Wind

B.D. Erickson

Energy Storage

Accure Battery Intelligence

Energy Storage

Colin Gault

The Bureau of Ocean Energy Management (BOEM) announced that the agency received an unsolicited lease request from Hecate Energy Gulf Wind LLC (Hecate Energy) to acquire commercial wind energy lease(s) on the Outer Continental Shelf (OCS) in the Gulf of Mexico. In response, BOEM is seeking information regarding whether competitive interest exists in the areas included in Hecate Energy’s request. The areas are located off the coast of southeast Texas and had been previously identified by BOEM as potential Wind Energy Areas (WEAs) suitable for offshore wind leasing in 2021. WEA Option C totals 74,113 acres, and WEA Option D totals 68,239 acres, for a total of 142,352 acres.

As required by the OCS Lands Act, BOEM is issuing a Request for Competitive Interest (RFCI) seeking comments and specific input regarding whether there is competitive interest in commercial offshore wind energy development in the areas requested by Hecate Energy. The RFCI will be published in the Federal Register on July 29, 2024. To comment on the RFCI, go to www.regulations.gov and search for BOEM-2024-0039. BOEM may use comments received to further identify and refine the area(s) being considered for wind energy development and inform future environmental analyses related to the potential lease area.

If BOEM receives one or more indications of interest in acquiring a commercial wind lease from qualified entities, BOEM may decide to move forward with a competitive lease sale. If BOEM does not receive competing indications of interest from qualified companies, BOEM may move forward with a noncompetitive lease issuance to Hecate Energy. BOEM worked with NOAA’s National Centers for Coastal Ocean Science to identify 14 potential WEAs via a comprehensive ecosystem-based ocean planning model as detailed in a joint report published in 2021.

The areas contained in Hecate Energy’s unsolicited lease request were identified as part of that effort and are different than the areas (WEA I-1, WEA I-2, WEA J, and WEA K) included in BOEM’s Proposed Sale Notice (PSN) for a second Gulf of Mexico offshore wind lease sale, published on March 21, 2024. The first lease sale in the Gulf of Mexico was held in August of 2023 and one lease was awarded to RWE Offshore US Gulf LLC.

BOEM received 25 comments in response to the March 2024 PSN, with one company expressing interest in participating. As a result, BOEM is cancelling this sale due to a lack of competitive interest. BOEM may decide to move forward with a lease sale at a future time, based on industry interest.

“The Gulf region benefits from great offshore wind resources and existing energy infrastructure,” said Gulf of Mexico Regional Director Dr. James Kendall. "The interest from industry leaders such as Hecate and RWE demonstrates the commercial potential in the region. As we continue to explore these opportunities, we will ensure that any potential development is done in a way that avoids, reduces, or mitigates potential impacts to ocean users and the environment.”

Since the start of the Biden-Harris administration, the Department of the Interior has approved the nation's first nine commercial scale offshore wind projects with a combined capacity of more than 13 gigawatts of clean energy — enough to power nearly 5 million homes. Since January 2021, the Department has held four offshore wind lease auctions – including a record-breaking sale offshore New York and the first-ever sales offshore the Pacific Coast and in the Gulf of Mexico. The Department also recently announced a schedule of up to 12 additional lease sales through 2028.

For more information on offshore wind in the Gulf of Mexico, visit: https://www.boem.gov/renewable-energy/state-activities/gulf-mexico-activities.

Bureau of Ocean Energy Management | https://www.boem.gov/

Paired Power, a leading U.S. solar microgrid electric vehicle charger manufacturer announces its installation of its PairTree EV charger for Sonoco (NYSE: SON), a leading global manufacturer of consumer, industrial, health care and protective packaging.

“We’re thrilled to provide the first offgrid electric vehicle solar charger to Sonoco, a world-class company with a strong track record of reducing emissions through recyclable material sourcing and countless initiatives,” said Tom McCalmont, Paired Power CEO. “Obtaining our PairTree to provide Sonoco’s staff with truly green electric car charging is an extension of their leadership’s commitment to the environment.”

“We’re thrilled to provide the first offgrid electric vehicle solar charger to Sonoco, a world-class company with a strong track record of reducing emissions through recyclable material sourcing and countless initiatives,” said Tom McCalmont, Paired Power CEO. “Obtaining our PairTree to provide Sonoco’s staff with truly green electric car charging is an extension of their leadership’s commitment to the environment.”

PairTree can be used for both standalone solar power, or for microgrid renewable power with optional grid connection. PairTree is a U.S.-made solar canopy that combines battery storage with solar power to deliver day or night charging for electric vehicles.

As a fully resilient source of electricity, PairTree can also provide emergency backup power during grid outages, and help reduce users’ dependence on the grid. A popular alternative to traditional grid chargers that use “brown” power such as oil and takes years for permitting, PairTree has little permitting and its installation takes less than a day.

Built with durability in mind, PairTree is wind-rated up to 130 mph, which is ideal for regions with unpredictable weather patterns in regions such as South Carolina.

PairTree fits into a standard 9 x 18 foot parking space. It has no moving parts, and doesn’t require ongoing maintenance like problematic tracker solutions. PairTree offers both one or two Level 2 EV charging ports with the industry standard J1772 EV interface.

“Paired Power’s solar, offgrid car charging technology is the ideal solution to provide resilient and clean energy for our employees who drive electric cars to work,” said Elizabeth Rhue, Vice President of Sustainability at Sonoco. “From the simplicity and efficacy of the chargers’ functions to the sleek design, PairTree fits with the ethos of our company’s mission and dedication to sustainability.”

Paired Power | www.pairedpower.com

Sonoco | www.sonoco.com

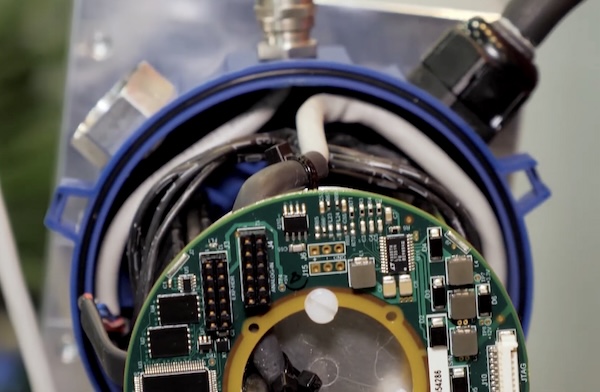

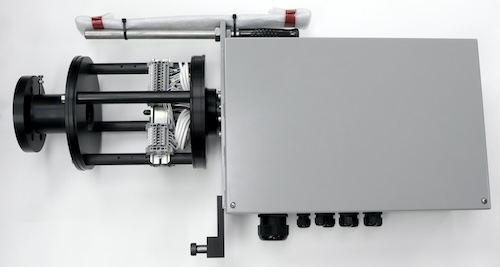

To improve reliability and reduce maintenance costs for wind farm managers, Moog has newly integrated its next-generation slip ring with a fiber optic rotary joint, or FORJ, as a direct replacement for the carbon-brush slip rings that control the blade pitch on 2.5-MW GE turbines and above.

“Moog’s new offering for 2.5-MW and higher GE turbines leverages our success providing more than 10,000 high-reliability pitch slip rings for GE turbines as well as thousands of FORJs into the wind energy market,” said Larry Bryant, Business Development Manager for Wind Energy Solutions at Moog. “We have a long track record of supplying rotary interfaces, and this new slip ring-FORJ integration represents an enhanced iteration of our proven offering. Moog’s experts designed our FORJ based on years of testing and delivering similar systems for the global wind market.”

Pitch systems, which include slip rings, control motion in wind turbine generator systems, ensure efficient use of wind energy, and protect the wind turbine by adjusting the blades’ angle of inclination. Existing carbon-brush slip rings in many GE wind turbines create dust that disrupts power and communications, leading to downtime and unplanned maintenance. Carbon brushes also need lubrication to maintain their contacts and signals; without it, they harden and require replacement. Moog has designed its new slip rings as a “set it and forget it” product from the outset due to its superior fiber brush technology.

Moog fiber brushes consist of a proprietary blend of high-end metals to ensure reliable transmission of power and data. According to Bryant, Moog’s maintenance-free technology can easily achieve 100 million revolutions. Customers testing Moog’s integrated slip ring and FORJ in the field have reported consistent, maintenance-free operation with no communication failures. This reliability saves wind farm managers from diverting resources and tying up technicians for two hours or more per incident to climb, diagnose, and repair issues in the nacelle.

For over a decade, the industry has recognized Moog’s wind energy slip rings for their high quality and performance. The latest integrated version, model WP7286-5N, incorporates a smaller footprint and weigh less than competing designs. Additionally, the integrated FORJ, model FO286, transfers data at higher rates via fiber optic output versus Ethernet. This addition to the WP7286 product family allows Moog to support an even larger number of wind farm sites.

Moog I www.moog.com

Heliene, Inc., a customer-first provider of North American-made solar PV modules, and Premier Energies, India’s 2nd largest solar cell manufacturing company, have announced their joint plan for a US based joint venture to create a solar cell manufacturing facility in the U.S. Under the terms of a recently-executed agreement, the new facility will produce an annual aggregate capacity of 1 GW NTyp cells to supply Heliene’s U.S. cell requirement as well as Premier’s.

With this joint venture and new cell plant, the Companies are investing in the growing U.S. solar industry and capitalizing on important incentives and tax credits for domestic clean energy manufacturing introduced under the Inflation Reduction Act (IRA) of 2022.

This joint venture builds on a longstanding partnership between Heliene and Premier Energies and a shared commitment to providing solar customers and developers with long-term, highly bankable, reliable and sustainable products. Heliene currently sources solar cells from PEPPL’s Hyderabad facility for use in module manufacturing at its Mountain Iron, MN location.

“Premier Energies has been a valued partner of Heliene’s for many years now and we share a commitment to providing the highest-quality, most-reliable products to solar customers. With demand for U.S.-made modules and components growing, now is the perfect time to embark on the next phase of our partnership with this joint venture,” said Martin Pochtaruk, CEO of Heliene. “Our new cell manufacturing facility will not only expand the footprint and impact of each of our companies, but it will also establish us as true leaders in the effort to friend-shore up the U.S. solar manufacturing supply chain.”

The IRA introduced important tax credits for the domestic production of solar cells, modules and components, but new U.S.-based cell manufacturing capacity is still required to meet increased demand for solar modules and projects. Heliene and Premier Energies’ planned facility will directly address this demand. Cells produced at the new site and incorporated into existing U.S. module manufacturing operations will also support developers seeking additional tax credits and incentives for their solar projects, including the lucrative domestic content bonus adder.

“As pioneers in solar technology and with our years of experience in solar cell manufacturing, Premier Energies is proud to partner with a fellow innovator and industry leader in Heliene,” said Chiranjeev Saluja, Managing Director at Premier Energies. “This joint venture will leverage the best of both companies’ resources and knowledge to tap the largely unaddressed demand for U.S. cell manufacturing.”

Under the terms of the joint venture, Heliene will contribute construction, project management, human resources, financial resource and management, facility operations, supply chain and logistics, and regulatory expertise. Premier will contribute cell technology engineering and operational expertise in the manufacturing process of the cells, manufacturing equipment selection, financial resources, raw material vendor relationships and supply agreements management. The Companies will announce further details on the project’s scope and timeline shortly.

Heliene | www.heliene.com

Premier Energies | www.premierenergies.com/

DCE Solar, a leading provider of innovative solar solutions, is proud to announce that its Eco-Top Roof-Top Mounting Structure has successfully passed the UL 3741 Standard. This certification marks a significant milestone in DCE Solar's commitment to delivering safe, reliable, and efficient solar energy solutions.

The UL 3741 certification is a stringent standard that ensures the highest level of safety for photovoltaic (PV) hazard control. Achieving this certification demonstrates that DCE Solar's Eco-Top solution meets the rigorous safety and performance requirements necessary for modern solar installations.

Key Features of the Eco-Top Roof-Top Solution:

Bill Taylor, CEO of DCE Solar, expressed his excitement about this achievement: "Passing the UL 3741 certification for our Eco-Top Roof-Top solution underscores our dedication to safety, innovation, and efficiency in the solar industry. This certification not only validates the quality of our product but also provides our customers with the confidence that they are investing in a top-tier, secure solar solution."

DCE Solar's Eco-Top Roof-Top solution is designed to be the most roof-friendly system on the market, providing exceptional protection for the roof membrane while offering superior performance and ease of installation. This achievement aligns with DCE Solar's mission to elevate the future of solar energy through cutting-edge technology and exceptional service.

DCE Solar | https://www.dcesolar.com/

Global clean tech leaders Kraken Technologies and SolarEdge Technologies, Inc. (“SolarEdge”) (NASDAQ: SEDG) are announcing a strategic partnership to unlock low-cost, green energy for SolarEdge Home Battery customers around the world. SolarEdge batteries will be integrated into Kraken – the world’s fastest growing energy platform and the technology behind Octopus Energy. This will allow SolarEdge customers to maximise earnings by charging their batteries with cheap, clean energy when it is most abundant, and selling energy back to the grid to support supply at peak times – all fully automated by Kraken.

The first to benefit from the partnership will be Octopus Energy customers in the UK and Texas, U.S., who will get access to Octopus Energy’s ‘Intelligent Octopus’ tariffs. These smart import and export tariffs offer customers competitive rates for consuming and selling their energy – up to 50% lower than on a regular tariff.

SolarEdge systems around the world will be able to join Kraken’s ‘Virtual Power Plant’ – currently 1.1GW of distributed domestic devices that balance energy supply and demand and unleash the full power of the future smart grid. This enables Kraken’s global client base of energy retailers to develop their own smart tariffs for SolarEdge battery owners. The client base includes major global energy players such as E.ON, EDF, Tokyo Gas, Origin and Octopus Energy.

Zvi Lando, CEO, SolarEdge Technologies, comments: “This strategic partnership puts SolarEdge customers at the centre of the energy ecosystem and helps drive greater energy resiliency to homes and the grid in the UK and Texas. As the world continues to transition towards net-zero, these programs will be critical to ensuring a stable penetration of renewable energy into the grid network.”

Devrim Celal, CEO of Kraken, says: “This partnership with SolarEdge sees a key player in clean domestic energy tech join our ecosystem. The scale this brings will benefit our customers’ pockets and support the transition to a clean, sustainable energy system.”

SolarEdge | https://www.solaredge.com/us/

Kraken Technologies | https://kraken.tech/

EVgo Inc. (NASDAQ: EVGO) (“EVgo” or the “Company”), one of the nation’s largest public fast charging networks for electric vehicles (EVs), announced it has expanded its leadership team with a strong bench of experienced talent from Tesla and General Motors. Former Tesla charging team leaders Martin Sukup and Jeff Inhofer joined EVgo earlier this month, with Sukup taking on the role of Executive Vice President of Engineering and Inhofer serving as the Vice President of Electric Vehicle Supply Equipment (EVSE) Engineering. Effective August 12, 2024, General Motors veteran Alex Keros will join EVgo as Senior Vice President of Product.

Altogether, these new additions to the leadership team will further cement EVgo’s positioning as the charging network of choice for EV drivers amid a shifting competitive landscape. Bringing their extensive expertise in product, engineering, EV charging hardware and software, these leaders will accelerate EVgo’s efforts to develop next generation charging architecture that is designed to deliver an elevated customer experience while achieving new cost efficiencies.

“As the EV charging industry evolves, it is imperative that we not only invest in network enhancements, but also recruit best-in-class talent that will enable us to continue to deliver a superior charging experience for EV drivers,” said Dennis Kish, President of EVgo. “By expanding our leadership team with seasoned automotive and engineering experts, EVgo will continue to innovate and build out our customer-centric network for the nation’s rapidly growing population of EV drivers, who are increasingly relying on public infrastructure for their charging needs.”

Sukup comes to EVgo after 14 years at Tesla. He held leadership positions at Tesla in residential product architecture and charging systems where he delivered multiple generations of Superchargers, as well as other AC charging and residential energy products. Sukup will be responsible for EVSE hardware and software, data management, reliability, and quality.

Inhofer will work on developing the next generations of EVSE for the EVgo charging network. In his 10 years at Tesla, he developed products for the global Supercharger network and later moved to Tesla’s solar engineering team to support residential solar installations.

Keros spent nearly 18 years at General Motors commercializing advanced technology and establishing new business models to enable the deployment of EVs, fuel cells, shared mobility, and charging infrastructure. He will soon join EVgo to focus on product and services strategy, including market research and defining product requirements to ensure a seamless customer experience.

EVgo | www.evgo.com

Wind Sep 15, 2023

The Kincardine floating wind farm, located off the east coast of Scotland, was a landmark development: the first commercial-scale project of its kind in the UK sector. Therefore, it has been closely watched by the industry throughout its installation....

Grid modernization is having a profound impact on the nature and regulation of North American utilities. It represents a significant...

An Automatic Transfer Switch (ATS) is a means of transferring power between a primary electrical power source and an alternative...

Pressing real-world issues are faced by wind turbine operators. Among them, the integrity of wind turbine bolted connections at the...

In today's digital age, information is readily accessible at our fingertips. From DIY tutorials on YouTube to social media influencers, aspiring solar installers have numerous avenues to explore the intricacies of photovoltaic systems. However, while....

Photovoltaic (PV) solar energy generation has been a viable technology for decades, and, until recently, PV solar installations were limited in number and small in capacity, ranging from a few kilowatts (kW) to several megawatts (MW). Traditional fos....

In a push towards sustainability, many coal- and gas-fired power plants across the U.S. are being replaced with environmentally friendly and renewable energy (RE) sources like wind and solar. However, there are plenty of environmental hurdles for RE ....

The global goal for offshore wind capaci....

Wind turbine diameter sizes continue to ....

Although community engagement has tradit....

For many years, energy use in businesses has been taken for granted, and largely gone unmanaged. Despite it being such a significant overhead, organizations have been guilty of not giving enough thought to exactly how, when, or where they use energy.....

Electric vehicles are hitting the mainstream, savvy consumers are adopting high-efficiency heat pumps, and induction cooktops are replacing gas stoves. Homes are becoming more complicated — and more energy hungry — as energy prices continue to sh....

Ever heard the saying, “One man’s trash is another man’s treasure”? Turns out this applies to batteries, as well. Batteries have been prematurely disposed of, despite still holding three to five years of discharge cycles within them, meaning ....

The Inflation Reduction Act (IRA) and the CHIPS Act have been the most significant policies passed in the modern era. The two together have brought about a half trillion in private investments and $300b in public infrastructure spending to the United....

In ongoing discussions around net zero, heavy-emitting sectors have taken center stage, primarily due to their reliance on fossil fuels. Hard-to-abate industries account for about 30 percent of the world’s greenhouse gas (GHG) emissions, so their d....

Cyberattackers love renewables. This is because they meet many of the key characteristics that make them prime targets. First, renewables pioneer and employ new technology. Threat actors feed off new technology because it allows them to target vulner....