Cleaner, Made-in-America PV Steel

Right now, China controls 84 percent of solar panel production, with one out of every seven panels produced worldwide coming from a single Chinese factory. In diplomatic understatement, the International Energy Agency calls this supply chain concentration “a vulnerability.”

If the world follows IEA’s net-zero-by-2050 roadmap, we will need to quadruple current PV capacity. In other words, current production of solar generation components must double by 2030.

Thanks to the 2022 Inflation Reduction Act, there’s plenty of money to build green manufacturing and infrastructure. We also have an ideal opportunity to clean up the one part of the solar module that, until recently, hasn’t seen significant innovation and cost savings, despite significant PV cost reductions overall.

That component is the frame. Made with very few design changes — from aluminum for at least four decades — it’s time for a change. It is actually possible for the world to get PV panels more affordably, with significantly lower embodied carbon (greenhouse gas), and less dependency on China. Time to swap aluminum module frames for recycled steel ones, and bring manufacturing back to the U.S.

The way we were

Aluminum became the material of choice for solar module frames because it’s lightweight, easy to work with, and has good corrosion resistance. Today, however, it’s not the only metal with those characteristics.

The advancement of anti-corrosion coatings has already made steel a commonly used material across the solar value chain, for components such as trackers, racking, mounts, and tubes. New techniques in roll forming steel can now deliver lower cost module frames that meet or exceed the quality manufacturers produce with aluminum.

In addition, mechanical load testing has shown that a 35-millimeter tall steel frame delivers superior performance characteristics, compared to a standard 40-millimeter aluminum frame. This means that module manufacturers who adopt such frames can provide a higher shipping density product without sacrificing strength or performance.

Module manufacturers can easily integrate steel frames into existing production processes; steel frames are compatible with current tooling, assembly, and mounting methods. Adopting steel would likely lead to a simple and low-impact manufacturing cutover.

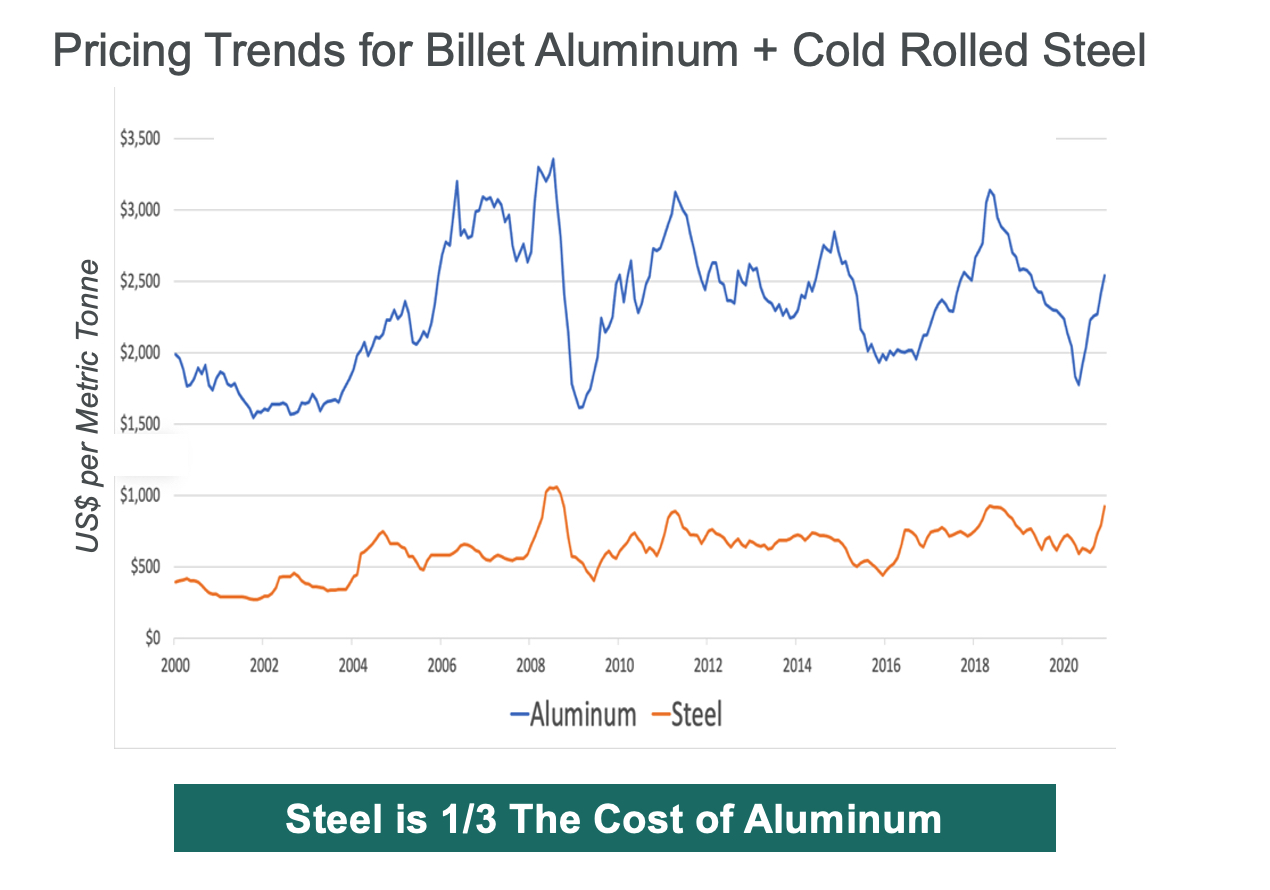

Another good reason to switch module frames from aluminum is cost. Despite its ubiquity as a framing material, aluminum is more expensive than steel. In fact, cold rolled steel averages one-third of the price of billet aluminum, and has for the past two decades, as this pricing trends chart demonstrates in Figure 1.

Figure 1 – Pricing trends for aluminum vs. steel

Apart from the components that make up the cell, the frame is estimated to be the most expensive part of a solar module. As recently as 2021, industry experts pegged the frame itself as costing 2.23 cents per watt, while the total cost for everything else beyond the cell – glass, backsheet, encapsulant, junction box, labor, and more – came to 8.9 cents per watt. Aluminum frames take up 25 percent of the module cost. Steel would bring that down.

Dirty business

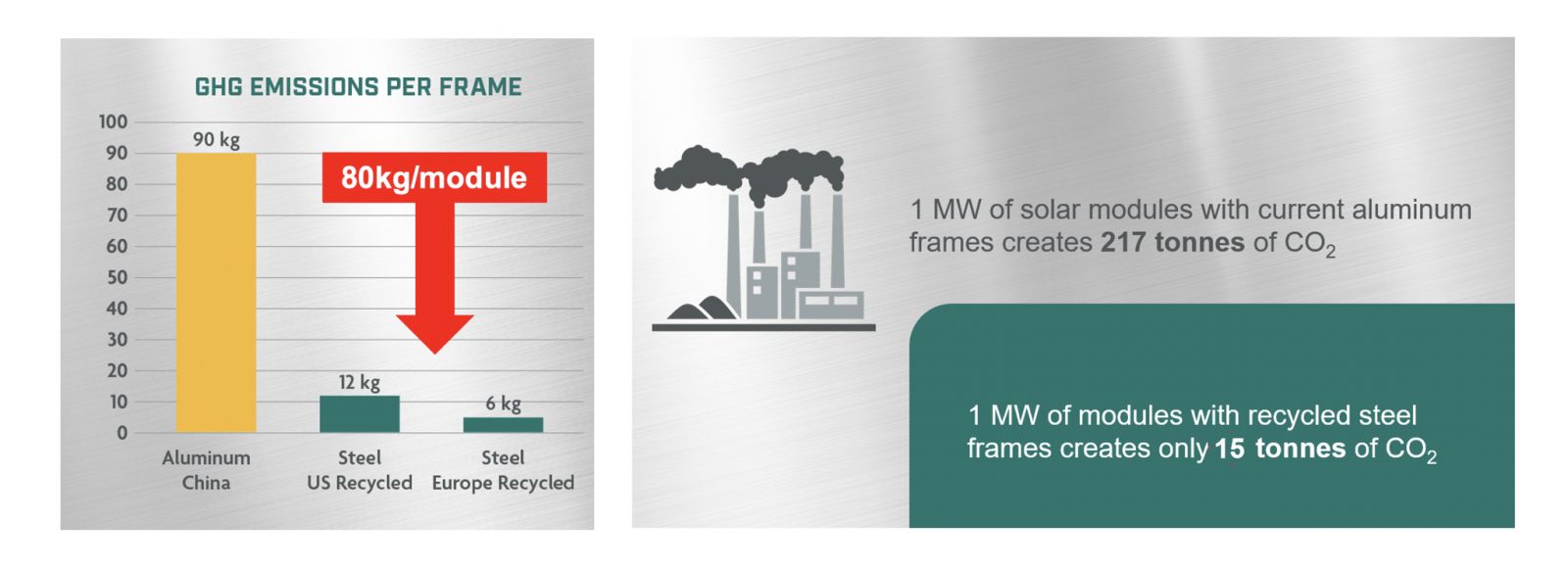

Along with being less expensive, the carbon footprint of steel is significantly lower than that of aluminum, making it a cleaner and greener material to use for solar module frames.

Research conducted last year investigated the greenhouse gas emissions of one U.S.-based manufacturer’s steel module frames produced in a U.S. or German plant, versus frames produced and shipped to the U.S. from China. This comprehensive analysis included “raw material extraction, refining, extrusion, deburring, anodizing, and transportation.”

Overall, U.S.-produced steel frames could reduce GHGs associated with production by 87 percent, compared to Chinese aluminum frames when recycled steel was used (73 percent if virgin steel is used). Steel frames produced in Germany delivered as much as a 93 percent reduction in GHGs, as shown in Figure 2.

The analysis reflects an assumption of extruded virgin aluminum module frames produced in China. It also includes fossil fuel consumed by the transportation of materials.

According to the IEA, electricity accounts for 80 percent of the energy used in PV manufacturing. Manufacturing in the U.S. occurred in a state that is 80 percent reliant on coal and natural gas, while the plant in Germany gets 45 percent of its power from renewables. Most Chinese production takes place in the provinces of Xinjiang and Jiangsu, where coal accounts for more than 75 percent of the power supply.

Simply bringing production back to the States or to Europe could green up PV panel manufacturing. Steel frames could clean things up even more, and contribute significantly to the important work of the Ultra Low-Carbon Solar Alliance.

Figure 2 – GHG emissions for steel vs. aluminum solar module frames

The report estimated that “up to 30 megatonnes of GHG emissions could be saved if steel module frames were to replace 10 percent of global aluminum solar frames by 2030. These GHG savings are equivalent to emissions from eight average-sized coal-fired power plants over an entire year.” Bring that percentage of steel frames up to 50 percent, and it could deliver a GHG reduction of up to 148 megatonnes, or 40 average-sized coal-fired power plants.

There’s so much to be gained by switching frames from aluminum to steel, and re-shoring PV production across the solar supply chain. Those changes would result in fewer GHG emissions, lower costs, and greater domestic energy security in solar module manufacturing. If we want cleaner, more affordable solar, with less dependence on Chinese imports, the time to make those changes is now.

Eric Hafter is the Founder of Origami Solar, a manufacturer of recycled steel solar panel frames.

Origami Solar | origamisolar.com

Author: Eric Hafter

Volume: 2023 July/August

.png?r=9798)