Growing the Lithium Industry in North America

There are 300 electric car manufacturers in China, according to the latest research from Xinhua. It dominates the global EV market, and, in turn, dominates all aspects of the lithium-ion battery supply chain. In fact, there’s so much lithium in China that government regulators have capped production, yet it continues to control and dominate the global lithium market.

There are 300 electric car manufacturers in China, according to the latest research from Xinhua. It dominates the global EV market, and, in turn, dominates all aspects of the lithium-ion battery supply chain. In fact, there’s so much lithium in China that government regulators have capped production, yet it continues to control and dominate the global lithium market.

China is 10 years ahead of the world in every respect. However, now that the transition to electric vehicles is in full swing across Western Europe and North America, the demand for lithium has increased, and will continue to do so.

The world does not lack in actual lithium; it lacks mineable lithium. It also lacks the processing facilities to convert 6 percent lithium spodumene into a usable raw material (hydroxide or carbonate) for the battery industry. In North America today, there isn’t an integrated lithium producer or significant lithium mining. There has been lots of movement to remedy this, but solutions are still years away, and many of them will die on the drawing board.

Whilst the US Geological Survey estimates China to be fourth in the world for lithium reserves (1.5m tons of lithium content), it has more than 70 percent of worldwide capacity for the supply of lithium-ion batteries. The United States is currently over-reliant on China for battery production, which is a risk on many levels.

Where does this leave North America, the birthplace of the mass-produced car? Can it maintain its leading position over the course of the next decade and beyond?

In June 2021, The White House announced plans to secure an end-to-end domestic supply chain for advanced batteries. President Biden even said, “we need automakers and other companies to keep investing here in America, and not take the benefits of our public investments and expand electric vehicles and battery manufacturing abroad.”

US automakers are also recognizing the need to invest in North America battery and lithium firms. Only recently have we seen investments and subsequent announcements from household auto brands, promoting plans to build one of the world’s largest battery facilities in Ohio, and potentially building two more plants in the next four years. We have also seen plans from a big global tech conglomerate to boost production capacity of batteries for a well-known US automaker in Nevada, in an investment expected to exceed $100 million.

The issue automakers have in the United States is not just sourcing lithium, but also processing the raw materials. While the United States has some of the world's largest reserves, the country today has only one large-scale lithium mine. It’s based in Nevada, and produces just 5,000 tons a year - less than 2 percent of the world's annual supply.

The issue automakers have in the United States is not just sourcing lithium, but also processing the raw materials. While the United States has some of the world's largest reserves, the country today has only one large-scale lithium mine. It’s based in Nevada, and produces just 5,000 tons a year - less than 2 percent of the world's annual supply.

Where the United States could really benefit is from their relationship with Canada. Canada's mining industry is one of the largest in the world, with the country producing more than 60 different metals and minerals. Additionally, the United States is neighbor to a country with the friendliest mining jurisdictions in the world.

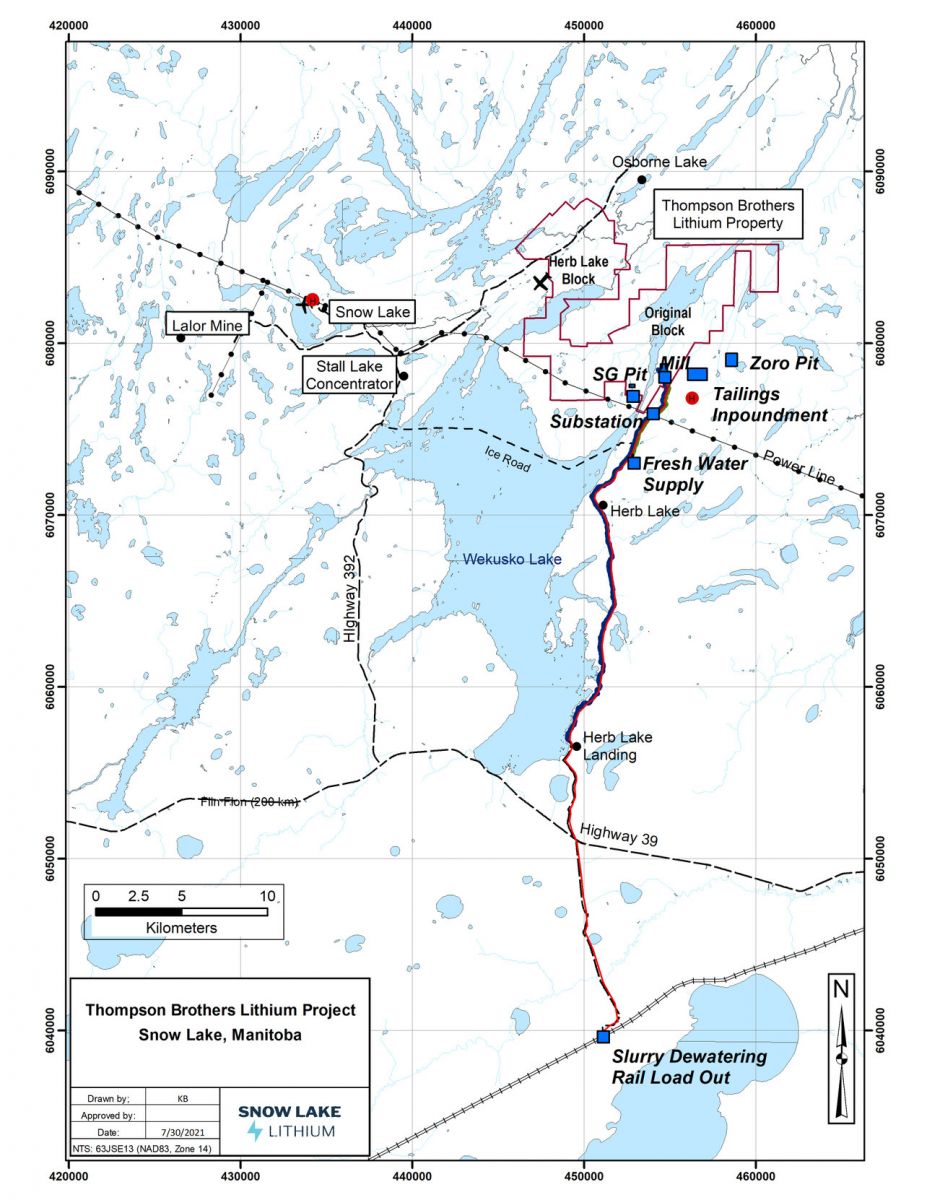

Snow Lake, a town located 685 km north of Winnipeg, Manitoba (Canada) is the perfect example of a place with the lithium resource to help supply the North American auto industry. Snow Lake is in a province that has over a century of a proud mining legacy, so the local and regional areas are well versed in all aspects of mining, and it has all the supporting infrastructure. Snow Lake, and Canada more broadly, is also extremely well connected by rail, with direct access to the entire North American auto market in a matter of days, reducing delays in the production and transportation of materials and batteries across the globe. Having a vertically integrated supply chain from Canada to the United States also significantly reduces the carbon footprint for every auto business, helping them to lower their national and global emissions output. It also supports the North American economy with investment and highly skilled jobs, and ensures automakers have easy access to the source, while also reducing transportation costs.

The real issue right now for US auto makers is that there is currently no facility in North America that can actually process the concentrate, which has been mined, to the next level of the value chain. For this to work, a sustainable and fully integrated lithium hydroxide processing plant will need to be built in North America. This will allow tens of mining operations in Canada to actively pursue production of lithium for the North American auto industry.

If North America and its car manufacturers do not adapt soon, all of them will lose market share. This is a once-in-a-generation opportunity for North America to make huge strides. If it falters, the future of the North American car industry may cease to exist.

With more than two decades of experience advising resources and mining operations, Philip Gross has covered everything from base metals and precious metals, to hydrocarbons and agriculture. Philip has led a number of metals and mining investment firms and has spent a large portion of his career developing mining investments as an investor, CEO, Exec Director, and non-Exec Director for both public and private ventures across the globe, with a particular focus in North America, Europe, and Australasia.

As CEO of Snow Lake Lithium, his ambition is for the company to become the first fully integrated, carbon-neutral lithium provider to the North American electric vehicle market.

Snow Lake Lithium | snowlakelithium.com

Author: Philip Gross

Volume: 2022 September/October