Exports and Leasing

Exports and Leasing

The future of distributed wind?

Distributed wind installations in the United States are closing in on the 1 gigawatt capacity threshold. Yet, over the past three years, growth rates in distributed wind have plateaued, pressing U.S. manufacturers to look for new ways to open markets. With record high sales overseas for small wind, and new financing mechanisms redefining opportunities at home, exports and wind leasing represent two markets that might help industry transition into a new chapter for distributed wind.

Distributed wind installations in the United States are closing in on the 1 gigawatt capacity threshold. Yet, over the past three years, growth rates in distributed wind have plateaued, pressing U.S. manufacturers to look for new ways to open markets. With record high sales overseas for small wind, and new financing mechanisms redefining opportunities at home, exports and wind leasing represent two markets that might help industry transition into a new chapter for distributed wind.

With over 75,000 wind turbines representing 934 MW of installed capacity in all 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands, distributed wind has entered markets across the United States. Distributed wind projects support a variety of users- small cabins off the grid, farmers looking for additional power, and revenue streams to support farm operations or industrial plants, such as flour mills, commercial beer bottling facilities, or automotive parts factories.

Despite the breadth of distributed wind projects, both geographically and in terms of types of applications, the amount of distributed wind installed in recent years is relatively small. After strong growth from 2008 through 2012, in which capacity additions easily exceeded 100 MW per year, installations in 2013, 2014, and 2015 have been relatively modest. In 2015, 28 states added 28 MW of new distributed wind capacity, representing 1,713 units and $102 million in investment.

The reasons for the slower growth are manifold. Reduced funding and incentive programs, both at the federal and state level, have contributed to a slower growth in recent years. For example, the U.S. Department of Treasury's Section 1603 cash payments expired at the end of 2012, contributing to slower sales in the ensuing years. State funding for distributed wind has declined in recent years, as well. Over the past four years, state level funding dropped from a high of $37 million in 2012 to $7 million in 2015. And in 2015, while several states offered incentive programs, only five states received applications that led to incentive funding. Competition from solar photovoltaics (PV), which has experienced dramatic drops in costs over the past years, also may be limiting new wind installations.

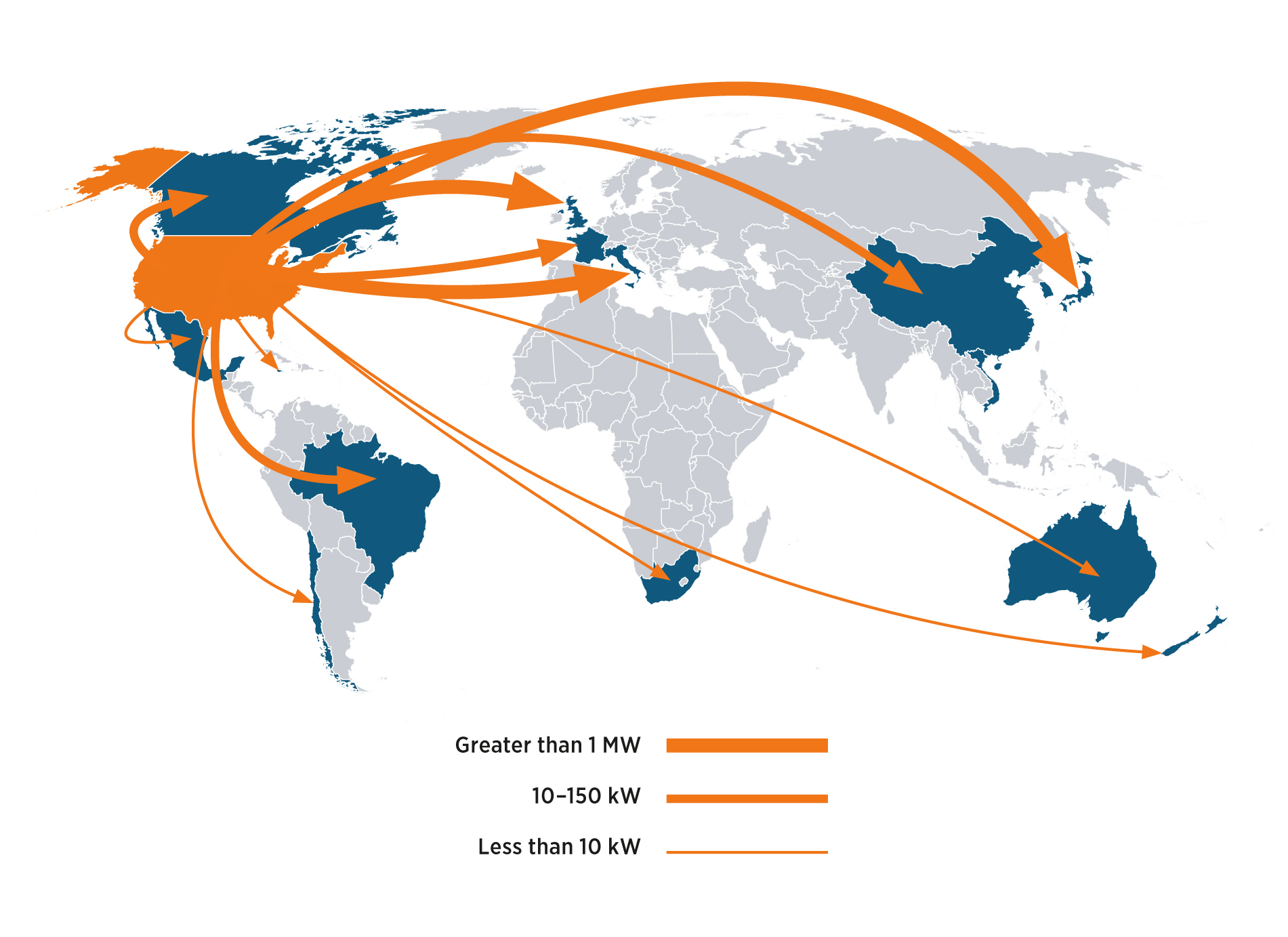

As the domestic market for distributed wind plateaus, two important market drivers, exports and wind leasing programs, stand out as having the potential to transform the small wind-market (defined as turbines sized 100kW and smaller). With the decline in domestic demand, U.S. based manufacturers of small wind turbines have, over the past several years, started to aggressively seek out opportunities abroad. Europe, Japan, and South Korea are the most popular destinations; they all have relatively steady policy environments that support deployment of renewable energy. US manufacturers of small wind turbines have made inroads into these markets and have greatly increased overseas sales. From 2012 to 2015, exports increased from 8 MW to 22 MW, representing a $122 million value in 2015 alone. Looking at the past twelve years, this trend is even more dramatic. Between 2003 and 2010, the share of exports (measured in MW) compared to total sales, stood at 27 percent. Between 2011 and 2015, the share stood at 59 percent.

The second important driver is wind leasing. This refers to third-party financing options that support property owners who are interested in hosting turbines on their property. The leasing company manages the procurement, siting, installation, interconnection, operation, and maintenance of the turbine, saving the property owner money, as well as a lot of tedious paperwork often needed to get a project installed and deployed. In exchange, the property owner pays monthly payments for the turbine and receives a reduced electricity bill. This leasing model has already been successful in growing the residential solar PV market across the United States.

Some wind turbine companies have already financed a number of projects, and are on target to develop considerably more in 2016. Several other companies are following that lead by launching their own leasing programs.

While the domestic market for distributed wind remains flat, U.S manufacturers are looking for new opportunities both within and outside of the United States. The combination of growing demand for electricity in emerging nations across the globe, as well as increased environmental awareness and calls to action (signified by the 2015 Paris climate agreement) support a growing global market for renewable energy. Over the past years, US manufacturers of small wind turbines have succeeded in opening new markets for their products, and are poised to expand their footprint in other countries. The wind leasing model can also help distributed wind reach greater market penetration across the United States, especially in those states where wind resources, state incentives, and high electricity rates drive new business ventures and customers. The lasting success of these individual efforts is unclear, but they have the power to propel the distributed wind industry into its next chapter.

Nikolas Foster is the co-author of the U.S. Department of Energy's Distributed Wind Market Report. At PNNL, he supports national and international projects in the area of energy efficiency, energy policy, and market analysis. Nik is also interested in finding ways to better integrate buildings with the electric grid, leading to efficiency gains and energy savings for building operators, owners, and tenants.

Nikolas Foster is the co-author of the U.S. Department of Energy's Distributed Wind Market Report. At PNNL, he supports national and international projects in the area of energy efficiency, energy policy, and market analysis. Nik is also interested in finding ways to better integrate buildings with the electric grid, leading to efficiency gains and energy savings for building operators, owners, and tenants.

Pacific Northwest National Laboratory | www.pnnl.gov

2015 U.S. Small Wind Exports across the Globe. Source: DOE

Volume: 2016 September/October