The Story Begins with Energy Throughput

Energy Throughput gives the amortized energy in and out of a battery over its entire life cycle. Energy Density is important, but not as important as Energy Throughput.

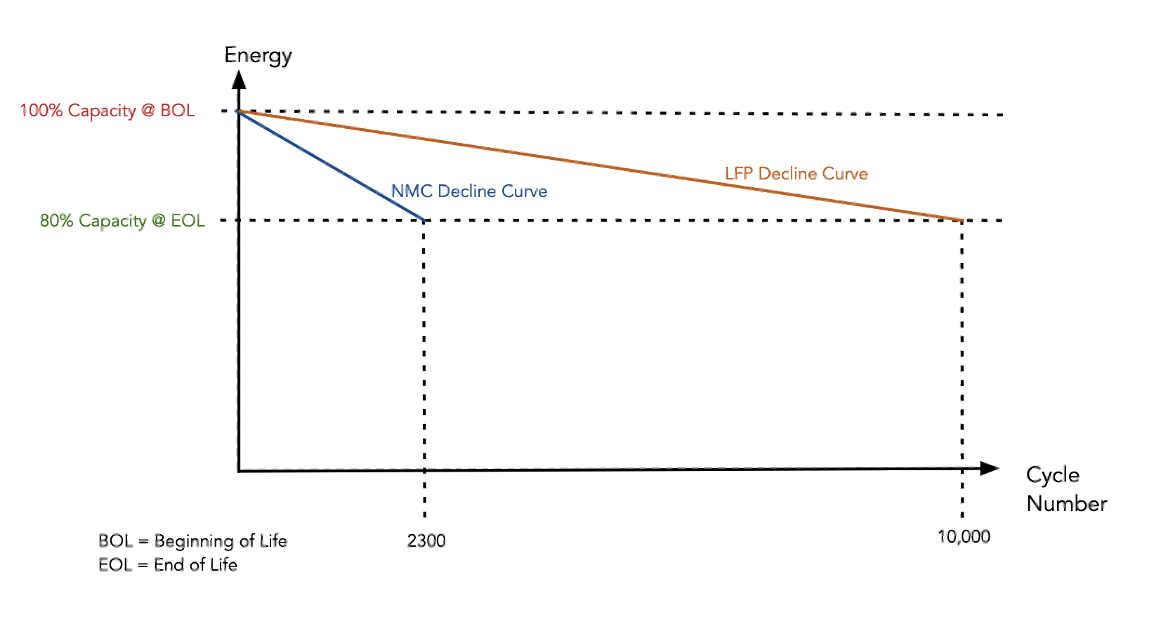

What is Energy Throughput? Add up all the cycles a battery is capable of. For a back-of-the-envelope comparison, use 10,000 for LFP, and 2300 for NMC. Multiply this by the sum of energy for all those individual cycles. That is the more valuable metric for a battery instead of energy density. Energy Density and related metrics of rated capacity of batteries only apply - in general - to the battery at the Beginning of Life (BOL). At the End of Life for a battery (EOL), we generally calculate this as when the energy capacity falls below 80 percent of rated capacity. There are, of course variations in the calculations, but the 80 percent figure is a good rule of thumb, and works well for business calculations such as return on investment, and amortization over a certain period of time for long term investing.

For example, your phone battery will die in 2-3 years if it is NMC, yet it will last at least three times that with LFP. The only thing you notice is that each charge does not last as long, but the battery life is greatly extended past 2-3 years. The simplified graph shown gives an illustration of the phenomenon. NMC at beginning of life looks better than LFP. However, NMC declines at a rapid rate, and LFP soon overtakes NMC in the long run.

For example, your phone battery will die in 2-3 years if it is NMC, yet it will last at least three times that with LFP. The only thing you notice is that each charge does not last as long, but the battery life is greatly extended past 2-3 years. The simplified graph shown gives an illustration of the phenomenon. NMC at beginning of life looks better than LFP. However, NMC declines at a rapid rate, and LFP soon overtakes NMC in the long run.

EV manufacturers know that the LFP battery will last at least 3 times longer than the NMC. Thus, when pack replacement comes around, it will be further into the future than with the NMC. Thus, the amortized cost per kilowatt hour over the life of the pack is better with LFP, even though, at first glance, the energy density of the NMC beats LFP. Would you rather replace your EV battery after 10 years, or after 3 years? That is the offering with LFP.

It must be noted, however, that there are still applications for NMC. Specifically, in performance vehicles where the life of the battery is not expected to go beyond 2-3 years. There are “hot rods” or racing vehicles that fall into this category. Also, some luxury brands may not be as concerned with the short battery life of the NMC chemistry, when the owner can expect to upgrade more often to get the expected luxury performance of the vehicle.

John Goodenough, a researcher at the University of Texas, invented the LFP cell around 1996. Owners of the patents included A123, Hydro-Quebec, and the University of Texas. The main patents expired in 2017, according to the US Patent office.

At the time of the patent expiration, China activated dozens of gigafactories that produced LFP in unheard of quantities. This action by the Chinese factories made LFP affordable across the board internationally. We can now purchase consumer LFP batteries off Amazon thanks to these Chinese gigafactories. One factor that influenced this decision by the Chinese was that China decided to convert all their buses to electric around that time, and LFP was one way of making this happen on the cell level. Also, for EVs in China, NMC was not allowed because of safety reasons, and so LFP was the obvious choice

EV manufacturers began to integrate LFP into their EV architectures in 2020 and 2021. Before this point, the Energy Storage System (ESS) markets were the only big players purchasing the LFP cells. Large players in the EV market are converting their fleets to LFP.

The EV players chose to integrate LFP in their systems around 2020 and 2022, because the remainder of certain patents for the technology expired in Europe in 2020, and in North America in 2021. Thus, factories around the world began an enormous effort to make available the LFP cell for the EV market. Today, the EV manufacturers account for approximately 80 percent of the LFP demand. Within a two-year period, most of the major the EV manufacturers switched from NMC to LFP.

How did this play out? This extreme change in the world market for cells completely disrupted the supply chains. The ESS market had integrated the LFP cells in various designs for over a decade. The above graph explained why. Amortization of assets over a long time period is extremely important in utility applications. Utilities make calculations in terms of decades, and, preferably, in terms of three decades (where possible) for expensive and large grid assets.

Furthermore, within a chemistry, there are different electrolyte recipes for a power dominant application versus an energy dominant application. For the ESS world, the focus is on energy dominant chemistries. For the EV world, the focus is on power dominant chemistries, since there are major current spikes in any EV drive cycle. ESS current draw curves tend to be more stable than the EV drive cycle models. Certain suppliers have dedicated production lines for ESS electrolyte recipes; long term partners can secure dedicated ESS LFP production lines for these special business relationships. However, since 2020, EV cells have been sneaking their way into the ESS supply chain, due to the enormous increase in demand.

Up until 2020 ESS manufacturers enjoyed a very stable cell market. The EV players came in and, within a two-year period, took up around 80 percent of the supply chain that was formerly the domain of ESS. This is a very big phenomenon. Today, ESS accounts for 13 percent of LFP demand. This is a major reorganization of the entire global supply chain for battery cells. IHS Market projects that, by 2025, EVs will have 90 percent of the LFP cell demand.

Projections of pricing predict that the price increases will not stabilize until 2024, when several LFP factories begin to come online and relieve the pressure of the supply chains due to the exponential  increase in demand from the EV market.

increase in demand from the EV market.

At the moment, those in the ESS business without long term supply agreements cannot find LFP cells. This means that hose just entering into the ESS market cannot source LFP cells. There are certain manufacturers that are focused on the ESS market for their production lines and supply chains. Those in the ESS business that have nurtured the relationships with their cell suppliers, who are dedicated with allocated production lines for ESS with the proper LFP electrolyte recipes, are in a better position to continue supplying their customers.

Those who have developed these close, and established relationships with top tier global suppliers have lead times of a couple of months. Those without these close relationships have lead times out 12-13 months. Those using LFP with dedicated ESS suppliers, combined with proprietary software management tools, are in a good position to avoid disruption in their supply chains with LFP cells.

The energy storage world has been revolutionized within the last 5-10 years. The electric vehicle world has also been revolutionized. Now, as opposed to 5-10 years ago, we are at the stage where such industries are profitable. For those of us who have participated in these industries over the past 20 years, it has been a long time coming. All of our efforts over the years have now paid off. It is indeed chaotic at this moment, but things will settle down in about 2 years or so. By then, our industry will have been established as something total new and profitable, and also a major player on the world economic stage.

Todd Hayes is President and CEO of e-On Batteries, which designs, assembles, and integrates Smart Battery Energy Storage Systems (SmartBess), with a focus on long-term reliability and safety throughout the United States, and beyond.

e-On Batteries | www.e-onbatteries.com

Author: Todd Hayes

Volume: 2022 September/October