IPS, a North American leader in the servicing, engineering, and remanufacturing of electrical, mechanical, and power management assets, has agreed to acquire assets of ABB’s Industrial Services business. The business includes a US and Canadian service shop network with locations in Tucson, Arizona; Evansville, Indiana; Charlotte, North Carolina; Edmonton, Alberta, Canada; and Burlington, Ontario, Canada, employing 114 talented employees. The transaction is expected to close in the third quarter of 2024. Financial details of the transaction were not disclosed.

The acquisition brings to IPS five well-equipped electric motor, generator, mechanical, switchgear, and circuit breaker service centers, which were a part of the General Electric Industrial Solutions acquisition by ABB in July 2018. The ABB Industrial Services business offers high-quality repair and field service capabilities for electric motors up to 50,000 HP and low and medium-voltage switchgear equipment from 480V to 15kV. Additionally, the service centers perform rotating equipment repair services for pumps, compressors, blowers, bearings, gearboxes, and OHV mining drivetrains.

The business has a decades-long relationship with customers, providing lifecycle solutions for critical processes in power generation, petrochemicals, pulp and paper, mining, metals, and other industrial applications. Based on its historic original equipment manufacturer service heritage, the business possesses specialized knowledge and expertise working on General Electric and ABB rotating equipment and switchgear.

For IPS, the addition of this business addresses service location gaps in Arizona, Western and Central Canada while adding complementary capabilities in the Midwestern and Southeastern US. This agreement follows IPS’ acquisition of ABB’s hydrogenerator and transformer repair business in June 2022.

“IPS is aspiring to become the trusted advisor for our customer’s electrical balance of plant and electromechanically driven processes,” said John Zuleger, IPS President and CEO. “The addition of these highly skilled technicians and service network, along with the legacy General Electric and ABB experience, puts IPS in a position to carry forward and improve on the confidence customers have placed in these teams to solve their biggest reliability challenges.”

Integrated Power Services | www.ips.us

On April 23, 2024, Voith Hydro unveiled its newest, multi-million dollar industrial-scale capital investment in American manufacturing with the addition of a 200-ton, 30-foot-tall PAMA Speedram 3000 horizontal boring mill at its York, Pa. manufacturing plant.

The HBM is one of the most advanced machines of its type to be installed in North America and will be used to machine components that are crucial to the operations of North American hydropower facilities. An inauguration of the machine, whose attendees included local, state, and federal officials, as well as employees, was held at Voith Hydro’s North American headquarters in West Manchester Township, Pa.

“Clean energy investments driven by the Infrastructure Investment and Jobs Act, as well as the Inflation Reduction Act, are creating an increased demand for hydropower here in the United States,” said Stanley Kocon, President and CEO of Voith Hydro North America. “This more than $5 million investment enhances our capabilities in hydropower manufacturing and demonstrates our commitment to being a part of the clean energy economy.”

During the inauguration, Voith Hydro also announced that it was selected to earn tax credits under the Qualifying Advanced Energy Project Tax Credit (48C), which is funded by the Inflation Reduction Act. The tax credit is for Voith’s investment in machinery to support the production of renewable energy equipment at Voith’s existing U.S. manufacturing facility. The installation of the HBM is just one of Voith Hydro’s investments qualifying for the Tax Credit.

"President Biden’s goal to deliver 100% clean electricity by 2035, by creating good-paying jobs right here in the United States allows Voith Hydro to stay true to its core values that a substantial local presence with local manufacturing capabilities can better serve the needs of the U.S. hydropower industry," added Kocon.

Voith Hydro traces its roots in Pennsylvania and the U.S. back nearly 150 years. Its York, Pa. facility is home to almost 350 hydropower professionals, including nearly 100 members of the IAMAW (International Association of Machinists and Aerospace Workers) union. Its location in York, Pa. is one of the largest, dedicated hydropower turbine equipment manufacturing facilities in the world, and the only hydropower manufacturing facility in North America with a hydraulic test lab and a dedicated staff of engineers designing, fabricating, and refurbishing hydroelectric equipment – from some of the smallest hydropower facilities to some of the largest.

Voith Group | https://voith.com/corp-en/index.html

Manitowoc is pleased to announce that Joern Henselmans has been appointed to Vice President and General Manager for Grove All-Terrain Cranes, effective April 12, 2024. In his new role, Henselmans is responsible for Operations, Purchasing, Engineering, New Product Development, Quality, Human Resources, and Safety at the Manitowoc facility in Wilhelmshaven, Germany. Henselmans will report to Les Middleton, Executive Vice President Americas & EU Mobile Cranes, The Manitowoc Company, Inc.

“With the appointment of Joern as Vice President and General Manager for Grove All-Terrain Cranes, we are ensuring that our customers, our partners, and our employees will gain an accomplished leader. Joern brings with him an extensive knowledge of our Grove all-terrain product line, manufacturing expertise as well as related processes, combined with close relationships to Manitowoc teams. I look forward to seeing the positive impact he will no doubt deliver with his background and customer-first mindset,” commented Mr. Middleton.

Most recently, Henselmans served as VP Operations, Senior Director of Quality and Director of Manufacturing at Manitowoc. He joined Manitowoc in October 2013.

“I am looking forward to fulfilling my new role at Manitowoc and could not be more excited to lead an amazing team of people, that is designing and manufacturing best-in class Grove all-terrain cranes and related services to meet our customers’ needs,” said Henselmans.

Manitowoc | www.manitowoc.com

Petitions were filed with the U.S. Department of Commerce and the U.S. International Trade Commission requesting imposition of anti-dumping and countervailing duties (AD/CVD) on crystalline silicon photovoltaic cells and modules imported from Cambodia, Malaysia, Vietnam, and Thailand.

The Solar Energy Industries Association (SEIA), American Clean Power Association (ACP), Advanced Energy United (United), and American Council on Renewable Energy (ACORE) issued the following statement on the petitions:

“Today’s filing creates market uncertainty in the U.S. solar industry and poses a potential threat to the build-out of a domestic solar supply chain.

“America’s energy security relies upon building a strong domestic solar supply chain, which our members strongly support, and the Advanced Manufacturing Tax Credit and incentives are working to drive historic investments in U.S. solar manufacturing that are building domestic capacity for a U.S. solar supply chain.

“We are deeply concerned the AD/CVD petitions will lead to further market volatility across the U.S. solar and storage industry and create uncertainty at a time when we need effective solutions that support U.S. solar manufacturers. We need constructive actions, like the Advanced Manufacturing Tax Credit and other policies, to expand domestic solar manufacturing and deploy clean energy at scale and speed to serve growing electricity demand.

“America’s clean energy industry is urging the Biden administration to consider alternative solutions to address the petitioners’ concerns so that we can uplift American manufacturers and maintain a thriving clean energy economy across the value chain.”

The American Clean Power Association | https://cleanpower.org/

Solar Energy Industries Association | www.seia.org

American Council on Renewable Energy | www.acore.org

Advanced Energy United | https://advancedenergyunited.org/

National Grid opened applications for its "Charging Our Future" Diversity, Equity, and Inclusion (DEI) Engineering Scholarship Program. The program supports students enrolled in undergraduate engineering programs with a strong interest in energy industry careers.

Now in its third year, National Grid launched the scholarship to empower high school seniors and college students from low- and moderate-income communities to pursue academic and professional success while cultivating a diverse workforce representative of the communities it serves. Up to 12 new scholars will be awarded as much as $10,000 each for the 2024-2025 academic year and a paid summer internship related to their field of study at one of the company's business locations in Massachusetts or New York.

"The continuation of the 'Charging Our Future' program underscores National Grid's commitment to building an equitable clean energy economy in Massachusetts and New York," said Natalie Edwards, Chief Diversity Officer, National Grid. "Creating a fair and affordable energy future requires a workforce that mirrors the diversity of our communities. We're proud to increase education and employment access for emerging leaders who will shape innovation in the energy industry."

Awards are renewable for up to three additional years or until an undergraduate degree is earned, based on academic performance, full-time enrollment in an eligible major, and the completion of a summer internship each year.

Syed Bazif, one of 12 scholars awarded since 2022, credits his internship experiences for expanding his skill set and knowledge of the energy industry. Now completing his bachelor's degree in mechanical engineering, Bazif has secured a full-time position as an Associate Engineer in National Grid's Electrical Planning and Design team.

"My goal is to establish an impactful career where I can apply my passion for engineering to solve complex problems, improve efficiency, and contribute to the advancement of technology for the betterment of society," said Bazif. "Through my internship at National Grid, I gained experience working on real-world engineering projects and developed my interpersonal skills. In the long term, I aspire to lead teams, drive innovation, and make a positive difference on society through sustainable engineering solutions."

Building a Diverse Talent Pipeline

The "Charging Our Future" DEI Engineering Scholarship is one of several programs and initiatives advancing National Grid's strategy to connect underrepresented and historically marginalized communities to career exploration, hands-on training, and valuable employment opportunities.

In its first year, National Grid's Strategic Workforce Development Initiative has led to 68 new full-time hires and has positively impacted on nearly 1,000 work-ready adults, college, high school, and middle school students in Massachusetts. The initiative offers four workforce development academies intended for a range of age groups – from STEM-oriented programming for adolescents to job training for work-ready adults.

National Grid is dedicated to delivering a smarter, stronger, cleaner energy system to support state climate goals and meet the long-term benefits of customers and communities in the Northeast U.S. The company's proposed transmission infrastructure plans – Future Grid for Massachusetts and Upstate Upgrade for Upstate New York – will boost economic growth and generate thousands of new jobs across its service territories over the next decade and beyond.

Eligibility Criteria

To be eligible for National Grid's "Charging Our Future" DEI Engineering Scholarship Program, applicants must:

The application deadline for the "Charging Our Future" DEI Engineering Scholarship Program is May 22, 2024. Students can apply through the Scholarship America Hub: https://learnmore.scholarsapply.org/ng-chargingourfuture/

National Grid | https://www.nationalgridus.com/Default.aspx

Battery materials pioneer Wildcat Discovery Technologies announced it received its 100th patent, reinforcing its industry-leading innovation and advancing its strategy for U.S.-based cathode materials manufacturing.

Wildcat has been developing battery materials since 2006 and plans to build a plant in the United States to manufacture lithium iron phosphate (LFP) in late 2026, lithium manganese iron phosphate (LMFP) in 2027, and disordered rock salt (DRX) in 2028. The company has received patents for cathode active materials (CAM) innovations, novel electrolytes and anodes, and various other battery-related technologies – including its unique high throughput platform that accelerates materials development and testing.

The 100th Wildcat patent, granted by the U.S. in January 2024, protects the company's leading-edge development of "Cathode with Disordered Rocksalt Material and Method of Forming the Cathode." Wildcat is poised to disrupt global CAM markets with DRX, which has gained significant attention in the field of energy storage due to its high energy density.

"Congratulations to our innovative Wildcat team for continuing to lead the industry in battery materials development," said Wildcat President and CEO Mark Gresser. "Wildcat's mission is to produce high-performance U.S.-made cathode materials to enable widespread adoption of clean energy, and our development and engineering capability is central to our strategy."

Wildcat's first U.S. patent, granted in 2010, recognized the company's unique "High Throughput Mechanical Alloying and Screening." It was the first in a series of patents relating to the Wildcat platform that allows scientists to perform comprehensive materials testing and development 10 times faster than conventional methods.

Wildcat has received 61 U.S. patents and 39 patents from other countries, including China, Germany, Great Britain, Japan, and South Korea. In addition, Wildcat has approximately 60 patents pending.

Wildcat Discovery Technologies | wildcatdiscovery.com

American Battery Technology Company (ABTC) (NASDAQ: ABAT), an integrated critical battery materials company that is commercializing its technologies for both primary battery minerals manufacturing and secondary minerals lithium-ion battery recycling, has published an amended Initial Assessment for its Tonopah Flats Lithium Project (TFLP).

The TFLP is one of the largest identified lithium resources in the U.S., and while initial pit designs and economic analyses in previous assessments evaluated the full resource, this updated Initial Assessment utilizes a commercialization pathway with a more rigorous mine plan that contemplates utilization of only Measured and Indicated Mineral Resources, and excludes Inferred Mineral Resources, to supply the planned commercial-scale lithium hydroxide monohydrate (LHM) refinery.

This commercialization pathway allows for an engineered phased development, with improved access to the higher quality portions of the resource, and at improved project economics. ABTC recently completed construction of its multi-ton per day integrated demonstration facility for the processing of its lithium-bearing claystone material into lithium products. Updated project metrics for ABTC's TFLP resource utilizing its internally-developed and demonstrated processing technologies include:

ABTC published the TFLP Initial Assessment in December 2023 and updated it in January 2024. ABTC is publishing this Amended Resource Estimate and Initial Assessment with Project Economics for the Tonopah Flats Lithium Project, Esmeralda and Nye Counties, Nevada, USA (Amended Initial Assessment), that includes these changes and other updates. The Amended Initial Assessment remains preliminary in nature, and there is no certainty that this economic assessment will be realized. Mineral Resources, including Measured and Indicated Mineral Resources, are too speculative geologically to be considered Probable or Proven Reserves.

To describe and walkthrough this updated commercialization plan and project scale-up, ABTC CEO Ryan Melsert was interviewed by Vrify CEO Stephen De Jong to talk through these highlights with visual graphics of the TFLP and its related infrastructure.

The interview highlights:

To view the interview, click here.

To view the interactive 3D Model used during the interview, click here.

American Battery Technology Company's Measured, Indicated, and Inferred Lithium Mineral Resource

|

Resource Classification |

Total kTons |

Average ppm Li |

Li kTons |

LHM kTons |

||||||||||||||

|

Measured |

721,000 |

702 |

510 |

3,060 |

||||||||||||||

|

Indicated |

2,439,000 |

565 |

1,380 |

8,340 |

||||||||||||||

|

Measured + |

3,160,000 |

596 |

1,890 |

11,400 |

||||||||||||||

|

Inferred |

2,931,000 |

550 |

1,610 |

9,750 |

||||||||||||||

|

Total |

6,091,000 |

574 |

3,500 |

21,150 |

||||||||||||||

ABTC received support for the commercialization of these internally-developed technologies for the manufacturing of battery grade lithium hydroxide from Nevada-based claystone resources from an initial U.S. Department of Energy (DOE) grant toward the $4.5M construction and operation of a multi-ton per day integrated pilot plant, and from a second DOE grant toward the $115M construction and commissioning of the first phase of a commercial scale lithium hydroxide refinery.

The Amended Initial Assessment supersedes all previously published reports effective as of April 5, 2024.

ABTC | www.americanbatterytechnology.com.

Alternative Energies May 15, 2023

The United States is slow to anger, but relentlessly seeks victory once it enters a struggle, throwing all its resources into the conflict. “When we go to war, we should have a purpose that our people understand and support,” as former Secretary ....

Unleashing trillions of dollars for a resilient energy future is within our grasp — if we can successfully navigate investment risk and project uncertainties.

The money is there — so where are the projects?

A cleaner and more secure energy future will depend on tapping trillions of dollars of capital. The need to mobilize money and markets to enable the energy transition was one of the key findings of one of the largest studies ever conducted among the global energy sector C-suite. This will mean finding ways to reduce the barriers and uncertainties that prevent money from flowing into the projects and technologies that will transform the energy system. It will also mean fostering greater collaboration and alignment among key players in the energy space.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

These risks need to be addressed to create more appealing investment opportunities for both public and private sector funders. This will require smart policy and regulatory frameworks that drive returns from long-term investment into energy infrastructure. It will also require investors to recognize that resilient energy infrastructure is more than an ESG play — it is a smart investment in the context of doing business in the 21st century.

Make de-risking investment profiles a number one priority

According to the study, 80 percent of respondents believe the lack of capital being deployed to accelerate the transition is the primary barrier to building the infrastructure required to improve energy security. At the same time, investors are looking for opportunities to invest in infrastructure that meets ESG and sustainability criteria. This suggests an imbalance between the supply and demand of capital for energy transition projects.

How can we close the gap?

One way is to link investors directly to energy companies. Not only would this enable true collaboration and non-traditional partnerships, but it would change the way project financing is conceived and structured — ultimately aiding in potentially satisfying the risk appetite of latent but hugely influential investors, such as pension funds. The current mismatch of investor appetite and investable projects reveals a need for improving risk profiles, as well as a mindset shift towards how we bring investment and developer stakeholders together for mutual benefit. The circular dilemma remains: one sector is looking for capital to undertake projects within their skill to deploy, while another sector wonders where the investable projects are.

This conflict is being played out around the world; promising project announcements are made, only to be followed by slow progress (or no action at all). This inertia results when risks are compounded and poorly understood. To encourage collaboration between project developers and investors with an ESG focus, more attractive investment opportunities can be created by pulling several levers: public and private investment strategies, green bonds and other sustainable finance instruments, and innovative financing models such as impact investing.

Expedite permitting to speed the adoption of new technologies

Another effective strategy to de-risk investment profiles is found in leveraging new technologies and approaches that reduce costs, increase efficiency, and enhance the reliability of energy supply. Research shows that 62 percent of respondents indicated a moderate or significant increase in investment in new and transitional technologies respectively, highlighting the growing interest in innovative solutions to drive the energy transition forward.

Hydrogen, carbon capture and storage, large-scale energy storage, and smart grids are some of the emerging technologies identified by survey respondents as having the greatest potential to transform the energy system and create new investment opportunities. However, these technologies face challenges such as long lag times between conception and implementation.

If the regulatory environment makes sense, then policy uncertainty is reduced, and the all-important permitting pathways are well understood and can be navigated. Currently, the lack of clear, timely, and fit-for-purpose permitting is a major roadblock to the energy transition. To truly unleash the potential of transitional technologies requires the acceleration of regulatory systems that better respond to the nuance and complexity of such technologies (rather than the current one-size-fits all approach). In addition, permitting processes must also be expedited to dramatically decrease the period between innovation, commercialization, and implementation. One of the key elements of faster permitting is effective consultation with stakeholders and engagement with communities where these projects will be housed for decades. This is a highly complex area that requires both technical and communication skills.

The power of collaboration, consistency, and systems thinking

The report also reveals the need for greater collaboration among companies in the energy space to build a more resilient system. The report shows that, in achieving net zero, there is a near-equal split between those increasing investment (47 percent of respondents), and those decreasing investment (39 percent of respondents). This illustrates the complexity and diversity of the system around the world. A more resilient system will require all its components – goals and actions – to be aligned towards a common outcome.

Another way to de-risk the energy transition is to establish consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation. The energy transition depends on policy to guide its direction and speed by affecting how investors feel and how the markets behave. However, inconsistent or inadequate policy can also be a source of uncertainty and instability. For example, shifting political priorities, conflicting international standards, and the lack of market-based mechanisms can hinder the deployment of sustainable technologies, resulting in a reluctance to commit resources to long-term projects.

Variations in country-to-country deployment creates disparities in energy transition progress. For instance, the 2022 Inflation Reduction Act in the US has posed challenges for the rest of the world, by potentially channeling energy transition investment away from other markets and into the US. This highlights the need for a globally unified approach to energy policy that balances various national interests while addressing a global problem.

To facilitate the energy transition, it is imperative to establish stable, cohesive, and forward-looking policies that align with global goals and standards. By harmonizing international standards, and providing clear and consistent signals, governments and policymakers can generate investor confidence, helping to foster a robust energy ecosystem that propels the sector forward.

Furthermore, substantive and far-reaching discussions at international events like the United Nations Conference of the Parties (COP), are essential to facilitate this global alignment. These events provide an opportunity to de-risk the energy transition through consistent policy that enables countries to work together, ensuring that the global community can tackle the challenges and opportunities of the energy transition as a united front.

Keeping net-zero ambitions on track

Despite the challenges faced by the energy sector, the latest research reveals a key positive: 91 percent of energy leaders surveyed are working towards achieving net zero. This demonstrates a strong commitment to the transition and clear recognition of its importance. It also emphasizes the need to accelerate our efforts, streamline processes, and reduce barriers to realizing net-zero ambitions — and further underscores the need to de-risk energy transition investment by removing uncertainties.

The solution is collaborating and harmonizing our goals with the main players in the energy sector across the private and public sectors, while establishing consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation.

These tasks, while daunting, are achievable. They require vision, leadership, and action from all stakeholders involved. By adopting a new mindset about how we participate in the energy system and what our obligations are, we can stimulate the rapid progress needed on the road to net zero.

Dr. Tej Gidda (Ph.D., M.Sc., BSc Eng) is an educator and engineer with over 20 years of experience in the energy and environmental fields. As GHD Global Leader – Future Energy, Tej is passionate about moving society along the path towards a future of secure, reliable, and affordable low-carbon energy. His focus is on helping public and private sector clients set and deliver on decarbonization goals in order to achieve long-lasting positive change for customers, communities, and the climate. Tej enjoys fostering the next generation of clean energy champions as an Adjunct Professor at the University of Waterloo Department of Civil and Environmental Engineering.

GHD | www.ghd.com

The Kincardine floating wind farm, located off the east coast of Scotland, was a landmark development: the first commercial-scale project of its kind in the UK sector. Therefore, it has been closely watched by the industry throughout its installation. With two of the turbines now having gone through heavy maintenance, it has also provided valuable lessons into the O&M processes of floating wind projects.

In late May, the second floating wind turbine from the five-turbine development arrived in the port of Massvlakte, Rotterdam, for maintenance. An Anchor Handling Tug Supply (AHTS)

vessel was used to deliver the KIN-02 turbine two weeks after a Platform Supply Vessel (PSV) and AHTS had worked to disconnect the turbine from the wind farm site. The towing vessel became the third vessel used in the operation.

This is not the first turbine disconnected from the site and towed for maintenance. In the summer of 2022, KIN-03 became the world’s first-ever floating wind turbine that required heavy maintenance (i.e. being disconnected and towed for repair). It was also towed from Scotland to Massvlakte.

Each of these operations has provided valuable lessons for the ever-watchful industry in how to navigate the complexities of heavy maintenance in floating wind as the market segment grows.

The heavy maintenance process

When one of Kincardine’s five floating 9.5 MW turbines (KIN-03) suffered a technical failure in May 2022, a major technical component needed to be replaced. The heavy maintenance strategy selected by the developer and the offshore contractors consisted in disconnecting and towing the turbine and its floater to Rotterdam for maintenance, followed by a return tow and re-connection. All of the infrastructure, such as crane and tower access, remained at the quay following the construction phase. (Note, the following analysis only covers KIN-03, as details of the second turbine operation are not yet available).

Comparing the net vessel days for both the maintenance and the installation campaigns at this project highlights how using a dedicated marine spread can positively impact operations.

For this first-ever operation, a total of 17.2 net vessel days were required during turbine reconnection—only a slight increase on the 14.6 net vessel days that were required for the first hook-up operation performed during the initial installation in 2021. However, it exceeds the average of eight net vessel days during installation. The marine spread used in the heavy maintenance operation differed from that used during installation. Due to this, it did not benefit from the learning curve and experience gained throughout the initial installation, which ultimately led to the lower average vessel days.

The array cable re-connection operation encountered a similar effect. The process was performed by one AHTS that spent 10 net vessel days on the operation. This compares to the installation campaign, where the array cable second-end pull-in lasted a maximum of 23.7 hours using a cable layer.

Overall, the turbine shutdown duration can be broken up as 14 days at the quay for maintenance, 52 days from turbine disconnection to turbine reconnection, and 94 days from disconnection to the end of post-reconnection activities.

What developers should keep in mind for heavy maintenance operations

This analysis has uncovered two main lessons developers should consider when planning a floating wind project: the need to identify an appropriate O&M port, and to guarantee that a secure fleet is available.

Floating wind O&M operations require a port with both sufficient room and a deep-water quay. The port must also be equipped with a heavy crane with sufficient tip height to accommodate large floaters and reach turbine elevation. Distance to the wind farm should also be taken into account, as shorter distances will reduce towing time and, therefore, minimize transit and non-productive turbine time.

During the heavy maintenance period for KIN-03 and KIN-02, the selected quay (which had also been utilized in the initial installation phase of the wind farm project), was already busy as a marshalling area for other North Sea projects. This complicated the schedule significantly, as the availability of the quay and its facilities had to be navigated alongside these other projects. This highlights the importance of abundant quay availability both for installation (long-term planning) and maintenance that may be needed on short notice.

At the time of the first turbine’s maintenance program (June 2022), the North Sea AHTS market was in an exceptional situation: the largest bollard pull AHTS units contracted at over $200,000 a day, the highest rate in over a decade.

During this time, the spot market was close to selling out due to medium-term commitments, alongside the demand for high bollard pull vessels for the installation phase at a Norwegian floating wind farm project. The Norwegian project required the use of four AHTS above a 200t bollard pull. With spot rates ranging from $63,000 to $210,000 for the vessels contracted for Kincardine’s maintenance, the total cost of the marine spread used in the first repair campaign was more than $4 million.

Developers should therefore consider the need to structure maintenance contracts with AHTS companies, either through frame agreements or long-term charters, to decrease their exposure to spot market day rates as the market tightens in the future.

While these lessons are relevant for floating wind developers now, new players are looking towards alternative heavy O&M maintenance options for the future. Two crane concepts are especially relevant in this instance. The first method is for a crane to be included in the turbine nacelle to be able to directly lift the component which requires repair from the floater, as is currently seen on onshore turbines. This method is already employed in onshore turbines and could be applicable for offshore. The second method is self-elevating cranes with several such solutions already in development.

The heavy maintenance operations conducted on floating turbines at the Kincardine wind farm have provided invaluable insights for industry players, especially developers. The complex process of disconnecting and towing turbines for repairs highlights the need for meticulous planning and exploration of alternative maintenance strategies, some of which are already in the pipeline. As the industry evolves, careful consideration of ports, and securing fleet contracts, will be crucial in driving efficient and cost-effective O&M practices for the floating wind market.

Sarah McLean is Market Research Analyst at Spinergie, a maritime technology company specializing in emission, vessel performance, and operation optimization.

Spinergie | www.spinergie.com

According to the Energy Information Administration (EIA), developers plan to add 54.5 gigawatts (GW) of new utility-scale electric generating capacity to the U.S. power grid in 2023. More than half of this capacity will be solar. Wind power and battery storage are expected to account for roughly 11 percent and 17 percent, respectively.

A large percentage of new installations are being developed in areas that are prone to extreme weather events and natural disasters (e.g., Texas and California), including high wind, tornadoes, hail, flooding, earthquakes, wildfires, etc. With the frequency and severity of many of these events increasing, project developers, asset owners, and tax equity partners are under growing pressure to better understand and mitigate risk.

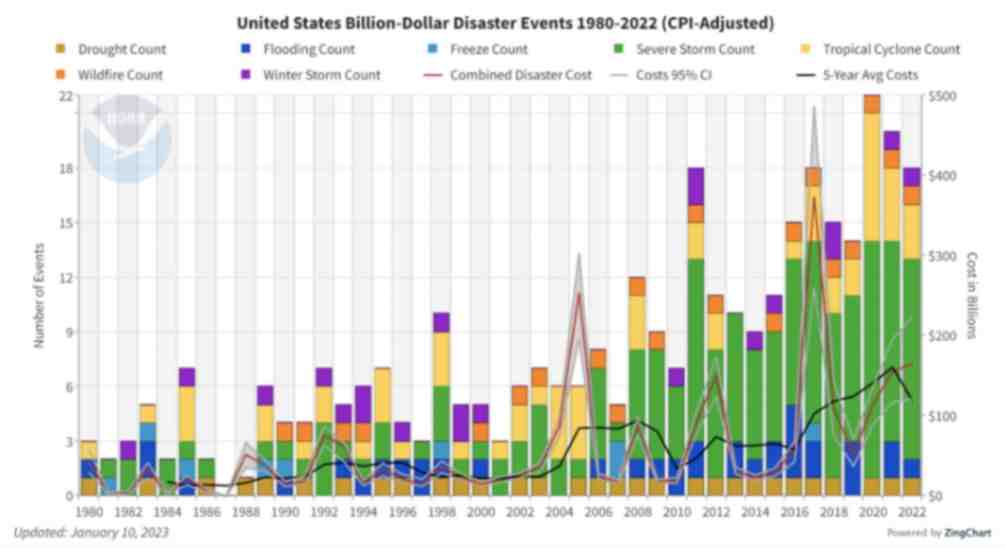

Figure 1. The history of billion-dollar disasters in the United States each year from 1980 to 2022 (source: NOAA)

In terms of loss prevention, a Catastrophe (CAT) Modeling Study is the first step to understanding the exposure and potential financial loss from natural hazards or extreme weather events. CAT studies form the foundation for wider risk management strategies, and have significant implications for insurance costs and coverage.

Despite their importance, developers often view these studies as little more than a formality required for project financing. As a result, they are often conducted late in the development cycle, typically after a site has been selected. However, a strong case can be made for engaging early with an independent third party to perform a more rigorous site-specific technical assessment. Doing so can provide several advantages over traditional assessments conducted by insurance brokerage affiliates, who may not possess the specialty expertise or technical understanding needed to properly apply models or interpret the results they generate. One notable advantage of early-stage catastrophe studies is to help ensure that the range of insurance costs, which can vary from year to year with market forces, are adequately incorporated into the project financial projections.

The evolving threat of natural disasters

Over the past decade, the financial impact of natural hazard events globally has been almost three trillion dollars. In the U.S. alone, the 10-year average annual cost of natural disaster events exceeding $1 billion increased more than fourfold between the 1980s ($18.4 billion) and the 2010s ($84.5 billion).

Investors, insurers, and financiers of renewable projects have taken notice of this trend, and are subsequently adapting their behavior and standards accordingly. In the solar market, for example, insurance premiums increased roughly four-fold from 2019 to 2021. The impetus for this increase can largely be traced back to a severe storm in Texas in 2019, which resulted in an $80 million loss on 13,000 solar panels that were damaged by hail.

The event awakened the industry to the hazards severe storms present, particularly when it comes to large-scale solar arrays. Since then, the impact of convective weather on existing and planned installations has been more thoroughly evaluated during the underwriting process. However, far less attention has been given to the potential for other natural disasters; events like floods and earthquakes have not yet resulted in large losses and/or claims on renewable projects (including wind farms). The extraordinary and widespread effect of the recent Canadian wildfires may alter this behavior moving forward.

A thorough assessment, starting with a CAT study, is key to quantifying the probability of their occurrence — and estimating potential losses — so that appropriate measures can be taken to mitigate risk.

All models are not created equal

Industrywide, certain misconceptions persist around the use of CAT models to estimate losses from an extreme weather event or natural disaster.

Often, the perception is that risk assessors only need a handful of model inputs to arrive at an accurate figure, with the geographic location being the most important variable. While it’s true that many practitioners running models will pre-specify certain project characteristics regardless of the asset’s design (for example, the use of steel moment frames without trackers for all solar arrays in a given region or state), failure to account for even minor details can lead to loss estimates that are off by multiple orders of magnitude.

The evaluation process has recently become even more complex with the addition of battery energy storage. Relative to standalone solar and wind farms, very little real-world experience and data on the impact of extreme weather events has been accrued on these large-scale storage installations. Such projects require an even greater level of granularity to help ensure that all risks are identified and addressed.

Even when the most advanced modeling software tools are used (which allow for thousands of lines of inputs), there is still a great deal that is subject to interpretation. If the practitioner does not possess the expertise or technical ability needed to understand the model, the margin for error can increase substantially. Ultimately, this can lead to overpaying for insurance. Worse, you may end up with a policy with insufficient coverage. In both cases, the profitability of the asset is impacted.

Supplementing CAT studies

In certain instances, it may be necessary to supplement CAT models with an even more detailed analysis of the individual property, equipment, policies, and procedures. In this way, an unbundled risk assessment can be developed that is tailored to the project. Supplemental information (site-specific wind speed studies and hydrological studies, structural assessment, flood maps, etc.) can be considered to adjust vulnerability models.

This provides an added layer of assurance that goes beyond the pre-defined asset descriptions in the software used by traditional studies or assessments. By leveraging expert elicitations, onsite investigations, and rigorous engineering-based methods, it is possible to discretely evaluate asset-specific components as part of the typical financial loss estimate study: this includes Normal Expected Loss (NEL), also known as Scenario Expected Loss (SEL); Probable Maximum Loss (PML), also known as Scenario Upper Loss (SUL); and Probabilistic Loss (PL).

Understanding the specific vulnerabilities and consequences can afford project stakeholders unique insights into quantifying and prioritizing risks, as well as identifying proper mitigation recommendations.

Every project is unique

The increasing frequency and severity of natural disasters and extreme weather events globally is placing an added burden on the renewable industry, especially when it comes to project risk assessment and mitigation. Insurers have signaled that insurance may no longer be the main basis for transferring risk; traditional risk management, as well as site and technology selection, must be considered by developers, purchasers, and financiers.

As one of the first steps in understanding exposure and the potential capital loss from a given event, CAT studies are becoming an increasingly important piece of the risk management puzzle. Developers should treat them as such by engaging early in the project lifecycle with an independent third-party practitioner with the specialty knowledge, tools, and expertise to properly interpret models and quantify risk.

Hazards and potential losses can vary significantly depending on the project design and the specific location. Every asset should be evaluated rigorously and thoroughly to minimize the margin for error, and maximize profitability over its life.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

ABS Group | www.abs-group.com

Throughout my life and career as a real estate developer in New York City, I’ve had many successes. In what is clearly one of my most unusual development projects in a long career filled with them, I initiated the building of a solar farm to help t....

I’m just going to say it, BIPV is dumb. Hear me out…. Solar is the most affordable form of energy that has ever existed on the planet, but only because the industry has been working towards it for the past 15 years. Governments,....

Heat waves encircled much of the earth last year, pushing temperatures to their highest in recorded history. The water around Florida was “hot-tub hot” — topping 101° and bleaching and killing coral in waters around the peninsula. Phoenix had ....

Wind turbines play a pivotal role in the global transition to sustainable energy sources. However, the harsh environmental conditions in which wind turbines operate, such as extreme temperatures, high humidity, and exposure to various contaminants, p....

Wind energy remains the leading non-hydro renewable technology, and one of the fastest-growing of all power generation technologies. The key to making wind even more competitive is maximizing energy production and efficiently maintaining the assets. ....

The allure of wind turbines is undeniable. For those fortunate enough to visit these engineering marvels, it’s an experience filled with awe and learning. However, the magnificence of these structures comes with inherent risks, making safety an abs....

Battery energy storage is a critical technology to reducing our dependence on fossil fuels and build a low carbon future. Renewable energy generation is fundamentally different from traditional fossil fuel energy generation in that energy cannot be p....

Not enough people know that hydrogen fuel cells are a zero-emission energy technology. Even fewer know water vapor's outsized role in electrochemical processes and reactions. Producing electricity through a clean electrochemical process with water....

In the ever-evolving landscape of sustainable transportation, a ground-breaking shift is here: 2024 ushers in a revolutionary change in Electric Vehicle (EV) tax credits in the United States. Under the Inflation Reduction Act (IRA), a transforma....

Now more than ever, it would be difficult to overstate the importance of the renewable energy industry. Indeed, it seems that few other industries depend as heavily on constant and rapid innovation. This industry, however, is somewhat unique in its e....

University of Toronto’s latest student residence welcomes the future of living with spaces that are warmed by laptops and shower water. In September 2023, one of North America’s largest residential passive homes, Harmony Commons, located....

For decades, demand response (DR) has proven a tried-and-true conservation tactic to mitigate energy usage during peak demand hours. Historically, those peak demand hours were relatively predictable, with increases in demand paralleling commuter and ....