Wind Energy Supply Chain & Blades: Turbine trends for 2013

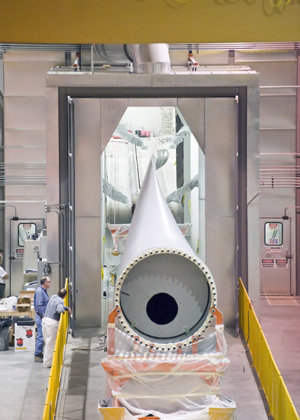

After enjoying an exciting seven-year growth slope, the wind industry’s supply chain is braced for a slump in 2013. From 2005 to 2012, turbine manufacturers flourished, expanding composite blade manufacturing capacity by a factor of four—2012 was a record year for wind power installations. Demand for larger, more sophisticated blades (as well as turbine nacelles and nose cones) drove construction of new factories across North America. Likewise, the operations and maintenance (O&M) segment that provides installation and field-repair services attracted many new entrants.

After enjoying an exciting seven-year growth slope, the wind industry’s supply chain is braced for a slump in 2013. From 2005 to 2012, turbine manufacturers flourished, expanding composite blade manufacturing capacity by a factor of four—2012 was a record year for wind power installations. Demand for larger, more sophisticated blades (as well as turbine nacelles and nose cones) drove construction of new factories across North America. Likewise, the operations and maintenance (O&M) segment that provides installation and field-repair services attracted many new entrants.

This year, however, many OEMs will be faced with increased costs for blades from their supply chain. The over-capacity of blade manufacturing is a problem in North America. When factories are operating at less than 50% capacity, costs escalate beyond what a competitive market will bear. The surviving players will likely prove to be the suppliers that can provide new product fabrication and aftermarket services for all wind composites—from blades to nacelles to spinners.

To succeed in this environment, suppliers will need to have engineering and technology depth, the capability to build various models for full facility utilization with a skilled labor force to match, as well as volume material procurement.

Trending

In the near term, many turbine manufacturers have redirected their focus from new equipment sales to support solutions. This includes locking up post-warranty O&M service contracts and equipment upgrade solutions for improving the profitability of aging fleets. The blade factories that support the OEM’s are also re-aligning their capabilities to provide needed aftermarket products and services.

In the area of O&M, preventative maintenance is coming into play as a smart move for gaining efficiencies and improving bottom lines. Wind farm owners are diverting funds, previously allocated to farm expansion, to projects for improving and maintaining equipment already in the field. O&M providers expect strong demand for leading-edge repairs, erosion protection measures, and updated or repaired lightening systems.

Refurbishing

Some blade factories staffed with engineers and a diversified skilled labor force are extending their services, and offering factory service for warranty (OEM) and post-warranty (farm operator and OEM) blade repairs. Although transportation costs are a factor to be reckoned with—depending on the distance and blade size—blade refurbishment in a factory setting has valuable benefits over field repairs.

Refurbishments done in a controlled factory environment by a technician team—backed by engineers and inspectors trained in the rigorous quality standards of new blade production—are often more consistent and predictable than field repairs. In a factory setting, blades can be thoroughly inspected prior to the reparations. Plus, additional improvements, including blade protection, lengthening, and functional lightning systems can be safely and cost-effectively added to the process.

Upgrading

A variety of equipment upgrade solutions that improve the efficiency and lifespan of legacy turbines have recently come online. This makes business sense for older equipment that was originally designed to (lower) production standards. Or, for cases where a farm’s original Wind Resource Evaluation (WRE) wasn’t accurate, or simply isn’t optimally productive.

Case-in-point: replacing turbine rotors with new, larger-diameter models. Amortized over a seven to 10-year period, the energy generation improvement can pencil out when insufficient output co-exists with other factors (such as, if blades have a known serial defect or a previous restoration history).

Some blade factories are also offering made-to-order replacement blades for models no longer carried by OEMs, which has become a growing need for owners of turbines older than 12 to 15 years. To a lesser extent, newer blades, which must be replaced due to latent defects, have added to the market potential for replacements.

Lengthening

Many successful projects are underway for lengthening blades, a practice that was common back when blades were smaller. Where conditions are amenable to onsite extension work, tip extensions can be an economically attractive proposition. An interesting project presented at the 2012 AWEA Fall Symposium (www.awea.org/events), described dissecting blades in half to add length in the center, rather than at the tip. Using this idea, a blade tip can easily be coned away from the tower, so tip clearance is not an issue.

There are other issues to consider with blade extensions, however, and questions worth asking. For example, will a larger rotor induce vibrations in resonance with other turbines? Will changes need to be made to the controller? Will the other original components be able to endure the additional load generated by longer or improved blades? Different operating RPM or cut-outs might be necessary. An upfront assessment by the service provider, using analysis tools to dynamically evaluate the turbine product solution, should be provided with facts and calculations that validate a business case.

There are limitations to extensions, but when combined with a scheduled overhaul, the value proposition is strong—moving the power curve to the left for profit improvement.

As this current overcapacity condition is reconciled, suppliers who stay attuned and innovate have the best chance of weathering the storm.

Gary Kanaby is the director of sales for Wind Energy at MFG Wind, a part of the Molded Fiber Glass Companies.

MFG Wind

www.mfgwind.com

Author: Gary Kanaby

Volume: January/February 2013