Global wind and solar fluctuations highlight the need for more detailed resource reporting

What do renewable energy project owners in India, Germany, and the USA have in common? The answer; in the summer of 2018, they all experienced first-hand just how fickle wind and solar resources can be as a source of fuel - and revenues.

In May, wind energy operators in many regions of the United States saw wind speeds drop up to 20 percent below long-term averages - only to pick up again in June, with an almost complete reversal in key markets, like Texas and Oklahoma.

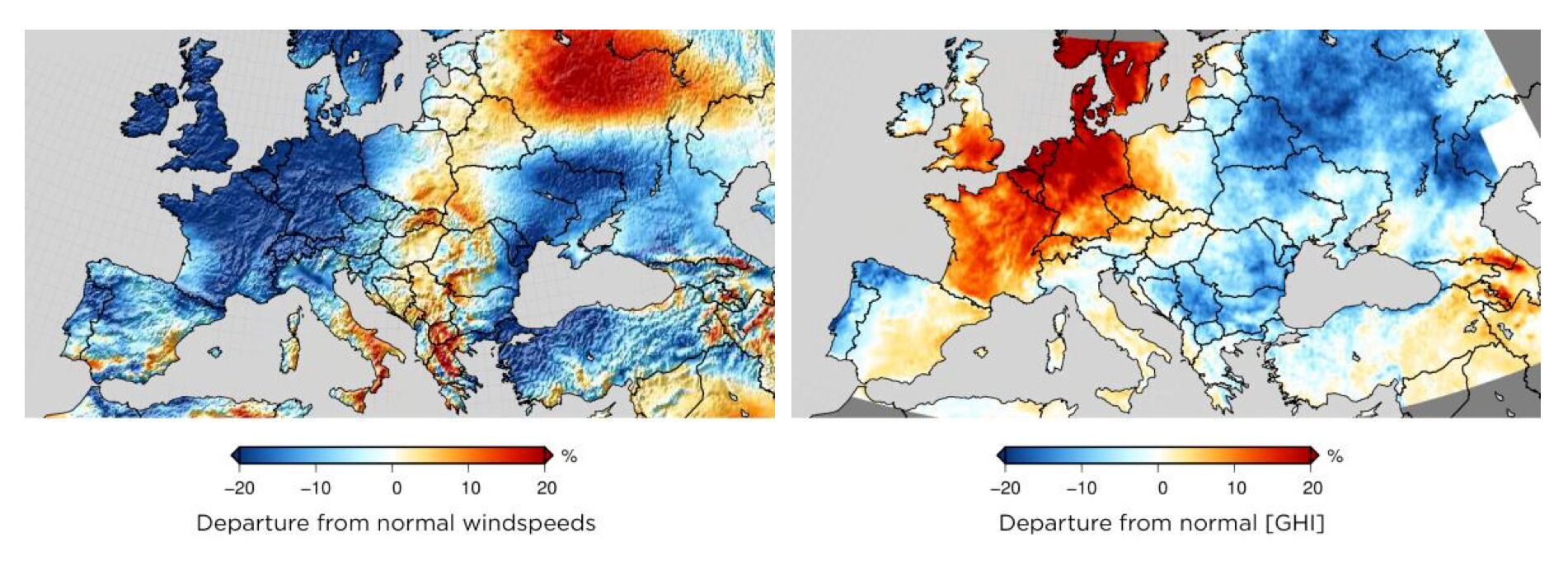

Throughout June, July, and August, European asset owners were affected by resource anomalies on an even greater scale than their American counterparts. The meteorological conditions behind the summer's heatwave in Western Europe contributed to a widespread 'wind drought'; wind energy project performance suffered in markets including the UK, France, Spain, Germany, and much of Scandinavia. These below-par winds were cited in the quarterly financial reporting of a number of major wind energy producers, at the end of both quarter three and quarter four.

At the same time, as one of Europe's hottest summers on record curtailed wind generation, solar plant performance in many of these countries increased. This striking example of 'negative correlation' between the wind and solar resource helped to 'plug the gap' in generation in Europe.

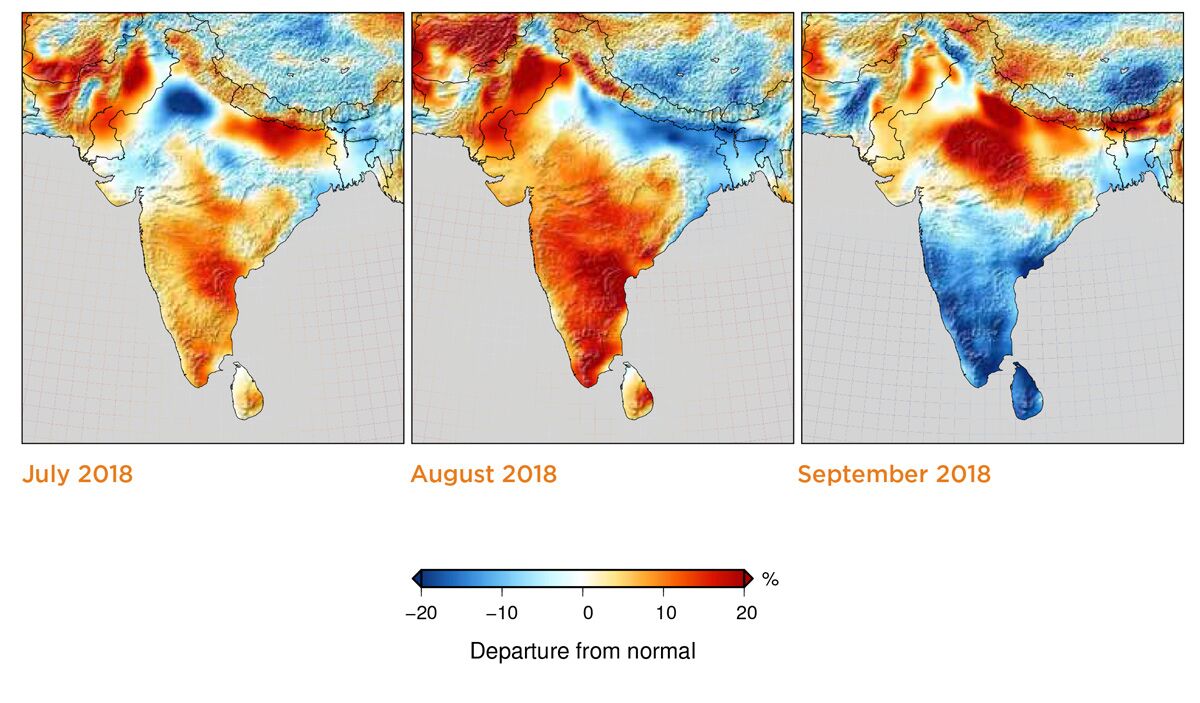

In India, wind farm owners experienced a change in fortune of a different kind. In July and August, after a prolonged year-on-year decline in wind speeds (during the annual monsoon season), the 2018 season brought significantly stronger winds. In key power markets, including Tamil Nadu and Andhra Pradesh, wind speeds were up to 20 percent above the long-term average recorded during the regions' traditional high-wind season.

In India, wind farm owners experienced a change in fortune of a different kind. In July and August, after a prolonged year-on-year decline in wind speeds (during the annual monsoon season), the 2018 season brought significantly stronger winds. In key power markets, including Tamil Nadu and Andhra Pradesh, wind speeds were up to 20 percent above the long-term average recorded during the regions' traditional high-wind season.

The overall picture across all of these prominent wind markets is mixed. In each case, there are factors at play that could be used as evidence to support the argument that 'it all balances out in the long run'. However, such significant departures from long-term averages may not only create doubt over the use of these averages as a reference point, but also highlight the more immediate challenge operators face in financial planning. Even if resource anomalies were to balance out over the long run, this might not help asset owners whose individual portfolios may lose out.

Cumulative under- or over-performance has a significant impact on annual operating and financial results. It may also contribute to surprise shifts in project value, which can have potentially damaging effects on both shareholder value and investor confidence. The burden falls primarily on operations teams and asset managers to present data in the boardroom that gets to the bottom of exactly what factors have contributed to changing performance on a month-by-month basis, and to refine their financial forecasting accordingly.

Typically, pre-construction estimates of wind speeds and actual energy production figures are used to forecast a site or portfolio's energy production (the energy budget). Deviations in actual performance from the energy budget are easy enough to track, but, all too often, under- or overperformance is attributed to weather variation.

Abnormal wind speeds are regularly cited as a leading cause of underperformance in wind energy operators' financial reports, but more needs to be done to isolate and accurately quantify their effects. In doing so, we can more clearly understand whether other factors are at play, and help reduce financial uncertainty.

The first step to achieving this is to analyze how more recent weather anomalies - such as those seen in the USA, Europe, and India - have impacted projects on a portfolio-wide and project-by-project basis. Looking back in greater detail at what happened to the on-site resource during a given period of underperformance is fully achievable - and helps operators gain an overview of just how much resource fluctuations really made a difference.

The first step to achieving this is to analyze how more recent weather anomalies - such as those seen in the USA, Europe, and India - have impacted projects on a portfolio-wide and project-by-project basis. Looking back in greater detail at what happened to the on-site resource during a given period of underperformance is fully achievable - and helps operators gain an overview of just how much resource fluctuations really made a difference.

In turn, project operators will benefit from greater flexibility and increased accuracy, allowing them to re-calibrate their energy budgets on a rolling, monthly basis. For the purposes of financial planning, and to avoid unpleasant surprises, situating performance in its short-term context is just as important as looking at pre-construction estimates and long-term averages.

In the absence of reliable data, it may be tempting to label unexplained differences in asset and portfolio performance as weather impacts. To deal with the impact of resource fluctuations on budgets, however, it's vital to seek a greater level of detail to support financial reporting.

Pascal Storck is Director, Renewable Energy at Vaisala, a global company that serves selected weather-dependent markets where accurate, real-time, uninterrupted, and reliable weather data is essential to run efficient operations.

Vaisala | www.vaisala.com

Author: Pascal Storck

Volume: 2019 March/April