Moving Towards a New Normal

Making sense of a changing distributed wind market

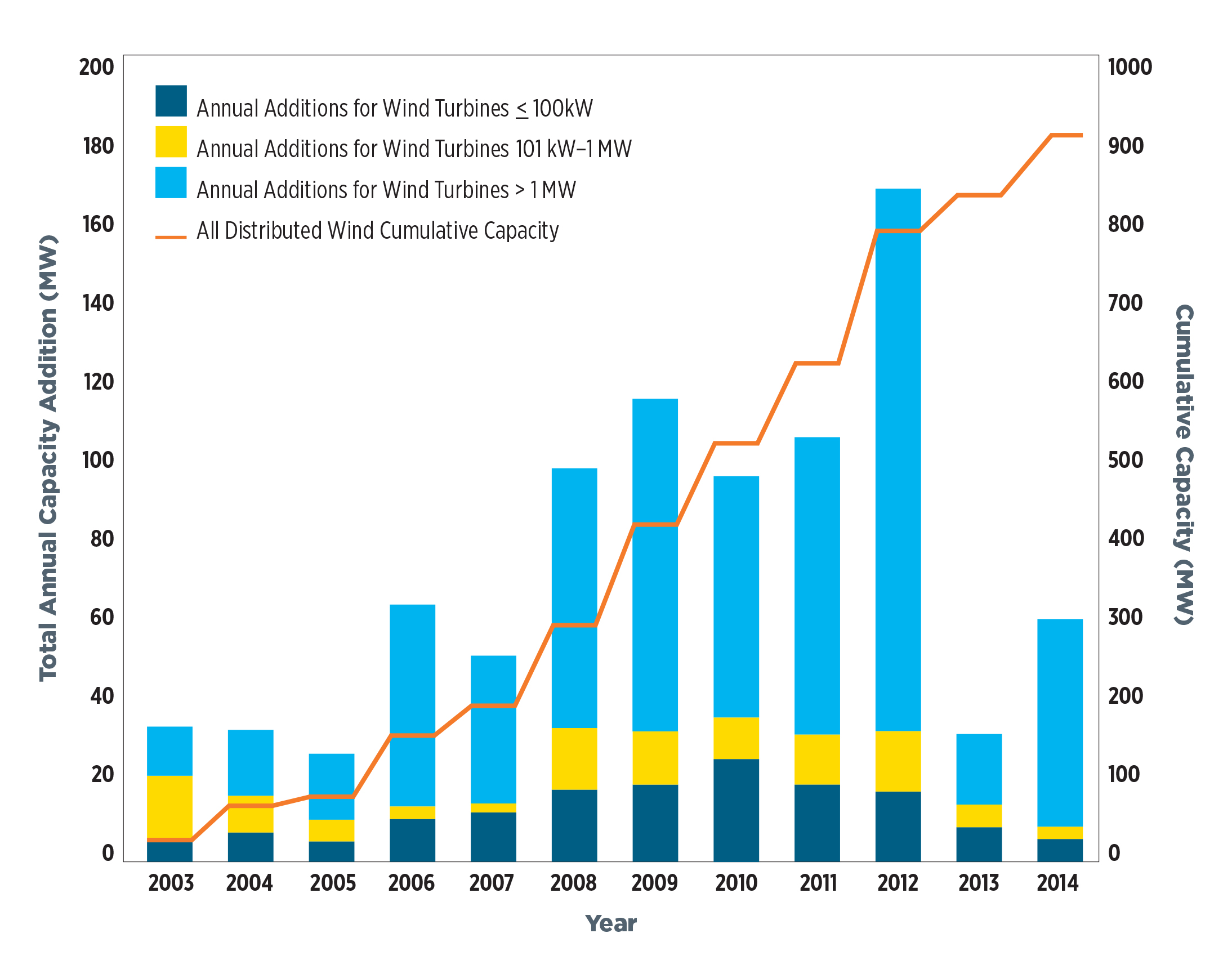

Reaching almost 1 GW of capacity in 2014, the market for distributed wind turbines in the United States rebounded by adding close to double the 2013 capacity. However, the market for small and mid-size sized turbines remains in flux. Increased opportunities in an expanding global market, new financing schemes, the availability of incentive programs, as well as competition from solar PV will affect the way distributed wind projects fare in 2015 and beyond.

In 2014, the U.S. distributed wind market grew by 63.6 MW of capacity coming from nearly 1,700 units (turbines) representing $170 million in investment across 24 states. Distributed wind is defined as wind projects that are either off-grid or grid-connected, and serve to offset all or a portion of the local energy consumption or support local grid operations and local loads. Distributed wind projects can be found across all 50 states, Puerto Rico, and the U.S. Virgin Islands at homes, farms and ranches, businesses, public and industrial facilities, and other sites. Distributed wind reached a cumulative capacity of almost 1 GW (906 MW) in the United States in 2014, reflecting nearly 74,000 wind turbines deployed.

In 2014, the U.S. distributed wind market grew by 63.6 MW of capacity coming from nearly 1,700 units (turbines) representing $170 million in investment across 24 states. Distributed wind is defined as wind projects that are either off-grid or grid-connected, and serve to offset all or a portion of the local energy consumption or support local grid operations and local loads. Distributed wind projects can be found across all 50 states, Puerto Rico, and the U.S. Virgin Islands at homes, farms and ranches, businesses, public and industrial facilities, and other sites. Distributed wind reached a cumulative capacity of almost 1 GW (906 MW) in the United States in 2014, reflecting nearly 74,000 wind turbines deployed.

For the third year in a row, the U.S. Department of Energy is examining the state of the distributed wind market in the United States. The vast majority of the 63.6 MW of new distributed wind capacity installed in 2014 came from projects with large-scale turbines, which grew almost threefold from 20.4 MW in 2013 to 57.5 MW in 2014. Conversely, the markets for distributed wind systems using small and mid-sized wind turbines continued to struggle with only 3.7 and 2.4 MW of new capacity installed in 2014, respectively, compared to 5.6 and 4.4 MW in 2013. Inconsistent federal and state incentives, including the ending of the U.S. Treasury Section 1603 cash grant payments, and high soft costs, which include non-hardware balance-of-system costs (e.g., permitting), were some of the reasons these segments of the market did not expand.

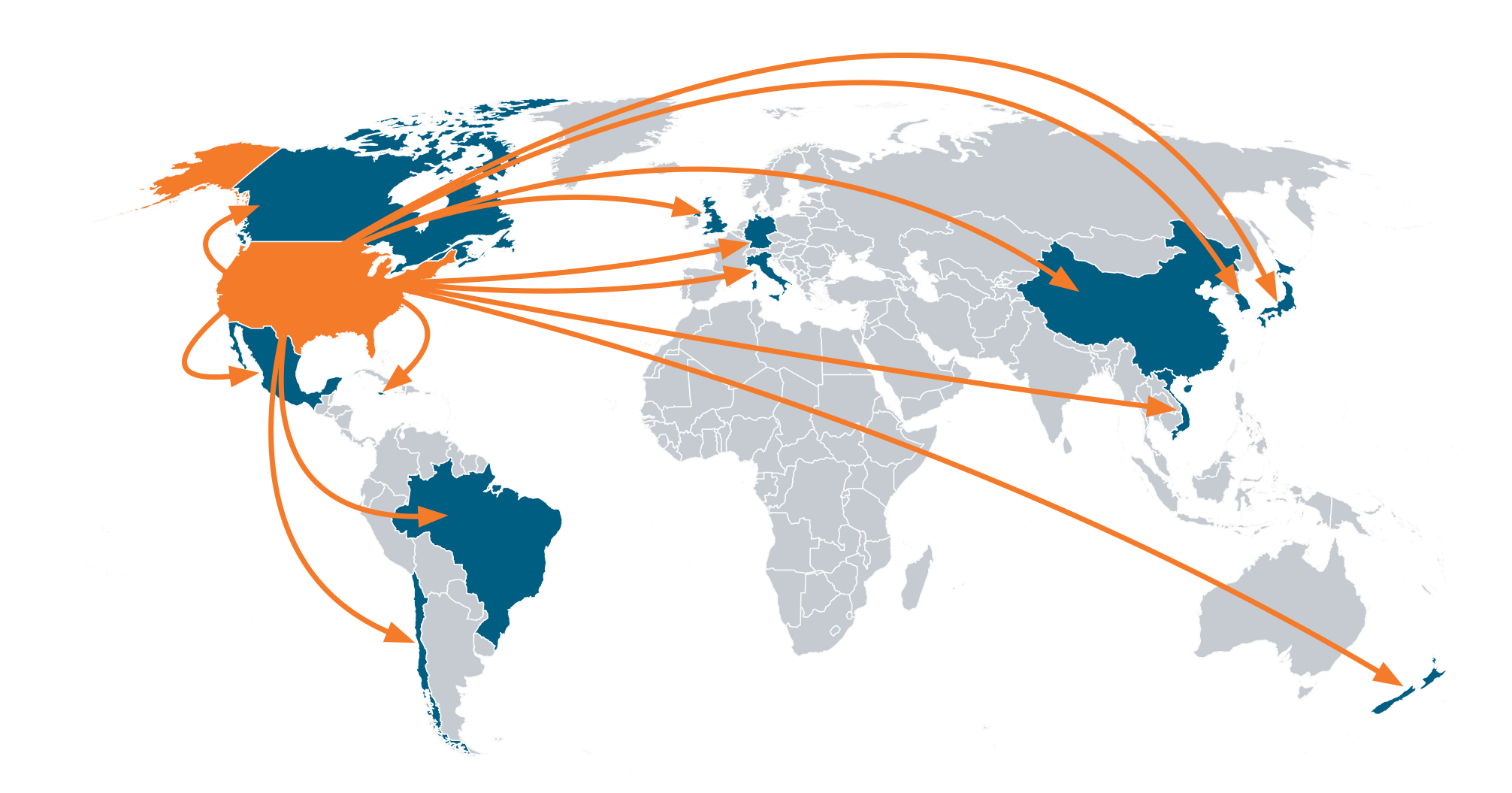

As a consequence, in 2014, several foreign-based small scale turbine manufacturers started to abandon the U.S. market, while U.S.-based manufacturers continued to focus on opportunities abroad. For the small scale turbine sector, exports remained an important source of revenue in 2014. Seven U.S. manufacturers exported 11.2 MW in 2014, at a value of $60 million. Nearly 80% of all small wind turbines manufactured in the United States were exported in 2014. The top reported export markets, in terms of capacity, were Italy, United Kingdom, and South Korea. New markets, including South Korea and Japan, are providing opportunities for manufacturers such as Northern Power, which has made inroads into these markets with new wind-diesel hybrid systems which also incorporate solar PV and energy storage.

As a consequence, in 2014, several foreign-based small scale turbine manufacturers started to abandon the U.S. market, while U.S.-based manufacturers continued to focus on opportunities abroad. For the small scale turbine sector, exports remained an important source of revenue in 2014. Seven U.S. manufacturers exported 11.2 MW in 2014, at a value of $60 million. Nearly 80% of all small wind turbines manufactured in the United States were exported in 2014. The top reported export markets, in terms of capacity, were Italy, United Kingdom, and South Korea. New markets, including South Korea and Japan, are providing opportunities for manufacturers such as Northern Power, which has made inroads into these markets with new wind-diesel hybrid systems which also incorporate solar PV and energy storage.

The top states for distributed wind capacity additions were New Mexico, Texas, and California, which accounted for 88% of all capacity additions in 2014. New Mexico accounted for nearly 55% of the total U.S. annual capacity with two large projects totaling 34.8 MW installed. Minnesota, New York, Nevada, and Iowa led the nation for the number of small wind turbines deployed in 2014. Currently, 16 states have more than 10 MW of cumulative distributed wind capacity.

Apart from the continued success in exports, some of the factors affecting the industry include new financing schemes, the continuation of existing grant and loan programs, as well as certification requirements. The United Wind lease program implemented in New York State is leading industry stakeholders to expect an increase in the small wind sector’s competitiveness. United Wind financed five projects in New York in 2014 and, as of May 2015, 27 projects have been commissioned per United Wind records and the New York State Energy Research and Development Authority reported 40 applications received so far. These numbers indicate increased interest in new financing models.

The continuation of existing grant and loan programs are also shaping the future of the U.S. distributed wind market. In total, $20.4 million in federal, state, and utility incentives were awarded to distributed wind projects in 2014, slightly more than the $15.4 million awarded in 2013. Lastly, the requirement by the U.S. Internal Revenue Service (IRS) that small wind turbines must meet performance and safety standards to be eligible for the federal 30% ITC will most likely support increased consumer, government agency, and financial institution confidence in distributed wind projects. However, while certification increases confidence, it will also represent another potentially costly investment for manufacturers undergoing the certification process.

Looking ahead, the outlook for the distributed wind market in 2015 and beyond remains mixed. The large-scale sector of the distributed wind market is expected to continue to grow in the near future and the mid-size sector may rebound, albeit on a very small level in terms of units deployed. Manufacturers and developers of small wind projects remain reliant upon the global market and hope for breakthroughs in financing and reductions in soft cost, which might inject some upward momentum into the 2015 market for small wind.

Nik Foster is an energy analyst in the energy and environment directorate at the US Department of Energy’s Pacific Northwest National Laboratory (PNNL). The US Department of Energy’s full 2014 Distributed Wind Market Report is available at http://energy.gov/eere/wind/downloads/2014-distributed-wind-market-report

Pacific Northwest National Laboratory | www.pnnl.gov

Volume: September/October 2015