The Three Big Promises of Sodium-Ion Batteries, Reports IDTechEx

Sodium-ion batteries are emerging as a compelling alternative to lithium-ion, offering a unique blend of material abundance, system compatibility, and enhanced safety. As the energy storage market searches for scalable, cost-effective solutions, sodium-ion's core promises could reshape how and where batteries are deployed. Here's a closer look at what makes this technology so promising.

Minerals abundance

Sodium ion batteries offer a key advantage in mineral abundance. Lithium prices spiked to over US$80,000 per ton in 2022 due to geopolitical tension, post-COVID supply issues, and rising demand. This highlighted the fragility of a supply chain dominated by China, which controls over 93 percent of graphite processing and more than 80 percent of global gigafactory output.

While lithium prices have since dropped to around US$10,000 per ton, sodium carbonate remains far cheaper. This implies a lower bill of materials and reduced exposure to supply shocks. Sodium is also widely available and can be sourced from common materials like trona or salt, making it a strong candidate for domestic production.

IDTechEx’s report, “Sodium-ion Batteries 2025-2035: Technology, Players, Markets, and Forecasts”, finds that if lithium prices climb above US$50,000 per ton again, sodium ion's cost advantage will become even more pronounced.

Drop-in compatibility

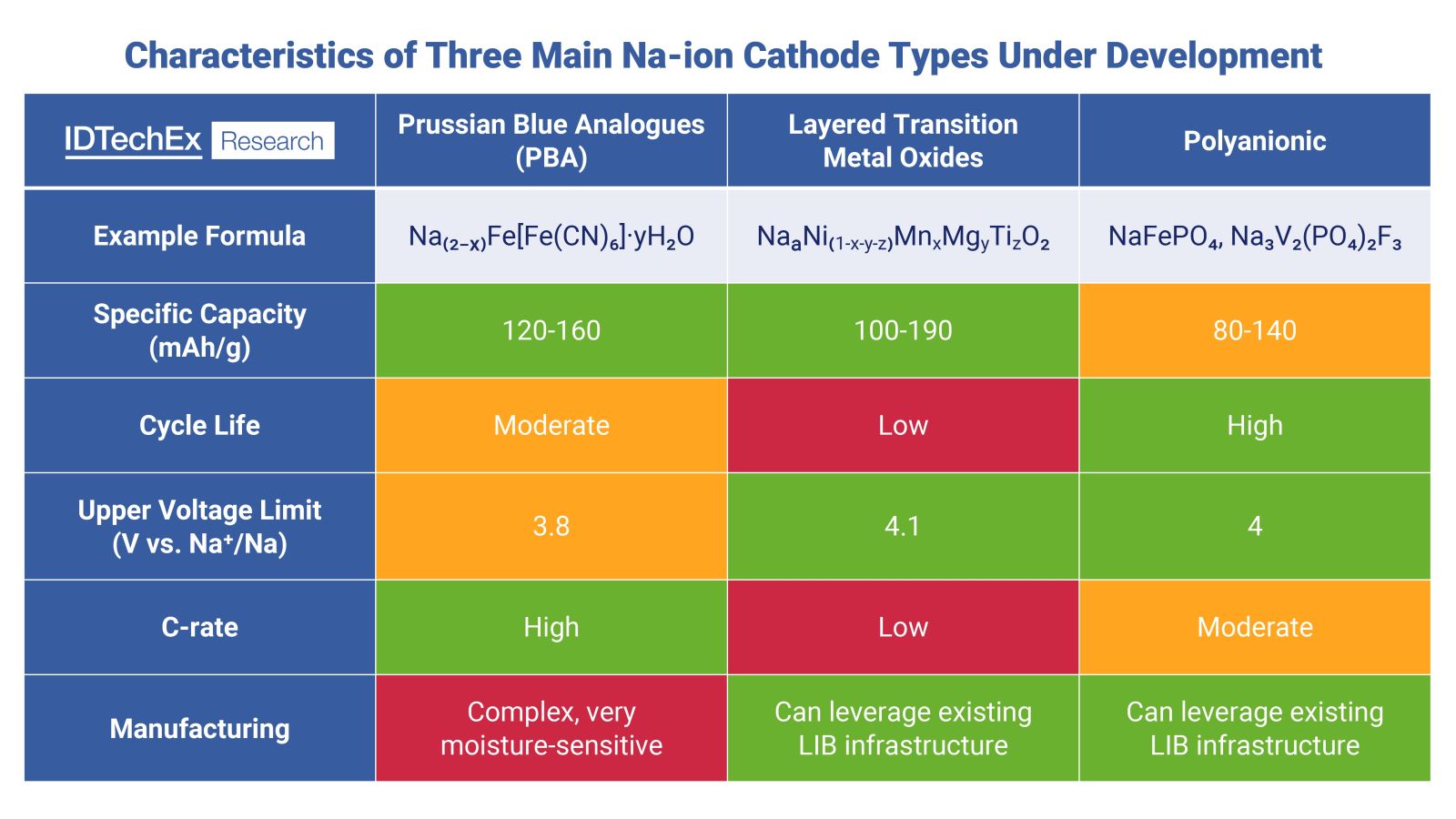

Sodium ion batteries offer strong compatibility with existing lithium-ion manufacturing. They can often be made using the same formats and equipment, enabling faster and cheaper scale-up. However, compatibility depends on the chemistry. Some materials, like layered oxides and Prussian Blue analogues, are moisture sensitive and require dry room handling to avoid performance loss from reactions with water vapor.

Sodium ion cells also have lower energy density, meaning more cells are needed to store the same energy. This increases equipment needs and raises processing costs by an estimated 15%. Still, sodium ion can leverage much of the lithium-ion supply chain, with shared processes and infrastructure offering a valuable shortcut to industrial scale.

Sodium-ion cell production compatibility with lithium-ion depends on the chemistry. Source: IDTechEx

Safety benefits

Sodium ion batteries can be shipped at zero state of charge, unlike lithium-ion cells. This reduces the risk of fire during transport and makes shipping safer, easier, and cheaper. It is a key logistical advantage, especially for global supply chains.

Sodium ion batteries typically use hard carbon anodes. Because sodium does not intercalate into graphite, this enables the use of different electrolyte solvents like propylene carbonate, or PC, which has a high flash point and wide liquid range. It is generally unsafe in lithium-ion systems but works well in sodium ion cells. PC can replace more flammable solvents like DEC and DMC, improving thermal stability and safety.

That said, the blanket statement that sodium ion batteries are always safer than lithium ion is not accurate. Safety depends heavily on the specific chemistry used. For example, layered oxide materials like NFPP or NFM behave differently under abuse conditions. These differences are covered in more detail in the full IDTechEx report, which includes ARC test data from several sodium ion battery developers.

In thermal abuse scenarios, sodium ion cells tend to enter thermal runaway at higher temperatures and progress more slowly than lithium-ion cells, which offers added safety under certain conditions.

Future Prospects

The IDTechEx report, "Sodium-ion Batteries 2025-2035: Technology, Players, Markets, and Forecasts", finds three key prospects that will enable this technology to compete in the energy storage market:

- Increased energy densities while maintaining safety. Involves improving the cathode, anode, electrolyte, and overall cell design and integration. Current commercially available Chinese sodium-ion cells with energy densities greater than 120 Wh/kg and 250 Wh/L are still not comparable to the energy densities of 160 Wh/kg and 300 Wh/L exhibited by LFP cells on average.

- Compete on total cost of ownership at systems level. Sodium ion cells could reach a competitive price point, not necessarily cheaper than LFP, but close enough that system-level improvements such as reduced operations and maintenance costs could tip the balance, like how LFP gained traction through cell-to-pack innovations.

- Find performance niches based on cell chemistry. Includes areas like low temperature performance, high power, or enhanced safety. This is best exemplified by Natron Energy working on uninterruptible power systems for data centres or CATL's hybrid battery packs that use sodium cells to improve SoC estimation and cold temperature performance.

To find out more about this report, please visit www.IDTechEx.com/Sodium. Downloadable sample pages are also available.

IDTechEx | www.idtechex.com