Wind Turbine Suppliers Deliver New Record Volume

Wind turbine manufacturers installed 127 GW of new wind power capacity in 2024, according to GWEC’s annual Supply Side Data report. The data from GWEC’s Market Intelligence team finds 29 different wind turbine suppliers mechanically installed 23,098 units last year despite the challenging macroeconomic pressures, rising commodity and capital costs, and prolonged supply chain disruptions.

The wind industry continues to set new annual installation records and will continue to do so in the coming years, according to GWEC forecasts. However, industry and governments must work together to remove structural barriers, improve market design and develop procurement mechanisms to accelerate and install the second Terawatt of wind power.

Find the Report on GWEC's Market Intelligence Site

Although some of the wind turbine manufacturers achieved a positive EBIT margin for their wind turbine production business in 2024 for the first time since 2021, more than half of the western and several Chinese turbine suppliers continued to see negative year-on-year (YoY) growth in net profit.

Ben Backwell, CEO of GWEC, said: “This new record in installations is a testimony to the key role wind energy is playing in delivering the energy transition and protecting people from ever-higher energy prices caused primarily by fossil fuel volatility.

“Governments need to urgently take action to kick start a much faster transition to renewables and remove barriers to deployment and investment. This means cutting red tape and bureaucracy, fast-tracking grid investments and ensuring that markets adequately remunerate green energy instead of subsidising fossil fuels.

“The world is seeing the energy transition take shape, but the pace at which it is delivered is in our control. We can rapidly deploy wind energy, and deliver the benefits of a clean, secure and abundant energy system if we scale up investment and reach the right level of installations – 380GW per year – by the end of this decade. That acceleration will come by clearing supply chain bottlenecks, correcting poor market design and delivering project certainty. The industry stands ready to deliver, help it accelerate deployment.”

The Data

GWEC’s Market Intelligence team found that in 2024, a total of 23,098 wind turbines were installed worldwide by 29 different wind turbine manufacturers - made up 18 from Asia Pacific, 8 from Europe, 2 from America and 1 from Middle East.

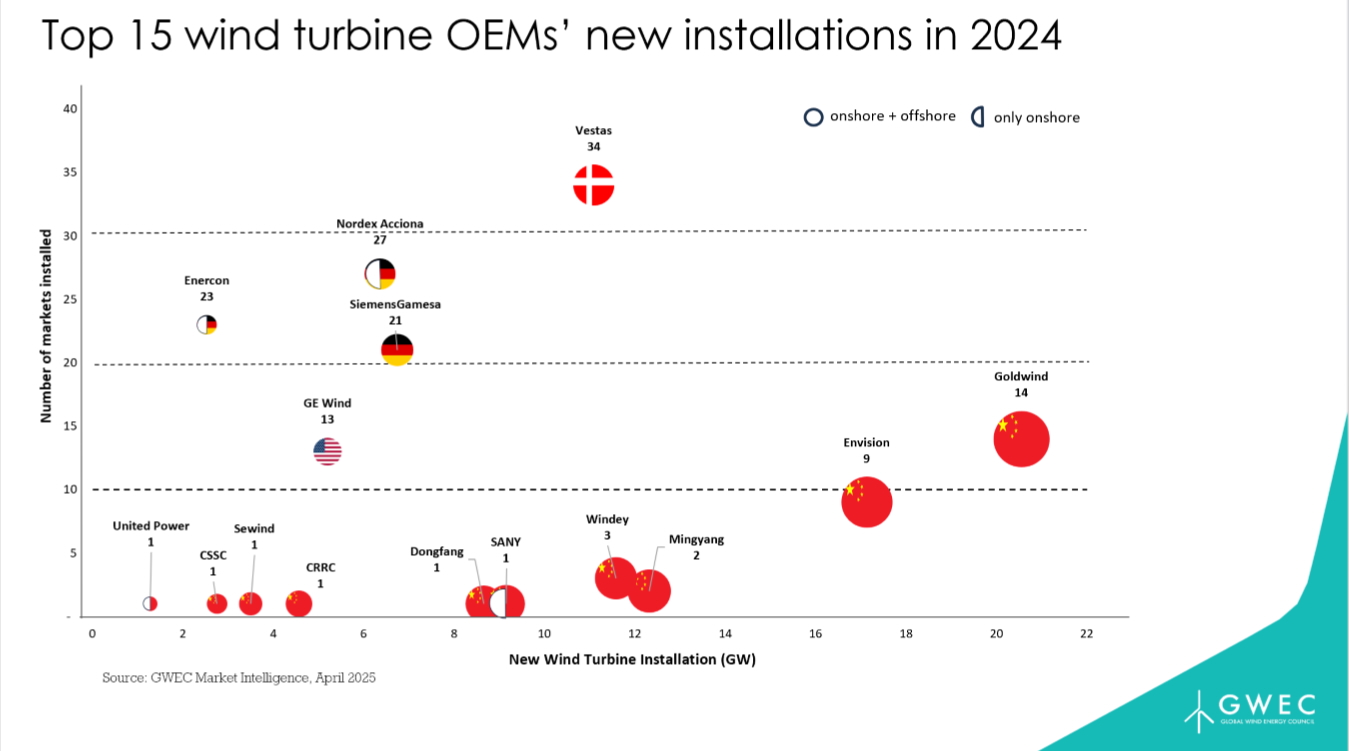

Last year continued to see Chinese wind turbine manufacturers increase their share of total installations due to strong growth in their home market. For the first time, the global the top 4 wind turbine suppliers came from China, with Denmark’s Vestas rounding out the Top Five. Within Europe, European suppliers continue to dominate in 2024 with a 92 per cent market share, which is four per cent higher than 2023.

Goldwind continues to hold top spot globally. China’s largest wind turbine supplier installed more than 20 GW worldwide in 2024, which is itself a record figure. Envision retained second place on the list, despite the Chinese OEM’s new installed capacity in its home market declining last year. Outside of China, Envision installed 3.5 GW new wind capacity across eight overseas markets last year, which is the highest figure ever for a Chinese OEM.

Mingyang moved up two positions to third place. The Chinese supplier had its best ever year for new installations in 2024, as did Windey, who round out the all-Chinese top four. Vestas fell two positions to fifth place from 2023, with new wind installations in 2024 dropping 13 per cent from the previous year. However, the Danish supplier remains the global leader in terms of the number of markets supplied last year, followed Nordex Group, Enercon and Siemens Gamesa.

Another theme seen in this year’s report is the continuing upward trend in wind turbine rating. The global average rated capacity of new turbines installed in 2024 reached almost 5,500 kW, which is 9% (or 435 kW) higher than in 2023. The average onshore wind turbine size in 2024 surpassed the 5,000-kW milestone while the average wind turbine size for offshore wind reached 9,815 kW. This upward trend is primarily due to larger onshore turbines being installed in China and more offshore wind turbines with a power rating greater than 10 MW being installed globally.

Medium-speed (or hybrid-drive) wind turbines continued to gain popularity in 2024, with the technology’s global market share increasing from 25.0 per cent in 2023 to 29.1 per cent in 2024. This was primarily due Goldwind switching drivetrain technology from PMG Direct Drive (DD) to medium-speed. The company accounted for 89 per cent of its total installations in 2024.

Combining the market share of conventional high-speed drive with medium speed drive, the global market share of geared-drive systems in 2024 is 91.3 per cent, which is the same as the previous year.

The diameter of wind turbine rotors continues to grow, with rotors larger than 180m now becoming the mainstream product, accounting for 58.6 per cent global market share in 2024, compared with 42.9 per cent in 2023.

GWEC | https://www.gwec.net/