The IRS Targets Energy Credits: How Companies Can Take a Proactive Stance

The focus of the Internal Revenue Service (IRS) Large Business and International (LB&I) initial compliance issues, announced earlier this year, troubled many energy companies. Rather than taking the historical approach of auditing the returns of the largest corporate taxpayers, the IRS now pools its audit resources around 13 initial campaigns, or issues of concern.

For energy companies, the campaign targeting the IRC 48C energy credit, and its impact on the bottom line, is of the most interest. The IRS stated that it plans to issue warning letters to encourage voluntary compliance, and will only conduct audits when necessary. However, if you are an energy corporation that takes, or plans to take the IRC 48C energy credit, you should be prepared to justify your tax position. While the increased risk of audit is a new reality, energy companies don't have to take a wait and see approach. They can ensure a proactive stance when it comes to their tax strategy.

The Intent of IRC 48C

The goal of IRC 48C is to stimulate growth of domestic manufacturing of clean energy, by offering a credit for machinery used to manufacture products that will reduce greenhouse gas emissions or air pollutants. Companies affected by this include manufacturers of wind turbines, solar panels, and low VOC chemicals. To qualify for this credit, manufacturers are required to go through a formal approval process with the Department of Energy, based on criteria such as:

The goal of IRC 48C is to stimulate growth of domestic manufacturing of clean energy, by offering a credit for machinery used to manufacture products that will reduce greenhouse gas emissions or air pollutants. Companies affected by this include manufacturers of wind turbines, solar panels, and low VOC chemicals. To qualify for this credit, manufacturers are required to go through a formal approval process with the Department of Energy, based on criteria such as:

- Net impact in reducing air pollutants or emissions of greenhouse gases

- Job creation

- Project time from certiï¬cation to completion

- Technological innovation and potential for commercial deployment

IRS audits will most likely target assertions on applications, as well as seek to confirm that companies enjoying this tax credit legitimately meet the review criteria, which include:

- Lowest levelized cost of energy

- Shortest project time from certification to completion

- Qualified facility

- Reductions of air pollutants

A Dynamic Tax Landscape Creates More Complexity

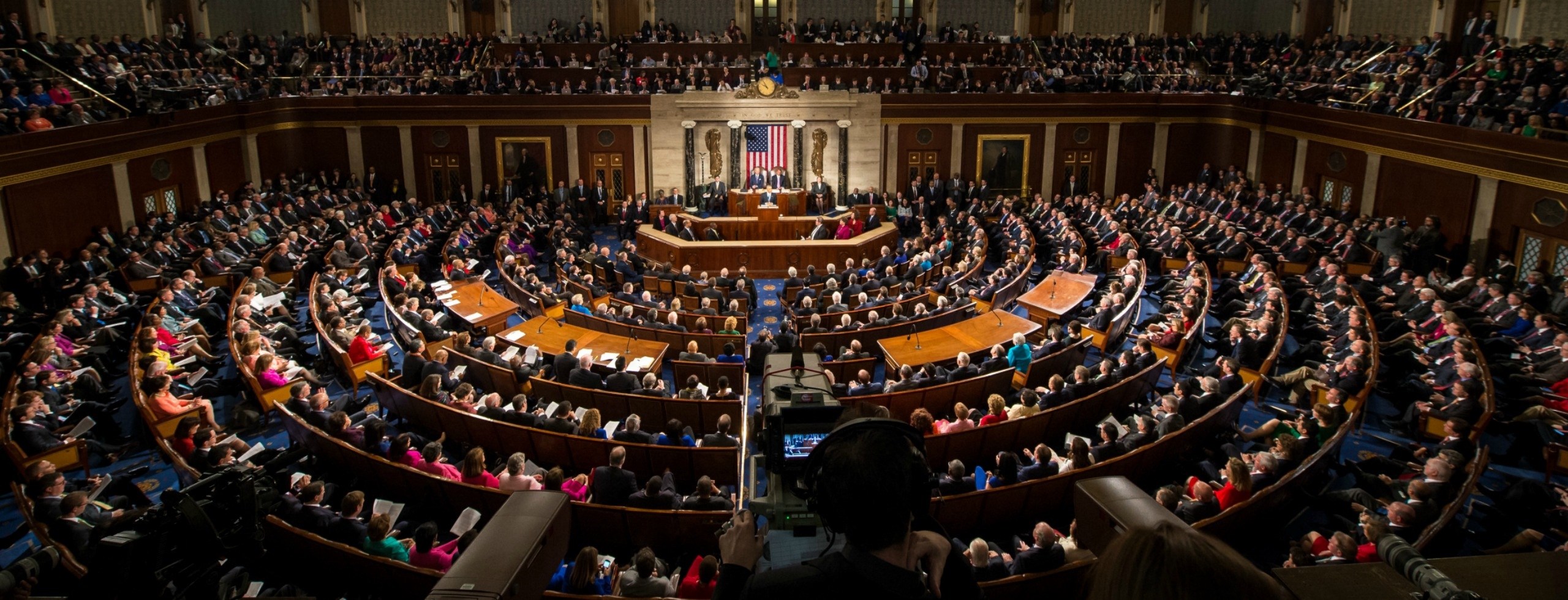

Besides the IRS specific audit campaign on IRC 48C, tax reform and recently introduced bills have muddied the waters on tax planning and strategy for energy financial executives. In May of this year, Senator Edward J. Markey (D-MA) and Senator Sheldon Whitehouse (D-RI) introduced the Offshore Wind Incentives for New Development Act (known as the "Offshore WIND Act"). On the same day, a companion bill was introduced by Representative Jim Langevin (D-RI) currently pending in the House of Representatives. In a nutshell, the bills would extend the 30 percent investment tax credit under IRC 48, for offshore wind through 2025. While the last extension of the ITC passed with bipartisan support, the Offshore WIND Act focuses exclusively on offshore wind, and may not enjoy the same level of support.

Tax reform under the current administration is another factor complicating tax planning and strategy for energy companies. The 2016 House GOP "Blueprint" seeks to "eliminate special-interest deductions and credits in favor of providing lower tax rates for all businesses and eliminating taxes on business investment." To balance the tax rate decreases, credits like IRC 48C would probably end up on the cutting room floor. However, unused IRC 48C credits will most likely be included in the company deferred tax assets (DTAs) as part of the carryforward credits, and would be available to offset future tax.

Although the Senate has not yet released any tax reform plans, in 2014, Senate Finance Committee Chairman Orrin Hatch's book "Comprehensive Tax Reform for 2015 and Beyond" proposed a "corporate integration" approach to eliminate double taxation of corporate income. This method would provide a dividend paid deduction for corporations, and, on the shareholder side, would result in an increased tax on dividends. This approach would leave the door open for continuing credits (such as energy credits) to drive behavior in our economy.

The White house tax reform plan, released in April 2017, is silent on tax credits, but does include a line for business reform: "Eliminate tax breaks for special interests." Time will tell how energy policies evolve across House, Senate, and the executive branch. Certainly, Wall Street has heavily invested in energy markets, and benefitted from the energy credits. As IRS audits increase in this area, and businesses weigh in on their needs, it will be interesting to see how tax reform impacts energy credits.

Taking a Holistic Approach

Tax credits aside, businesses should review depreciation rules for solar and wind energy property to determine if there are any additional benefits that may be available under accelerated depreciation. As an example, wind and solar fall into a "5-year property" category, which qualifies for bonus depreciation in the first year placed in service. More than half the cost of these renewable energy projects could be covered by tax incentives - once accelerated depreciation, bonus depreciation, and tax credits are applied. Knowing the tax law is only part of the equation. In order to determine the most beneficial tax strategies, it's essential to perform what-if analysis to model out potential impacts for select years and various scenarios.

Between potential tax reforms, recently introduced energy-related bills, and the new IRS approach to tax audits, tax and financial executives at energy companies should put holistic tax planning and strategy at the top of their priority list. By taking into account the impacts of tax depreciation, state tax, and potential tax reform, energy companies can ensure that corporate tax decisions are beneficial to the bottom line, and in compliance with the latest IRS guidance.

Diane Tinney is the Director of Product Management for Bloomberg BNA's software products, responsible for developing and implementing corporate tax and accounting solutions. Prior to joining Bloomberg BNA, Diane founded several startups, managed a global corporate tax product development team, and worked for KPMG as a Senior Tax Manager, specializing in State and International Tax.

Diane Tinney is the Director of Product Management for Bloomberg BNA's software products, responsible for developing and implementing corporate tax and accounting solutions. Prior to joining Bloomberg BNA, Diane founded several startups, managed a global corporate tax product development team, and worked for KPMG as a Senior Tax Manager, specializing in State and International Tax.

Bloomberg BNA | www.bnasoftware.com

Volume: 2017 September/October