Boosting ROI for PV-Cell-Plus-Battery Storage

By 2050, global energy demand is slated to grow by 47 percent. Thanks to their competitive costs, scalability, and newly associated Inflation Reduction Act (IRA) tax incentives, alternative energy systems that merge photovoltaic (PV) cells and PV storage batteries are “rising star” technologies in this market scenario.

Combining solar panel projects with battery storage solutions not only provides improved energy efficiency, it also unlocks new revenue opportunities by commercializing available solar energy storage flexibility.

The on-site optimization of these systems is a critical factor in achieving project success, and planning is essential. Identifying the complex environmental and engineering challenges of a given physical site early on enables smart considerations and realistic financial models that optimize a project for the best rate of return.

Incorporating a commitment to “safety by design” should also be a project priority. This kind of assurance includes equipment design, construction, lifting points for major equipment, site ergonomics during equipment installation, and any off-site construction of modular pieces. A successful project is a safe one.

Below is an overview of the key phases and considerations of any PV plus Battery Storage Project.

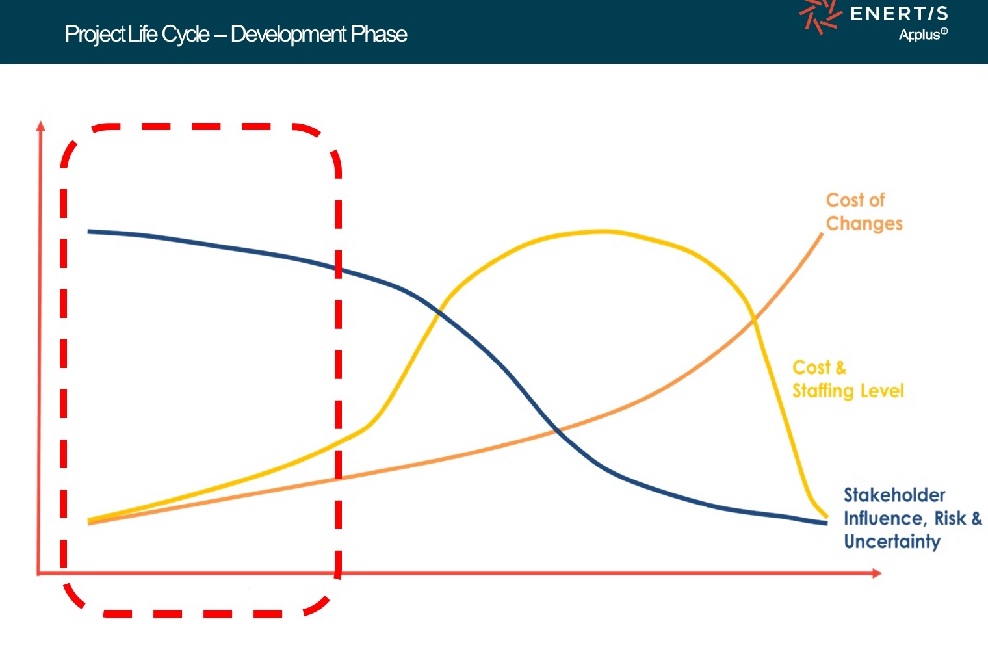

Development Phase

Stakeholder influence is high, and cost of change is low.

Planning by creating a use case for early modeling is critical to getting the numbers right. Modeling various use cases and revenue streams help to determine the correct inputs for the financial plan before an offer is submitted, regarding a Power Purchase Agreement (PPA), Request for Proposal (RFP), or any other form of offtake agreement. Although the newly passed IRA has extended and redefined investment tax credits (ITCs) and production tax credits (PTCs) for solar projects, including stand-alone, guidance is currently unclear as to how these credits can be combined for the highest possible ROI. For now, the best strategy is to build base case assumptions and evaluate financial models on the site’s specific configurations and demands.

The first step in identifying specific project assumptions is to determine who the target customer will be. Will the energy be used for customer services, utilities, or independent system operator/regional transmission organization services (ISO/RTO)? This question becomes trickier with the new IRA stand-alone PV storage tax credit, because the site can be built in a more complex environment (close to a major substation or node on the grid, near a city-center site, near an environmentally challenged area, adjacent to an existing or retiring fossil fuel asset, and/or any other kind of building-based area). Any one of these locations can present additional issues, such as environmental exclusions, noise receptors, easements, or National Fire Protection Association (NFPA) 855 Standard requirements.

Another basic decision to be made is whether the project should be AC or DC coupled. This depends on a number of factors: interconnection restrictions, frequency regulation, demand response, non-spinning reserve, and environmental considerations, such as microclimates (i.e., ramp rate control).

Challenges like these can change initial site considerations and financial models. It’s critical, therefore, for early identification of permitting and environmental restrictions to determine “what will fit” the project’s buildable area and desired capacity.

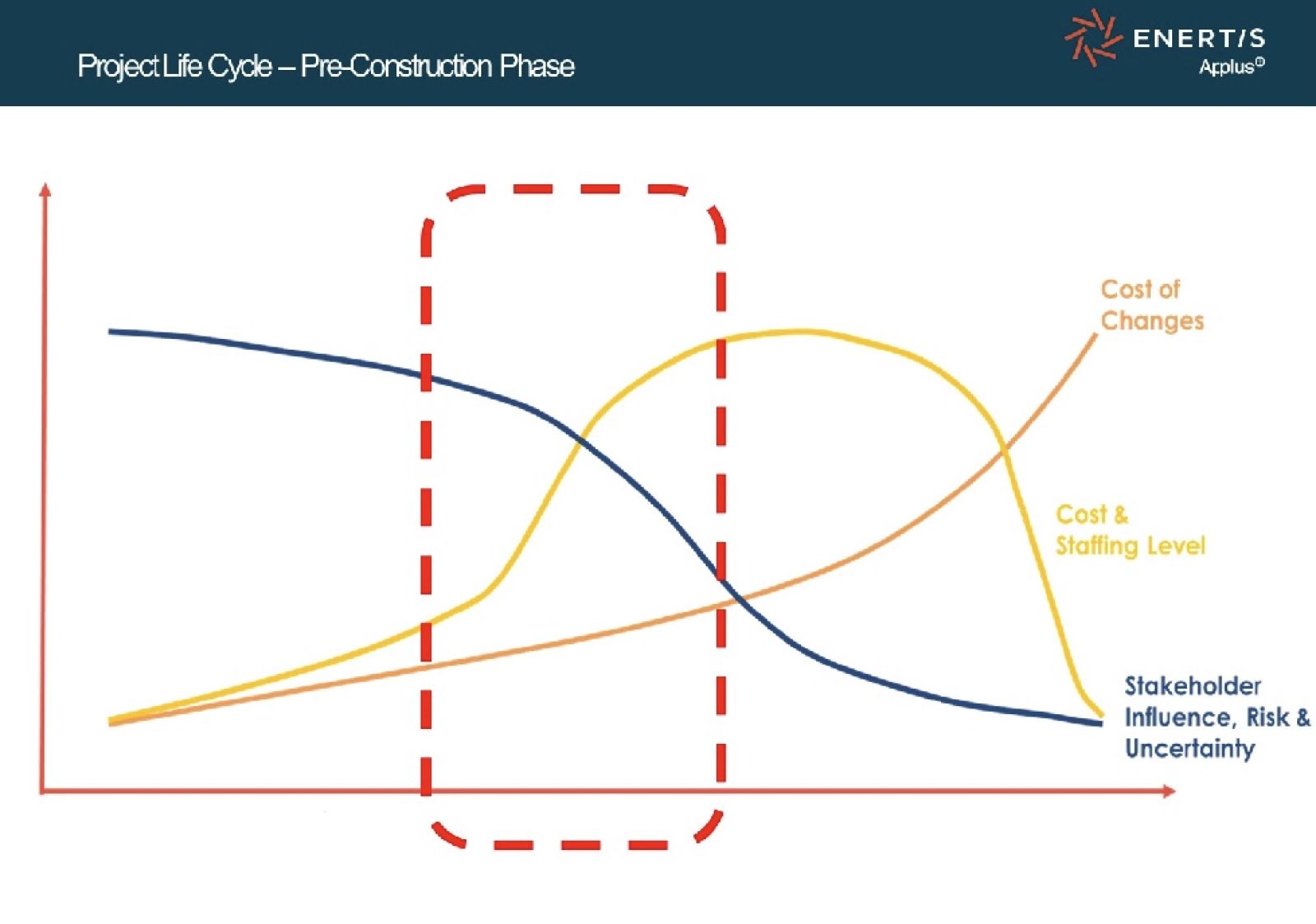

Preconstruction Phase

Project costs are starting to rise, and stakeholder influence is declining.

The priority is to define a clear division of responsibility among the battery storage supplier, the engineering, procurement and construction (EPC) managers, the site owner, the transmission supplier, and the due diligence officer. Each of these project members must be coordinating with and talking to one another on an ongoing basis. An ideal set of activities for the project includes managing the RFP process, providing the necessary engineering support, and factoring in lead times with the overall project schedule, to set the project up for success in the final Construction/Commissioning Phase.

At this stage, it’s essential to understand how much lead time is required and how much of the RFP design package is necessary to start procuring project materials (particularly those with long lead times). A common misconception is that a full 60 percent of the design is needed to start the process. This is not accurate. In fact, for much of this equipment, as little as 10 percent of the design can be enough to generate high level specifications to secure a manufacturing slot, especially for transformers.

It’s imperative that the batteries are guaranteed by the manufacturer to operate throughout their useful life in extreme environmental conditions (i.e., variations of temperature, humidity, air quality, noise level, and intensity of light). This protects the revenue stream and provides grid reliability for target customers.

Another consideration is whether to have a fully integrated solution (the supplier provides both the battery and inverter in a turn-key package), or opt for self-integration (all components are purchased separately, and a software company is hired to integrate the various pieces). There are pros and cons to either choice from a risk and cost standpoint; it all depends on the specific site’s use case, as well as the buying power of project management.

Heat rate (“round trip efficiency” in battery terms) and energy availability are crucial in the day-ahead market for traditional thermal plants. Several ISO markets — including Pennsylvania-New Jersey-Maryland Interconnection (PMJ), California Independent System Operator Corp. (CAISO), and Electric Reliability Council of Texas (ERCOT) —

either offer or plan to implement more dispatch incentives based on an asset’s availability and efficiency. As PV energy is often used to off-set electricity rates and/or provide energy during outages, planning for efficiency and the ability to respond to grid outages are additional considerations for solar cell plus battery storage systems.

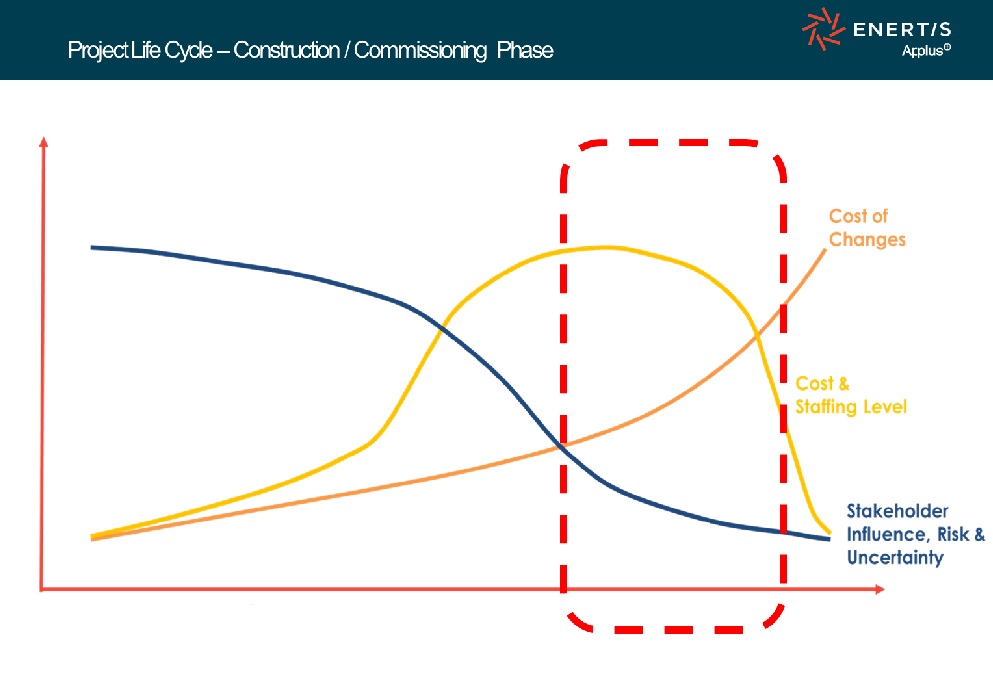

Construction/Commissioning Phase

The cost of change is high, and staffing levels are dropping as the end of the project nears.

What’s important in this phase is to follow the defined division of responsibility for project members, as well as hold suppliers and contractors to their agreements. The most critical step at this point in the project is going from Mechanical Completion (planning and getting the materials on site) to Substantial Completion (actually putting the materials together on site, and turning the project on).

Though construction can be pretty straightforward, the proper labelling of equipment (cables, conduits, meters, etc.) can help site operators troubleshoot later on. Once the project breaker is closed and the inverters/battery components are “hot commissioning,” the clock is ticking to get to commercial operation. Troubleshooting usually occurs if things do not operate as they were intended to per the contract.

The last step is performance testing to ensure the equipment purchased meets all contractual obligations. Effectiveplanning during development and pre-construction phase is the best recipe for end of project success.

Matthew Towery, BSME, PE, PMP, is a Senior Manager of Energy Storage at Enertis Applus+, which provides technical consulting, engineering, testing, and quality control services to developers, owners, financial entities, equity investors, and contractors.

Enertis Applus+ | www.enertis.com

Author: Matt Towery

Volume: 2023 January/February