Massachusetts Solar Projects Face Limited Time to Secure Both SMART 3.0 and ITC

The Massachusetts Department of Energy Resources (DOER) has finalized SMART 3.0, the state’s updated solar incentive program. With the federal Investment Tax Credit (ITC) now on a phase-out schedule, businesses, property owners, and public entities that act quickly can maximize value by securing both state and federal incentives.

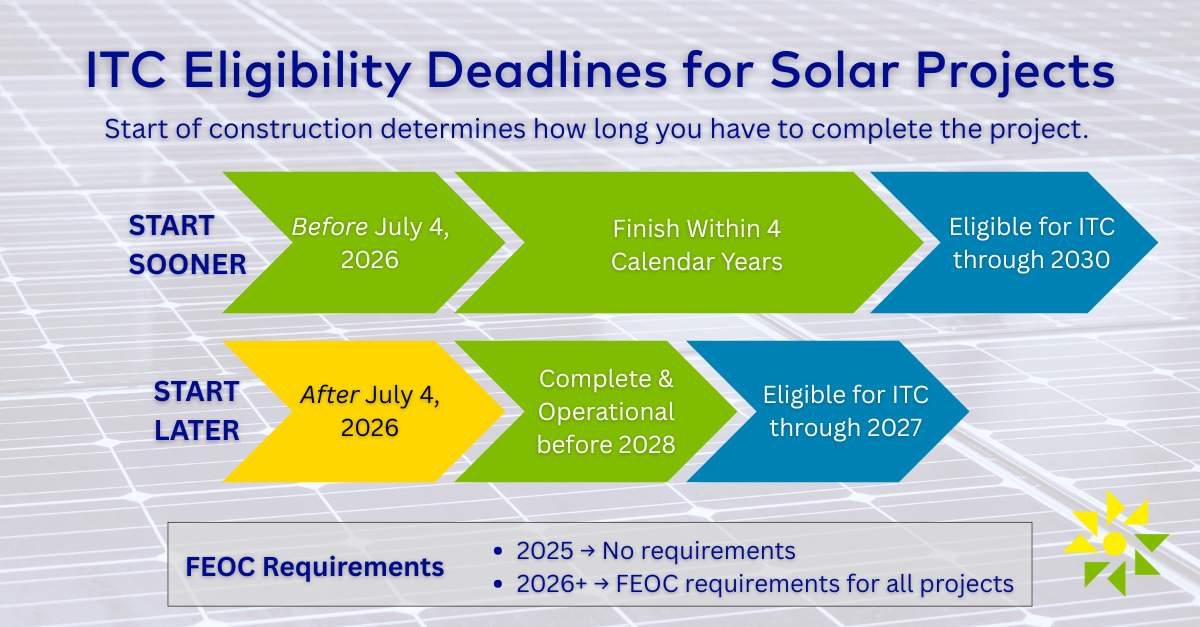

SMART 3.0, effective September 12, 2025, shifts the state’s incentive structure to an annually adjusted model and prioritizes rooftop, canopy, and brownfield projects. Enrollment for Program Year 2025 opens October 15 with 900 MW of statewide capacity, followed by a second enrollment period on January 2, 2026 for Program Year 2026. In parallel, the federal ITC phase-out sets clear deadlines: projects that start construction before July 4, 2026, have four calendar years to finish and still claim the credit, while projects starting later must be completed and operational by December 31, 2027.

“SMART 3.0 and the federal ITC together create one of the strongest opportunities Massachusetts has seen for solar and storage projects,” said Matt Shortsleeve, Senior Vice President of Marketing & Policy at Solect Energy. “Timing is critical to safe harbor ITC eligibility. At Solect, we’ve purchased and warehoused equipment to ensure customers can access qualifying, cost-effective equipment even as new federal requirements take effect. That investment along with our team's readiness gives organizations confidence to move forward now and capture the full stack of incentives available.”

To learn more about SMART 3.0, ITC eligibility deadlines, and how organizations can prepare, read Solect’s full blog post here: A New Era for Clean Energy: Inside Massachusetts’ SMART 3.0.

Solect Energy | www.solect.com

.png?r=6242)