Next Hydrogen Solutions Inc. (the “Company” or “Next Hydrogen”) (TSXV:NXH, OTC:NXHSF), a designer and manufacturer of electrolyzers, is pleased to report its financial results for the fourth quarter and full year ended December 31, 2023.

“We had a very promising end to 2023 with: (1) our electrolyzer (up to 2.25MW) exceeding US DOE energy efficiency targets, showing 30% lower capex and successfully graduating from pilot scale testing to commercial module builds, (2) growing our backlog from $3M at the beginning of the year to $8M contracted, with a $3M follow-on order expected, and (3) announcing strategic partnerships with Casale and GE,” said Raveel Afzaal, President & CEO. “In 2024, we intend to: (1) demonstrate our system at a customer site, (2) further improve our energy efficiency to exceed US DOE 2026 targets to world class efficiency levels, (3) complete pilot scale testing of our large-scale product line (up to 8MW per module) targeting large scale 100MW+ solutions, and (4) double our growing backlog. With extensive inhouse testing (~18,000 hours) of our electrolyzers and a fully financed business plan for 2024, we are looking forward to a transformative 2024.”

2023 Financial Highlights

- Cash balance was $10.9M as of December 31, 2023, compared to $22.1M as of December 31, 2022. We have sufficient capital to achieve our 2024 objectives.

- Revenue for the three-month period ended December 31, 2023 was $0.8M compared to $0.6M in the prior year. Revenue for the full year 2023 was $1.0M compared to $0.7M during the previous full year.

- Net loss and comprehensive loss for the three-month period ended December 31, 2023 was $3.3M compared to $3.2M in the prior year. Net loss and comprehensive loss for the full year 2023 was $12.0M compared to $14.3M during the previous full year.

Management is proud to highlight several recent milestones that demonstrate significant recent progress:

- Next Hydrogen has met its energy efficiency targets cell performance of 1.90 V/cell at 1 A/cm2 and 70°C for its electrolyzer technology exceeding the recently reported US Department of Energy (“DOE”) technical targets status for energy efficiency. Our efficiency performance achievement has positioned the Company as an industry leader in electrolysis cell performance. Next Hydrogen has a progressive goal to achieve 1.70 V/cell at 1.2 A/cm2 during 2024 that will exceed US DOE’s 2026 targets and firmly plant us as a global best-in-class water electrolysis company.

- Next Hydrogen and General Electric Vernova (“GE Vernova”) have signed a memorandum of understanding to integrate Next Hydrogen’s electrolysis technology with GE Vernova’s power systems offerings to produce green hydrogen. This collaborative effort will encompass installation, rigorous testing, and the seamless integration of a Next Hydrogen water electrolyzer with a power supply meticulously designed and fabricated by GE Vernova. This collaboration will further support Next Hydrogen’s commitment to pioneering innovative green hydrogen technologies, addressing climate change, and promoting global energy sustainability.

- The Company has received a repeat project for a project involving a specialized nuclear application worth $7.7M. Under the agreement, Next Hydrogen will conduct design engineering (Phase 1) and subsequently provide the electrolyzer needed (Phase 2) for the project. A $5M purchase order has been received for Phase 1, with a follow-on order of $2.7M planned for Phase 2 with electrolyzer delivery expected to occur in 2025.

- Next Hydrogen and Casale SA (“Casale”) signed a memorandum of understanding and subsequently Next Hydrogen received a purchase order for the integration of Next Hydrogen’s electrolysis technology and products within Casale’s green ammonia and methanol production systems. The companies will bring together their collective experience and capabilities to accelerate and scale-up green ammonia and methanol plants connected to renewable energy sources. This collaboration provides a compelling pathway to producing clean, zero-emission ammonia and methanol from green renewable energy power sources.

- Next Hydrogen has appointed Mr. Rob Campbell as Chief Commercial Officer (CCO), who brings a distinguished career in senior leadership roles in the global clean technology sector with a focus on hydrogen, fuel cells and solar industries. Mr. Campbell will help Next Hydrogen execute the Company’s go-to-market strategy introducing our products into strategic market applications.

- The Company was awarded $5.1M from Sustainable Development Technology Canada (“SDTC”) towards the development and demonstration of the Company’s next generation electrolysis technology. Further, Next Hydrogen is working with blue-chip industry partners representing end-users, suppliers and channel partners to ensure strong product-market fit needed for follow-on revenue generation. This project will run to early 2025, resulting in the launch of our initial product line (~2MW) with cost and performance improvements and a larger-scale product line (~8MW). Next Hydrogen will be well positioned to support the needs of its customers with the launch of these products for near-term market demonstrations and longer-term large-scale green hydrogen systems.

- Next Hydrogen received $0.8M in research and development funding from the National Research Council of Canada Industrial Research Assistance Program (“NRCC IRAP”) toward the development and demonstration of the Company’s next generation products. This will further help the Company accelerate its product roadmap and its mission of driving large scale adoption of green hydrogen solutions to decarbonize the global economy.

Next Hydrogen | nexthydrogen.com

.jpg?r=9588)

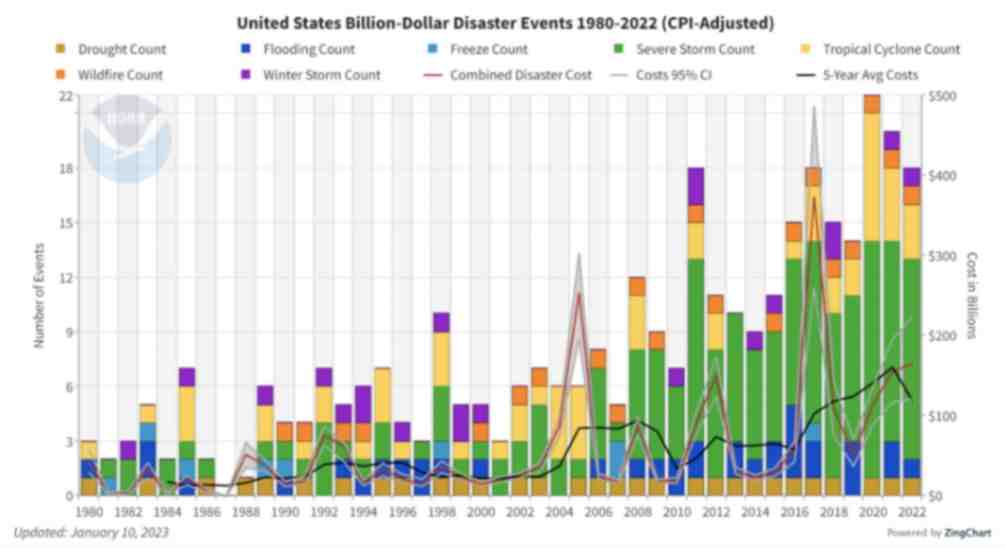

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.