Financial Technology

Financial Technology

A pathway to growth in solar

The solar industry has flourished in the past five years, growing from 1.85 gigawatts installed in 2011, to an estimated 16 gigawatts in new installations by the end of 2016. This growth can be attributed, in large part, to rapid reductions in solar equipment costs through manufacturing efficiencies in panels and inverters. To continue this positive trajectory, however, the industry must see a reduction in soft costs as well. Particularly in the commercial and industrial solar sector, financing remains a common obstacle to project execution. Non-residential solar features a plethora of project sizes and power purchasers, often making the due diligence needed for financing, extremely complex and relatively expensive. Bringing financial technology innovation to solar financing can reduce the overall capital cost for the developer and owners and offer more tailored, streamlined financing solutions.

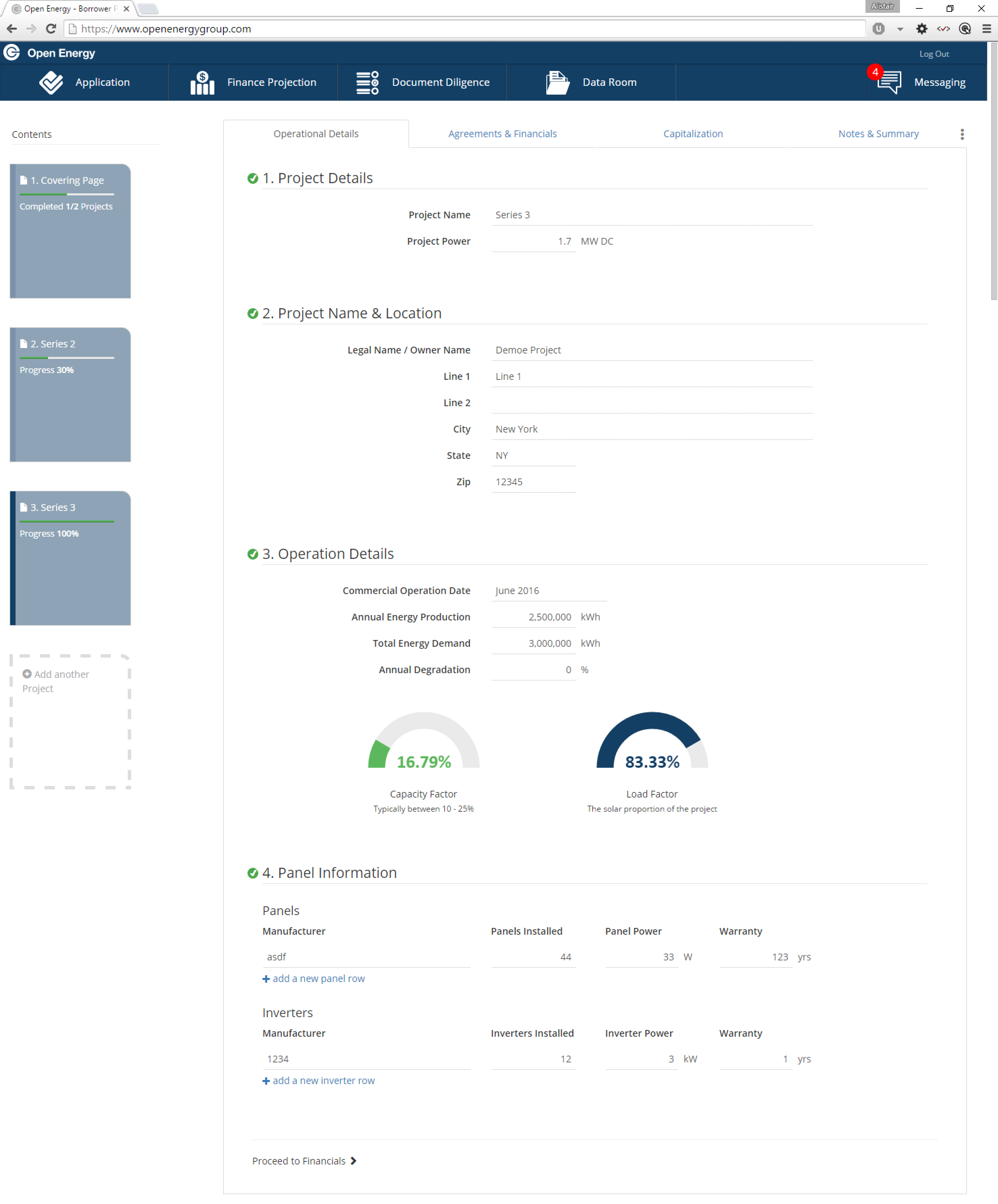

Bringing commercial solar financing online increases efficiency almost instantly, by reducing the time necessary to apply for financing. Allowing developers to view all of the information upfront that they will need to present in an application, means they can start the process with a clear idea of what their prospective financier will require. An online application also ensures that developers complete the entire process thoroughly, as forms typically cannot be submitted if elements are missing. This saves on time wasted going back and forth to identify missing information, and gets the financiers working sooner.

In addition to being more efficient, online platforms allow solar financiers to be highly responsive to their clients. Most developers have dealt with slow response times, ambiguous instructions, or misplaced information when working with traditional lenders. Simple automations, like securely auto-saving a web form so that data is not lost, can make a big difference in the ease of use experience for developers and asset-owners seeking capital. The solar industry can look to e-commerce for best practices; the consumer retail industry has devoted copious resources to cultivating highly user-centric online experiences. By creating an interface that operates seamlessly and is easy to use, financiers will promote customer loyalty and reduce the time it takes to apply and fund solar projects.

Technology can also help simplify the project due diligence in solar. Without document standardization, especially in an industry known for its variety in projects, it is difficult to take the human review elements out of the due diligence process. However, a good portion of project due diligence involves sending various iterations of documents back and forth among stakeholders to obtain comments and signatures. Allowing developers to upload and edit documents in one centralized location online, can cut financing approval times from months to days. More importantly, this technology already exists in numerous enterprise software platforms. With some simple customizations, the solar finance industry can harness these software systems to further reduce transaction costs.

Technology can also help simplify the project due diligence in solar. Without document standardization, especially in an industry known for its variety in projects, it is difficult to take the human review elements out of the due diligence process. However, a good portion of project due diligence involves sending various iterations of documents back and forth among stakeholders to obtain comments and signatures. Allowing developers to upload and edit documents in one centralized location online, can cut financing approval times from months to days. More importantly, this technology already exists in numerous enterprise software platforms. With some simple customizations, the solar finance industry can harness these software systems to further reduce transaction costs.

Innovative financial technology can also reduce the labor involved in processing loans. Automation has transformed personal finance from a slow-moving industry into one that is speedy, customer-oriented, and almost entirely digitized. The solar finance industry needs a similar disruption to make the lenders and borrowers more efficient.

Solar projects are inherently complex and often full of project-specific nuances. While financial technology cannot replace human expertise in solar, it can do much to improve efficiency and streamline processes for developers and lenders alike, significantly reducing financing costs and accelerating the growth of the US solar industry.

Graham Smith is CEO of Open Energy, an innovative provider of debt financing solutions for commercial solar projects. Smith has over 15 years of experience in renewable energy finance and building capital markets brokerage platforms. He founded Open Energy in 2013 to use financial technology innovation to drive debt financing and unlock the U.S. commercial solar market.

Graham Smith is CEO of Open Energy, an innovative provider of debt financing solutions for commercial solar projects. Smith has over 15 years of experience in renewable energy finance and building capital markets brokerage platforms. He founded Open Energy in 2013 to use financial technology innovation to drive debt financing and unlock the U.S. commercial solar market.

Open Energy | www.openenergy.com

Volume: 2016 September/October

.png?r=3405)