The evolution of the redox flow battery over several decades has seen various chemistries being developed, commercialized, or even abandoned due to factors such as poor electrochemical reversibility and cross-contamination of active species. The vanadium redox flow battery (VRFB) has prevailed as the most widely deployed and commercialized RFB chemistry over the last decade; despite this, the volume of their installations for stationary energy storage applications is still minimal compared to the incumbent Li-ion battery, with economic barriers inhibiting their market growth. However, as suggested in IDTechEx's market report, "Redox Flow Batteries Market 2024-2034: Forecasts, Technologies, Markets", a combination of factors including developments in vanadium markets, development of cheaper RFB chemistries, and future demand for long duration energy storage (LDES) technologies, could see increasing penetration of the redox flow battery in the stationary energy storage market over the coming years. These developments will aid in RFB market growth and IDTechEx forecasts that by 2034, this market will be valued at US$2.8B.

Economic barriers for VRFBs

VRFBs have suffered from high upfront costs due to the vanadium electrolyte and membranes employed. Vanadium electrolyte accounts for 30-50% of the unit cost of a VRFB, and is influenced by overall system size, as well as duration of storage required. The membrane typically adopted in VRFBs are expensive cationic ion exchange membranes, such as NafionTM offered by The Chemours Company. Significant decreases in the cost of membranes are unlikely, given that cheaper versions could impact VRFB performance. This could include reduced ionic exchange capacity or ionic conductivity, higher permeation of active species, or reduced chemical resistance to aggressive species. However, upfront electrolyte cost reductions could be facilitated by the exploitation of new vanadium mines, thus increasing electrolyte supply or the adoption of vanadium electrolyte leasing models.

Vanadium electrolyte supply and leasing models

In 2021, 120,000 MT of vanadium was supplied by miners globally, including from key players Glencore, Largo, and Bushveld, with 92% of this going towards steel production and 2% being supplied to the VRFB market. In steel production, vanadium is used as a strengthening agent in rebars, buildings, and other industrial infrastructure. As such, VRFB developers will be competing against steel producers for the supply of vanadium. The limited growth in vanadium supply, and its continuously increasing demand and concentration of supply in China and Russia, will keep the cost of vanadium high in the medium-term. However, junior miners are exploring opportunities to establish new vanadium mines, with focus mostly in Canada and Australia. The successful exploitation of these resources could see greater vanadium supply, potentially lowering its cost and thus facilitating reduced VRFB CapEx and improving its economic case.

VRFB developers could also rent electrolyte from a vanadium supplier over the lifetime of the VRFB. An example sees key VRFB developer, Invinity Energy Systems, forming a company named Vanadium Electrolyte Rental Limited (VERL), with Bushveld Minerals. VERL offers the provision of electrolyte via a rental option to its customers. This helps to reduce the capital cost of a VRFB, making it more competitive with incumbent Li-ion batteries for stationary storage applications. Clearly, however, the customer renting the electrolyte would incur greater costs over the course of the VRFB project's lifetime than if it were to pay the electrolyte supplier with upfront capital. Electrolyte could also be recovered at the end of the VRFB lifetime through ultrafiltration or other more complex re-processing steps. The rented electrolyte could, therefore, be collected by an electrolyte manufacturer and reprocessed to produce vanadium pentoxide. Therefore, renting parties can re-obtain the vast majority of their rented electrolyte, improving the attractiveness of this business model from their perspective.

VRFB player activity

Despite the economic barriers to be overcome to help facilitate the more widespread commercial adoption of the VRFB, signs of continued activity from key players suggest that this technology will continue to be deployed, albeit in lesser volumes than Li-ion batteries for stationary storage applications. IDTechEx estimates that, cumulatively, over 800 MWh of VRFBs have been installed globally up to 2022. This is skewed by a 400 MWh installation made by Chinese RFB player Dalian Rongke Power in 2022. This is a 4-hour duration of the storage system, supporting the connection of new renewable generation sources to the Dalian grid and lowering the peak electricity load in the region. A second phase of the project is expected to bring the project to 200 MW / 800 MWh. Market activity from other VRFB players includes installations made by key players Sumitomo Electric Industries (Sumitomo), Invinity Energy Systems, H2 Inc., and CellCube. Also, in February 2023, Sumitomo announced it will expand its RFB business, making an initial US$7.6 million investment to prepare for local production and installation of RFBs in the US. Such players are looking to continue growing their project pipelines and scale business operations.

Promise of cheaper RFB chemistries

Other RFBs which use cheaper and more widely available active materials for electrolyte could, however, pose a future threat to VRFB players. Other chemistries being developed include all-iron, zinc-bromine, zinc-iron, and hydrogen-bromine, among more. The electrolyte costs in these RFB systems are estimated by IDTechEx to be approximately an order of magnitude less than vanadium electrolytes, presenting a key advantage.

While many of these chemistries see a number of pilot projects and commercial demonstration projects being deployed in recent years, key player CMBlu Energy AG (CMBlu), developing an organic redox flow battery (ORFB) technology, seem to be gearing towards technology commercialization. In October 2023, Technology Group STRABAG invested €100M (~US$108M) into CMBlu. IDTechEx has identified this as one of the largest funding rounds into a RFB company in recent years, beaten only by Dalian Rongke Power (VRFB developer), raising over US$145M, and WeView (zinc-iron developer), raising over US$140M across 2022 - 2023,, respectively. Moreover, Mercedes-Benz Group AG ordered an 11 MWh ORFB from CMBlu in March 2024 and is expected to come online in H2 2025, marking one of the largest projects of an ORFB globally. While such developments signify ongoing commercial activity for ORFBs, the field performance of these technologies will be needed to start validating any technical advantages over VRFBS or other RFB chemistries at commercial scale.

Future RFB application for Long Duration Energy Storage

Regardless of chemistry, it is important to consider when demand for RFB technologies is expected to increase. Li-ion batteries exhibit a CapEx competitive with or lower than many of the alternative RFB chemistries at shorter durations of storage (1 - 4 hours). Moreover, the round-trip efficiency of Li-ion batteries is greater than that of RFBs, demonstrating another advantage. Li-ion batteries have been deployed on a much wider scale than RFBs for stationary energy storage applications, such as energy shifting, or for providing ancillary services to the grid over short durations (

However, as the penetration of variable renewable energy (VRE) increases in electricity grids in key regions, as will the need to manage the unpredictability and variability in electricity supply from these sources. Energy storage systems will be needed to dispatch energy over longer timeframes when energy from VRE sources is not available. Redox flow batteries would be well suited as a long duration energy storage (LDES) technology, given the ability to decouple their energy capacity and power output. This can reduce RFB CapEx (on a $/kWh basis) at longer durations of storage, making them more economically feasible to deploy than Li-ion batteries at these longer durations. However, demand for LDES technologies is not expected to increase until the mid-2030s in key regions and thus is when demand for RFBs, regardless of chemistry, is likely to increase.

Redox flow battery outlook

Historically, the VRFB has been the dominant RFB technology and is the most widely deployed and well-understood. However, its high upfront cost has been one of the key barriers to its more widespread deployment, and Li-ion batteries still dominate the stationary battery storage market. Potential increases in vanadium supply from the exploitation of new mines and the adoption of electrolyte leasing models could reduce upfront VRFB costs, improving their economic viability. In the short term, VRFBs are still likely to dominate the RFB market due to more widespread commercial demonstration and understanding of these technologies and established supply chains already in place between electrolyte and component suppliers and VRFB developers. However, players developing cheaper RFB chemistries using more widely available materials could look to take increasing RFB market share. Ultimately, it is expected that demand for LDES technologies will only increase in the next decade, in which RFBs are likely to be a suitable candidate. Therefore, an increasing penetration of RFB technologies, regardless of chemistry, is likely only in the longer term.

For more information on RFB materials, players, value chains, technologies, economics, and granular 10-year RFB market forecasts, please refer to IDTechEx's market report "Redox Flow Batteries Market 2024-2034: Forecasts, Technologies, Markets".

For more information on LDES technologies, players, applications, revenue streams, electricity markets, variable renewable energy (VRE) penetration, grid stability and flexibility, and granular 20-year market forecasts, please refer to IDTechEx's market report "Long Duration Energy Storage Market 2024-2044: Technologies, Players, Forecasts".

IDTechEx | www.idtechex.com

NEMA President and CEO Debra Phillips issued the following statement in response to the Department of Housing and Urban Development (HUD) and U.S. Department of Agriculture (USDA) adopting the 2021 International Energy Conservation Code (IECC) as the reference standard for the new construction of HUD- and USDA-assisted housing:

“NEMA commends Acting HUD Secretary Todman and USDA Secretary Vilsak for their leadership on this final determination that will create cost savings, generate efficiency gains, and further reduce emissions from buildings, benefitting all Americans. This decision will lower the energy burden on low-income homes, reducing monthly utility bills in the process.

“As a leading Standards Development Organization, NEMA has a lengthy history of leading on code adoption and energy efficiency in the building sector. Access to efficient, energy resilient, high-performing homes is critical to the energy transition – and our members manufacture products that contribute to the construction of these safe, efficient, and resilient homes in communities across the United States.

"Since February, NEMA and our partners in the Campaign for Lower Home Energy Costs Coalitionhave engaged with the Administration and Congress to highlight the importance of energy efficiency standards in newly constructed homes.

“HUD’s May 2023 preliminary determination found that the IECC 2021 and ASHRAE 90.1 2019 energy codes will generate significant cost savings for low-income households without significant impact to housing affordability or availability. According to HUD, residents will save an estimated $14,500 for single-family homes and $5,886 per multifamily unit over 30 years, net of costs, compared to homes under existing U.S. requirements. Additional research from the Department of Energy (DOE) and the national laboratories demonstrated that adopting the proposed code will increase the habitability of homes in the event of power outages.

“Finalizing this determination to adopt the IECC is a critical step forward and a triple-win for energy efficiency, affordability, and resiliency in communities that need it most. Electrical manufacturers value HUD’s and USDA’s engagement on this decision, and we urge them to act to implement the code as quickly as possible.”

National Electrical Manufacturers Association | www.nema.org

The U.S. Department of Energy's ("DOE") Grid Deployment Office announced that it has selected a project owned by Great Basin Transmission, LLC ("GBT") to enter into capacity contract negotiations as part of DOE's Transmission Facilitation Program. GBT is a wholly owned subsidiary of LS Power.

The Southwest Intertie Project-North ("SWIP-North") is a $1+ billion, 285-mile, 500-kilovolt (kV) transmission line that will connect the Midpoint substation near Twin Falls, Idaho, with the Robinson Summit substation near Ely, Nevada, providing a new pathway for delivering energy between the Desert Southwest and the Pacific Northwest.

SWIP-North will also extend to Idaho the benefits of transmission lines developed earlier by LS Power that have served Nevada and the California Independent System Operator ("CAISO"). The concept of an inter-regional transmission project spanning multiple states originated in the 1980s, with LS Power acquiring rights to the project in 2005. Since then, LS Power has developed or will develop the following projects:

"SWIP-North will deliver economic benefits and strengthen the electric grid in the western U.S., while also connecting renewable energy resources to customers that need them," said Paul Thessen, President of LS Power Development. "SWIP-North's bidirectional capability and ability to unleash latent capacity on ON Line make it a valuable and cost-effective transmission system improvement. This final piece of the transmission corridor will provide benefits to multiple Western states by helping meet electricity needs and increasing economic development and employment.

"We are honored to partner again with the DOE," added Thessen. "The selection of SWIP-North for a potential capacity contract provides an anchor that will allow us to move forward more quickly with procurement activities and securing slots for long-lead equipment, thereby proceeding to construction and placing the project in service faster than otherwise possible."

Construction on SWIP-North is slated to begin in 2025, with completion in 2027. Once placed in service, SWIP-North, coupled with ON Line and DesertLink, will:

"We sit at an inflection point today where we are building a clean energy system while meeting growing demand, and we're doing so without putting affordability or reliability at risk," said Paul Segal, CEO of LS Power. "Enhancing grid reliability and providing access to clean energy resources are top priorities for LS Power. SWIP-North and the benefits it provides are important elements of our focused effort to enhance affordability, sustainability, and reliability across the nation through innovative solutions for power generation, transmission, and energy transition."

"Investing in the grid means getting more power to more people in more places and DOE is using all of the tools in the toolbox to make that happen," said Maria Robinson, Director, Grid Deployment Office, U.S. Department of Energy. "But we aren't just financing the projects of today, we're investing in the grid of our future. DOE's unique authorities through the Bipartisan Infrastructure Law and the Inflation Reduction Act enable innovative mechanisms, like the TFP's capacity contracts, that are increasing investor and consumer confidence and leveraging private capital as well as public financing. By supporting projects like SWIP-North, we are setting the stage for meaningful impact on advancing critical infrastructure, good-paying jobs, and clean, reliable power throughout the country."

In December 2023, GBT was selected as part of CAISO's 2022-2023 Transmission Plan to develop, permit, finance, construct, own, operate and maintain the SWIP-North Project. This selection is subject to certain conditions, as further described on CAISO's website.

LS Power | lspower.com

LS Power Grid | lspowergrid.com

LiTHOS Group Ltd., ("LiTHOS" or the "Company") (CBOE CA: LITS) (OTCQB: LITSF) (FSE: YU8) (WKN: A3ES4Q) a leader in sustainable lithium production technologies, is pleased to announce its selection for the next phase of the Chilean National Mining Company (ENAMI)'s direct lithium extraction project. This selection follows a competitive global Request for Information (RFI) where LiTHOS showcased the application of its innovative AcQUA extraction technology for the High Andean Salt Flats project in the Atacama Region.

ENAMI will evaluate results from laboratory tests with brine samples from the project site with a select few vendors who were invited to ENAMI's technology screening process. The lab testing phase is crucial for assessing the feasibility and effectiveness of LiTHOS's AcQUA technology in promoting sustainable lithium extraction practices that can operate in harsh field environments.

This advancement in the RFI process highlights ENAMI's and LiTHOS's commitment to environmental stewardship through the application of technological innovation in the mining sector. The company's proprietary technology, which eliminates the need for traditional evaporation ponds, aligns with Chile's efforts to minimize environmental impacts and enhance resource efficiency.

LiTHOS Technology is honored to contribute to this significant project, which aligns with its strategic objectives and the global movement toward sustainable mining practices.

Chilean National Mining Company | https://www.enami.cl/

LiTHOS | https://www.lithostechnology.com/

WeaveGrid, a leading software provider whose products help enable accelerated electric vehicle (EV) adoption on the electric grid, announced they will collaborate with Southern Company subsidiary Alabama Power to launch an innovative new program for EV owners in the Alabama Power service footprint. The company is simultaneously working with Georgia Power, piloting a similar program for a limited number of EV owners in Georgia.

The program aims to support EV adoption by simplifying home charging for customers in both states, offering streamlined access to electric utility incentives for charging vehicles during off-peak periods, as well as managed charging that optimizes charging for economic and grid benefits.

Georgia Power and Alabama Power customers who participate will be able to optimize their home charging and access exclusive EV benefits. Customer enrollment is facilitated through WeaveGrid's user-friendly evPulse platform. The platform supports qualifying vehicles and home charging stations.

EV owners who participate will have access to benefits such as:

In addition to the consumer benefits, utilities like Georgia Power and Alabama Power are interested in learning from these efforts to support greater grid flexibility, enhance grid reliability and further encourage EV growth.

"We are thrilled to be working with Southern Company to launch our EV program in Alabama and to pilot that program in Georgia," said Apoorv Bhargava, WeaveGrid CEO. "The program is designed to help Southern Company accelerate EV adoption in the Southeast," added Bhargava. "It exemplifies our commitment to making EV ownership effortless and rewarding, and we believe it will serve as a model for similar initiatives across the country."

"Southern Company is proud to collaborate with WeaveGrid on this very innovative value-added program," said Hank Adams, senior vice president of Customer Solutions for Southern Company. "The WeaveGrid EV program aligns perfectly with our vision of a clean energy future and demonstrates our commitment to providing customers with the tools and resources they need to embrace sustainable transportation options."

WeaveGrid | www.weavegrid.com

Southern Company | www.southerncompany.com

Ricoh USA, Inc. announced the launch of a Sustainability Services Dashboard, a first-of-its-kind platform designed for Ricoh customers to measure, report and act upon emissions data associated with Ricoh Digital Services. The dashboard integrates cutting-edge technology and industry-leading expertise to address one of the most significant challenges facing corporations today: reducing emissions from vendors and suppliers. The new offering builds on Ricoh's portfolio of solutions focused on digital transformation.

Indirect supplier – or Scope 3 – emissions can account for more than 80 percent of total carbon contributions for many companies, making reductions in this area essential to achieving climate goals and achieving regulatory compliance. The Sustainability Services Dashboard by Ricoh incorporates Watershed's granular emissions measurement and offers data-driven insights into carbon emissions across all scopes. Leveraging Watershed data, the dashboard provides customers with a comprehensive Scope 3 emissions footprint of their business with Ricoh using both privately and publicly disclosed financial and climate data.

"Addressing Scope 3 emissions is critical for companies committed to sustainability, yet it has been a near-impossible task for many until now," said Lauren Sallata, Chief Marketing Officer, Ricoh North America. "Ricoh's Sustainability Services Dashboard empowers our customers to measure, understand, and reduce emissions, establishing a baseline to transition to more sustainable services while meeting increasing regulatory and compliance demands."

"The first step to decarbonization for any business is a deep understanding of their carbon footprint, including the emissions from their supply chain," said Jessica Shalek, Head of Climate Advisory at Watershed. "We applaud Ricoh for putting supply chain data directly in the hands of their customers — making it simpler for those companies to form a full picture of their Scope 1-3 emissions and take actions to reduce them."

Key benefits of the Sustainability Services Dashboard include:

Since its inception, Ricoh has a long-standing commitment to environmental sustainability and continues to do so as it cements its role as a leader in digital information services. Ricoh was recently named a leader in the IDC MarketScape for Worldwide Sustainability Programs and Services Hardcopy 2023 Vendor Assessment, which noted strengths in Reducing Emissions, Sustainability Across the Portfolio, Reuse and Recycling, and Managed Print & Automation Services. Ricoh holds the distinction of inclusion in the Dow Jones Sustainability World Index (DJSI World Index), one of the world's most renowned indices for ESG (environmental, social, and governance), for four consecutive years. Additionally, for ten consecutive years, Ricoh has been awarded a Gold rating from EcoVadis, the world's most trusted provider of business sustainability ratings – placing Ricoh amongst the top 5% of companies assessed. The company has also been named a 2024 ENERGY STAR® Partner of the Year for Sustained Excellence by the U.S. Environmental Protection Agency (EPA), another achievement in relation to the company's long-term commitment made more than 45 years ago to the preservation of the environment and sustainability of the planet.

For more information about how Ricoh is driving sustainability for the future, please visit: https://www.ricoh-usa.com/en/about-us/corporate-responsibility-and-environmental-sustainability.

Ricoh | www.ricoh.com

EDP Renewables North America LLC (EDPR NA), a leading top five renewable energy developer and operator in North America, is pleased to present the recently completed Misenheimer Solar Park, located in the Village of Misenheimer in Stanly County, North Carolina. The solar project is one of the largest in the state, with an installed capacity of 74 megawatts (MW).

Misenheimer Solar Park (Misenheimer), which will be operated by EDPR NA, will generate enough energy annually to power the equivalent of more than 12,000 North Carolina homes while providing economic and environmental benefits to communities near the project and across the state.

Over the lifespan of the solar park, local landowners will be paid more than $27 million for their participation in the project, with an additional estimated $3.5 million to be disbursed to local governments to support schools, roads, public transportation, and other community services. Millions of dollars of additional investment are also anticipated to funnel into local Stanly County businesses, bolstering area restaurants, hotels, and stores.

Most importantly, Misenheimer will create hundreds of local jobs and long-term employment opportunities, starting with those filled during construction and continuing into operations phase, with several full-time team members being recruited to safely run and perform routine maintenance of the solar park. From an environmental stewardship standpoint, Misenheimer will save more than 93 million gallons of water that would be needed by conventional generation sources to produce the same amount of energy as the solar park.

Development on Misenheimer was begun by Orion Power Generation, LLC - a joint venture between Orion Renewable Energy Group LLC and Eolian - with EDPR NA taking the solar park's development and construction forward from 2020 onwards.

EDPR NA promptly engaged with the local community, successfully expediting development of the solar park. With Stanly County serving as a regional hub for higher education, Misenheimer collaborated with students at neighboring Pfeiffer University on the project logo, with the student body casting votes to choose the solar park's official logo. Additionally, the university partnered with EDPR NA to host a Community Open House prior to construction, educating stakeholders throughout the County on the technologies being implemented as well as the local community's crucial role in the project's success.

"The fully operational Misenheimer Solar Park is a success that can be attributed to the strong partnership and collaboration between EDPR NA's team and the communities of the Village of Misenheimer and Stanly County who worked together to make this project a reality," stated Sandhya Ganapathy, CEO of EDP Renewables North America. "Our mutual dedication and commitment to the community was the primary driver for its success, and we see this as the beginning of a journey, united together, to power North Carolina with affordable clean energy."

North Carolina marks the 18th U.S. state where EDPR NA operates a utility-scale renewable energy project, with the company currently seeking additional opportunities to bring more renewable energy to the state.

EDPR NA continues its leadership in the United States, anticipating adding approximately 5.7 gigawatts (GW) of new operational renewable energy capacity to the grid by 2027.

EDP Renewables North America | www.edpr.com/north-america

Alternative Energies May 15, 2023

The United States is slow to anger, but relentlessly seeks victory once it enters a struggle, throwing all its resources into the conflict. “When we go to war, we should have a purpose that our people understand and support,” as former Secretary ....

Unleashing trillions of dollars for a resilient energy future is within our grasp — if we can successfully navigate investment risk and project uncertainties.

The money is there — so where are the projects?

A cleaner and more secure energy future will depend on tapping trillions of dollars of capital. The need to mobilize money and markets to enable the energy transition was one of the key findings of one of the largest studies ever conducted among the global energy sector C-suite. This will mean finding ways to reduce the barriers and uncertainties that prevent money from flowing into the projects and technologies that will transform the energy system. It will also mean fostering greater collaboration and alignment among key players in the energy space.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

These risks need to be addressed to create more appealing investment opportunities for both public and private sector funders. This will require smart policy and regulatory frameworks that drive returns from long-term investment into energy infrastructure. It will also require investors to recognize that resilient energy infrastructure is more than an ESG play — it is a smart investment in the context of doing business in the 21st century.

Make de-risking investment profiles a number one priority

According to the study, 80 percent of respondents believe the lack of capital being deployed to accelerate the transition is the primary barrier to building the infrastructure required to improve energy security. At the same time, investors are looking for opportunities to invest in infrastructure that meets ESG and sustainability criteria. This suggests an imbalance between the supply and demand of capital for energy transition projects.

How can we close the gap?

One way is to link investors directly to energy companies. Not only would this enable true collaboration and non-traditional partnerships, but it would change the way project financing is conceived and structured — ultimately aiding in potentially satisfying the risk appetite of latent but hugely influential investors, such as pension funds. The current mismatch of investor appetite and investable projects reveals a need for improving risk profiles, as well as a mindset shift towards how we bring investment and developer stakeholders together for mutual benefit. The circular dilemma remains: one sector is looking for capital to undertake projects within their skill to deploy, while another sector wonders where the investable projects are.

This conflict is being played out around the world; promising project announcements are made, only to be followed by slow progress (or no action at all). This inertia results when risks are compounded and poorly understood. To encourage collaboration between project developers and investors with an ESG focus, more attractive investment opportunities can be created by pulling several levers: public and private investment strategies, green bonds and other sustainable finance instruments, and innovative financing models such as impact investing.

Expedite permitting to speed the adoption of new technologies

Another effective strategy to de-risk investment profiles is found in leveraging new technologies and approaches that reduce costs, increase efficiency, and enhance the reliability of energy supply. Research shows that 62 percent of respondents indicated a moderate or significant increase in investment in new and transitional technologies respectively, highlighting the growing interest in innovative solutions to drive the energy transition forward.

Hydrogen, carbon capture and storage, large-scale energy storage, and smart grids are some of the emerging technologies identified by survey respondents as having the greatest potential to transform the energy system and create new investment opportunities. However, these technologies face challenges such as long lag times between conception and implementation.

If the regulatory environment makes sense, then policy uncertainty is reduced, and the all-important permitting pathways are well understood and can be navigated. Currently, the lack of clear, timely, and fit-for-purpose permitting is a major roadblock to the energy transition. To truly unleash the potential of transitional technologies requires the acceleration of regulatory systems that better respond to the nuance and complexity of such technologies (rather than the current one-size-fits all approach). In addition, permitting processes must also be expedited to dramatically decrease the period between innovation, commercialization, and implementation. One of the key elements of faster permitting is effective consultation with stakeholders and engagement with communities where these projects will be housed for decades. This is a highly complex area that requires both technical and communication skills.

The power of collaboration, consistency, and systems thinking

The report also reveals the need for greater collaboration among companies in the energy space to build a more resilient system. The report shows that, in achieving net zero, there is a near-equal split between those increasing investment (47 percent of respondents), and those decreasing investment (39 percent of respondents). This illustrates the complexity and diversity of the system around the world. A more resilient system will require all its components – goals and actions – to be aligned towards a common outcome.

Another way to de-risk the energy transition is to establish consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation. The energy transition depends on policy to guide its direction and speed by affecting how investors feel and how the markets behave. However, inconsistent or inadequate policy can also be a source of uncertainty and instability. For example, shifting political priorities, conflicting international standards, and the lack of market-based mechanisms can hinder the deployment of sustainable technologies, resulting in a reluctance to commit resources to long-term projects.

Variations in country-to-country deployment creates disparities in energy transition progress. For instance, the 2022 Inflation Reduction Act in the US has posed challenges for the rest of the world, by potentially channeling energy transition investment away from other markets and into the US. This highlights the need for a globally unified approach to energy policy that balances various national interests while addressing a global problem.

To facilitate the energy transition, it is imperative to establish stable, cohesive, and forward-looking policies that align with global goals and standards. By harmonizing international standards, and providing clear and consistent signals, governments and policymakers can generate investor confidence, helping to foster a robust energy ecosystem that propels the sector forward.

Furthermore, substantive and far-reaching discussions at international events like the United Nations Conference of the Parties (COP), are essential to facilitate this global alignment. These events provide an opportunity to de-risk the energy transition through consistent policy that enables countries to work together, ensuring that the global community can tackle the challenges and opportunities of the energy transition as a united front.

Keeping net-zero ambitions on track

Despite the challenges faced by the energy sector, the latest research reveals a key positive: 91 percent of energy leaders surveyed are working towards achieving net zero. This demonstrates a strong commitment to the transition and clear recognition of its importance. It also emphasizes the need to accelerate our efforts, streamline processes, and reduce barriers to realizing net-zero ambitions — and further underscores the need to de-risk energy transition investment by removing uncertainties.

The solution is collaborating and harmonizing our goals with the main players in the energy sector across the private and public sectors, while establishing consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation.

These tasks, while daunting, are achievable. They require vision, leadership, and action from all stakeholders involved. By adopting a new mindset about how we participate in the energy system and what our obligations are, we can stimulate the rapid progress needed on the road to net zero.

Dr. Tej Gidda (Ph.D., M.Sc., BSc Eng) is an educator and engineer with over 20 years of experience in the energy and environmental fields. As GHD Global Leader – Future Energy, Tej is passionate about moving society along the path towards a future of secure, reliable, and affordable low-carbon energy. His focus is on helping public and private sector clients set and deliver on decarbonization goals in order to achieve long-lasting positive change for customers, communities, and the climate. Tej enjoys fostering the next generation of clean energy champions as an Adjunct Professor at the University of Waterloo Department of Civil and Environmental Engineering.

GHD | www.ghd.com

The Kincardine floating wind farm, located off the east coast of Scotland, was a landmark development: the first commercial-scale project of its kind in the UK sector. Therefore, it has been closely watched by the industry throughout its installation. With two of the turbines now having gone through heavy maintenance, it has also provided valuable lessons into the O&M processes of floating wind projects.

In late May, the second floating wind turbine from the five-turbine development arrived in the port of Massvlakte, Rotterdam, for maintenance. An Anchor Handling Tug Supply (AHTS)

vessel was used to deliver the KIN-02 turbine two weeks after a Platform Supply Vessel (PSV) and AHTS had worked to disconnect the turbine from the wind farm site. The towing vessel became the third vessel used in the operation.

This is not the first turbine disconnected from the site and towed for maintenance. In the summer of 2022, KIN-03 became the world’s first-ever floating wind turbine that required heavy maintenance (i.e. being disconnected and towed for repair). It was also towed from Scotland to Massvlakte.

Each of these operations has provided valuable lessons for the ever-watchful industry in how to navigate the complexities of heavy maintenance in floating wind as the market segment grows.

The heavy maintenance process

When one of Kincardine’s five floating 9.5 MW turbines (KIN-03) suffered a technical failure in May 2022, a major technical component needed to be replaced. The heavy maintenance strategy selected by the developer and the offshore contractors consisted in disconnecting and towing the turbine and its floater to Rotterdam for maintenance, followed by a return tow and re-connection. All of the infrastructure, such as crane and tower access, remained at the quay following the construction phase. (Note, the following analysis only covers KIN-03, as details of the second turbine operation are not yet available).

Comparing the net vessel days for both the maintenance and the installation campaigns at this project highlights how using a dedicated marine spread can positively impact operations.

For this first-ever operation, a total of 17.2 net vessel days were required during turbine reconnection—only a slight increase on the 14.6 net vessel days that were required for the first hook-up operation performed during the initial installation in 2021. However, it exceeds the average of eight net vessel days during installation. The marine spread used in the heavy maintenance operation differed from that used during installation. Due to this, it did not benefit from the learning curve and experience gained throughout the initial installation, which ultimately led to the lower average vessel days.

The array cable re-connection operation encountered a similar effect. The process was performed by one AHTS that spent 10 net vessel days on the operation. This compares to the installation campaign, where the array cable second-end pull-in lasted a maximum of 23.7 hours using a cable layer.

Overall, the turbine shutdown duration can be broken up as 14 days at the quay for maintenance, 52 days from turbine disconnection to turbine reconnection, and 94 days from disconnection to the end of post-reconnection activities.

What developers should keep in mind for heavy maintenance operations

This analysis has uncovered two main lessons developers should consider when planning a floating wind project: the need to identify an appropriate O&M port, and to guarantee that a secure fleet is available.

Floating wind O&M operations require a port with both sufficient room and a deep-water quay. The port must also be equipped with a heavy crane with sufficient tip height to accommodate large floaters and reach turbine elevation. Distance to the wind farm should also be taken into account, as shorter distances will reduce towing time and, therefore, minimize transit and non-productive turbine time.

During the heavy maintenance period for KIN-03 and KIN-02, the selected quay (which had also been utilized in the initial installation phase of the wind farm project), was already busy as a marshalling area for other North Sea projects. This complicated the schedule significantly, as the availability of the quay and its facilities had to be navigated alongside these other projects. This highlights the importance of abundant quay availability both for installation (long-term planning) and maintenance that may be needed on short notice.

At the time of the first turbine’s maintenance program (June 2022), the North Sea AHTS market was in an exceptional situation: the largest bollard pull AHTS units contracted at over $200,000 a day, the highest rate in over a decade.

During this time, the spot market was close to selling out due to medium-term commitments, alongside the demand for high bollard pull vessels for the installation phase at a Norwegian floating wind farm project. The Norwegian project required the use of four AHTS above a 200t bollard pull. With spot rates ranging from $63,000 to $210,000 for the vessels contracted for Kincardine’s maintenance, the total cost of the marine spread used in the first repair campaign was more than $4 million.

Developers should therefore consider the need to structure maintenance contracts with AHTS companies, either through frame agreements or long-term charters, to decrease their exposure to spot market day rates as the market tightens in the future.

While these lessons are relevant for floating wind developers now, new players are looking towards alternative heavy O&M maintenance options for the future. Two crane concepts are especially relevant in this instance. The first method is for a crane to be included in the turbine nacelle to be able to directly lift the component which requires repair from the floater, as is currently seen on onshore turbines. This method is already employed in onshore turbines and could be applicable for offshore. The second method is self-elevating cranes with several such solutions already in development.

The heavy maintenance operations conducted on floating turbines at the Kincardine wind farm have provided invaluable insights for industry players, especially developers. The complex process of disconnecting and towing turbines for repairs highlights the need for meticulous planning and exploration of alternative maintenance strategies, some of which are already in the pipeline. As the industry evolves, careful consideration of ports, and securing fleet contracts, will be crucial in driving efficient and cost-effective O&M practices for the floating wind market.

Sarah McLean is Market Research Analyst at Spinergie, a maritime technology company specializing in emission, vessel performance, and operation optimization.

Spinergie | www.spinergie.com

According to the Energy Information Administration (EIA), developers plan to add 54.5 gigawatts (GW) of new utility-scale electric generating capacity to the U.S. power grid in 2023. More than half of this capacity will be solar. Wind power and battery storage are expected to account for roughly 11 percent and 17 percent, respectively.

A large percentage of new installations are being developed in areas that are prone to extreme weather events and natural disasters (e.g., Texas and California), including high wind, tornadoes, hail, flooding, earthquakes, wildfires, etc. With the frequency and severity of many of these events increasing, project developers, asset owners, and tax equity partners are under growing pressure to better understand and mitigate risk.

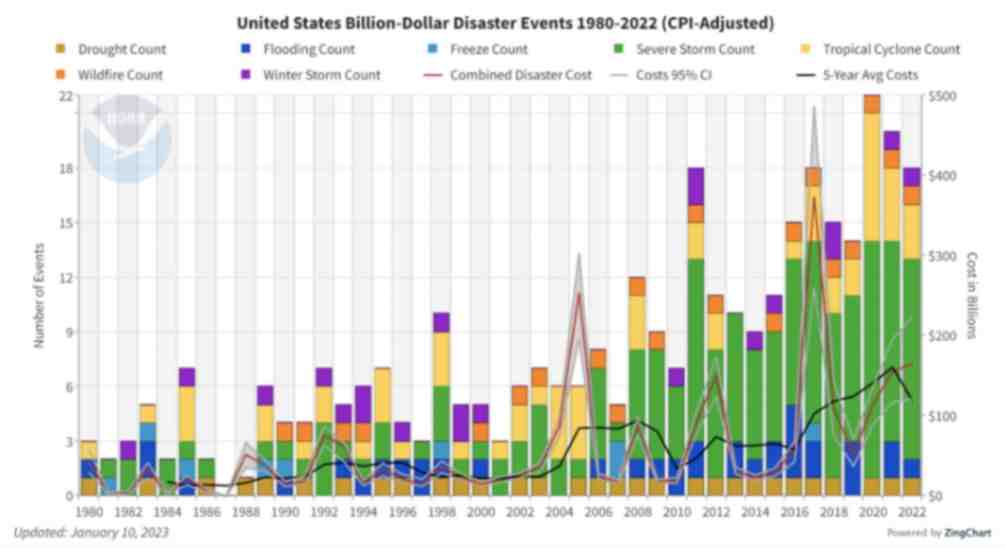

Figure 1. The history of billion-dollar disasters in the United States each year from 1980 to 2022 (source: NOAA)

In terms of loss prevention, a Catastrophe (CAT) Modeling Study is the first step to understanding the exposure and potential financial loss from natural hazards or extreme weather events. CAT studies form the foundation for wider risk management strategies, and have significant implications for insurance costs and coverage.

Despite their importance, developers often view these studies as little more than a formality required for project financing. As a result, they are often conducted late in the development cycle, typically after a site has been selected. However, a strong case can be made for engaging early with an independent third party to perform a more rigorous site-specific technical assessment. Doing so can provide several advantages over traditional assessments conducted by insurance brokerage affiliates, who may not possess the specialty expertise or technical understanding needed to properly apply models or interpret the results they generate. One notable advantage of early-stage catastrophe studies is to help ensure that the range of insurance costs, which can vary from year to year with market forces, are adequately incorporated into the project financial projections.

The evolving threat of natural disasters

Over the past decade, the financial impact of natural hazard events globally has been almost three trillion dollars. In the U.S. alone, the 10-year average annual cost of natural disaster events exceeding $1 billion increased more than fourfold between the 1980s ($18.4 billion) and the 2010s ($84.5 billion).

Investors, insurers, and financiers of renewable projects have taken notice of this trend, and are subsequently adapting their behavior and standards accordingly. In the solar market, for example, insurance premiums increased roughly four-fold from 2019 to 2021. The impetus for this increase can largely be traced back to a severe storm in Texas in 2019, which resulted in an $80 million loss on 13,000 solar panels that were damaged by hail.

The event awakened the industry to the hazards severe storms present, particularly when it comes to large-scale solar arrays. Since then, the impact of convective weather on existing and planned installations has been more thoroughly evaluated during the underwriting process. However, far less attention has been given to the potential for other natural disasters; events like floods and earthquakes have not yet resulted in large losses and/or claims on renewable projects (including wind farms). The extraordinary and widespread effect of the recent Canadian wildfires may alter this behavior moving forward.

A thorough assessment, starting with a CAT study, is key to quantifying the probability of their occurrence — and estimating potential losses — so that appropriate measures can be taken to mitigate risk.

All models are not created equal

Industrywide, certain misconceptions persist around the use of CAT models to estimate losses from an extreme weather event or natural disaster.

Often, the perception is that risk assessors only need a handful of model inputs to arrive at an accurate figure, with the geographic location being the most important variable. While it’s true that many practitioners running models will pre-specify certain project characteristics regardless of the asset’s design (for example, the use of steel moment frames without trackers for all solar arrays in a given region or state), failure to account for even minor details can lead to loss estimates that are off by multiple orders of magnitude.

The evaluation process has recently become even more complex with the addition of battery energy storage. Relative to standalone solar and wind farms, very little real-world experience and data on the impact of extreme weather events has been accrued on these large-scale storage installations. Such projects require an even greater level of granularity to help ensure that all risks are identified and addressed.

Even when the most advanced modeling software tools are used (which allow for thousands of lines of inputs), there is still a great deal that is subject to interpretation. If the practitioner does not possess the expertise or technical ability needed to understand the model, the margin for error can increase substantially. Ultimately, this can lead to overpaying for insurance. Worse, you may end up with a policy with insufficient coverage. In both cases, the profitability of the asset is impacted.

Supplementing CAT studies

In certain instances, it may be necessary to supplement CAT models with an even more detailed analysis of the individual property, equipment, policies, and procedures. In this way, an unbundled risk assessment can be developed that is tailored to the project. Supplemental information (site-specific wind speed studies and hydrological studies, structural assessment, flood maps, etc.) can be considered to adjust vulnerability models.

This provides an added layer of assurance that goes beyond the pre-defined asset descriptions in the software used by traditional studies or assessments. By leveraging expert elicitations, onsite investigations, and rigorous engineering-based methods, it is possible to discretely evaluate asset-specific components as part of the typical financial loss estimate study: this includes Normal Expected Loss (NEL), also known as Scenario Expected Loss (SEL); Probable Maximum Loss (PML), also known as Scenario Upper Loss (SUL); and Probabilistic Loss (PL).

Understanding the specific vulnerabilities and consequences can afford project stakeholders unique insights into quantifying and prioritizing risks, as well as identifying proper mitigation recommendations.

Every project is unique

The increasing frequency and severity of natural disasters and extreme weather events globally is placing an added burden on the renewable industry, especially when it comes to project risk assessment and mitigation. Insurers have signaled that insurance may no longer be the main basis for transferring risk; traditional risk management, as well as site and technology selection, must be considered by developers, purchasers, and financiers.

As one of the first steps in understanding exposure and the potential capital loss from a given event, CAT studies are becoming an increasingly important piece of the risk management puzzle. Developers should treat them as such by engaging early in the project lifecycle with an independent third-party practitioner with the specialty knowledge, tools, and expertise to properly interpret models and quantify risk.

Hazards and potential losses can vary significantly depending on the project design and the specific location. Every asset should be evaluated rigorously and thoroughly to minimize the margin for error, and maximize profitability over its life.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

ABS Group | www.abs-group.com

Throughout my life and career as a real estate developer in New York City, I’ve had many successes. In what is clearly one of my most unusual development projects in a long career filled with them, I initiated the building of a solar farm to help t....

I’m just going to say it, BIPV is dumb. Hear me out…. Solar is the most affordable form of energy that has ever existed on the planet, but only because the industry has been working towards it for the past 15 years. Governments,....

Heat waves encircled much of the earth last year, pushing temperatures to their highest in recorded history. The water around Florida was “hot-tub hot” — topping 101° and bleaching and killing coral in waters around the peninsula. Phoenix had ....

Wind turbines play a pivotal role in the global transition to sustainable energy sources. However, the harsh environmental conditions in which wind turbines operate, such as extreme temperatures, high humidity, and exposure to various contaminants, p....

Wind energy remains the leading non-hydro renewable technology, and one of the fastest-growing of all power generation technologies. The key to making wind even more competitive is maximizing energy production and efficiently maintaining the assets. ....

The allure of wind turbines is undeniable. For those fortunate enough to visit these engineering marvels, it’s an experience filled with awe and learning. However, the magnificence of these structures comes with inherent risks, making safety an abs....

Battery energy storage is a critical technology to reducing our dependence on fossil fuels and build a low carbon future. Renewable energy generation is fundamentally different from traditional fossil fuel energy generation in that energy cannot be p....

Not enough people know that hydrogen fuel cells are a zero-emission energy technology. Even fewer know water vapor's outsized role in electrochemical processes and reactions. Producing electricity through a clean electrochemical process with water....

In the ever-evolving landscape of sustainable transportation, a ground-breaking shift is here: 2024 ushers in a revolutionary change in Electric Vehicle (EV) tax credits in the United States. Under the Inflation Reduction Act (IRA), a transforma....

Now more than ever, it would be difficult to overstate the importance of the renewable energy industry. Indeed, it seems that few other industries depend as heavily on constant and rapid innovation. This industry, however, is somewhat unique in its e....

University of Toronto’s latest student residence welcomes the future of living with spaces that are warmed by laptops and shower water. In September 2023, one of North America’s largest residential passive homes, Harmony Commons, located....

For decades, demand response (DR) has proven a tried-and-true conservation tactic to mitigate energy usage during peak demand hours. Historically, those peak demand hours were relatively predictable, with increases in demand paralleling commuter and ....