Saga Metals Corp. (the “Company” or “Saga”), a North American exploration company focused on critical mineral discovery in Canada, is pleased to announce that it has entered into an asset purchase agreement (the “APA”) with two arm’s length private vendors (the “Vendors”), pursuant to which the Company will acquire a 100% interest in 606 mining claims covering an area of 31,347.76 hectares in the Eeyou Istchee James Bay region of Québec (the “Amirault Property”).

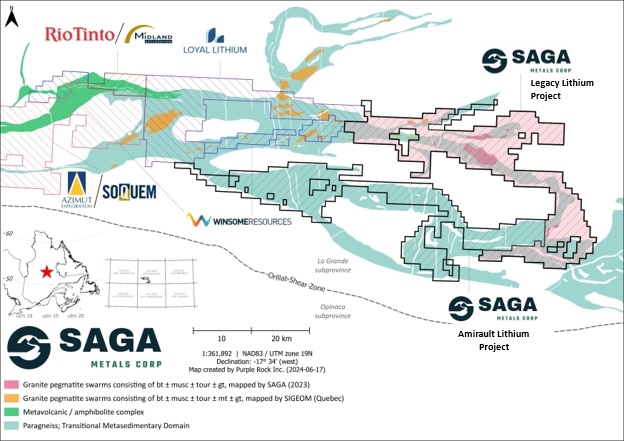

The Amirault Lithium Property is contiguous to Saga’s Legacy Lithium project expanding the total contiguous land holdings to 1,274 claims spanning 65,849.20 hectares (658 square kilometers). The acquisition increases the Company’s foothold on the striking paragneiss, all of which can be considered prospective for pegmatites following the discovery trend of Winsome Resources, Azimut Exploration, Rio Tinto, and Loyal Lithium (See Figure 1).

To-date, Saga has confirmed over 100+ identified pegmatites with a combined 7km strike of lithium, cesium & tantalum (LCT) bearing pegmatites at the Legacy Lithium Project with over 90% of the project still to be explored.

The Legacy Lithium Project has continued validation by major companies announcing results from their winter drill programs including:

- Winsome Resources’ Adina Lithium project announced an increase to its resource now estimated to be 78Mt at 1.15% Li2O. Read More.

- Loyal Lithium’s Trieste project continues to take shape with thick high-grade intercepts with 32.8m of 1.2% Li2O including 8.3m at 2.4% Li2O at Dyke # 04. Read More.

- Azimut Exploration and Soquem drilled an additional 3,203m at their Galinee project in their second phase of the campaign. Results include 2.68% Li2O over 54.6m and 3.48% Li2O over 35.85m. Read More.

- Midland Exploration in partnership with Rio Tinto confirms high-grade lithium up to 7.2% Li20 and identifies additional spodumene-bearing pegmatites on Galinee project. Read More.

Figure 1: A map of the “Lithium Neighborhood” at the Legacy Lithium Project in Quebec

“This is an exciting acquisition for Saga Metals Corp. Increasing our claim package over the prospective paragneiss in this up-and-coming eastern district of James Bay’s La Grande sub-province gives the Company lots of options in the future,” stated Michael Garagan, Chief Geological Office of Saga Metals Corp. “With early indications from lake sediments over the area we look forward to uncovering what this property holds.”

Acquisition Terms

Pursuant to the APA, the Company agreed to acquire 100% in the Amirault Property from the Vendors in consideration for payment of $200,000 (the “Cash Payment”) and issuance of 4,000,000 common shares in the capital of the Company (the “Consideration Shares”).

The Cash Payment is payable in $10,000 monthly instalments until no later than five days following the closing of the Company’s initial public offering and all documents pursuant to the APA having been delivered, or such other date as the parties may agree (the “Closing Date”), at which point the balance of the Cash Payment is payable on the Closing Date, which will be equal to $200,000 less the total aggregate monthly instalments.

The Consideration Shares are subject to contractual restrictions on resale (the “Lock-Up Restrictions”), as well as a statutory hold period of four months and one day from the later of (i) the date of issuance, and (ii) the date that Saga becomes a reporting issuer in any province or territory of Canada. In accordance with the Lock-Up Restrictions, the Vendors may not sell, pledge, encumber, assign or otherwise dispose of or transfer the Consideration Shares until they are released in accordance with the release schedule, pursuant to which 10% of the Consideration Shares will be released on the Closing Date and 15% of the Consideration Shares will be released every six months thereafter for a total period of 36 months.

“This is another great milestone completed as we continue to build towards our IPO”, stated Mike Stier, CEO & Director of Saga Metals Corp. “We are working through the regulatory process and anticipate filing our final prospectus in the coming days.”

In accordance with the APA, the Company will grant the Vendors a 2.0% (1.0% per Vendor) gross overriding royalty on the Amirault Property. The closing of the acquisition is subject to customary conditions and approvals. No finder’s fees or commissions were paid in connection with the acquisition.

Saga Metals | www.sagametals.com