Better Battery Manufacturing, Not Just Better Batteries

As gas prices and temperatures continue to rise in parallel, leaders across the globe are fueling initiatives like the Inflation Reduction Act (IRA) to combat climate change and boost renewable energy. This crucial legislation targets a reduction in carbon emissions of 40 percent by 2030 on the path to a 2050 net-zero objective. Accelerated EV adoption is vital to achieving the impending emissions reduction targets, as electric vehicles can save up to 60 percent on carbon emissions compared to similar fuel-based cars.

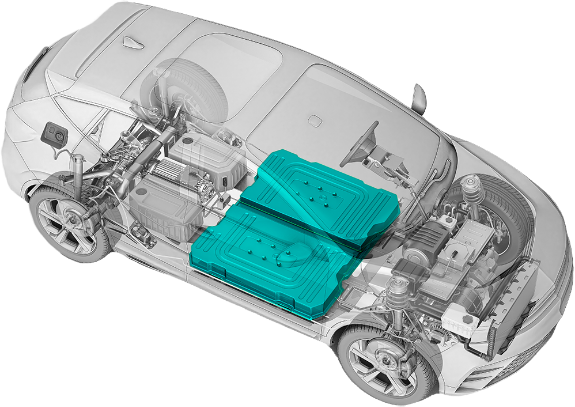

With affordability a known roadblock to EV adoption, the IRA includes a $7,500 point-of-sale tax credit to motivate consumer purchases. Critically, most EV car models at present do not meet the legislation's U.S. battery manufacturing requirements for critical minerals and battery components that activate the full tax credit amount. Consequently, reaching transportation electrification requires considerable investment in bringing lithium-ion battery manufacturing to North America, and necessary advancements in manufacturing.

Achieving net-zero means reducing greenhouse gas (GHG) emissions from vehicles on the road and those in production – including the GHG impacts of manufacturing those EVs and their batteries. The manufacturing impact is critical, as projections for EV purchases jumped from 43 percent to more than 50 percent of all new car sales by 2030, following the passing of the IRA. These numbers indicate the need to scale up domestic production rapidly. For this reason, we must enact sustainable manufacturing solutions now to meet our decarbonization targets.

Addressing domestic battery supply chain gaps

The IRA consumer tax credit for EVs requires battery raw materials to be sourced from North America or a U.S. free-trade agreement partner, and vehicle battery components (such as cathode and anode material) to be manufactured or assembled in North America. The government intends to bridge critical domestic battery supply chain gaps by adding these stipulations. Previously, the U.S. heavily relied on international markets for battery raw materials and components manufacturing, with China being the dominant worldwide supplier. Now, automotive manufacturers are investing in U.S. battery production, but demand will continue to outpace the supply for some time.

Additionally, an immense gap exists in domestically - sourced raw material supply and component production. North American cathode production only has the ability to meet 4 percent of demand by 2030. This supply and demand gap further drives the importance of investing in innovations that not only meet today's requirements, but are also resilient and long-term solutions. With billions of dollars being deployed, we cannot be short-sighted in our developments. We can simultaneously meet the domestic supply chain requirements for battery materials and components while ensuring that the manufacturing we invest in is built for future success.

EV battery manufacturing challenges

Lithium-ion battery manufacturers must address areas in which the conventional process is counter to decarbonization goals. In particular, the cathode active material (CAM) is the most expensive and carbon-intensive component in today's lithium-ion battery, by a significant margin. Due to high emissions, waste, and cost, conventional li-ion battery cathode manufacturing methods cannot support climate goals. Upwards of 60 percent of CAM processing materials are disposed of as waste in the form of sulfuric acid, which has to be transported and disposed of properly, carrying a high cost and carbon burden. Moreover, current cathode manufacturing techniques require billions of gallons of water annually; this must be remediated to avoid depleting another critical natural resource as we advance.

Further, each manufacturing facility can produce only one type of battery chemistry, which will be problematic as battery technology changes. We have already seen numerous advancements in battery chemistry, both in terms of finding more efficient and longer-lasting chemistries and in terms of efforts to curtail the sourcing of limited critical minerals. What happens when billions of dollars have been invested in a particular chemistry once that chemistry is no longer the best way to make a battery? Introducing optionality (the ability to produce multiple chemistries from the same asset) to cathode manufacturing ensures that U.S. EV production stays viable and environmentally sound in a landscape of shifting technologies and scarcity of materials.

The role of recycling in battery sustainability

It is worth noting that today's battery manufacturing headlines often focus on recycling, which is frequently cited as the answer to reducing costs and creating a more sustainable EV supply chain. Supply chain constraints for critical minerals used in lithium-ion batteries are a substantial risk, and recycling both increases available minerals and helps further decarbonization. However, there are some key considerations when utilizing these recycled materials.

The cathode is already in its mixed metal state in a used battery, meaning that lithium and other metals are intermingled. Recyclers are individually reprocessing the metals into their separate states as conventional cathode manufacturers enact a multi-step process to bind them together. As battery recycling increases, there is excellent potential for a one-step manufacturing method that eliminates the need to separate the metals, thus eliminating steps within the recycling process, and furthering reductions in costs and carbon emissions.

While EV battery recycling is a vital piece of the bigger net-zero challenge, ample material supply from recyclers will likely not be available for at least a decade, as that is the average lifespan of a battery. We are only now reaching a threshold of EV use that will provide a source from which to recycle. Waiting for recycling to take hold is not an option. We can make battery manufacturing greener today – starting with the cathode.

The next generation of cathode production must be future-proof

Future-proofing cathode production means ensuring the manufacturing process is built to withstand the advancements and pressures of today, and beyond. To do that, the next generation of CAM production should incorporate cleaner, more efficient technologies. For example, using less processed material inputs. For example, using metal oxides and hydroxides instead of metal sulfates expands the yield to 99 percent, virtually removing waste (and the issue of sulfuric acid). Working with metal oxides and hydroxides also broadens the range of precursor material inputs, meaning a more expansive catalog of critical minerals can be used. This is one immediate way to ease the pressure on limited mining resources, like nickel, which is in high demand from the booming battery industry.

A one-step process that eliminates water is also more eco-friendly, and drastically reduces the footprint needed. A smaller facility could mean as much as a 40 percent reduction in plant capital, which promotes localized production, reducing transportation costs and further shrinking the carbon footprint of the manufacturing process. Innovations like these are essential to achieving a lower-cost, more sustainably manufactured EV in the near term.

While EV usage is fundamental to achieving climate goals, the importance of ensuring less environmental impact throughout the EV value chain cannot be overstated. Employing future-proofed, next-generation cathode manufacturing processes will help the domestic EV market grow and remain competitive, while boosting local economies. The purpose of the electrification movement is decarbonization, so we must make this transition as sustainably as possible.

Virginia Klausmeier is CEO at Sylvatex, an advanced materials technology company. Sylvatex tests battery performance evaluations throughout the scaling of materials, and leverages public-private partnerships with national labs for expertise and equipment for speed and efficiency.

Sylvatex | sylvatex.com

Author: Virginia Klausmeier

Volume: 2023 July/August