Steer Clear of IRA Risks and Costs - How noncompliance endangers renewable energy project developers and investors

The Inflation Reduction Act (IRA) is arguably the most significant piece of renewable energy legislation in American history. It creates a unique opportunity for project developers and investors to accelerate the transition to renewables — and according to analysts, will provide an estimated $1.2 trillion in incentives by 2032.

Maximizing the financial benefits of this game-changing program requires project developers and EPCs to meet complex IRS compliance measures, while protecting investors from the risks of a recapture audit.

Even as legal rules continue to evolve, taking advantage of the IRA presents substantial risks if not done carefully. Colossal losses could ensue from noncompliance penalties, litigation, and reputation damages. The following can help developers of utility- and community-scale PV and energy storage projects avoid trouble as they navigate incentives under the Investment Tax Credit (ITC) and Production Tax Credit (PTC) programs.

Keeping a close eye on internal risks

1. Maximizing the financial benefit

The primary and most severe risk of noncompliance would be to lose the ability to take advantage of incentives, which can be 30 percent or more of the value of the project capex based on tax incentive adder qualification.

Developers can’t fully maximize the value of the tax credits unless they reduce tax-equity investor risk of noncompliance.

In addition, penalties for non-compliance are severe. Failing an IRS audit of the Prevailing Wage requirement can result in penalties of $5,000 per employee (if there is proof of an attempt to comply with wage requirements) or $10,0000 per employee if no effort was made to meet wage provisions. Plus, failure to meet the required apprenticeship percentage entails an additional penalty of $5,000 per employee.

2. Considering Legal Liability

In addition to providing significant tax incentives, the IRA also authorized hiring 30,000 new IRS employees, many of whom will be focused on ensuring adherence to all federal requirements for clean energy projects to receive tax incentives.

With average legal fees exceeding $500 per hour, defending against an IRA audit can quickly result in significant expense. A robust compliance documentation and reporting program can significantly shorten the defense and increase the likelihood of success.

A failed IRS tax-incentive audit can result in a cascading effect of not only lost time and cost, but potential litigation as well. The tax equity investor sues the developer and its insurance provider for the value of the lost credits plus penalties and legal fees. Subsequently, the developer and their insurance will pursue legal actions against its EPC for failing to comply with PWA compliance requirements as required.

The risk of Domestic Content noncompliance includes loss of the 10 percent adder tax credit. Because EPCs typically source steel and iron products, they can be held liable for domestic content noncompliance. However, “manufactured products” like inverters, modules, and batteries are often sourced directly by developers who would lose the value of the 10 percent adder if these are noncompliant.

3. Insuring Against Losses

Clean energy project insurance policies range between 2 and 3 percent of a project’s costs. However, insurance policies contain requirements that require developers to demonstrate how they will actively manage tax-insurance compliance and other risks as part of their underwriting policy before insurance can be provided. Just like a homeowner’s insurance policy requires smoke detectors and burglar alarms, tax equity insurance will require tax equity compliance management as well.

Looking at Broader External Risks

While harder to quantify, external business risks associated with IRA noncompliance can derail a developer’s track record and threaten future deals. Project investors forced to pursue legal action to recover tax losses likely won’t continue as partners in the future.

Developers spend an enormous amount of time and energy building relationships with the local communities where they operate. A failed incentive audit could cause those local officials and community groups to lose faith in a developer, threatening future projects.

Avoiding Problems from the Start

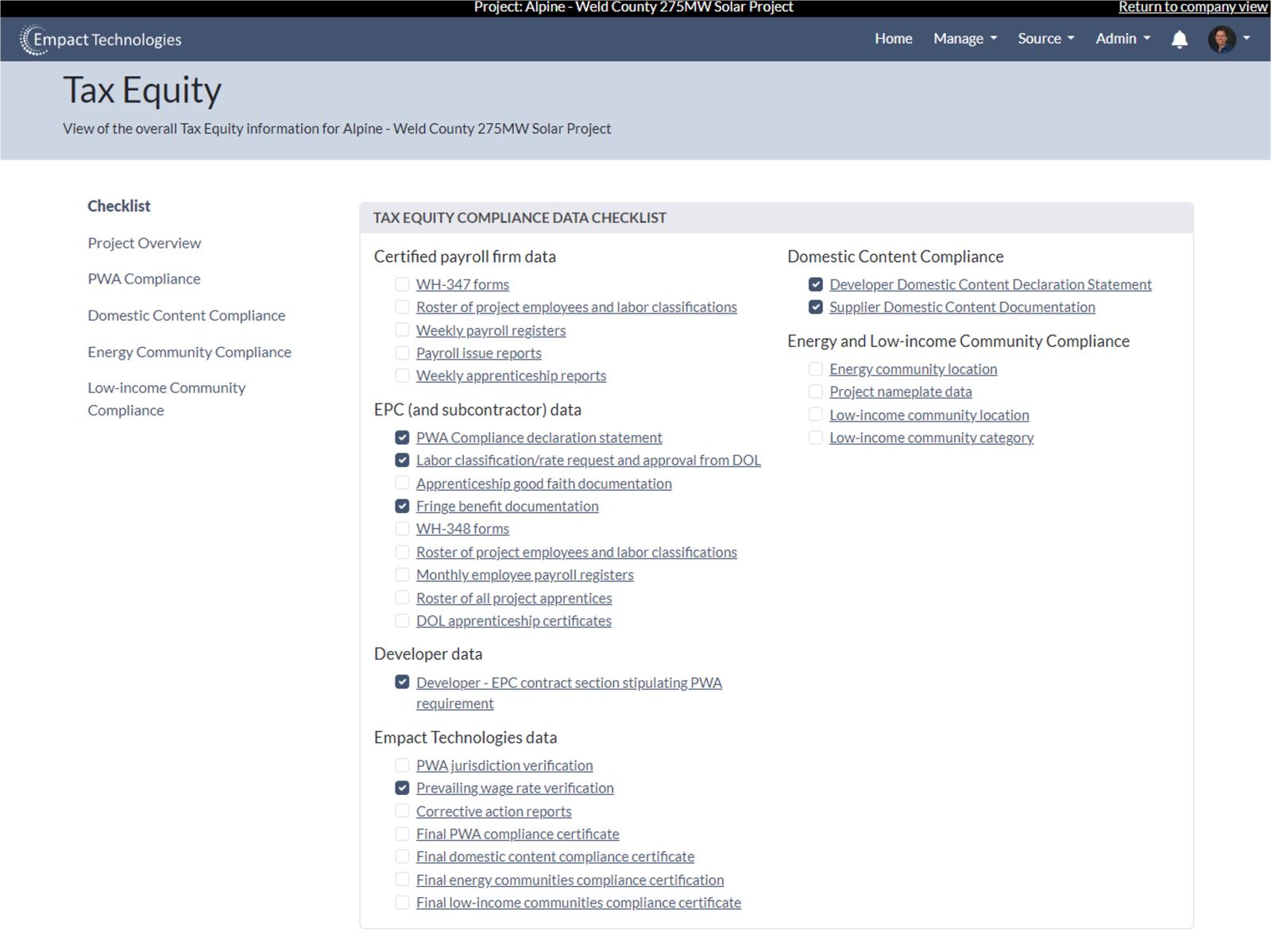

ITC management platform consolidates all incentive reporting

Risks can be easily managed with an IRA compliance program. Consider these best practices:

- Form a dedicated internal team that is accountable and rewarded for meeting key performance measures.

- Work with your attorneys and tax accountants to create program with policies for compliance.

- Consult with your tax insurance advisor to understand what is needed to prove active compliance risk management.

- Aggregate and manage compliance data across all projects, EPCs and programs. Options include building and hosting a custom internal system using tools like excel and sharepoint, or working with a dedicated third-party system.

- Ensure EPCs and key suppliers provide data weekly; include contract language with partners specifying how often and in what form data will be shared.

- Actively compile weekly employment records for all workers, review compliance to PWA requirements, identify issues and manage issue resolution, and generate reports for investors and insurance carriers during construction.

- Provide a data repository to the tax equity investor, and maintain system records for five years (ITC), or ten years (PTC) to protect against IRS recapture audit risks.

The IRA offers a lucrative opportunity for American solar investors and developers. Don’t let an audit erode your margins and damage your reputation. Take time to evaluate software platforms that actively manage incentives instead of putting all of your faith in project insurance.

Charles Dauber is the founder and CEO of Empact Technologies, which maximizes the impact of clean energy project tax incentives. Developers use Empact to secure construction financing, ensure regulatory compliance, and protect investors from IRS recapture audit risk.

Charles Dauber is the founder and CEO of Empact Technologies, which maximizes the impact of clean energy project tax incentives. Developers use Empact to secure construction financing, ensure regulatory compliance, and protect investors from IRS recapture audit risk.

Empact Technologies | www.empacttechnologies.com

Author: Charles Dauber

Volume: 2023 November/December

.jpg?r=3812)

.gif?r=8395)