Wind Experts Report that Average Operating Expenses for Land-Based Wind Projects have Declined by ~50% Over the Last Two Decades

We are pleased to announce the publication of a new article (link is external) in the journal Renewable Energy Focus. This work draws on a survey of wind industry professionals to clarify trends in the operational expenditures (OpEx) of U.S. land-based wind power plants.

Wind plant OpEx is an important but sometimes overlooked driver of levelized cost of energy (LCOE) trends for land-based wind. In particular, plant OpEx has implications for operating life and overall project viability. This new work draws primarily from a survey of senior members of the U.S. wind industry to describe historical and current trends in land-based wind OpEx and to provide insights into drivers of those trends. It compares the resulting estimates for average OpEx with other OpEx benchmarks and extrapolates the historical data to estimate future land-based wind OpEx, comparing the resulting estimates with other recent assessments.

Key findings and insights include:

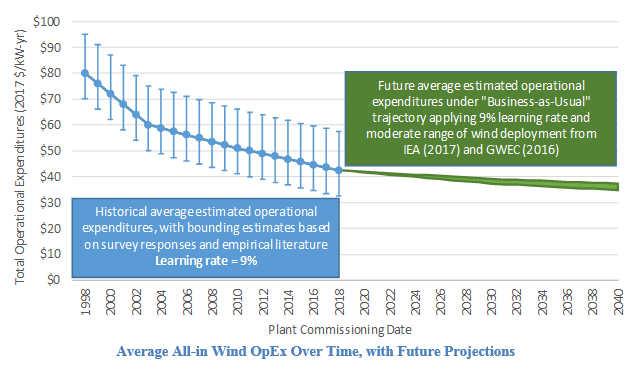

- Average total lifetime OpEx has declined from approximately $80/kW-yr (~$35/MWh) for projects built in the late 1990s to a level approaching $40/kW-yr (~$11/MWh) for projects built in 2018 (see figure below).

- Turbine operations and maintenance (O&M)-inclusive of scheduled and unscheduled maintenance-represents the single largest component of overall OpEx and the primary source of cost reductions over the last decade.

- Experts report a wide range in OpEx estimates around these averages; for example, survey respondents cite expected OpEx for projects commissioned between 2015 and 2018 from a low of $33/kW-yr to a high of $59/kW-yr (~$9-16/MWh).

- The core drivers of OpEx variability include turbine, project, and fleet size; wind project location; turbine maturity and assumed rates of component failure; wind resource; and local tax rules. Other drivers include the choice between entering into service contracts with the turbine manufacturer versus self-provision of O&M services, as well as tradeoffs between the cost and value of enhanced O&M practices.

- The observed historical OpEx learning rate is 9% (OpEx reduction) for each doubling of global installed wind capacity. Based on this rate, this research projects a further $5-$8/kW-yr (12%-18%) OpEx reduction from 2018 to 2040, which would reduce LCOE by as much as $2/MWh.

- This projection suggests that continued OpEx reductions may contribute 10% or more of the expected reductions in land-based wind's LCOE over the next few decades.

- These estimates likely understate the importance of OpEx, owing to the multiplicative effects through which operational advancements influence not only O&M costs but also component reliability, performance, and plant-level availability.

Overall, given the limited quantity and comparability of previously available OpEx data, the data and trends reported here may usefully inform OpEx assumptions used by electric system planners, analysts, modelers, and research and development managers. The results may also provide useful benchmarks to the wind industry, helping developers and asset owners compare their OpEx expectations with historical experience and other industry projections.

The Renewable Energy Focus article can be found here (link is external). An earlier Lawrence Berkeley National Laboratory report on the research can be found here.

The research was funded by the U.S. DOE's Office of Energy Efficiency and Renewable Energy.

Electricity Markets & Policy Group | emp.lbl.gov