Battery Behemoths: Covid-19 impact on electric ships

The introduction this year of the International Maritime Organization's global sulphur limit on marine fuels (less than 0.5 percent by weight), alongside a growing base of zero-emission ports, is driving meaningful change in marine transportation. While multiple avenues to emissions reduction exists (fuel cells, LNG, alternative liquid fuels, scrubbers, slow-steaming etc.), batteries enhance these alternative solutions by peak-shaving, and will coexist rather than compete in applications where they lack energy density.

In the past five years, Li-ion battery adoption on ships has flourished as startups have capitalized on falling battery cell prices. Ultimately, this is driven by economies of scale of the battery-electric and plug-in hybrid passenger vehicle markets, which swept past 7 million total sales last year (representing roughly 230GWh).

The modern commercial electric vessel era began circa 2013, in short-sea and inland segments, particularly ferries. Ferries are the largest vessels capable of becoming pure electric because of the well-defined operational cycles. These cycles allow easy sizing of a battery, optimal location of shore-side charging infrastructure, and time to charge during normal operation (as passengers board).

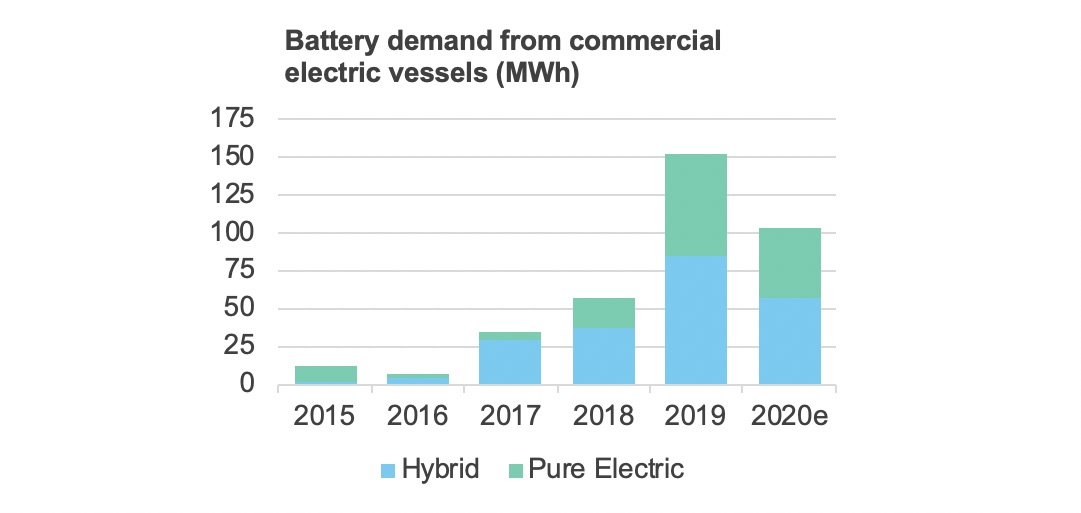

While the number of electrified vessels is low (around 520 in total), marine battery demand is amplified by the large battery capacities per vessel, which is steadily increasing year on year. In 2018, the largest marine battery order was 6MWh, which surged to 10MWh in 2019 (both for cruise ships). Although not yet on order, some operators have indicated potential roadmaps to install 50MWh battery systems on vessels once the technology has more field experience.

Source: IDTechEx

The marine sector has taken advantage of the auto industry's economies of scale by using the same battery cell suppliers. However, designs differ at the system level because safety has become the focus of innovation: the risk from a serious battery fire is much greater on a vessel isolated out at sea.

The crown jewel of marine battery start-ups' IP has therefore converged on the thermal management. The extra engineering (and manufacturing) to obtain the corresponding class compliance from industry certifiers, alongside the lower volumes, has created a premium over other electric vehicle sectors. Battery pack costs in the auto industry are at roughly $160 per kWh today, whereas marine battery systems are priced at up to four times this rate, depending on the chemistry and project size.

The current price level is, however, a drop from over $1000 per kWh in 2016, which has been low enough to induce an industry boom from 12MWh in 2015, to 152MWh last year. In part, this is because the industry is less price sensitive, but also because battery startups have capitalized on the industry practice of oversizing engines, which inflates both fuel consumption and operating costs.

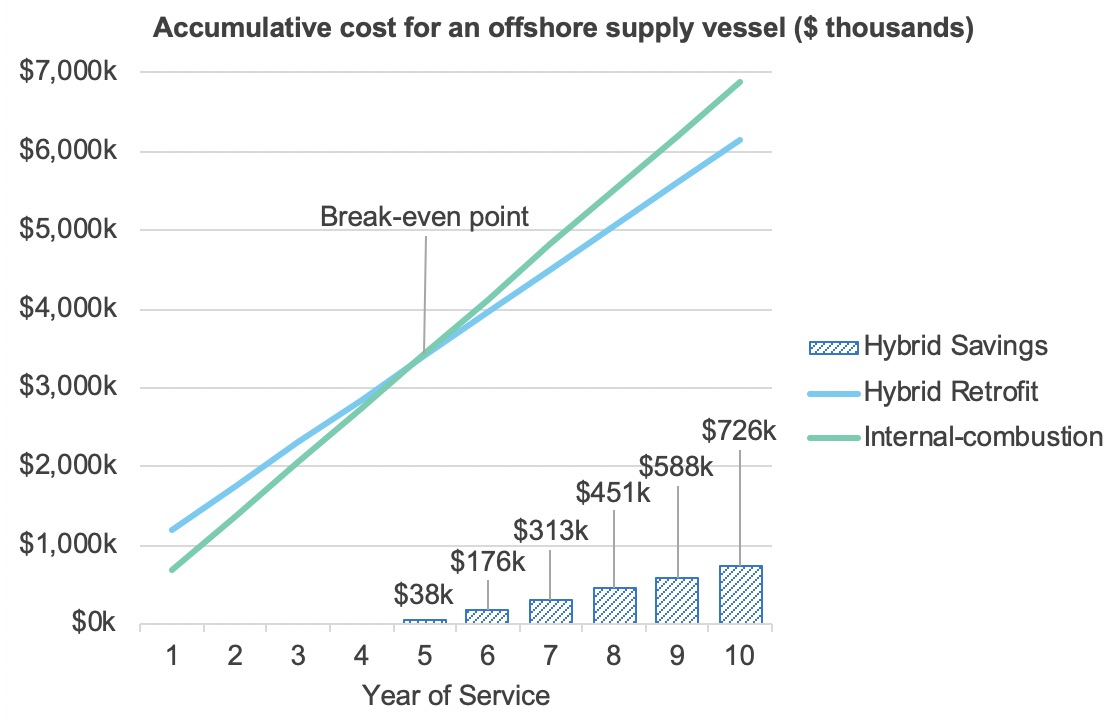

Below is a comparison between a conventional offshore support vessel (OSV) and a hybrid OSV, with each operating 200 days of the year. The hybrid OSV is retrofitted in the first year with a 650kWh battery. It breaks even after the fifth year. After the tenth year (the typical service life of the battery) the hybrid vessel has saved $726,000 on fuel.

Hybrid costs reflect the initial cost of retrofitting a Li-ion batteryplus yearly operational fuel costs. Internal-combustion costs reflect operational fuel costs only, from an existing vessel. Source: IDTech Ex

The question is, against the backdrop of covid-19, will the growth continue? The marine industry is used to much longer sales cycles than on-road transport, so the true impact of the pandemic will be delayed. However, because the core driver of emissions regulation is not changing, it is likely that the disruption will be concentrated to certain subsegments that are more fundamentally affected.

Take, for example, cruise ships. In recent years, cruise ships have been criticized for higher levels of pollution during an industry boom. Like other sectors, the core driver to electrify is emissions reduction and regulation. Currently, the overall cruise sector is facing huge disruption, with passenger demand evaporating due to the risk of being confined at sea with thousands of passengers.

With project delays, alongside cancellations from vulnerable sub-segments like cruise ships (which garner the largest battery orders), it is estimated that marine battery capacity installations will be down roughly 30 percent in 2020. On a positive note, the decline will be short-term as batteries increasingly play a central role in hitting emissions targets. Growth will recover quickly in 2021, (back to 2019 levels) as delayed projects restart; the market for commercial electric vessels will then accelerate for two decades to over $45 billion in 2041.

With project delays, alongside cancellations from vulnerable sub-segments like cruise ships (which garner the largest battery orders), it is estimated that marine battery capacity installations will be down roughly 30 percent in 2020. On a positive note, the decline will be short-term as batteries increasingly play a central role in hitting emissions targets. Growth will recover quickly in 2021, (back to 2019 levels) as delayed projects restart; the market for commercial electric vessels will then accelerate for two decades to over $45 billion in 2041.

The question is, against the backdrop of covid-19, will the growth continue? The marine industry is used to much longer sales cycles than on-road transport, so the true impact of the pandemic will be delayed. However, because the core driver of emissions regulation is not changing, it is likely that the disruption will be concentrated to certain subsegments that are more fundamentally affected.

Take, for example, cruise ships. In recent years, cruise ships have been criticized for higher levels of pollution during an industry boom. Like other sectors, the core driver to electrify is emissions reduction and regulation. Currently, the overall cruise sector is facing huge disruption, with passenger demand evaporating due to the risk of being confined at sea with thousands of passengers.

With project delays, alongside cancellations from vulnerable sub-segments like cruise ships (which garner the largest battery orders), it is estimated that marine battery capacity installations will be down roughly 30 percent in 2020. On a positive note, the decline will be short-term as batteries increasingly play a central role in hitting emissions targets. Growth will recover quickly in 2021, (back to 2019 levels) as delayed projects restart; the market for commercial electric vessels will then accelerate for two decades to over $45 billion in 2041.

Luke Gear is a Senior Analyst at IDTechEx, where he leads the research on Electric Vehicles. He has a specialist knowledge of the markets and technologies underlying electric vehicles, as well as expertise in forecasting, technology benchmarking, and competitive landscape analysis.

IDTechEx | www.idtechex.com/EV

Author: Luke Gear

Volume: 2020 November/December