Shining a Spotlight on Solar Panel Manufacturing

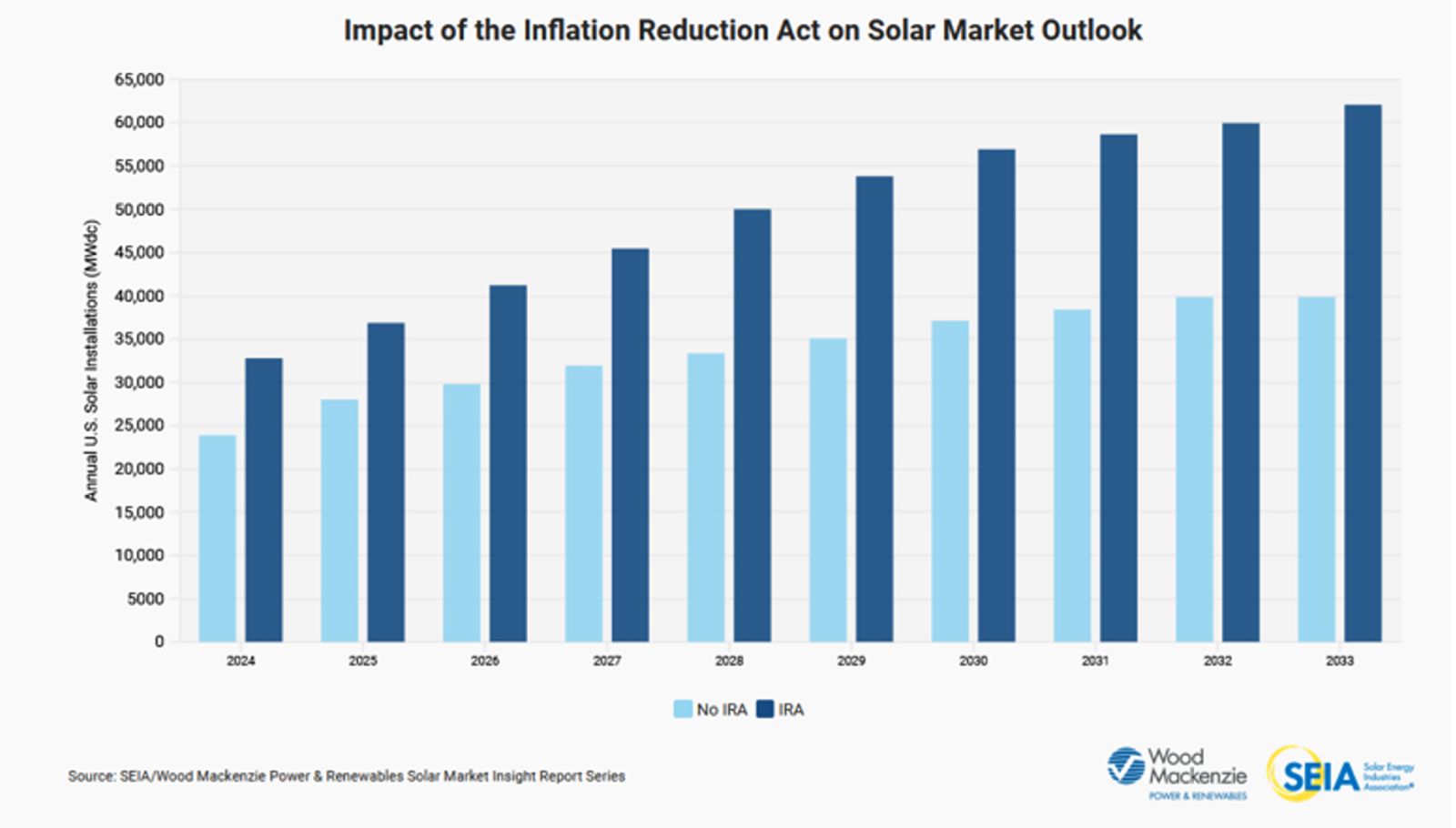

Since the passage of the Inflation Reduction Act nearly two years ago, U.S. solar panel makers navigate a promising market amid production, legal, and investment considerations

Nearly two years after U.S. President Joe Biden signed the Inflation Reduction Act into law, it is time to take stock of the scope of the major climate and energy initiative and its provisions for solar panel manufacturers in the United States.

The White House is being bullish on the new law, saying “Outside groups estimate the Inflation Reduction Act’s clean energy and climate provisions have created more than 170,000 clean energy jobs already, companies have announced over $110 billion in clean energy manufacturing investments in the last year alone.”

But it is also important to dig deeper and address some of the questions and issues surrounding solar panel production.

For example, a recent story noted that solar panel components production is 65 percent cheaper in China than it is in the United States. While this may appear to be bad news for U.S.-based solar companies, that is not necessarily the case.

As we approach the two-year anniversary of the landmark law, it’s important to assess the role of overseas solar panel manufacturing, explore how clean energy provisions of the IRA — such as tax credits — are benefiting U.S solar panel manufacturers, and offer a glimpse into the next phase of solar panel production in the U.S.

Overseas production

At this moment, anyone producing panels outside of China faces an uphill battle. The U.S. has a moratorium in place until June with Chinese-made modules circumventing U.S. import duties. By contrast, European producers of solar modules are doomed to disappear due to the overwhelming stocking of low-priced Chinese modules without restrictions.

U.S. solar companies face other hurdles. Solar panel makers in Asia planning to export panels or even some raw materials to the States must provide a full traceability report showing their sources of polysilicon are not from the Xinjiang region in China, where the U.S. government says there are forced labor camps. That puts an added layer of pressure on U.S. companies to perform due diligence.

At the same time, there are some common misconceptions about solar panel production in China. The thinking is that, because they are cheap, the panels must be of poor quality. The truth is that the most advanced solar modules do, indeed, come from China, which has an indisputably long lead in the industry.

Additionally, virtually no solar manufacturing machinery is produced in the United States, as most of it comes from China, and a few companies in Germany and Italy.

While these factors may seem to be stacked against U.S. solar makers, there is actually good news on the horizon. Chinese products will face higher taxes when their moratorium is reversed in June. That means that any Chinese modules that are made overseas and brought to the U.S. will cost much more than those made in the States. That will help to boost the local industry for solar panel manufacturers.

Benefits of the IRA provisions

Just as the White House has signaled, the main benefit of the IRA is that a new solar industry has spawned across the United States. New job opportunities exist for thousands of Americans in new, clean technologies that will continue to evolve — due largely to the provisions afforded to U.S. solar panel makers under the new law.

For instance, the IRA has a provision known as “Section 45X,” which is a tax credit for businesses that manufacture and sell energy components. To qualify for the 45X production tax credit (PTC), U.S. makers need to sell their production to non-related clients based in the U.S.

Solar makers can either cash or trade their tax credits set at 7 cents on the watt. Thus, a 1-gigawatt factory can theoretically generate a non-taxable $70 million per year on the tax credits alone. These tax credits will impact the production of solar panels in the U.S. We are seeing a huge flow of investment in the industry, which will increase competition and help to pull the prices down, thereby leveling the field. To wit, the past year has seen an uptick in announcements of new factories across the nation.

Source: NREL

Developers can also integrate upstream as they seek to secure the supply of their needed modules, and finance these acquisitions with the tax credits themselves.

What’s next?

The remainder of 2024 and beyond looks promising for U.S.-based solar panel manufacturers from a production and investment perspective. In terms of solar panel production, solar panel makers will likely increase the sourcing of raw materials from local suppliers. In fact, most new entrants into solar panel manufacturing foresee this; they’re already investing heavily in integrated operations to secure the sourcing of solar cells instead of importing them (and facing possible confiscations at customs checkpoints).

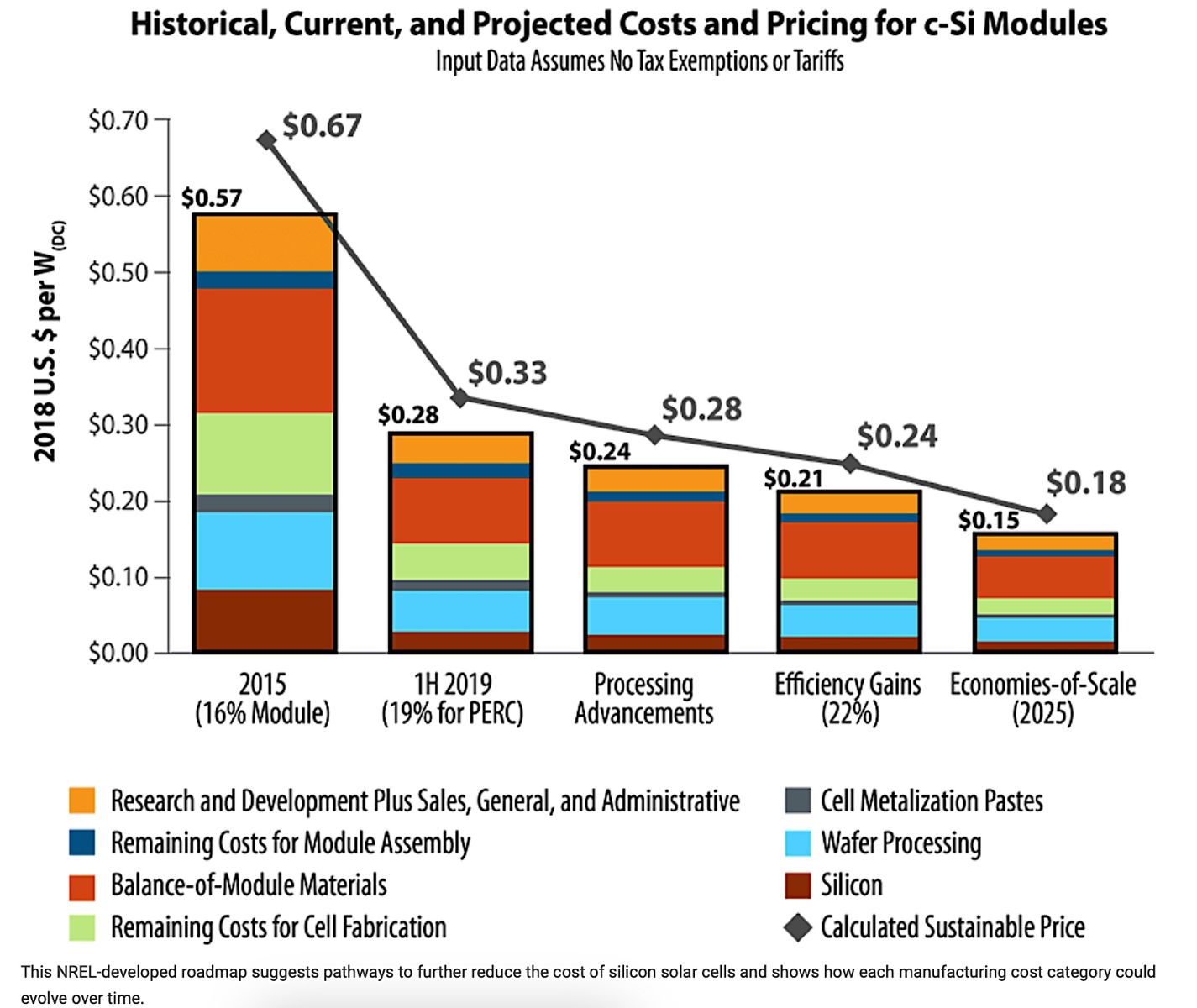

As these new integrated solar panel manufacturers begin to operate and expand, the cost of producing modules in the U.S. will inevitably begin to decline.

Also watch for local manufacturers to begin shifting to the more efficient N-Type solar cell, referring to the “negative” carriers of the electric charge in the materials. Why? Most cell manufacturers — including the cell machinery manufacturers in China — have aggressively begun the transition to N-Type cells. With this, some processes within the manufacturing will also begin to change.

Finally, investors will continue to aim to understand the dynamics of the PTC, which is a key to boosting investments into the solar panel manufacturing sector. The IRS rules with respect to the cash treatment are not completely clear, leading to an increase in the trading of these tax credits. The tax credits can provide healthy, short-term returns to investors helping to motivate larger funds to back these investors, thus increasing the number and amount of financing opportunities for the industry at large.

Ultimately, the solar panel manufacturing market in the United States is growing and has great promise. But it will also be critical for manufacturers to effectively navigate the maze of production, legal, and investment issues as the industry evolves in the coming months.

Ricardo Jimenez is the CEO of PANASOL USA LLC, a state-of-the-art solar panel manufacturing facility being installed in College Station, Texas.

PANASOL USA LLC | panasol.solar

Author: Ricardo Jimenez

Volume: 2024 May/June

.png?r=7283)