Planning BESS Projects? Use Predictive Analysis to Prove Out Profitability

Accurate economic analysis and foresight are critical to the success of energy transformation projects, where the full impact of decisions made today may not be seen for years. New and rapidly maturing battery energy storage systems (BESS) — tapping into a diversity of chemistries and technologies — offer attractive paths forward for achieving more reliable, more sustainable, and more profitable energy investments. Stakeholders, including utilities, developers, integrators, and regulators, all have incentives to put new BESS strategies to the test to determine which can best contribute to an energy infrastructure that’s more stable, resilient, and adaptable to long-term demands.

Analysis of any specific energy project must go beyond simply measuring the cost and performance of a particular BESS in isolation. Each project’s holistic mix of site location, BESS technology, and market application can produce unique results; getting even two out of three right doesn’t guarantee success. Investments cannot be justified or optimized without rigorous study and planning that anticipates future challenges and prepares to meet them.

Answer the right questions with the right tools

Confidently eliminating blind spots across the lifespan of a project’s specific distributed energy resources, energy storage, and any microgrids is requisite to gauge financial viability. Given the stakes, no part of these decades-long commitments should be left to chance. Long before turning over the first shovel of dirt on a BESS project, leaders must know with a high degree of certainty whether they’re digging a financial grave or are on a path to profit. While a BESS technology congruent with the project’s profitability is essential, an accurate evaluation will be the product of anticipating grid demand, customer preferences, and other market perspectives (all in conjunction with the BESS’s own output).

Project stakeholders can tap free and open source tools to perform this project-level analysis, such as the Electric Power Research Institute’s (EPRI) DER-VET tool that clarifies the long-term strengths and weaknesses of particular distributed energy resources from a technical perspective. Solutions like DER-VET can accurately assess the long-term impact of choosing a particular BESS, accounting for energy storage, PV systems, and controllable loads. They can factor in variables such as project site weather data, electricity and gas tariffs, electrical thermal loads, and time-of-use rates. Analysis should also anticipate limitations imposed by their distributed energy resources, as well as battery cycling limits, power import/export caps, and battery grid charging caps.

Project-level analysis produced by appropriately powerful tools will offer predictions that should then shape optimized strategies. These strategies should curb operational costs, boost reliability, limit asset upgrade expenses, and capitalize on wholesale market opportunities. They should also include detailed hour-by-hour planning, driven by cost-benefit analyses to maximize utilization of distributed energy resources.

.jpg)

In order to offer an accurate assessment of a project’s financial potential, analyzed strategies must also carefully account for every IRA incentive, tax break, and financing detail. With that complete analysis in front of them, stakeholders can then make a clear-eyed decision as to whether a particular project is financially viable, will remain so over its lifetime, and can offer better returns versus other opportunities.

An example project-level BESS analysis

EPRI recently conducted a sample analysis comparing potential stationary storage applications using lithium-ion and NiH2 battery technologies. This analysis modeled net present value (NPV) for each BESS option using the aforementioned open-source DER-VET tool.

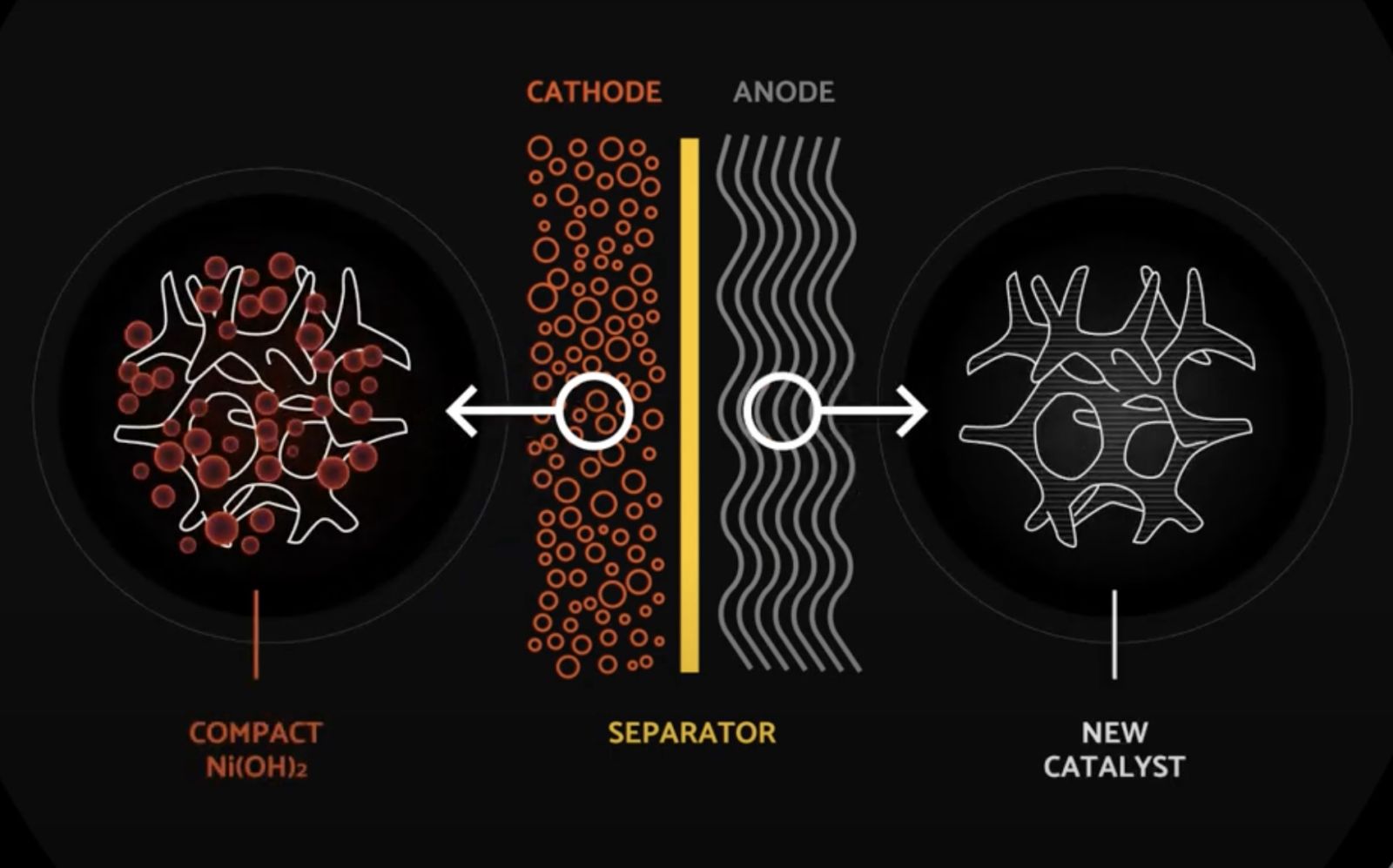

As battery technologies for grid use cases, lithium-ion and NiH2 offer an interesting set of comparisons and contrasts. Each is an inverter-based resource, capable of quick and efficient energy delivery. That said, their profiles differ significantly in measures of lifespan, overcharge/discharge/deep-cycle flexibility, charge/discharge range, fire and thermal runaway risk, acceptable operation temperatures, and overall operating and maintenance costs.

EPRI’s analysis selected a range of scenarios to simulate for each technology, looking at BESS configurations across two-hour, four-hour, six-hour, and eight-hour durations, in both Texas’s ERCOT and California’s CAISO energy and ancillary service markets.

Analysis focused on energy time-shifting and frequency regulation revenue streams. For both technologies in both markets, energy time-shifting delivered a similar slightly positive NPV. NiH2 won when it came to frequency regulation, however, earning a much better NPV in both markets and at every duration. Specifically, NiH2 hit an NPV of $2500-3000/kW in the CAISO market, where lithium-ion languished in the low hundreds per KW. NiH2 reached an NPV of $3000-4000/kW in the ERCOT market, versus $500-700/kW for lithium-ion.

Why? The analysis reveals the answer: NiH2 batteries last longer. Lithium-ion offers 3,500 cycles at 100 percent DoD, whereas a NiH2 BESS can complete 30,000 cycles at 100 percent depth of discharge (DoD), thereby collecting more revenue — as the stark difference in regulation services earnings makes clear. This type of analysis is essential to making accurate financial decisions around these technologies, yet would remain invisible without this depth of consideration.

Look before you leap

The above example demonstrates the importance of conducting careful predictive analysis versus rolling the dice on major energy infrastructure transformation investments. Once stakeholders commit to a project location, BESS technology, and market strategy, those decisions need to be unequivocally right. Achieving accurate foresight makes all the difference between failed projects, and those that deliver predictable profits for decades to come.

Spencer Hanes is Vice President of Business Development at EnerVenue, which builds metal-hydrogen batteries for large-scale renewable and storage applications. Prior to joining EnerVenue, Spencer spent 16 years with Duke Energy in various business development and public policy roles, focusing on focus on renewable energy and energy storage. His development experience spans transmission, wind, solar, and energy storage projects across 32 states.

Spencer Hanes is Vice President of Business Development at EnerVenue, which builds metal-hydrogen batteries for large-scale renewable and storage applications. Prior to joining EnerVenue, Spencer spent 16 years with Duke Energy in various business development and public policy roles, focusing on focus on renewable energy and energy storage. His development experience spans transmission, wind, solar, and energy storage projects across 32 states.

EnerVenue | enervenue.com

Author: Spencer Hanes

Volume: 2024 September/October