Margin Recovery Possible for GE Vernova, Morningstar Report Finds

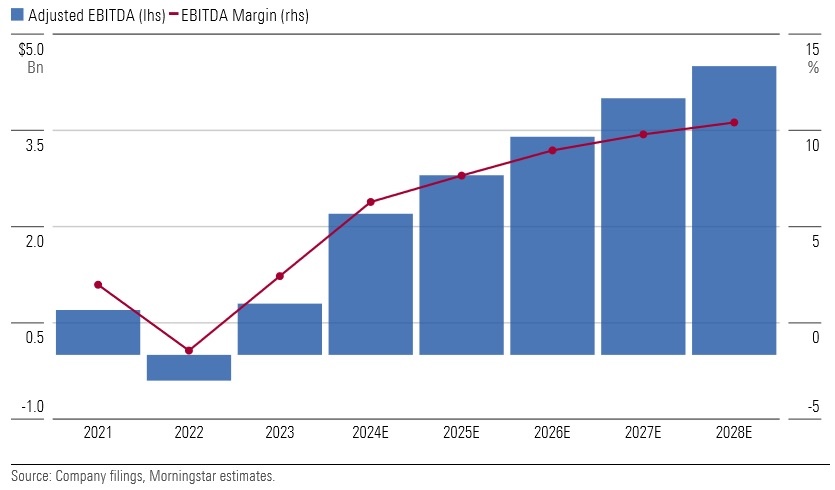

GE Vernoa is a global power generation behemoth, with its installed base accounting for 30% of the world’s power generation. Despite the company’s leading market position, its past financial results have been underwhelming, and adjusted earnings margins have trended near break-even levels over the past three years. According to Morningstar’s recently published “GE Vernova: 10 Key Takeaways” report, however, GE Vernova can close the gap between its market position and financial performance. By 2028, Morningstar expects adjusted earnings margins will slightly surpass the company’s target of 10%.

The below graph shows GE Vernova’s expected earnings before interest, taxes, depreciation, and amortization through 2028.

Key takeaways from the report include:

- GE Vernova has made progress on operating cost efficiency through leveraging support functions, outsourcing non-core activities, and optimizing IT and legal operations. By 2028, the company expects to lower general and administrative costs to $2.8 billion, a $500 million reduction from 2023.

- The company holds $100 million in debt and a $1.9 billion net pension deficit, but this is manageable relative to its balance sheet and improving fee cash flow. General Electric set GE Vernova up for success during the spinoff through a $2 billion cash contribution, leaving GE Vernova with a total cash balance of about $4.2 billion pending the sale of its nuclear steam business.

- Demand for wind power in the United States is expected to rebound in the coming years, as the Inflation Reduction Act of 2022 provides greater long-term certainty for wind tax credits. Given its leading market position, GE Vernova should heavily benefit from this increase in demand.

- GE Vernova’s gas power segment largely consists of servicing its existing fleet of 7,000 turbines, as the market for new builds has slowed in the past decade. As electricity demand grows, however, wind and solar alone may not be able to keep up. This creates an opportunity for the company to increase utilization of existing gas plants, supporting service revenues.

GE Vernova | https://www.gevernova.com/