfarne”) announced the completion of a previously announced acquisition of four energy projects in Chile with a combined 909 Megawatts (“MW”) of installed capacity comprised of 588 MW of solar and associated battery energy storage system (“BESS”) facilities with a capacity of 1.61 Gigawatt-hours (“GWh”) (321 MW equivalent). Glenfarne acquired the assets from METLEN Energy & Metals (“METLEN”).

The projects are located in Chile’s northern provinces, which feature some of the highest levels of solar irradiance in the world. The projects feature fully operational solar infrastructure integrated with BESS assets METLEN will complete during the first half of 2026. The projects’ geographic diversity and multiple interconnection nodes across Chile’s Sistema Eléctrico Nacional (SEN) enable enhanced asset optimization and utilization.

The transaction is valued at $865 million including the assumption of debt, based on certain financing and post-closing assumptions. Concurrent with the transaction, Glenfarne executed an over $1 billion finance package to fund the acquisition and provide flexibility for future acquisitions and refinancings. Scotiabank, BNP Paribas, and Societe General led and underwrote the facilities.

Glenfarne Chief Executive Officer and Founder Brendan Duval said, “With this acquisition, Glenfarne is increasing the technology diversity of our infrastructure by adding battery capacity and increasing geographic and revenue diversification. METLEN has been a terrific partner throughout this transaction and our common focus on energy security and sustainability create opportunities for future cooperation in Glenfarne’s businesses across the Americas.”

METLEN Chairman Evangelos Mytilineos added, “Co-located Solar and BESS projects will pave the way forward in METLEN’s Global Asset Rotation Plan. With new projects developed on a hybrid basis but also through the hybridization of existing solar projects, METLEN’s Energy Transition Platform is uniquely positioned to capture this emerging and growing opportunity.”

Glenfarne Group Partner and President Bryan Murphy added, “Along with this accretive transaction that provides high quality, stable EBITDA to the portfolio in a great market, Glenfarne has created a comprehensive funding package that financially optimizes our portfolio and positions Glenfarne for future opportunistic growth.”

Glenfarne’s assets, including the assets of EnfraGen and Termonorte, total over 3.1 GW of capacity and 1.61 GWh of battery storage (321 MW equivalent) across Chile, Panama, Colombia, and Costa Rica, and 32.8 million tonnes of LNG per year under development in North America.

Paul Hastings LLP, White & Case LLP, and Claro & Cia acted as legal advisors for Glenfarne. Milbank LLP and Larrain acted as legal advisors for Metlen. Milbank LLP and Garrigues acted as legal advisors for Scotiabank, BNP Paribas, and Societe General.

Glenfarne Group | www.glenfarne.com

METLEN Energy & Metals Plc | https://www.metlengroup.com/

Everlight Solar proudly closed out the holiday season by giving back to communities across the Midwest. Team members from multiple offices volunteered and helped donate gifts to support local families and organizations in need.

In Madison, Wisconsin, Everlight volunteered with Santas Without Chimneys, helping sort and wrap gifts to ensure children in the community experienced a joyful holiday season. They also donated gifts to Waunakee Neighborhood Connection, supporting a local family of five during the holiday season.

The Milwaukee, Wisconsin, team volunteered at the Waukesha Food Pantry, assisting with food distribution efforts that support families throughout the area. Additionally, they donated gifts to Children's Wisconsin, helping to bring comfort and joy to young patients during the holiday season.

In Minneapolis, Minnesota, Everlight team members volunteered with the Boys & Girls Clubs of the Twin Cities, supporting programming that provides a safe and engaging environment for youth. The Minneapolis offices also donated gifts to Children's Minnesota, helping brighten the holidays for children and their families.

The Omaha, Nebraska team partnered with Omaha Parks and Recreation, volunteering to support community programs, and donated gifts to Toys for Tots, contributing to the organization's mission of delivering holiday joy to children in need.

"Giving back has always been part of our roots," says President and CEO William Creech. "When you're part of a community, you take care of it—and that's something we're proud to do." Everlight Solar remains committed to making a positive impact through clean energy solutions and ongoing community involvement across its expanding footprint.

Everlight Solar | www.everlightsolar.com

On 22 December 2025, Revolution Wind LLC, a 50/50 joint venture with Global Infrastructure Partners’ Skyborn Renewables, and Sunrise Wind LLC, a fully-owned subsidiary, received orders from the U.S. Department of the Interior’s Bureau of Ocean Energy Management (BOEM) instructing the projects, respectively, to suspend all ongoing activities on the outer continental shelf for the next 90 days. BOEM reserves the right to extend the 90-day suspension.

Revolution Wind LLC and Sunrise Wind LLC are complying with the respective orders and are taking appropriate steps to suspend related activities in a manner that prevents impacts on health, safety, and the environment.

Ørsted is evaluating all options to resolve the matter expeditiously, together with its partners. This includes engagement with BOEM and other permitting agencies as well as the evaluation of potential legal proceedings.

Revolution Wind and Sunrise Wind are both in advanced stages of construction and will be ready to deliver reliable, affordable power to American homes in 2026, with Revolution Wind expected to begin generating power in January.

Revolution Wind and Sunrise Wind are fully permitted, having secured all required federal and state permits following comprehensive, years-long reviews. As a requirement of the permitting process for these projects, Revolution Wind LLC and Sunrise Wind LLC consulted closely and directly with the U.S Department of Defense Military Aviation and Installation Assurance Siting Clearinghouse to evaluate and address potential impacts to national security and defense capabilities from construction and operation of the Revolution Wind and Sunrise Wind projects.

Revolution Wind has 20-year power purchase agreements to deliver 400 MW of electricity to Rhode Island and 304 MW to Connecticut. Sunrise Wind has a 25-year power purchase agreement to deliver 924 MW to New York State. Taken together, Sunrise Wind and Revolution Wind can power approximately 1 million homes across the three states.

Ørsted is investing in American energy generation, grid upgrades, port infrastructure, and a supply chain, including US shipbuilding and manufacturing, extending to more than 40 states. Revolution Wind and Sunrise Wind employ hundreds of local union workers supporting construction activities. Ørsted’s US offshore wind projects have totalled approximately 4 million labour union hours to date.

Ørsted | orsted.com

Alternative Energies Nov 25, 2025

Modernizing the electric grid involves more than upgrading control systems with sophisticated software—it requires embedding sensors and automated controls across the entire system. It's not only the digital brains that manage the network but also ....

The solar industry’s rapid evolution is a story of innovation, fierce competition, and dramatic exits. As countries move toward decarbonization and grow the share of renewable energy in the total energy mix, the commercial solar panel sector has se....

Utility-scale solar plants are under mounting pressure to deliver maximum energy output while meeting strict performance guarantees. This pressure is reshaping the role of irradiance monitoring, where precision now directly affects a project's financ....

The pressures solar developers face are growing as fast as the demand for the sites they’re racing to build. Renewable energy installation will likely continue its unprecedented trajectory, having averaged 28 percent annual expansion in the la....

Wind power has been a highly successful ....

As wind turbines keep growing taller and....

2024 finally marked the return to a "normal" consumer auto market. After four years of turmoil, car buyers no longer face inventory shortages or long waits for their preferred vehicles. While many factors contributed to the auto market i....

The conversation around energy often centers on grid reliability, skyrocketing generation demand, backup power, and consumer savings. Residential Battery Energy Storage Systems (BESS) have become known for their ability to provide backup power and ma....

As the United States retreats from its investment in the energy transition, Canada and other countries are stepping up their efforts to invest in and grow their energy storage industries. Despite this changing market dynamic, rechargeable zinc batter....

Modernizing the electric grid involves more than upgrading control systems with sophisticated software—it requires embedding sensors and automated controls across the entire system. It's not only the digital brains that manage the network but also ....

It is no secret that the current administration harbors hostility toward renewable energy. From tariffs to tax breaks, it seems that everywhere you turn there’s a new hurdle or wall threatening to slow or erase the major gains the industry has made....

After months of debate in Congress, the One Big Beautiful Bill Act (OBBBA) was finally signed into law. With the goal of restructuring and simplifying federal incentive programs while reducing long-term costs, the OBBBA comes with several updates and....