Anza Releases Q2 Storage Pricing Insights Report

The second quarter of 2025 delivered the sharpest single jump in battery energy storage prices since Anza’s inception in 2021, exceeding even the industry-wide lift seen between 2021 and 2022 as the industry dealt with post-pandemic supply chain woes. Successive layers of United States tariffs landed within a forty‑day window, and manufacturers reset quotes almost overnight. This report analyzes two common project sizes: a 40 MW distributed‑generation project and a 200 MW utility‑scale project, each configured for four hours of duration. All prices come directly from manufacturers through the Anza platform and include the latest tariffs, shipping, and duties.

Important notes:

● All figures are shown on a project CapEx basis for the U.S., covering costs like materials, commissioning, and applicable tariffs.

● Data runs through May 19, 2025, and reflects the 90 day China tariffpause effective beginning May 14, which temporarily lowers the rate on Chinese battery imports.

● AC system prices cover the battery block, Power Conversion System (PCS), and Energy Management System (EMS).

● DC systems cover the battery block only.

Key Market Factors Affecting Current Energy Storage Prices

1. TariffShock Drives the Market

A universal 10 percent tariff, a 145 percent total IEEPA tariffrate on China, and Section 301 pushed every manufacturer to pause quoting in early April. Most returned to the market by late April with shorter validity windows. The May reprieve cuts the IEEPA China rate to 30% for 90 days beginning May 14 (Section 301 remains in effect), but suppliers continue to protect their margin through contract contingency clauses.

2. Lithium-Carbonate Prices Fall

Spot lithium‑carbonate indices fell from 77,500 CNY per tonne in February to 64,500 by early May (-17%), reaching their lowest level since 2021. The savings on cell cost could not offset the tariffshock, so delivered system prices still rose.

3. Shipping Costs Increase

Asia-U.S. container production rose sharply due to the tighter vessel supply caused by tariffs. The 90-day tariffreprieve that went into effect on May 14 is expected to increase shipping costs in Q3 2025 as all industries try to bring imports into the US to take advantage of the lower tariffs.

4. Preliminary Anode-Material Ruling Under Review

The International Trade Commission released a preliminary countervailing‑duty decision on Chinese active anode material on May 20, 2025. The base duty of 6.55% may have minimal impact at the DC block level. Still, we are continuing to track this in depth, including the ongoing anti-dumping (AD) investigation and potential implications for affected OEMs.

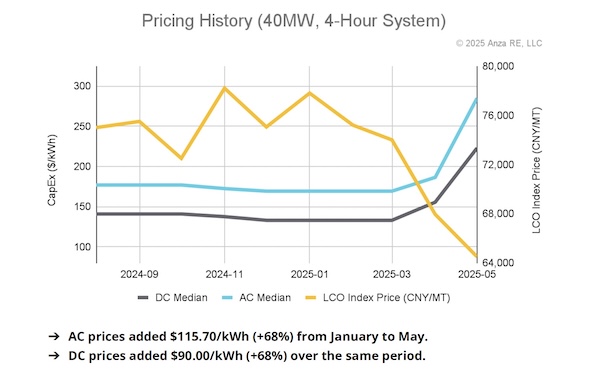

DG 40 MW, 4-Hour System

Monthly trend

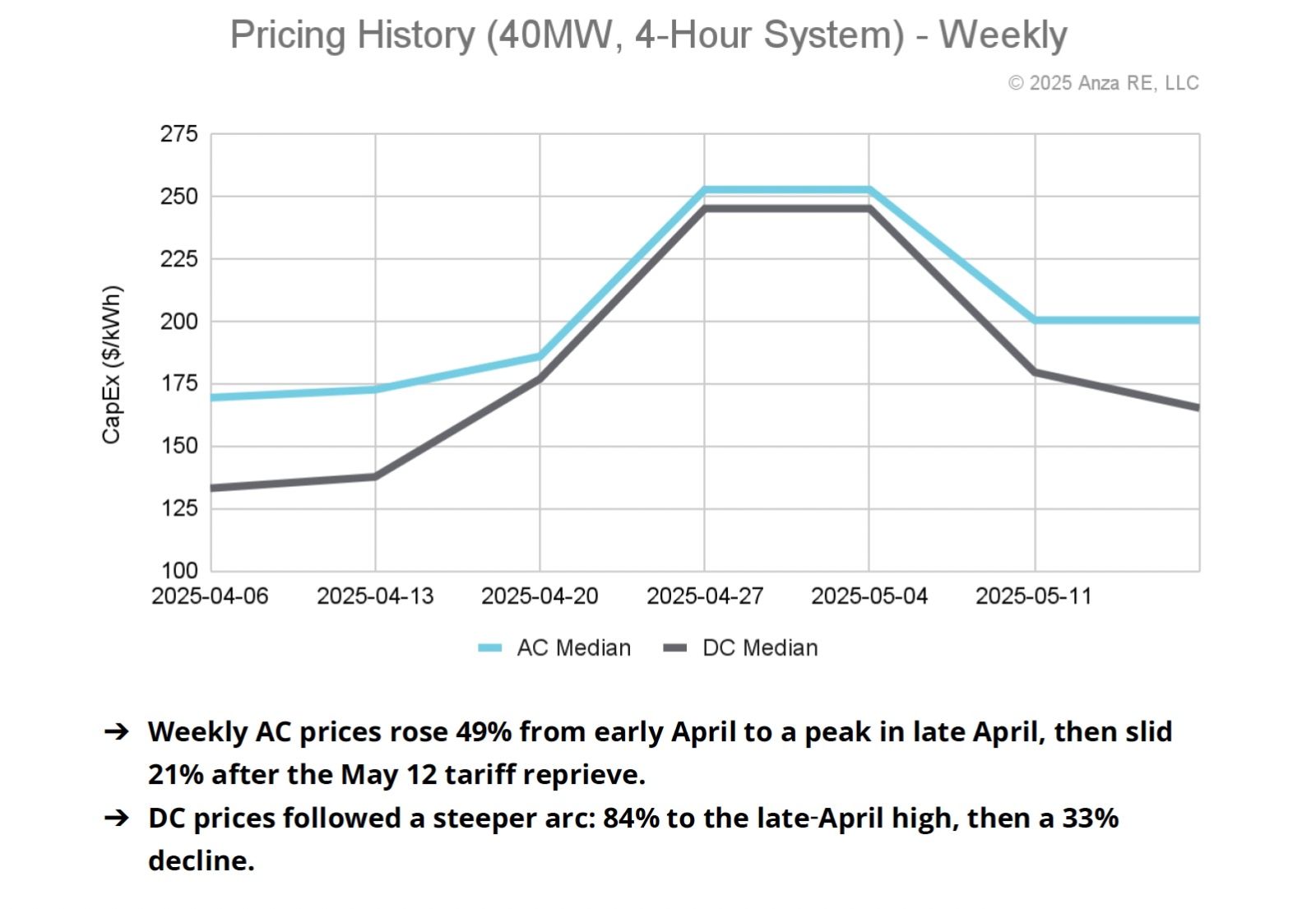

Weekly Trend (April 6, 2025 - May 18, 2025)

This month, we present a bonus chart. Because our data view uses medians, it smooths out the sharp, tariff‑driven jumps. A week‑by‑week lens shows how quickly Anza’s continuously updated pricing captures those swings, giving subscribers timely visibility that static price surveys miss.

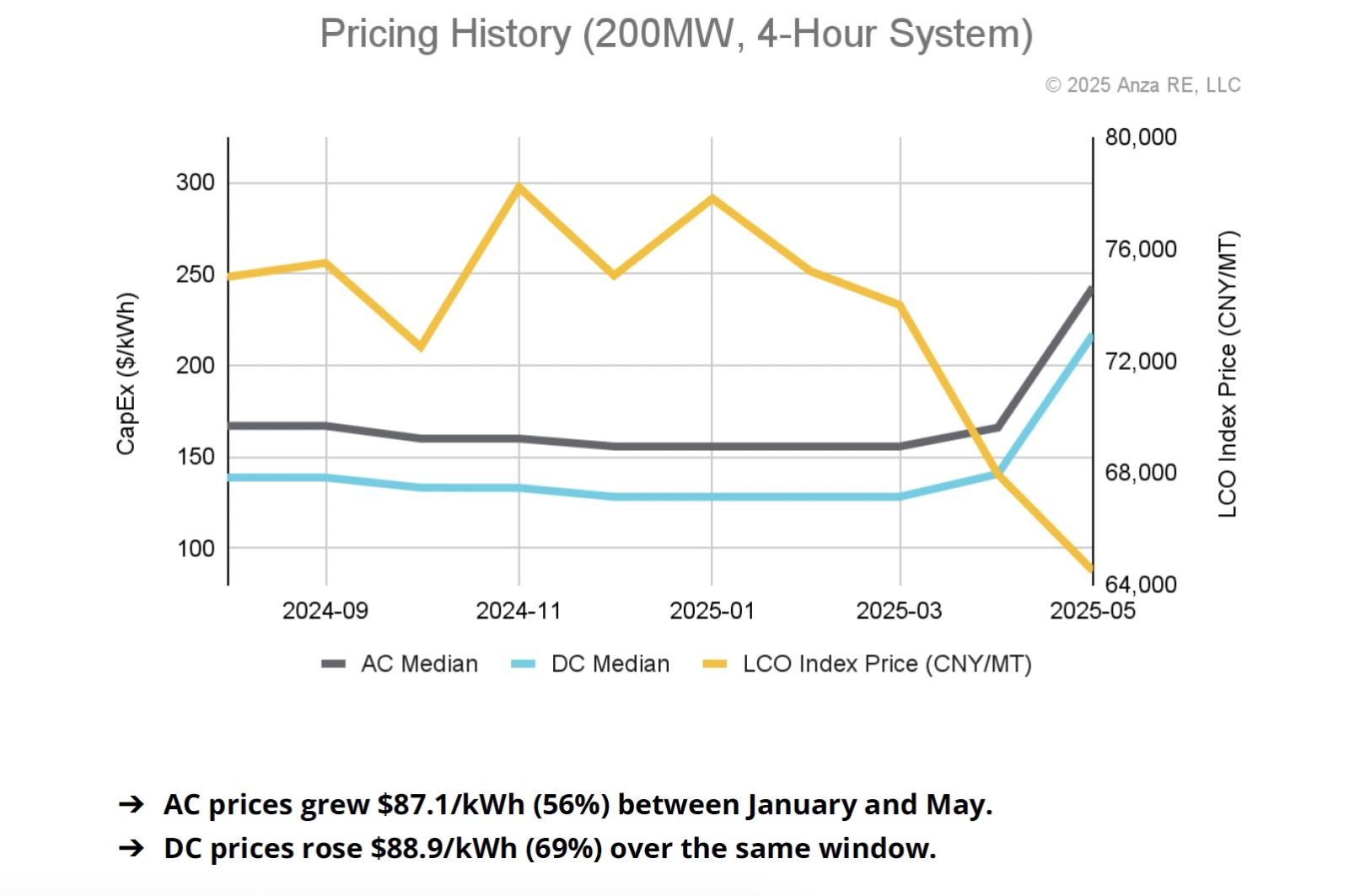

Utility-Scale 200 MW, 4-Hour System

Tariffs eclipsed every cost tailwind this quarter. Falling lithium‑carbonate and incremental efficiency gains could not match the tariffshock, and freight premiums piled on. Compared with January 2025 levels, delivered AC system prices now sit 68% higher in the DG market and 56% higher at utility scale. DC‑only solutions climbed 68% and 69%, respectively. We expect prices to stay volatile until policy clarity returns.