REPORT: Energy Storage Market Continues Strong Growth in Q1 2025

According to the new U.S. Energy Storage Monitor developed by Wood Mackenzie and the American Clean Power Association (ACP), the American energy storage market experienced record growth in Q1 2025—amidst current policy uncertainty.

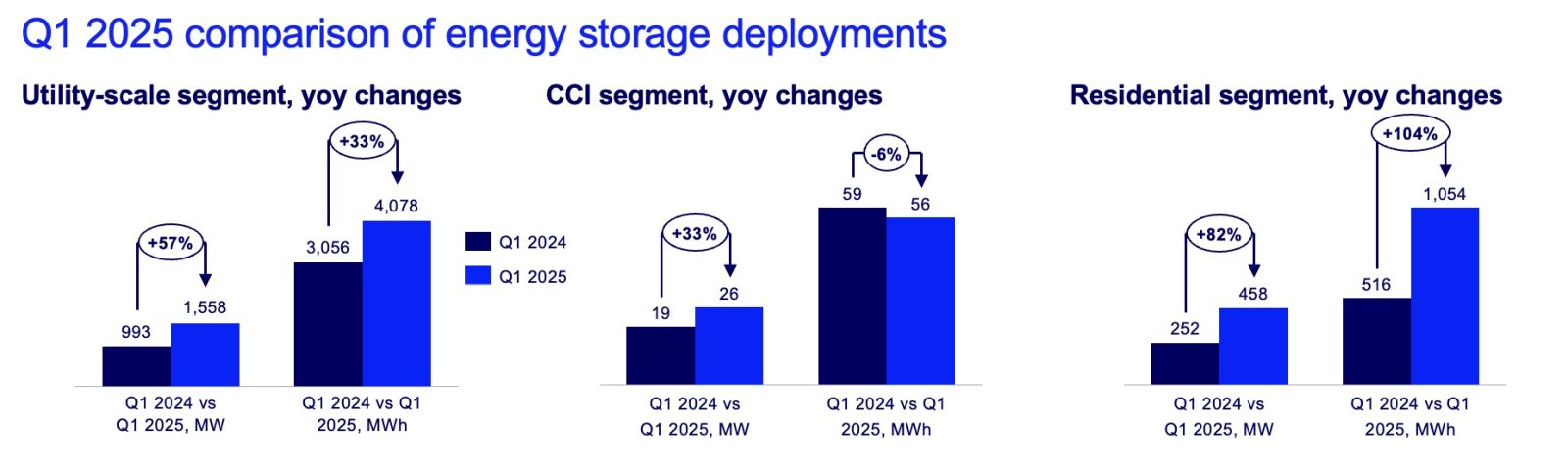

The U.S. energy storage market added more than 2 GW across all segments in Q1 2025, marking the highest Q1 on record. The utility-scale segment led the way with more than 1.5 GW of new capacity, representing a significant 57% increase compared to Q1 2024.

“Surging energy demand is putting the electric grid under strain. The energy storage market is responding to help keep the lights on and support this unprecedented growth in an affordable and reliable way,” said John Hensley, ACP SVP of Markets and Policy Analysis. “Policy uncertainty is now one of the most significant risks that remains on the horizon as we tackle a balanced approach to allowing our economy to expand while maintaining the energy reliability that Americans deserve.”

New horizons in the market

The report shows there is a growing appetite across the country for deployment of grid-scale energy storage, as utilities, regulators, and communities further integrate the technology into their resource planning. In Q1 of 2025, states such as Indiana highlighted the geographic diversification that continues to take place as the market expands beyond early adopters such as Texas and California.

The growing market in Indiana is made possible due to factors such as land availability and clear state permitting guidelines.

-

Indiana added 256 MW of new storage to the grid in Q1 2025, effectively quadrupling its operational storage capacity.

-

Indiana has more than 10 GW of new storage active in the interconnection queue—the fifth largest storage queue in the country.

“We're now seeing significant deployment of energy storage resources in emerging markets like Indiana, while states across the Southwest like Nevada and Arizona continue to expand their energy storage portfolio,” said ACP Vice President of Energy Storage, Noah Roberts. “Energy storage was the second most deployed resource in Q1 2025, demonstrating its unique ability to be quickly built to address critical reliability needs."

The residential storage market also saw significant year-over-year (YoY) growth, installing a record-breaking 458 MW in Q1. California and Puerto Rico accounted for 74% of this growth, while new markets like Illinois are beginning to emerge.

A moment of policy uncertainty

The total 5-year utility-scale capacity forecast remains strong. However, the segment is at risk for a potential 29% contraction in 2026 due to policy uncertainty.

The community-scale, commercial, and industrial (CCI) segment has seen a 42% reduction in its five-year outlook, struggling with tariff uncertainty and slower-than-anticipated transition to NEM 3.0 projects in California.

The report cautions that potential changes to current tax credits could significantly impact the industry’s overall growth. If access to the Investment Tax Credit (ITC) is severely reduced as proposed in the reconciliation bill passed by the House, it could lead to a 27% reduction in buildout over the forecast period. (Note: this report was developed before the U.S. Senate Finance Committee released its version of the reconciliation bill on June 16.)

Distributed storage would be the most impacted segment, with a potential 46% drop from the base case over the next 5 years. Utility-scale installations would decrease by 16 GW over the next 5 years if the tax provisions are changed.

In the near term, the report projects that 15 GW/49 GWh of energy storage capacity will be installed across all segments in 2025. The utility-scale segment is expected to grow 22% YoY in 2025.

As the market evolves, continued innovation, supportive policies, and strategic planning will be crucial to navigate the changing landscape and capitalize on the immense potential of energy storage in the U.S. energy transformation.

“The Q1 2025 results demonstrate the demand for energy storage in the US to serve a grid with both growing renewables and growing load. However, the industry stands at a crossroads, with potential policy changes threatening to disrupt this momentum,” said Allison Weis, Global Head of Energy Storage at Wood Mackenzie. “It's crucial that policymakers understand the importance of stable, supportive policies for the continued expansion of energy storage.

Purchase the full report at ACP’s website.

American Clean Power Association | cleanpower.org

Wood Mackenzie | woodmac.com