The Solar Energy Boom

Preparing for grid parity sooner rather than later

For many years, solar electric power generation has been an expensive research project, supported by government grants and ratepayer subsidies. For those who haven’t followed the industry trends, this may seem nothing more than a futile attempt at creating an industry whose only real impact is clean air.

In 2011, it wasn’t uncommon to hear about the failure of some US solar companies (consider Solyndra and Evergreen Solar). Though some analysts might speculate that a company’s inability to compete is an indicator the industry is not only healthy, but thriving. Over the last couple of years, solar manufacturing has grown at a dizzying pace, with several larger facilities now capable of production greater than two gigawatts (GW) per year. More solar panels were manufactured and purchased than in any other time to date. Clearly, increased manufacturing is an important factoid for the industry. But the big news of the past year for solar revolves around a positive move in the sector’s most important metric, which is down—dramatically down.

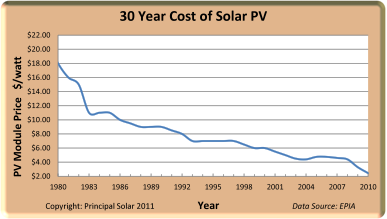

Like almost any industry, the number one metric driving growth is affordability. Thirty years ago, solar PV cost was so high that no one would have predicted it could ever compete in the mainstream. Installations in outer space and for locations off the grid made sense, but consideration as a mainstream resource was out of the question.

A revolution

To gain a perspective on this, think about the smart phone—really a computer—most people now carry in their pockets. An iPhone is more powerful than the most powerful supercomputer built in the early 1980s, at a cost of a few hundred dollars. This amazing story is the result of the silicon revolution. It’s a second silicon revolution that is driving down the cost of solar. The trend line for the cost of solar PV is shown in the Chart I.

Chart I

Many people will make different arguments for why we should embrace renewable energy sources. At the end of the day, capitalism will be the determining factor. The failure and bankruptcy of some companies last year serves a warning for those building more efficient panels that have “cool” features and a high per-watt price tag. The lesson: price is everything. Some pundits compare one panel manufacturer to another, using analogies like comparing a BMW to a Yugo. However, this analogy simply doesn’t apply.

The consumer is buying electrons, which conveniently flow into a wall plug. How those electrons were produced is a mystery, but the cost is not. Having said that, there’s a bit of engineering worthy of note: solar panels are made up of silicon, essentially an abundant rock. A solar panel has no moving parts, and its fuel is free. If the trend line, shown in Chart 1 continues, we have something dramatically significant.

In fact, a closer look shows an increase in cost in the 2005 time period, so it’s worth questioning what happened there and if it could happen again.

In 2005, the world demand for silicon began to climb dramatically as Europe and Japan began installing large, solar generation facilities. Prior to that time, raw silicon manufacturing was primarily done for micro-processors, where bulk quantities and low cost were not an issue. During that time period, one plant burned to the ground while another went bankrupt. The demand and the price for silicon soared, driving up the cost of solar PV. Once new facilities were online in 2009, the market began to experience a sharp decline in solar module prices again.

The future

Chart I should help everyone see why so many who’ve studied the issue believe a time is coming—soon—when solar will be able to compete with traditional generation. This isn’t the stuff of tree huggers or the green movement, though we should probably thank them for driving this trend. The inevitable inflection point, when solar will be able to compete with traditional generation (aka: grid parity), is now the stuff of good engineering and capitalism.

Every smart investor and every forward-looking energy executive should be monitoring and finding ways to participate. In fact, nearly every major financial think-tank has opined on this issue in the last few years, including the Boston Consulting Group, Bloomberg, Goldman Sachs, and Barclays.

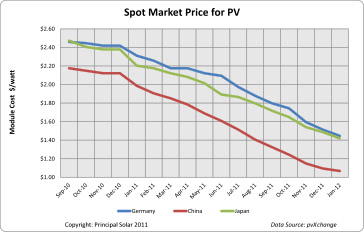

If solar is still more expensive than traditional generation sources, why have manufacturers ramped up production at such a fast pace? Once again, the answer is found in the cost data. Chart II plots the spot price for modules taken from the pvXchange (www.solarserver.com) over the last 18 months. German, Japanese, and Chinese PV manufacturers are noted.

Chart II

No one predicted anything like this. In the quest for grid parity, we are one year closer to the mark. If this trend continues, we will be at grid parity by the end of 2013. Of course, only the true believers are predicting another 18 months, wherein the cost decline will continue. Seems it would be smarter to believe it will happen in the next three to five years, but prepare as if it might happen next year.

In conclusion, consider some important questions. If the data is convincing in terms of grid parity, what happens one year after we reach grid parity? Will the downward trend stop there, or will it reach the point where solar electricity actually costs less than fossil fuels? Will it mimic Moore’s Law and the ongoing lower costs of computing power?

We should be doing everything we can to maintain this downward trend. Preservation of our natural resources and fossil fuels will be enhanced by continuing to drive this trend in solar power. Our air will improve as we burn fewer fossil fuels. And, smart investors will significantly profit from this next energy boom, while consumers benefit from lower cost electricity.

Michael Gorton, a lawyer and power systems engineer is CEO and chairman of Principal Solar.

Principal Solar

www.principalsolar.com

Author: Michael Gorton

Volume: March/April 2012

.png?r=3102)