Standard Lithium Ltd. (“Standard Lithium” or the “Company”) (TSXV:SLI) (NYSE American:SLI) (FRA:S5L), a leading near-commercial lithium development company, announced the closing of a landmark strategic partnership (the “Transaction”) with Equinor ASA (NYSE: EQNR), a multinational energy company and recognized leader in renewables and low-carbon solutions, to accelerate the development of Standard Lithium’s large-scale, sustainable lithium projects in the Smackover Formation.

The Transaction includes Equinor's contribution of up to US$160 million, representing its total gross project-level investment and reflecting its 45% ownership stake in the two entities. This investment includes a US$30 million cash payment to Standard Lithium at closing, a work program solely funded by Equinor of US$60 million, representing a US$33 million carry by Equinor for Standard Lithium’s portion, and US$27 million for Equinor’s portion, at the South West Arkansas Project (SWA) and East Texas (ETX) properties (ETX and together with SWA, the “Projects”), and up to US$70 million in payments to Standard Lithium subject to both parties taking positive Final Investment Decisions. Standard Lithium and Equinor will each own 55% and 45% of the Projects respectively, with Standard Lithium retaining operatorship.

Dr. Andy Robinson, Director, President and COO said: “We are delighted to have concluded this transaction and begun an exciting new partnership with Equinor. We believe this partnership with a global energy major validates the quality of our team, our DLE flowsheet and experience, and our world-class lithium-brine resources in Arkansas and Texas. We’re at a crucial stage in our Company’s growth and this partnership with Equinor will be fundamental to the continued de-risking and execution of these important projects. One thing that we have observed in the lithium world over the past decade is that strong, mutually-aligned partnerships are the key to successful project execution and operation, and we believe we have aligned with the right partner to take SLI and the lithium industry in Arkansas and Texas to the next level.”

Transaction Highlights

- Partnership between Standard Lithium and Equinor is strategic and complementary; it combines SLI’s unparalleled DLE and Smackover brine processing expertise, plus world-class assets, with a global energy major with deep experience in sub-surface assessment and production, project development, financing, construction and operations;

- Significantly de-risks project execution at Standard Lithium’s Projects, including the development and project execution at SWA;

- The Transaction immediately strengthens Standard Lithium’s financial position; additionally, the cost carry component on agreed project development expenditures at the Projects provides further benefits and results in no dilution to existing shareholders;

- Equinor as a partner has a track record of project excellence;

- Strong alignment between Standard Lithium and Equinor to develop a sustainable lithium business, adhering to high levels of environmental and social responsibility.

“This partnership with Equinor is a major accomplishment for Standard Lithium. It has long been our belief that success in this sector hinges on strategic partnerships with companies who share our vision and bring complementary strengths. Equinor’s culture and values align with ours in using innovation, integrity and responsible development to enable the global energy transition. With this partnership, we have the opportunity to accelerate our progress and carve out a significant role in shaping the future of sustainably produced lithium,” stated Standard Lithium CEO, Robert Mintak.

“We are looking forward to developing these opportunities in the Smackover Formation together with Standard Lithium. With Standard Lithium as operator and by building on Equinor's core competencies such as sub-surface and project execution capabilities, we believe that more sustainably produced lithium has growth potential and will be an enabler for the energy transition,” says Morten Halleraker, senior vice president for New Business and Investments in Technology, Digital and Innovation at Equinor.

Transaction Details

The Transaction was completed effective May 7, 2024 with Equinor, an arms-length party, acquiring interests in two Standard Lithium subsidiaries, one of which holds Standard Lithium’s South West Arkansas Project and the other the East Texas properties. Pursuant to the terms of the Transaction, Equinor acquired a 45% interest in each of the subsidiaries for an initial cash payment of US$30 million to Standard Lithium and the commitment to invest up to an additional US$130 million subject to both parties taking positive Final Investment Decisions as follows:

- Equinor to solely fund the first US$40 million of development costs at SWA upon completing the Transaction, after which all additional capital expenditures would be funded on a pro-rata basis;

- Equinor to solely fund the first US$20 million in exploration and development costs at the ETX properties, after which all additional capital expenditures would be funded on a pro-rata basis;

- Standard Lithium will receive up to US$70 million in milestone payments associated with SWA and ETX subject to the parties taking Final Investment Decisions by certain dates, respectively;

- Standard Lithium will maintain majority ownership and operatorships pursuant to Development Services Agreements at each of SWA and the East Texas Properties;

- Each special purpose entity will be governed by a Limited Liability Company Agreement with a management structure that integrates the expertise and resources from both companies; and

- No parent-level common equity ownership dilution at Standard Lithium as a result of the Transaction.

Standard Lithium | www.standardlithium.com

.jpg?r=4064)

Highland Electric is first CIB-funded company to lease ZEBs for school transportation across Canada.

Highland Electric is first CIB-funded company to lease ZEBs for school transportation across Canada.

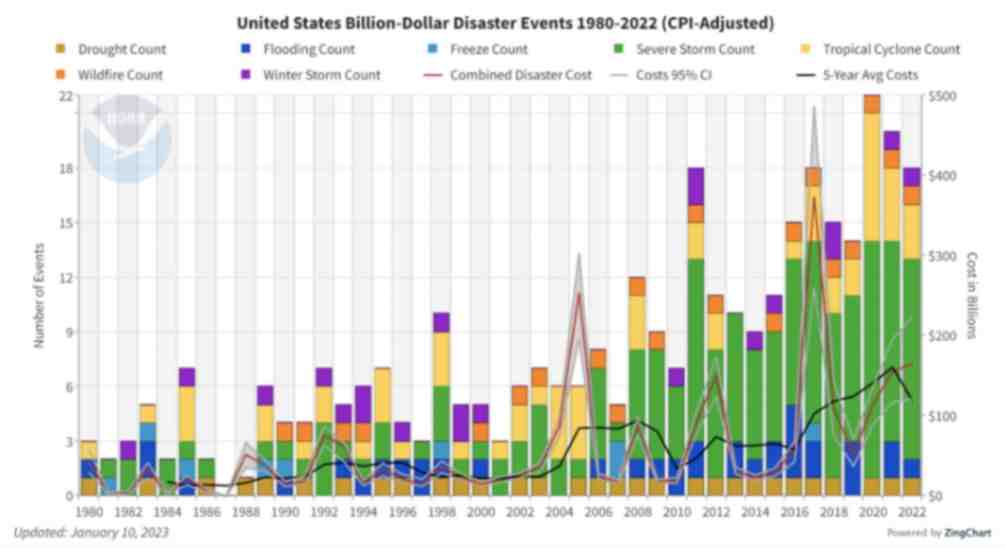

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.