Transformer Asset Tax Qualification in Renewable Energy Projects

Renewable Energy projects have been blessed with tax credits. Tax credits are incentives provided for green energy by the federal government; certain qualifications must be met in order to receive them. Wind and solar projects, in particular, have benefited the most from these assets.

Renewable Energy projects have been blessed with tax credits. Tax credits are incentives provided for green energy by the federal government; certain qualifications must be met in order to receive them. Wind and solar projects, in particular, have benefited the most from these assets.

The Solar investment tax credit (ITC) is a tax credit that can be claimed on federal corporate income taxes, for up to 30 percent of the cost of a solar photovoltaic (PV) system placed in service within the period specified. Other types of renewable energy are also eligible for the tax incentive, but are beyond the scope of this guidance.

In December 2020, Congress passed an extension of the ITC, which provides 26 percent for systems commencing construction in 2020-2022, 22 percent for systems commencing construction in 2023, and 10 percent for systems commencing construction in 2024, or thereafter. (Pictured right: Tax credit qualified transformers can be very complicated) Any PV system placed in service after 2025, regardless of when it commenced construction, can receive a maximum tax credit of 10 percent. A subsequent amendment extended the 26 percent eligibility up to 2022.

For those in the wind industry, the Production Tax Credit (PTC) provides a tax credit per kilowatt-hour. This benefit follows a similar scale down and has a sunset similar to solar projects.

While the Solar ITC and the Wind PTC differ in their treatment application, we’ll focus more on the qualification process using an asset like a Power Transformer.

An important aspect referred to and evaluated is the “physical work of significant nature” commenced on the project site, or on project equipment at the manufacturing factory. Physical work has to be “integral” to the project; preliminary activities on site (e.g., clearing the site, or building a fence or access road, do not count as “integral”). “Continuity safe harbor” is an important test of qualification, and is satisfied in reasonable ways rather than through the demonstration of real, continuous, and physical work. (Left: Tax credit qualified conservator tank)

An important aspect referred to and evaluated is the “physical work of significant nature” commenced on the project site, or on project equipment at the manufacturing factory. Physical work has to be “integral” to the project; preliminary activities on site (e.g., clearing the site, or building a fence or access road, do not count as “integral”). “Continuity safe harbor” is an important test of qualification, and is satisfied in reasonable ways rather than through the demonstration of real, continuous, and physical work. (Left: Tax credit qualified conservator tank)

Transformer equipment and renewable tax credits

Custom engineered, designed, and custom-manufactured transformers can help a project to qualify for a renewable tax credit. This begins when a Developer/Owner/Operator is able to pin down specifications for custom transformers. They are designed to this spec and sought for approval by the transformer manufacturer. The manufacturer then identifies and proposes the custom engineered and designed components within the custom transformer; upon approval, it completes manufacture of these identified components before the end of the calendar year as required for tax qualification.

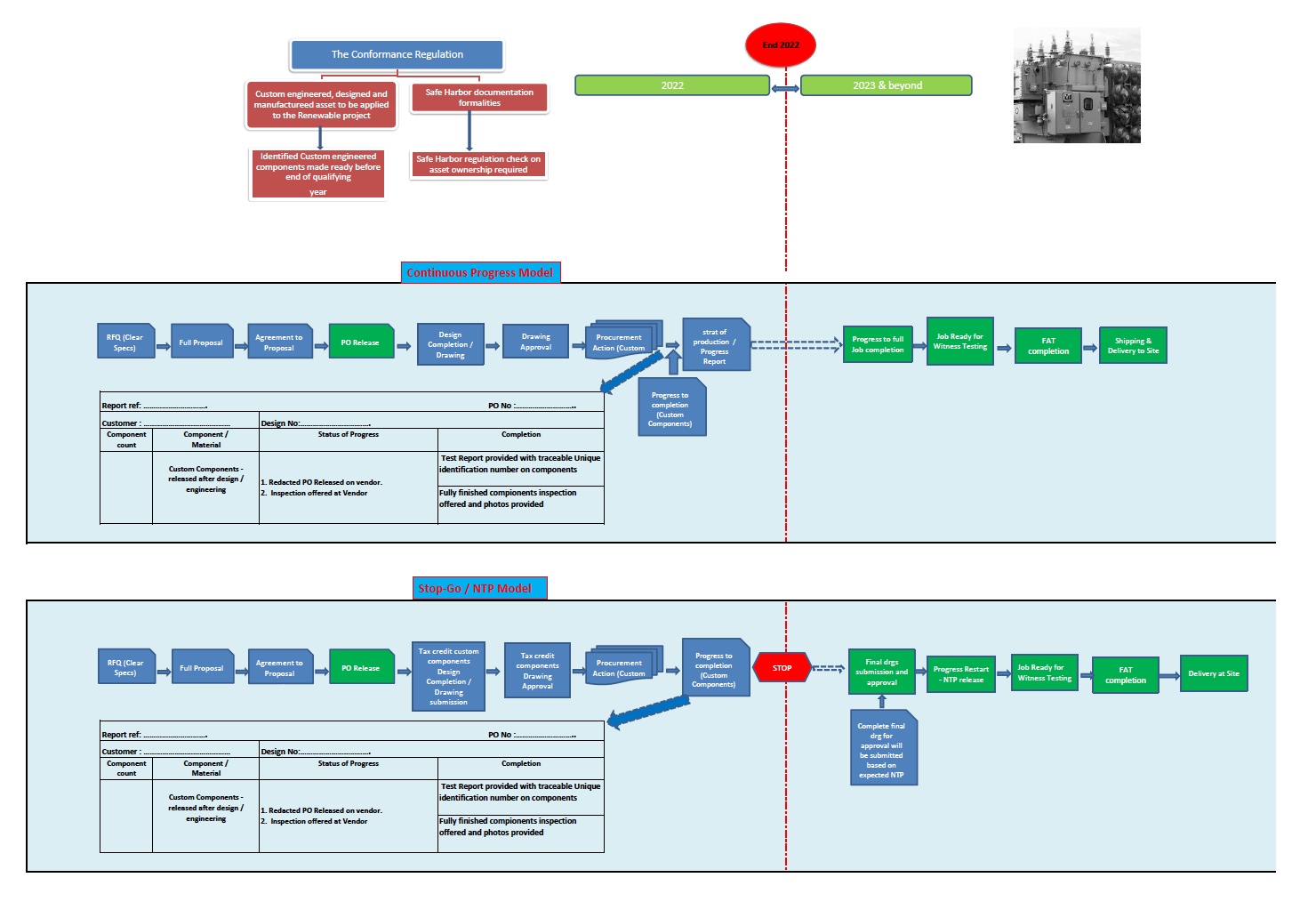

![]()

This whole process – and the offering of a custom transformer for the renewable project – aims at offering support to the renewable energy industry. Some pioneering work was done to offer dual process models to qualify – a “Continuous Process” and a “Stop-Go NTP process” (NTP - Notice To Proceed) based model. While the “Continuous Process” model continues manufacture and assembly of the transformer (after the qualification ITC components are completed by the year end), the “Stop-Go NTP” model completes the ITC qualification components by end of the year, then stops to await an NTP; upon receiving NTP, it then goes on to complete the transformer. Given the uncertain commercial operation deadlines so typical of renewable projects, it’s important to factor in the storage, care, upkeep, and maintenance of the finished transformer until the site is ready to accept delivery. This 360-degree customer support helps qualify the transformer for the tax qualification under either of the two models, and is the reason many developers consider it an excellent proposal.

(Above: Tax qualified finished Transformer; incorporating the Tax qualified components)

Developers covering a large number of projects have used these unique process models to get qualified for tax credit under both the ITC and PTC.

Keep in mind that 2022 is the final year to take advantage of the extended 26 percent ITC credit for the tax sunset period ending 2025, for project completion. To guarantee you’re getting the most bang for your buck, be sure to work with an industry professional experienced in making these tax credit projects qualify with transformers.

Balram Ramamurthy is Director Renewables at Virginia-Georgia Transformer Corp. With experienced Engineers using over 15,000 designs, four integrated transformer facilities in North America, state-of-the-art equipment and testing facilities, Virginia-Georgia Transformer Corp. provides power transformers up to 400MVA/500kV to Renewables, Utilities, and Industrial markets in North America. Balram Ramamurthy can be reached at [email protected]

Virginia-Georgia Transformer | www.vatransformer.com

Author: Balram Ramamurthy

Volume: 2022 July/August