From Cost to Value

The economics of battery energy storage

Last year, in many ways, proved the "Year of the Battery." After the U.S. installed ~44 and ~62MW of energy storage capacity in 2013 and 2014, respectively, through just Q3 2015 some 108MW had already been deployed, according to GTM Research and the Energy Storage Association. Tesla's long-anticipated Powerwall and Powerpack batteries made their debut to much excitement. Stem bid aggregated, customer-sited batteries into California's real-time electricity market as a demand response resource for the first time in September. And investment bank Lazard released its first-ever in-depth analysis of the levelized cost of storage in November.

To date, much attention has been focused on battery cost, and especially how comparatively cheap (relative to recent historical prices) batteries have gotten and how rapidly they've come down the cost curve. But the energy storage conversation is now shifting to crucially add in the second half of the economics equation: value and revenue.

So far most energy storage capacity in the country has been front-of-the-meter installations with utility-scale batteries. And even when they're installed behind the meter, they're usually deployed for a single, primary use, whether demand-charge reduction or backup power for a commercial customer or frequency regulation in places such as PJM's wholesale electricity market. But this approach underutilizes and undervalues the battery, especially relative to its cost. It's akin to buying a Swiss Army knife multi-tool and using only the blade.

A battery is capable of delivering many services with the same device, yet that's not how they're being used today. Batteries deployed to reduce demand charges, for example, might only be used 5–50 percent of their useful life. Enabling batteries to deliver a stack of additional services during that balance of time they're sitting "idle" could unlock more value, and thus greatly enhance battery storage economics.

The report The Economics of Battery Energy Storage* asked several fundamental questions:

- What services can batteries provide?

- Where on the grid can they deliver each service?

- How much value can they generate when highly utilized and services are stacked?

- What barriers—especially regulatory—stand in the way?

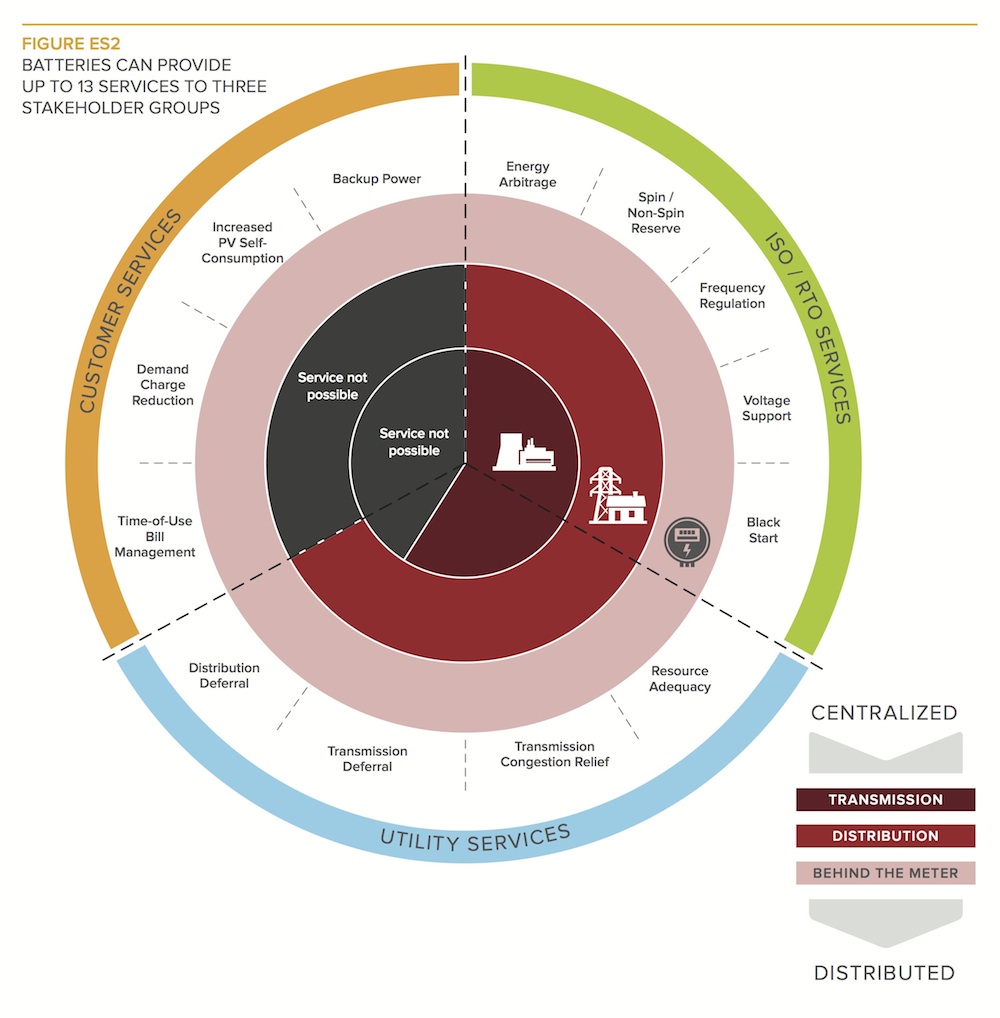

The research indicated that batteries, when placed behind the meters of residential, commercial, or industrial customers, can deliver 13 services to the electricity system at large (see figure 1). Batteries deployed further downstream in the electricity system (behind the meter) can technically deliver the maximum number of services to the grid.

The research indicated that batteries, when placed behind the meters of residential, commercial, or industrial customers, can deliver 13 services to the electricity system at large (see figure 1). Batteries deployed further downstream in the electricity system (behind the meter) can technically deliver the maximum number of services to the grid.

Batteries deployed behind the meter can be cost effective today

This finding, though important, doesn’t tell how much net value batteries can deliver to the electricity system. To estimate this, an energy storage dispatch model was developed to understand the economics of energy storage in four potential real-world scenarios. The results were surprising. Batteries deployed behind the meter are “in the money” right now, under prevailing cost structures, without subsidy. This finding comes with two major caveats:

Batteries must be well utilized and deliver multiple services to customers and the grid in order to be cost effective.

The modeling results assume no regulatory barriers to aggregated, behind-the-meter market participation or revenue generation.

The economics are promising, but regulations must evolve

Every one of the revenue-generating services in this example is being delivered by some behind-the-meter energy storage systems in operation today. But very few projects are simultaneously providing this full stack of services (or other combinations thereof) with a single device or fleet of devices. A number of regulatory prohibitions currently prevent batteries deployed behind the meter from delivering and getting paid for many of these services.

This is because energy storage—and other distributed energy resources (DERs) like smart controls, energy efficiency, and rooftop solar PV—has matured faster than the rates, regulations, and utility business models needed to support them as core components of the future grid. That needs to change, and regulators, utilities, and battery and other distributed energy resource (DER) developers can all play a role.

Battery-based energy storage is a powerful resource capable of reducing grid costs and customer bills, increasing the resilience of the grid, and supporting a largely renewable electricity system. And even though the economics of storage look good today, they’re only going to get better as costs come down further. It’s time for utility business models to evolve, and for regulations to change in order for the benefits offered by behind-the-meter, battery-based storage to be captured across the U.S.

Jesse Morris is a manager and Garrett Fitzgerald is a senior associate in the electricity practice at Rocky Mountain Institute, an independent nonprofit focused on market-based energy efficiency and renewable energy solutions.

Rocky Mountain Institute | www.rmi.org

*The Economics of Battery Energy Storage: How Multi-Use, Customer-Sited Batteries Deliver the Most Services and Value to Customers and the Grid; released by Rocky Mountain Institute in October 2015.

Author: Jesse Morris and Garrett Fitzgerald

Volume: January/February 2016