Moving the Goalposts for Organic Photovoltaics - When will commercialization come?

Organic photovoltaics (OPV) has continued to draw the focus of much research as an alternative solar technology, because of the allure of its core attributes: it's lightweight, flexible, inexpensive, highly tunable, and potentially disposable. Yet, OPV researchers have spent the better part of a decade struggling to translate these competitive promises into something that could be commercially successful.

Organic photovoltaics (OPV) has continued to draw the focus of much research as an alternative solar technology, because of the allure of its core attributes: it's lightweight, flexible, inexpensive, highly tunable, and potentially disposable. Yet, OPV researchers have spent the better part of a decade struggling to translate these competitive promises into something that could be commercially successful.

Expectations for OPV stalled in 2012 largely due to the demise of Konarka, which was arguably the company closest to a real-world product and they had plans for large-scale factory output. In the end, they were recognized for attracting hundreds of millions of dollars from investors with very little to show for it.

Surveying the OPV landscape today, we still see a sector striving to translate early lab-scale results into real-world products. However, there are some encouraging signs that the technology is moving closer to commercial readiness.

Technology marches forward

Industry leaders have partnered together and strategically committed to OPV's eventual success. Such supporters point to progress being made in a number of areas:

- Conversion efficiency has risen to 11%-12% for both polymers and small-molecule OPV, and 5%-7% percent now on pilot production lines.

- Suppliers claim a 10 year lifespan could be achieved within a year or two, which would be enough to start targeting some building-integrated photovoltaics (BIPV) applications.

- Much of those efficiency and lifetime gains are to be credited to improvements in both cell architecture, including tandem and triple-junctions, and new materials such as transparent electrodes and non-fullerene acceptors.

- Work continues on improving various aspects of actual OPV manufacturing processes, including: large-area monolithic panels and thicker junctions, printing multiple layer stacks, and inkjet printing processes. Heliatek has had a pilot line since 2012, but CSEM Brazil claims an even bigger OPV R2R pilot line running since September 2014.

- Several recent field test installations, most notably by Heliatek and Mitsubishi Chemical, are showing OPV in several BIPV contexts: glass facade, concrete, and attached to a polymer inflatable building shell.

Managing expectations

While acknowledging that OPV technology is progressing, and key suppliers certainly seem convinced that market readiness is imminent, there's still quite a lot of improvement needed, particularly in lifetimes. Bridging performance achievements made in a lab into an actual full scale production line are several years away from happening for OPV. Heliatek's proposed factory by 2019 will require an additional €70 million in fresh investments, assuming both technology improvements and investor interest persist.

OPV also has some serious competition in its intended target markets. Other solar PV technologies can make similar promises about flexibility, transparency, and low-light performance, and are arguably further along the commercialization path. They do, however, need to address stability and lifetime concerns:

Dye-sensitized (DSC) visibly has pulled ahead in multiple ways: efficiency levels, pilot projects, and key partnerships especially in BIPV glass.

Thin-film copper-indium-gallium-(di)selenide (CIGS) offers potentially significant higher efficiencies, and already has a roofing shingle product in the market.

The newest solar wonder material, Perovskite, has dazzled researchers with the potential for remarkably high conversion efficiencies combined with cost-effective wet-chemistry processing. This technology, which could be called "next-generation DSC," is far from production-readiness, but the heavy interest among researchers should result in relatively fast performance improvements.

OPV end-markets

The targeted end-markets for OPV haven’t changed: off-grid charging applications, grid-connected building-integrated (BIPV), and building-applied (BAPV) systems. Additionally, energy harvesting cells and portable solar chargers can accommodate much low-power conversion efficiencies than what is needed for solar panels, because there is an acceptable trade-off for other features such as flexibility. Moreover, a few years of lifetime is often sufficient to last as long as whatever they're attached to, be it a pack or table awning.

For BIPV, efficiency requirements may not be quite as lax, but there are similar trade-offs among other factors such as low weight, flexibility, and an ability to be integrated into a building's design. Early field trials suggest that enough OPV spread around building areas could actually outperform c-Si panels in long-term energy production. Longer lifetimes are a high priority; early expectations are 10 years, but it is recognized that 20+ years is required to really open up the market.

Most suppliers today remain adamant that the BIPV market can provide the necessary volumes required to generate real revenues and profits for OPV. Higher field performance will happen soon enough and reward users who have patience. However, others prefer to focus on solar charging where applications, if not profit margins, seem broadest, and choose to revisit BIPV once efficiencies and lifetimes improve.

To fulfill OPV's promise of high-volume, low-cost production processes, there needs to be enough volumes to achieve economies of scale. It seems clear this will have to come from BIPV markets, assuming anticipated further performance improvements are realized in actual production. Off-grid solar charging applications present potentially large markets (consider developing regions of the world and the billion people without power today) and have less stringent performance requirements that allow for inroads sooner. Overall, this seems too fragmented and lower-value to be a path for sustainable revenues.

When Will OPV Be Ready?

In the end there remains, the one overriding question for OPV: when will the persistent enthusiasm translate into market delivery and profitability? Even today's OPV industry supporters privately ask, with varying degrees of concern, how many more years will pass before OPV is not just "production-ready" but is actually a competitive product, generating substantial revenues and profits in target markets?

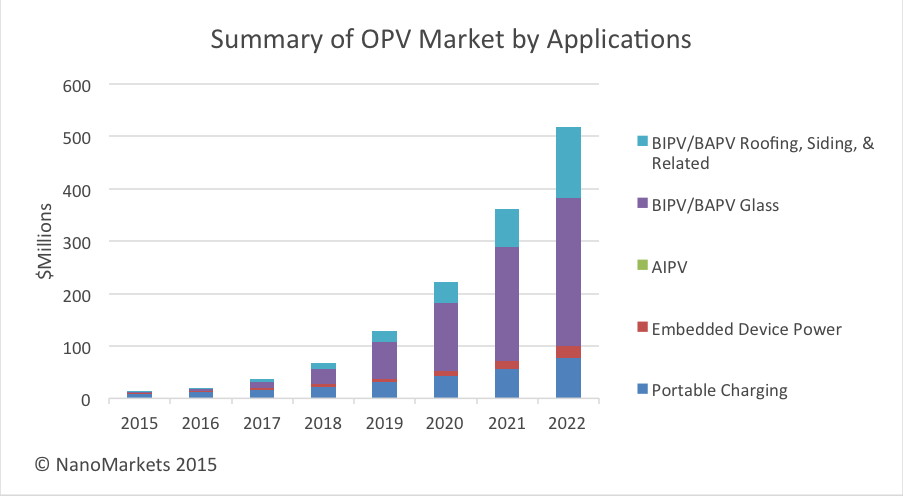

In viewing the state of the supply chain and of the two major target end-markets, it may be at least 5 years before OPV is a viable, sustainable product, and even longer to establish a strong foothold in BIPV. Projections show OPV ultimately exceeding $100 million within the next five years, and topping $500 million by 2022. However encouraged by ongoing progress, the warnings about market entrance still ring true: OPV can’t afford to slip much further behind when competition seems to pull ahead.

Jim Montgomery is senior market research and content editor for NanoMarkets.

NanoMarkets | www.nanomarkets.net

Author: Jim Montgomery

Volume: March/April 2015

.png?r=6996)