Battery Analytics Impacts BESS Performance and Profitability

The energy storage industry is at a transition point.

As market growth accelerates, an increasing number of stakeholders are managing large fleets of batteries for the first time. Plus, subspecialty vendors are scaling to help owners get greater value from these batteries. As with most shifts in maturing markets, however, growing pains are common. With batteries, operational complexity due to electro-chemical considerations, coupled with the challenge of managing outliers among millions of batteries in growing portfolios — sometimes result in incidents, unplanned expenses, and lost revenue.

The management challenge, for both experienced hands and newcomers alike, is about achieving the desired outcomes of BESS while controlling for the range of operating risks. With large-scale storage, operational risks arrive from many angles: outliers in battery cell quality; errors in system installation; faulty state estimations among Battery Management Systems (BMS); and a lack of best practices.

As the industry matures, it is becoming clear that deep insights from battery data result in safer and more profitable systems.

Data plays a critical role

Batteries generate high volumes of data; the information it contains can be tremendously valuable when modern software is applied. Within every BESS, the BMS ensures that the batteries operate within certain operational bounds. This simple logic chip continuously governs voltage, current, and temperature. Every day, the BMS creates thousands and thousands of data points for each individual battery.

While BMSs have limitations, the data hold a significance extending well beyond basic onsite purposes. By combining BMS data with cutting-edge analytics techniques that leverage the power of the cloud, a comprehensive understanding of the battery's health and internal processes can be attained. A hybrid approach of physics-based models, machine learning and artificial intelligence, and other advanced statistical techniques are providing new value to today’s operators. This powerful combination of technologies enables precise predictions of the battery's current states and future performance with high degrees of accuracy.

Yet, when it comes to battery data, a lacking in awareness of these digital capabilities is leading many BESS owners and operators to leave value on the table. When asked about what they are doing with their battery data, the typical response is: “Not much.” These missed opportunities in managing battery assets are resulting in preventable incidents, foregone revenues, and higher-than-expected operating expenses.

Cloud-based battery analytics can answer several pressing questions for operators and asset managers:

- Is a dangerous situation imminent?

Analytics can track and predict critical cell, pack, and system conditions. Many thermal runaway events can be detected weeks or even months in advance. It enables a proactive (rather than reactive) approach to safety.

- Is the battery performing at the expected capacity?

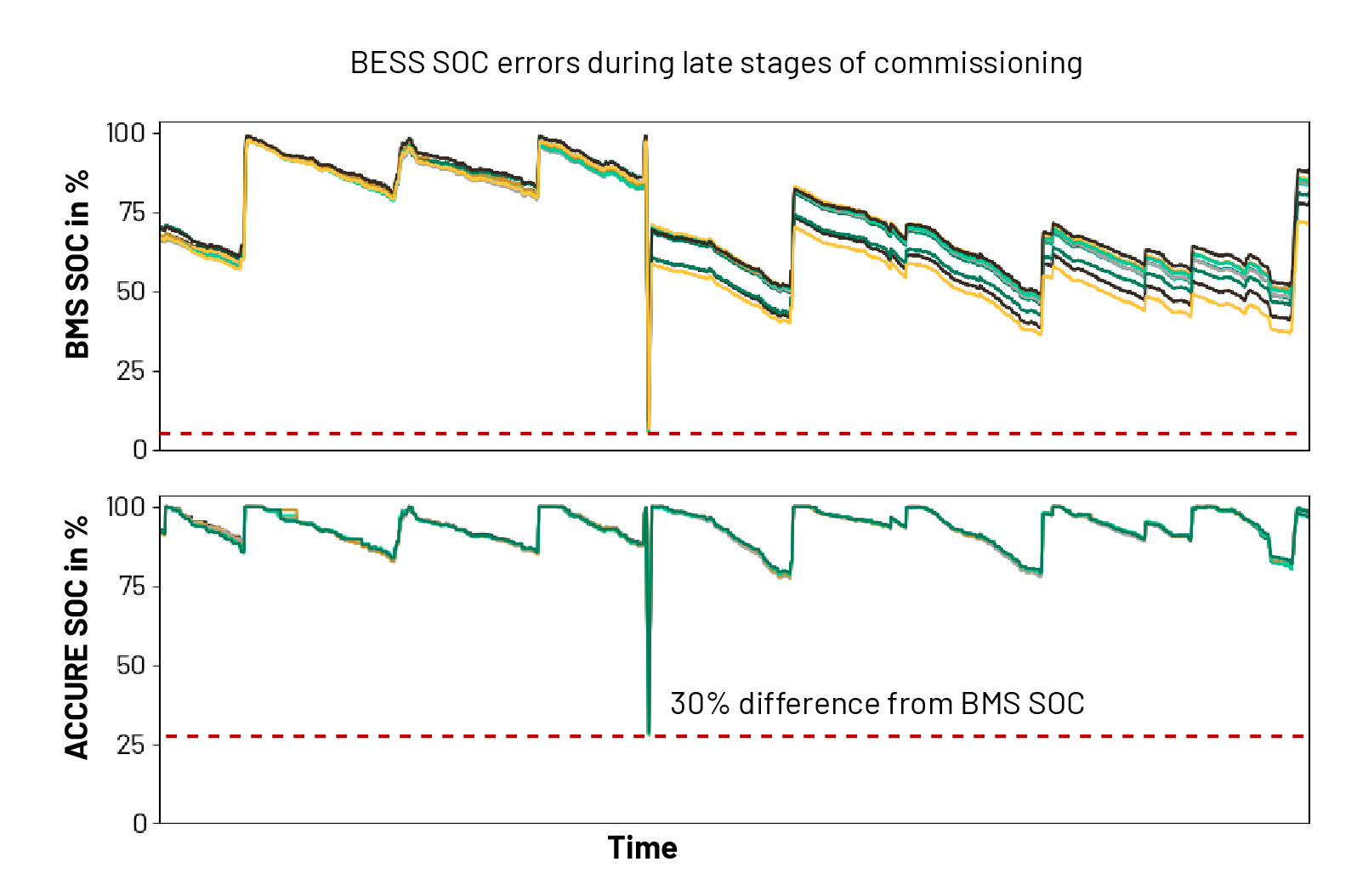

Downtime and underperformance result in significant financial losses. If your BMS is underrepresenting the battery’s State of Charge (SOC), money is left on the table. This is compounded as other factors, such as accelerated aging, may occur from suboptimal asset utilization. (INSERT SOC GRAPHIC)

- Will the battery reach its anticipated lifetime?

By understanding the drivers and impacts of battery aging, it’s possible to identify the most suitable countermeasures to minimize degradation. This gives operators insights into augmentation strategies, degradation costs per cycle, and terminal value considerations on the investment.

Small changes in how you treat your battery today can significantly impact what happens in ten to fifteen years. Numerous safety, performance, and accelerated aging issues can be tracked across use cases, battery technologies, and environments. In fact, a recent independent study by U.S. national laboratories identified variance among O&M actions and high rates of warranty claims for systems that are not very old.1

The role of analytics with BESS commissioning

The commissioning phase of BESS is an acute problem for many stakeholders. It plays a critical role in determining asset performance. Unfortunately, it can also be a source of delays, disputes, and potential underperformance in the future.

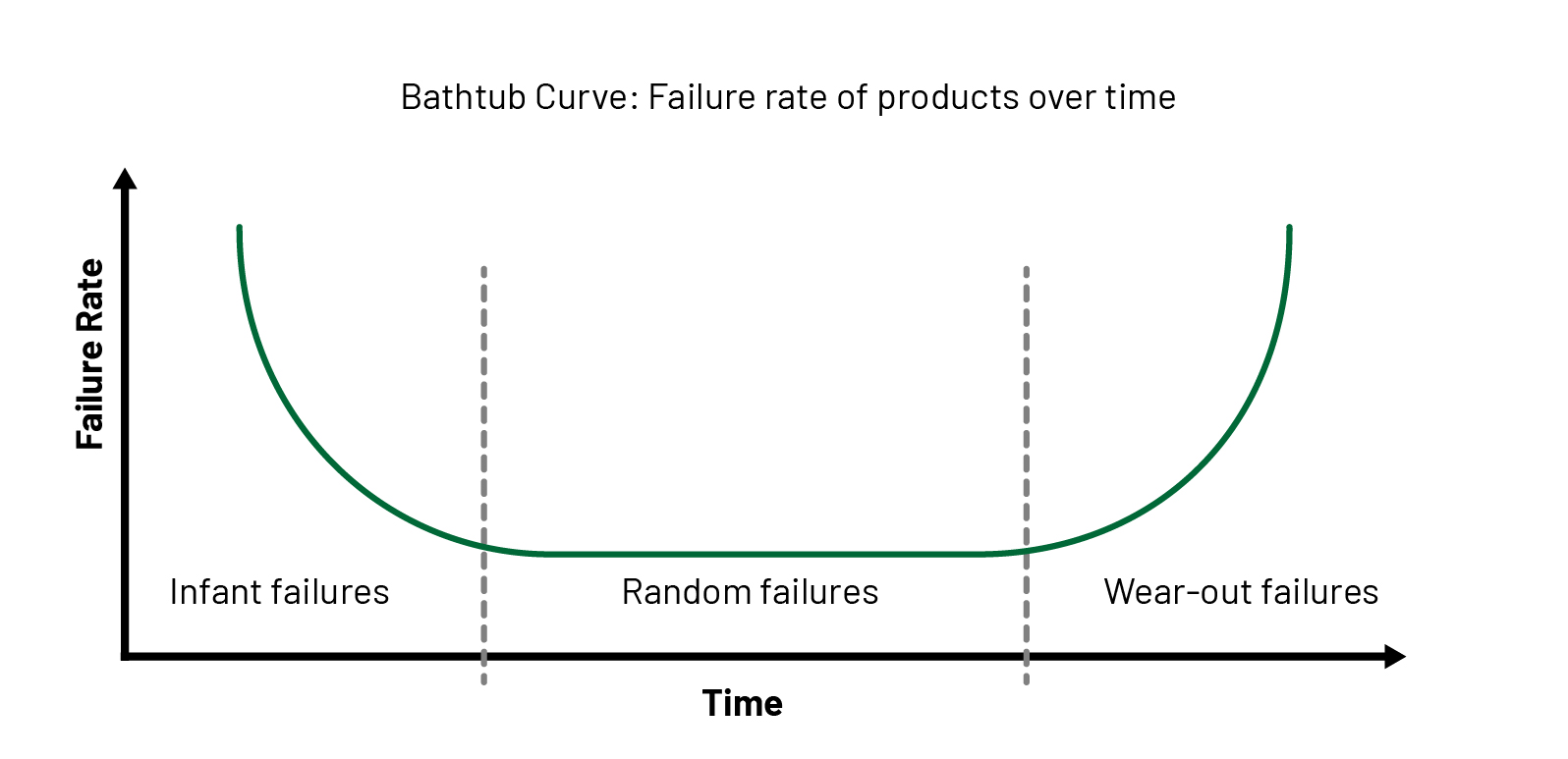

While all batteries require continuous monitoring, the first three to four years of BESS lives are particularly prone to failures, and many issues begin during commissioning. Public data compiled by EPRI illustrates a bathtub curve of problems (Figure 1) (INSERT BATHTUB CURVE GRAPHIC). These findings are unsurprising, even considering many issues go unreported. When BESS issues are left unaddressed, problems can also accelerate in non-linear ways — issues with battery cell quality, BMS failures, and SOC errors result in imbalanced racks.

Owners and operators who have the tools in-hand to utilize their battery data during the commissioning process can proactively avoid delivery delays, underperformance issues, and prolonged discussions with contractors regarding potential claims. Once the site acceptance is completed, continuous battery monitoring minimizes operational risks, and ensures optimal asset performance throughout the year.

Battery storage is unique

Some stakeholders approach the management of BESS assets like other energy assets. While some lessons are transferrable, this approach does have limitations. BESS assets are unique among power generation technologies. Batteries have a level of operational complexity unlike other assets, due partly to dynamic electro-chemical states among millions of batteries in large portfolios.

Batteries also have a broad range of use cases and differing management practices that change asset performance. For instance, batteries can be used across large geographies as distributed assets, or bulk power systems interconnected to transmission systems. They operate as both generator and as a source of flexible demand. They can also sit idle, awaiting dispatch and charge signals while charging and discharging at different rates to achieve specified outcomes. And that’s just the beginning.

Large-scale storage portfolios contain millions of battery cells. The overall safety and performance of these systems are defined by small numbers of the weakest cells, which vary over time. In recent cases, battery fires have started from just one cell.2 Complexity is further compounded by the extensive array of manufacturers, diverse battery chemistries available, and the frequent introduction of new battery generations approximately every 18 months. Moreover, navigating through convoluted warranties and modified performance contracts can adds more confusion.

No battery cell is identical or completely safe, even among cells produced on the same manufacturing lines. Use cases and environmental conditions vary considerably, further affecting BESS risk profiles. All factors indicate the need for specialized tools to manage these critical assets.

Battery analytics is revolutionizing the management of large-scale storage systems, which are an important and transformative force in the industry. Market leaders have recognized the immense value of independent, third-party battery analytics providers. Data analytics empower BESS asset owners with the insights to make better business decisions, reduce risk, and increase profitability.

Ted L. James is Head of Americas at ACCURE Battery Intelligence, a predictive analytics software provider that is helping companies reduce risk, enhance performance, and maximize the business value of their energy storage assets.

ACCURE Battery Intelligence | www.accure.net

Author: Ted L. James

Volume: 2023 September/October