7 Key Criteria to Choosing a Revenue Management Company for Distributed Generation

So, you want to hire a subscription and revenue management company for your distributed generation portfolio … where to start? As an investor, developer, operator, or asset owner, you need projects that pencil. The easiest way to achieve that is through a fully-subscribed site with high-quality subscribers. But there are a lot of details along the way.

In the distributed generation (DG) industry, there are many hiccups that can get in the way of delivering a client’s revenue – late utility data, subscriber security regulations, nonpayment issues. You name it.

Following is a list of factors to consider when evaluating the platform you entrust to maximize profit for the life of your DG project.

1. People

You want to be sure you're working with a professional team that has the experience and focus required to maximize your return. We’re talking about years of experience in the industry, at reputable firms, with a history of success.

Don't just talk to the sales team – you’ll want to get a sense of the whole company. This industry changes all the time. You need a partner with deep expertise in each of the key functional areas that can be nimble to adapt as program rules and business needs change.

2. Subscriber acquisition

Filling your sites with the right mix of high-quality subscribers requires a diverse blend of acquisition channels and the scale to keep a backlog of subscribers ready to replace subscribers who churn.

You’ll need a variety of subscriber types: large enterprises, mass market residential, low-to-moderate income, small commercial, and more. The subscriber mix varies depending on the state and your revenue objectives. But one factor is constant – the need for a range of acquisition channels that can be deployed quickly at scale.

3. LMI

Low-to-moderate income (LMI) subscribers are a vital segment of community solar subscribers. With the federal Inflation Reduction Act’s LMI incentives, it's more important than ever to have a clear strategy for acquiring LMI subscribers.

You need a team that has a proven track record with this market segment, as well as the flexibility to adapt to the changing requirements quickly.

4. Flexible billing systems

Your revenue management company needs to make it as simple as possible for subscribers of all shapes and sizes to pay their bills.

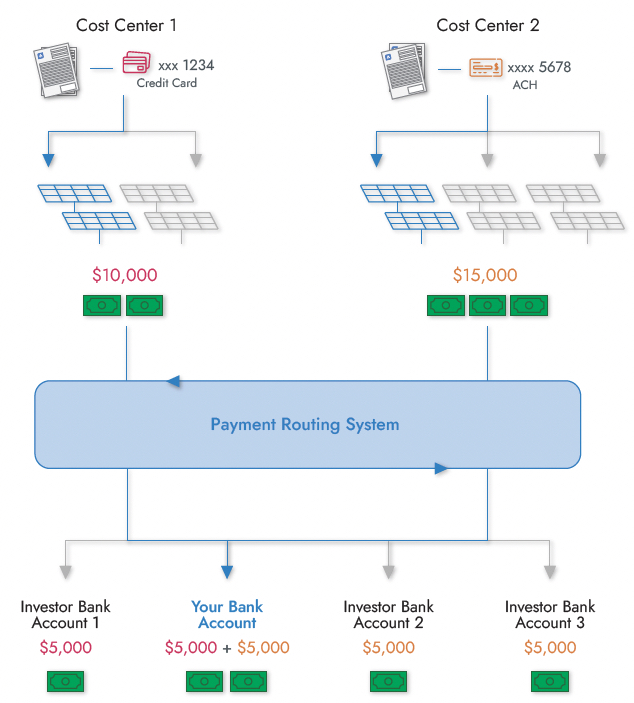

For example, billing enterprise subscribers is far more complicated than it may seem. These large customers often have thousands of electric meters across many community solar sites, sometimes across different states, and often with different credit discounts. The meters may also belong to different corporate cost centers, each of which can have a unique payment method (e.g., a separate ACH account). This complexity requires clear reporting and an enterprise-grade billing platform. Be sure your provider can accommodate the needs of subscribers of all sizes.

5. Revenue optimization

Revenue optimization is how a company mobilizes all the data it collects to deliver the maximum revenue. We all know that DG assets are dynamic, with constantly changing variables. Having systems and people who are aware of those changing variables, combined with the knowledge of how to adjust appropriately, truly is the difference between profit and loss.

Utility Integration

When it comes to data flows with the utility, speed and accuracy make all the difference. Some utilities provide APIs for access, but linking directly to the subscriber account is usually the best option for providing a real-time view of usage and changes. This level of access can shave months off the time it takes to receive subscriber data for optimization purposes.

Active Allocations

People’s energy usage changes over time. In DG, subscribers are allocated a share of the solar farm’s output. Is your revenue management company continuously updating subscription sizes? This is called Active Allocation. It’s the practice of monitoring subscriber energy use and deploying changes across your assets to adjust for these changes, and enables you to receive the highest financial benefit possible.

Without continuous subscription size correction, you risk subscriber underperformance, which can ultimately lead to churn and lost revenue. Your prospective revenue management partner should regularly monitor and adjust for subscriber electricity usage fluctuations, credit banks, and other factors that drive variability in site revenue.

6. Account management

The account management team is who you’ll be working with for the duration of the project. When setbacks arise and decisions need to be made, these are the folks who help navigate the details and work through solutions. You’ll want to meet them to get a feel for how they operate.

While it’s true that evaluating the team is fairly subjective, there are some concrete factors you can assess to gain more insight, including experience, response time, reporting capabilities, and the ability to provide expert regulatory insights.

7. Technology and security

The 2021 Colonial Pipeline ransomware attack demonstrates how damaging a security breach can be, both for a company and the grid. An increase in phishing, malware, and social engineering attacks leaves your data vulnerable to exposure. You’re collecting some very sensitive customer information. A security breach brings both regulatory compliance and reputational risks.

Ask to see evidence the company is following these practices:

- Are they ISO-27001 certified? This is the security gold standard that lets you sleep well at night.

- Do they conduct regular penetration tests to identify weaknesses in their defenses?

- Do they use highly-regarded payment processors to validate and manage customer payment information?

- Do their services comply with PCI and NACHA?

Hiring a revenue management company is a meaningful investment, so you’ll want to make sure the company’s platform, processes, and people are able to meet your needs. It's a sound practice to evaluate your prospective partner across these seven criteria to ensure they can acquire a diverse range of subscribers, handle the minutiae of billing them, and ultimately, maximize your profit for the 20+ year life of your project.

Nate Owen is CEO at Ampion, a company that connects people to local solar farms to help boost sustainability in communities and support local economies.

Nate Owen is CEO at Ampion, a company that connects people to local solar farms to help boost sustainability in communities and support local economies.

Ampion | ampion.net

Author: Nate Owen

Volume: 2024 March/April

.png?r=5717)