The Flow Battery Permitting Conundrum: What regulators need to know

Renewable energy will play an increasingly dominant role in the global energy landscape. Scaling energy storage is critical to address the variability of renewable energy resources, which make up 75 percent of the world’s new generation capacity. The IEA estimates that grid-scale battery capacity could expand to 970 GW by 2030, a 35-fold increase from 2022. To get there, grid operators will have to add about 120 GW of storage per year through 2030.

Despite the bright future and demand for batteries, high-profile incidents like the Moss Landing fire in Northern California earlier this year have damaged the reputation of the energy storage sector. As regulators and communities delay or even pause new projects to assess their safety risks, development for non-flammable alternative chemistries like flow batteries may also be slowed. As the energy storage market evolves, safe and effective battery chemistries should not be pigeonholed by blanket regulations.

Understanding a diverse energy storage landscape

Lithium-ion remains the dominant battery type on the market for residential and commercial-scale applications. Lithium-ion batteries store energy in lithium ions on the anode, which are released to the cathode when the battery is discharged. The process is reversed when charging.

In recent years, flow batteries have gained recognition among policymakers, investors, and industry experts as a viable and affordable solution for large-scale applications, particularly for storage durations of four hours and longer. In 2024, China led the world in installing and commissioning nearly 2 GWh of flow battery storage capacity, a figure that’s expected to double this year.

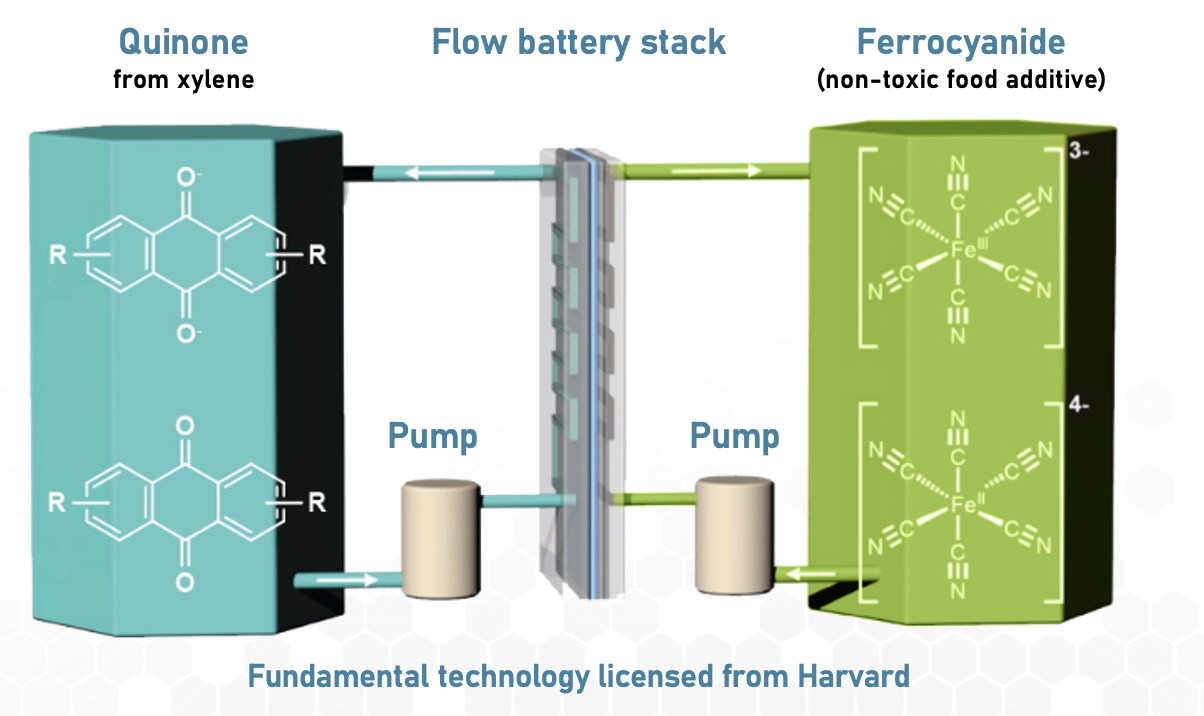

Flow batteries store energy in liquid solutions, also called battery electrolytes, in external tanks. During operation, the liquids are circulated to a flow battery stack which can convert the chemical energy in the liquids to electrical energy put out in a chemical reaction, or incoming electrical energy back into chemical energy in the reverse reaction; this is analogous to gasoline and air being delivered to a car engine where they are reacted. The size of the liquid tanks is completely separate from the size of the stack, allowing the battery’s energy capacity to be decoupled from its rated power.

While flow batteries are heavy, precluding their use in consumer electronics or electric vehicles, they are more attractive for stationary storage and can even enable higher energy density than lithium-ion batteries — on the basis of land usage.Compared to lithium-ion or lead-acid batteries, flow batteries are known for their excellent resistance to capacity degradation even when subjected to deep cycling. This, coupled with their fire safety advantages, make flow batteries ideal for projects in densely populated areas and within communities, or for use cases that require very frequent deep cycling that would rapidly degrade other kinds of batteries. At the end of life, flow batteries can also be easily recycled because the active material liquids can be drained from the system and subsequently purified without needing to disassemble millions of small cells.

Water-based organic flow batteries utilize active materials derived from petroleum aromatics or coal tar chemicals, which are abundant, inexpensive, and produced domestically. This gives them a unique advantage over vanadium-based energy storage systems. While vanadium has become a common flow battery reactant, it is a critical material with a high-cost floor, which can introduce supply chain and availability challenges.

The global flow battery market is slated to experience impressive growth driven by investments in renewable energy and the urgent need for large-scale energy storage systems. Research shows that flow battery deployments grew over 320 percent from 2023 to 2024. Flow batteries need revenue streams — and supportive policy — to get across the finish line.

Prioritizing safety & accounting for new innovations

Battery fires, though rare, can be catastrophic. Amid increasing demand for safer batteries, some manufacturers have introduced 'non-flammable batteries.' However, this term is potentially misleading as it might be applied to the potential for thermal runaway during operation, but the components themselves can still sustain and propagate fires if started externally. In installations consisting of millions of cells, a single manufacturing defect could still be enough to cause a fire.

While battery safety must continue to be a paramount consideration for the industry, there is a presumption that all battery chemistries and designs are liable to starting fires. This is not true, especially for flow batteries. In the worst-case scenario in which a fully charged water-based flow battery is instantaneously discharged, the liquids would merely experience a temperature rise of less than 20 degrees Celsius, because the specific heat capacity of water is so high.

Sometimes, permitting and regulatory reforms mean rebuilding the entire regulatory landscape. For example, fire safety regulations such as NFPA are only updated every three years, which can’t keep up with the pace of innovation in energy storage. Any new regulations that treat all battery chemistries as having the same (high) fire risk without taking into account safer alternatives — including flow batteries — will end up bottlenecking progress on battery innovation, grid storage, and the broader energy transition.

Instead, regulators, battery developers, municipalities, and local leaders should take action to ensure each chemistry has its own regulatory framework that accounts for unique factors like flammability, size, application, and more. It’s well-understood that energy storage projects support more stable grids, reduce reliance on fossil fuels, and provide critical, reliable back up power. Now is the time to increase education around the types of battery solutions and chemistries and parlay this awareness into more discerning regulatory policies and, eventually, a more robust and enduring U.S. energy storage market.

Eugene Beh is CEO of Quino Energy. Quino’s flow battery chemistry uses materials made from abundant sources – coal tar chemicals – and can be easily supplied through fully domestic (US) supply chains.

Quino Energy | quinoenergy.com

Author: Eugene Beh

Volume: 2025 July/August