Tariffs Strain BESS Operators

As the global energy transition accelerates, battery energy storage systems (BESS) have become essential to grid flexibility, helping to balance intermittent renewable resources and ensure reliability. However, as storage installations age, battery degradation will become an increasingly pressing issue, prompting operators to seek out practical ways to restore lost capacity.

One widely accepted approach is augmentation. This enables BESS operators to regain performance by replacing degraded battery modules or expanding the original installation for longer charging/discharging durations and enhanced performance. But while augmentation has long been viewed as a practical fix to battery degradation, it’s no longer the straightforward solution it once was.

For many operators, augmentation has traditionally seemed like a logical and even routine next step. Today, augmentation is a complex and increasingly uncertain path forward, both technically and economically.

Why augmentation isn't so simple

Though augmentation may have been seen as an easy solution for expanding BESS capacity, the process was rarely as straightforward as many storage operators assumed.

Successful augmentation requires clearing several complex technical hurdles. Integrating new battery modules with older ones is challenging, as voltage mismatches, differing chemistries, and firmware variations can compromise system stability and performance. Since new and old cells degrade at different rates, this can also lead to issues with system performance due to uneven energy distribution; older batteries may not be designed to handle the thermal profiles of newer ones, increasing the risk of overheating or accelerated degradation.

Balancing new modules with old modules is technically challenging, meaning augmentation is not automatically a simple way to expand capacity. An unsuccessful augmentation can further introduce new problems for operators, such as overheating cells and compromised performance. These technical issues are not new, but today’s geopolitical climate, characterized by trade tensions and policy shifts, makes them even more difficult to navigate.

Rising tariffs, supply chain instability, and growing protectionist policies are bringing new uncertainty into the augmentation equation. The industry has typically focused on how these issues affect new grid-scale storage projects, but they equally impact efforts to expand and maintain existing systems.

Just as the need for grid flexibility is reaching new heights, growing tariffs are set to make augmentation an even more expensive undertaking. Rising protectionism is making augmentation not just technically risky, but also financially questionable. Although the bilateral tariff regime between China and the United States continues to be in flux, the cost of importing components for lithium-ion batteries from China will rise. Even before the early 2025 trade conflict began, tariffs approved by the U.S. in 2024 were set to significantly raise the cost of importing battery components.

This new reality demands a shift in augmentation strategy and a renewed focus on maximizing asset performance.

Unlocking greater capacity through new software, not hardware

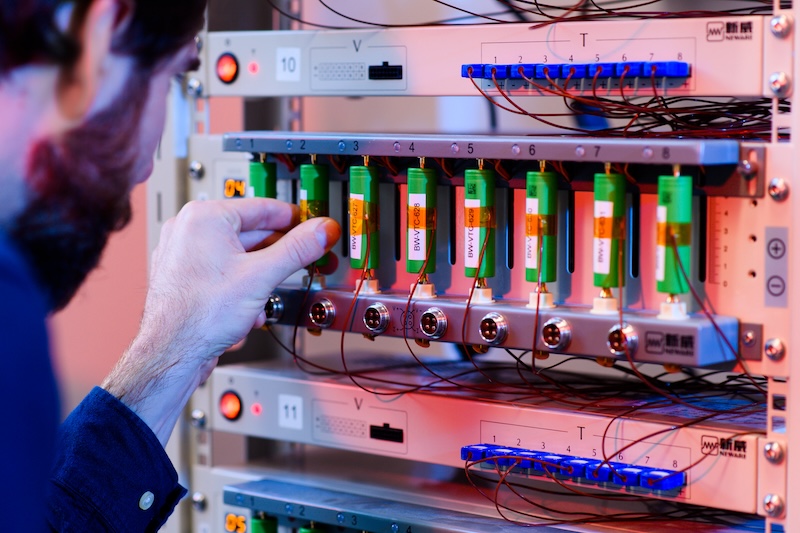

Operators can delay augmentation by getting more out of their existing battery assets. Rather than replace entire modules, operators can expand battery capacity by leveraging advanced analytics for a more targeted expansion. These tools provide deep insights into a battery’s inner workings and offer actionable recommendations to optimize performance. Unlike standard battery management systems, analytics software enables operators to pinpoint the root causes of underperformance, such as natural aging or controllable factors like aggressive charging and discharging. Through this advanced data analysis, software empowers operators to make smarter, data-driven decisions.

One feature of analytics, for example, is to quantify the energy that can be discharged from a BESS at any given moment. This ability provides critical insight into a battery’s true capacity, and will give operators advanced information on the cause of lower-than-expected capacity. Analytics will recommend changes in operational strategy to recover lost capacity, such as through better charge/discharge strategies or refined thermal management. The software also identifies individual cells that need replacing, so that if a BESS does require hardware changes, operators can perform them as part of predictive maintenance rather than a process as involved as augmentation.

Analytics can also help align operations with warranty compliance, making it easier to plan maintenance and avoid unnecessary downtime.

In suggesting operational changes and recommending maintenance, BESS analytics enables operators to defer augmentation. Pursuing costly hardware additions could go sideways due to the challenge of installing new battery modules, and the cost of augmentation will only rise as lithium-ion components fall under increasing tariffs. Pairing the existing BESS battery modules with advanced analytics, operators can instead expand capacity through operational adjustments with a better understanding of what is causing degradation.

In suggesting operational changes and recommending maintenance, BESS analytics enables operators to defer augmentation. Pursuing costly hardware additions could go sideways due to the challenge of installing new battery modules, and the cost of augmentation will only rise as lithium-ion components fall under increasing tariffs. Pairing the existing BESS battery modules with advanced analytics, operators can instead expand capacity through operational adjustments with a better understanding of what is causing degradation.

The need for energy storage will not go away, even as the economics of batteries face greater uncertainty. To meet the growing demand for grid flexibility, operators should instead focus on maximizing the capabilities of their current BESS by using BESS analytics to unlock more value from what they already have.

Lennart Hinrichs is Executive Vice President and General Manager, Americas, at TWAICE, which provides BESS analytics to reduce risk, optimize performance, and maximize lifetime value for asset managers and operations teams.

TWAICE | www.twaice.com

Author: Lennart Hinrichs

Volume: 2025 July/August