GE Vernova's Grid Solutions business (NYSE: GEV), a leader in advanced grid technologies, and Sonelgaz, Algeria's national electricity and gas company, are expanding existing capabilities at GE Algeria Turbines (GEAT) for the deployment of grid solutions. This strategic agreement, effectuated through the amendment of their existing joint venture,represents a significant step towards achieving Algeria's energy objectives. It demonstrates a shared commitment to accelerating sustainable energy development, localizing industrial capabilities, and promoting economic growth.

GEAT is a joint venture founded in 2014 between Sonelgaz and GE Vernova that has manufactured skids and turbine auxiliaries, as well as rolled out gas turbines, steam turbines, and control systems in Algeria from its state-of-the art facility in Ain Yagout, Batna. It is a one-of-a-kind facility for GE Vernova on the African continent.

Given the development needs of Algerian power grids, Sonelgaz and GE Vernova agreed, under an amendment to the shareholders’ agreement entered into in 2014, to diversify GEAT's core business by directing it towards the manufacture of high and extra-high voltage substations. Other power grid automation equipment and solutions for efficient and reliable power transmission are also expected to be supplied by the joint venture, enabling the integration and complementary use of renewable energy sources.

The localization of this industrial production has the potential to further strengthen national engineering capacities and create additional job opportunities in Algeria. This collaboration with GE Vernova's Grid Solutions business marks an important step in Algeria's energy transition, as well as in the development of the country's capacity to produce equipment for the transmission grid. It is the cornerstone of contributions by both parties Sonelgaz and GE Vernova to improve the infrastructure of the Algerian network, ensure better access to electricity transmission facilities throughout the country, improve efficiency and enable the connection of renewable energy production facilities.

In his statement, Mr. Mourad Adjal, CEO of Sonelgaz emphasized, "In collaboration with GE Vernova, Sonelgaz is confident in both partners' abilities to build a more resilient and efficient energy grid for the future. This new trajectory of collaboration between the two parties, which is in line with the orientations of the country's highest authorities in terms of national integration, will enable the progressive domiciliation of the manufacture of equipment and materials (high and very high voltages) for electricity transmission structures. This means the transfer of knowledge, know-how and expertise in these fields, which is totally new in our country, as well as an increase in the national potential for exporting this type of equipment in the long term, which will contribute considerably to reducing the country's import bill.”

Philippe Piron, President and CEO of GE Vernova's Electrification Systems businesses, said, “We are honored to expand our relationship with Sonelgaz. Through this collaboration, we aim to roll out advanced Grid Solutions technologies in Algeria, which will modernize the country's grid, enhance its efficiency, and accelerate the country's energy transition. By expanding our relationship to include grid solutions, we are committed not only to localizing grid production but also to fostering the growth of local talent and creating job opportunities.”

With almost 50 million inhabitants spread across Africa’s largest country by area, Algeria is diversifying its energy mix to include renewable sources, such as solar and wind, to meet the growing demand for energy and transition to a lower-carbon future. The grid will play a crucial role by enabling the efficient transmission and distribution of electricity from these renewable sources, ensuring a reliable and sustainable energy supply for Algeria's growing population and economy. The expansion of the GE Vernova and Sonelgaz relationship at GEAT also aligns with Algeria's vision to enhance its grid infrastructure to accommodate increasing power generation capacity and to export excess power to neighboring countries.

GE Vernova spun-off from GE (NYSE: GE) and began trading as an independent company on the New York Stock Exchange (NYSE) on April 2, 2024. In addition to the GEAT joint venture with Sonelgaz, the company has a strong legacy of contributions to the development of Algeria’s energy sector, providing power generation, transmission, and distribution solutions, as well as digital applications, and employs over 300 people in the country.

GE Vernova | https://www.gevernova.com/

EV Connect, Flash, and Qmerit—pioneers in the electric vehicle (EV) charging, parking technology, and EV implementation and maintenance fields, respectively—announced a partnership that will accelerate the expansion of EV charging solutions by uniting an integrated charging management platform by EV Connect, the scale of Flash’s North American digital infrastructure, and the installation, integration, and maintenance services offered by Qmerit. The companies are combining these services to provide a seamless, reservable parking and charging experience for drivers while simplifying management for asset owners and operators. In doing so, the partners address the issues of management, reliability, discoverability, and usability that have slowed the nation’s transition to EVs.

Each partner will contribute their specialized technology and services: Flash’s innovative cloud-based parking technology ecosystem with over 10,000 parking assets and digital demand network exceeding 100 million drivers via native partner integrations; EV Connect’s leading software platform and services for electric vehicle charging networks; and Qmerit’s leading expertise in electrification infrastructure, installation and maintenance services.

EV drivers using Flash’s network through one of its many native integrations will now be able to access chargers on the EV Connect network and vice versa. This allows users to predictably and reliably find, reserve, access, and pay for charging when they park, all via a single platform and a single payment. The integration will likewise tie together the various aspects of parking- and charging management by giving asset owners and operators one hassle-free platform supported by Qmerit’s installation and service options.

The Problem: a Charging Crisis

The rapid and accelerating adoption of EVs in the United States—EV sales in 2023 were up more than 50% from the previous year—presents a significant problem: the expansion of the nationwide EV charging network must outpace demand or become a limiting factor for electrification as a whole. Much of the focus on closing this gap is concerned with public, government-funded charging infrastructure, which must exceed a forecasted 1.2 million chargers by 2030 in order to support demand, per the National Renewable Energy Laboratory. The same report calls for 28 million private chargers, including the commercial sector, which must evidently bear the vast majority of the EV charging burden. To reach those goals, the existing charger network will have to increase twenty-fold.

“The transition to EV in this decade requires all-hands-on-deck, especially as the next generation of EV adopters make the switch, and we can’t rely on public charging infrastructure alone,” said Dan Sharplin, CEO at Flash. “Facilities with private parking, from retail and hospitality to events and community venues, are a key part of the solution, and must be prepared to meet EV driver expectations.”

The EV charging crisis can be attributed to a wide range of causes, not the least of which are a lack in quality and ease-of-use. The inconvenience of finding an accessible parking spot with a well-functioning charger deters consumers, making them less likely to value or use the installed base of private-sector chargers. This, in turn, has discouraged investment by commercial operators who may be reluctant to take on the management and maintenance of a charging system.

The Solution: Streamlined Parking, Charging, and Maintenance Experience

Making the EV experience more convenient, accessible, predictable, and reliable will minimize the friction experienced by drivers and encourage the adoption of EV charging systems on commercial properties—a clear necessity for overcoming the charging crisis at large. The partnership between EV Connect, Flash, and Qmerit is designed to serve as an important part of that solution, while enhancing the return on investment for the commercial sector.

"Our state-of-the-art EV charging technology is a key component to driving this partnership forward, representing a significant leap with unmatched reliability, performance and uptime through our Network Operations Center and round-the-clock customer support," said Daniel Bryant, VP of Customer Operations for EV Connect.

Beyond the task of connecting the driver with accessible parking-and-charging stations, fulfilled by Flash, high-quality, well-managed, and thoroughly-maintained equipment is essential for growing the charging network. EV Connect will help ensure station reliability and access with comprehensive management and customer service, while Qmerit will provide private operators with the installation and maintenance support they need.

"We're excited to bring our top-tier implementation and maintenance services to this partnership, laying the foundation for a robust and efficient charging network. With a 26% increase in publicly available EV chargers and a 59% surge in EV sales in the first three quarters of 2023, as reported by J.D. Power, our partnership aims to expand reservable infrastructure, catering to the rising demand for combined parking and charging solutions,” said Tracy Price, founder and CEO of Qmerit.

What Comes Next?

Over the next 12 months, a series of new agreements with major operators in the hospitality, events, and mixed-use sectors will be announced, together with details about where and when the unified system of parking and charging will be made available to the public. As a result, it is expected that thousands of new ports will be installed this year.

EV Connect | www.evconnect.com

Flash | www.flashparking.com

Qmerit | https://qmerit.com/

ABB announced a minority investment in GridBeyond, a leading technology player providing energy management solutions based on artificial intelligence and data science that will enable our customers to optimize distributed energy resources and industrial loads. The investment was made through ABB’s Technology Ventures unit.

This newly formed strategic partnership will contribute to the continued expansion of ABB’s sustainability advisory services portfolio, and help customers and operators across utilities, industry, infrastructure and transportation to transition to net zero.

Based in Ireland, GridBeyond works with over 900 clients across four continents to deliver technological solutions to the world’s energy challenges. Through its AI platform, GridBeyond enables its customers to precisely control the energy consumption profiles of their assets, allowing them to unlock new revenue streams, deliver energy and cost savings, optimize production processes and increase resilience by predicting and preventing system failures.

“Our investment in GridBeyond reflects our commitment to driving technological innovations and creating an ecosystem of partners to enable customers’ energy transition to net zero,” said Stuart Thompson, President, ABB Electrification Service.

“We are helping to transform the way industries generate, distribute and consume energy. We greatly look forward to working with GridBeyond’s team of experts to help drive their next phase of growth.”

Michael Phelan, Chief Executive Officer and Co-founder of GridBeyond, added: “We are delighted to complete this transaction. This funding, together with the support of our new partners, will enable us to expand our product offering and strengthen our leadership position in this space.

“Increasing the reach of our intelligent energy platform to deliver world-class AI and powerful automation capabilities to smart grid and energy markets, supports our ambition to advance the transition of the global energy networks towards digitalization, decarbonization, and decentralization.”

ABB joins investors EDP, ESB, TotalEnergies, Act and DublinBIC. Financial terms of the transaction were not disclosed.

ABB Electrification | https://electrification.us.abb.com/

GridBeyond | https://gridbeyond.com/

UGE International Ltd. (TSXV: UGE) (OTCQB: UGEIF) (the "Company" or "UGE"), a leader in commercial and community solar, announces that it has reached the 'Notice to Proceed' (NTP) milestone for its 847kW rooftop community solar project in Queens, New York. The NTP milestone indicates that financing for the project has closed and all necessary permits and interconnection approvals for the project are in place.

The project will be built atop a new 249,675-square-foot warehouse and parking facility in College Point, Queens that is developed and owned by New York City-based real estate developer Wildflower Ltd LLC. Once the project reaches commercial operation, it will be UGE's sixth solar project completed with Wildflower, with a seventh under construction and an eighth in development.

"Our long-term partnership with UGE supports Wildflower's mission to create innovative, sustainable and socially beneficial physical infrastructure in New York City," said Adam Gordon, Managing Partner of Wildflower. "We are pleased to be bringing yet another community solar project to life with UGE."

Each year, the project will offset over 1,000 metric tons (roughly 2.5 million pounds) of CO2 emissions, the equivalent produced by burning nearly 125,000 gallons of gasoline. At 847kW it will produce enough electricity to power more than 200 homes.

UGE will reserve 50% of the project's energy output for Low- to Moderate-Income (LMI) subscribers, allowing these households and businesses to save upwards of 10% on their electricity costs. As electricity rates continue to rise across the country, these savings become increasingly meaningful for Americans looking for ways to save money in today's inflationary environment.

UGE had the College Point project appraised by a third party for a fair market value of USD$2.7 million or USD$3.14/watt.

Having reached NTP, the College Point project will now enter deployment and construction - the final phase before reaching commercial operation. UGE now has 9 projects totaling 18.6MW in this final development phase. Once complete, these projects will join UGE's operating portfolio, which currently stands at 6.6MW. The College Point project is projected to reach commercial operation this summer.

UGE | www.ugei.com

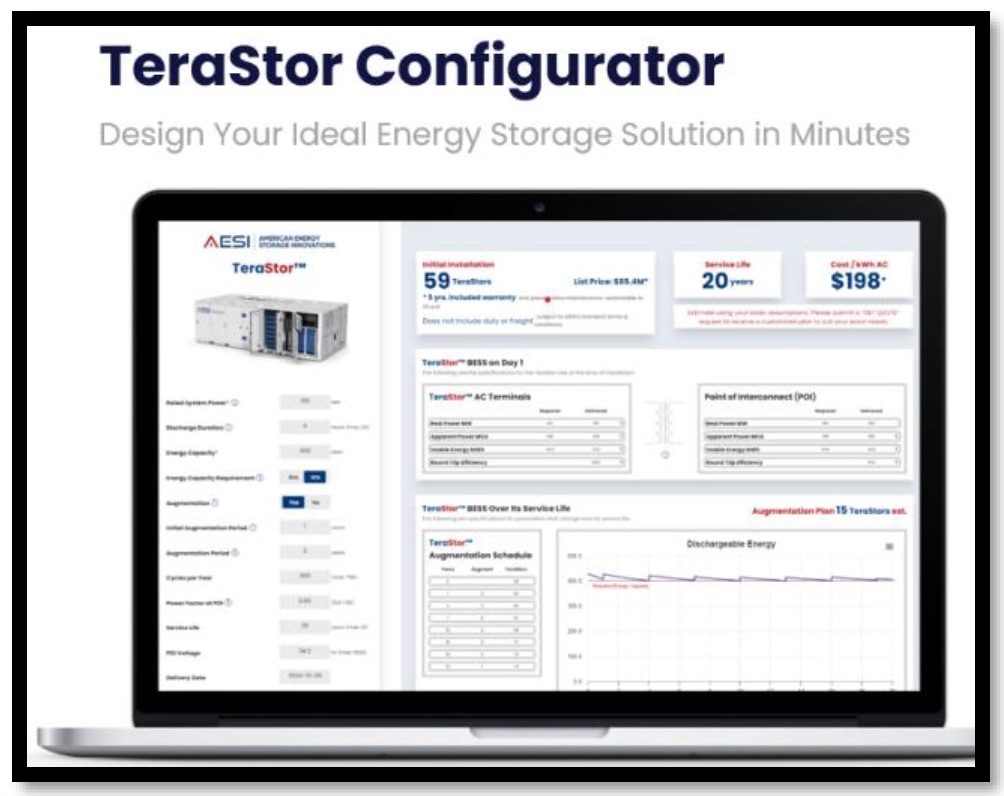

American Energy Storage Innovations, Inc. (AESI), a leading provider of ultra-dense, safe, efficient and reliable energy storage solutions (ESS), announced the launch of a revolutionary online tool that empowers users to design their ideal TeraStor configuration in minutes.

AESI is committed to the highest level of transparency and developed the configurator tool to streamline the planning process for energy storage, addressing common pain points. Users can click the new “configure” button on the TeraStor product page to launch the tool, currently available on all devices larger than a standard mobile phone.

AESI is committed to the highest level of transparency and developed the configurator tool to streamline the planning process for energy storage, addressing common pain points. Users can click the new “configure” button on the TeraStor product page to launch the tool, currently available on all devices larger than a standard mobile phone.

Revolutionizing the Way Customers Select and Purchase Energy Storage

The TeraStor Configurator simplifies the energy storage selection and estimation process, eliminating the guesswork and frustration often associated with traditional methods. Users can now:

“The TeraStor Configurator is a game-changer for anyone evaluating various options for this efficient and reliable energy storage solution,” said Bud Collins, CEO of AESI. “We believe that everyone deserves the power to harness the potential of clean energy, and this tool makes it easier than ever before to estimate the right TeraStor configuration for their specific project’s needs.”

The TeraStor Configurator: Transforming the Energy Storage Experience

The TeraStor Configurator represents a significant step forward in the energy storage industry, offering:

Over the coming months, AESI will be rolling out many tool enhancements including additional parameter levers and a state-of-the-art 3D visualization tool that will enable customers to see the resulting layout on their exact site or in realistic virtual settings.

Ready to configure your dream energy storage solution? Launch the TeraStor Configurator today by clicking the “configure” button at https://www.aesi-ess.com/terastor/

American Energy Storage Innovations | https://aesi-ess.com/

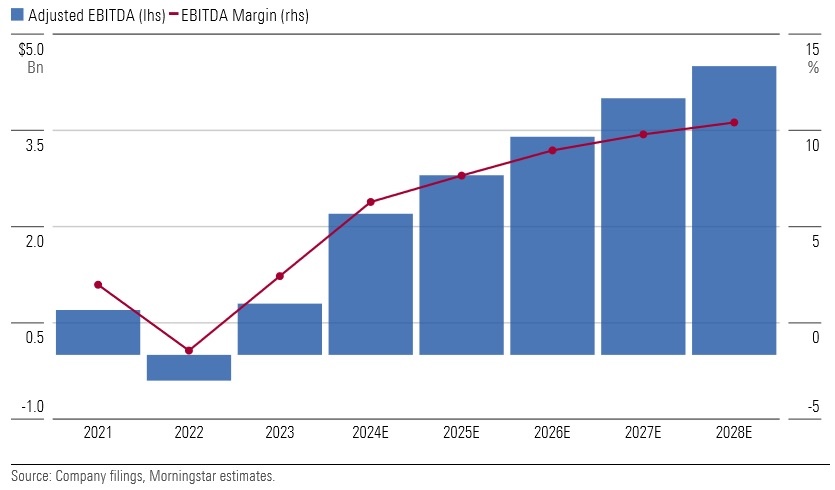

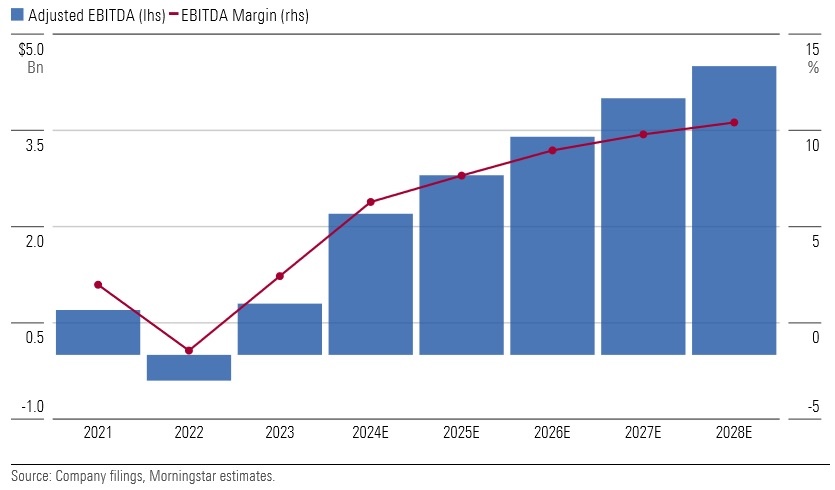

GE Vernoa is a global power generation behemoth, with its installed base accounting for 30% of the world’s power generation. Despite the company’s leading market position, its past financial results have been underwhelming, and adjusted earnings margins have trended near break-even levels over the past three years. According to Morningstar’s recently published “GE Vernova: 10 Key Takeaways” report, however, GE Vernova can close the gap between its market position and financial performance. By 2028, Morningstar expects adjusted earnings margins will slightly surpass the company’s target of 10%.

The below graph shows GE Vernova’s expected earnings before interest, taxes, depreciation, and amortization through 2028.

Key takeaways from the report include:

GE Vernova | https://www.gevernova.com/

BoxPower is set to revolutionize rural energy systems in California, thanks to a significant grant from the California Energy Commission (CEC) under the Electric Program Investment Charge (EPIC) program. This funding will dramatically enhance BoxPower's manufacturing capabilities, enabling faster production times and the standardization of modular subsystems for its Remote Grid SolarContainer.

This grant accelerates the deployment of the SolarContainer, a robust microgrid solution that integrates solar PV, energy storage, and backup generation into one unit. Designed to replace traditional power infrastructure in areas at high risk of wildfires and outages, the SolarContainer offers a resilient, cost-effective, and environmentally friendly alternative that supports California's clean energy goals.

The enhancement of production capabilities means BoxPower can more quickly meet the needs of rural communities, setting a new standard for rural electrification that can be replicated nationwide, ensuring more communities benefit from reliable and sustainable energy. We believe this story will engage your readers because it highlights significant advancements in unique clean energy solutions and rural infrastructure resilience.

BoxPower | www.boxpower.io

Alternative Energies May 15, 2023

The United States is slow to anger, but relentlessly seeks victory once it enters a struggle, throwing all its resources into the conflict. “When we go to war, we should have a purpose that our people understand and support,” as former Secretary ....

Unleashing trillions of dollars for a resilient energy future is within our grasp — if we can successfully navigate investment risk and project uncertainties.

The money is there — so where are the projects?

A cleaner and more secure energy future will depend on tapping trillions of dollars of capital. The need to mobilize money and markets to enable the energy transition was one of the key findings of one of the largest studies ever conducted among the global energy sector C-suite. This will mean finding ways to reduce the barriers and uncertainties that prevent money from flowing into the projects and technologies that will transform the energy system. It will also mean fostering greater collaboration and alignment among key players in the energy space.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

These risks need to be addressed to create more appealing investment opportunities for both public and private sector funders. This will require smart policy and regulatory frameworks that drive returns from long-term investment into energy infrastructure. It will also require investors to recognize that resilient energy infrastructure is more than an ESG play — it is a smart investment in the context of doing business in the 21st century.

Make de-risking investment profiles a number one priority

According to the study, 80 percent of respondents believe the lack of capital being deployed to accelerate the transition is the primary barrier to building the infrastructure required to improve energy security. At the same time, investors are looking for opportunities to invest in infrastructure that meets ESG and sustainability criteria. This suggests an imbalance between the supply and demand of capital for energy transition projects.

How can we close the gap?

One way is to link investors directly to energy companies. Not only would this enable true collaboration and non-traditional partnerships, but it would change the way project financing is conceived and structured — ultimately aiding in potentially satisfying the risk appetite of latent but hugely influential investors, such as pension funds. The current mismatch of investor appetite and investable projects reveals a need for improving risk profiles, as well as a mindset shift towards how we bring investment and developer stakeholders together for mutual benefit. The circular dilemma remains: one sector is looking for capital to undertake projects within their skill to deploy, while another sector wonders where the investable projects are.

This conflict is being played out around the world; promising project announcements are made, only to be followed by slow progress (or no action at all). This inertia results when risks are compounded and poorly understood. To encourage collaboration between project developers and investors with an ESG focus, more attractive investment opportunities can be created by pulling several levers: public and private investment strategies, green bonds and other sustainable finance instruments, and innovative financing models such as impact investing.

Expedite permitting to speed the adoption of new technologies

Another effective strategy to de-risk investment profiles is found in leveraging new technologies and approaches that reduce costs, increase efficiency, and enhance the reliability of energy supply. Research shows that 62 percent of respondents indicated a moderate or significant increase in investment in new and transitional technologies respectively, highlighting the growing interest in innovative solutions to drive the energy transition forward.

Hydrogen, carbon capture and storage, large-scale energy storage, and smart grids are some of the emerging technologies identified by survey respondents as having the greatest potential to transform the energy system and create new investment opportunities. However, these technologies face challenges such as long lag times between conception and implementation.

If the regulatory environment makes sense, then policy uncertainty is reduced, and the all-important permitting pathways are well understood and can be navigated. Currently, the lack of clear, timely, and fit-for-purpose permitting is a major roadblock to the energy transition. To truly unleash the potential of transitional technologies requires the acceleration of regulatory systems that better respond to the nuance and complexity of such technologies (rather than the current one-size-fits all approach). In addition, permitting processes must also be expedited to dramatically decrease the period between innovation, commercialization, and implementation. One of the key elements of faster permitting is effective consultation with stakeholders and engagement with communities where these projects will be housed for decades. This is a highly complex area that requires both technical and communication skills.

The power of collaboration, consistency, and systems thinking

The report also reveals the need for greater collaboration among companies in the energy space to build a more resilient system. The report shows that, in achieving net zero, there is a near-equal split between those increasing investment (47 percent of respondents), and those decreasing investment (39 percent of respondents). This illustrates the complexity and diversity of the system around the world. A more resilient system will require all its components – goals and actions – to be aligned towards a common outcome.

Another way to de-risk the energy transition is to establish consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation. The energy transition depends on policy to guide its direction and speed by affecting how investors feel and how the markets behave. However, inconsistent or inadequate policy can also be a source of uncertainty and instability. For example, shifting political priorities, conflicting international standards, and the lack of market-based mechanisms can hinder the deployment of sustainable technologies, resulting in a reluctance to commit resources to long-term projects.

Variations in country-to-country deployment creates disparities in energy transition progress. For instance, the 2022 Inflation Reduction Act in the US has posed challenges for the rest of the world, by potentially channeling energy transition investment away from other markets and into the US. This highlights the need for a globally unified approach to energy policy that balances various national interests while addressing a global problem.

To facilitate the energy transition, it is imperative to establish stable, cohesive, and forward-looking policies that align with global goals and standards. By harmonizing international standards, and providing clear and consistent signals, governments and policymakers can generate investor confidence, helping to foster a robust energy ecosystem that propels the sector forward.

Furthermore, substantive and far-reaching discussions at international events like the United Nations Conference of the Parties (COP), are essential to facilitate this global alignment. These events provide an opportunity to de-risk the energy transition through consistent policy that enables countries to work together, ensuring that the global community can tackle the challenges and opportunities of the energy transition as a united front.

Keeping net-zero ambitions on track

Despite the challenges faced by the energy sector, the latest research reveals a key positive: 91 percent of energy leaders surveyed are working towards achieving net zero. This demonstrates a strong commitment to the transition and clear recognition of its importance. It also emphasizes the need to accelerate our efforts, streamline processes, and reduce barriers to realizing net-zero ambitions — and further underscores the need to de-risk energy transition investment by removing uncertainties.

The solution is collaborating and harmonizing our goals with the main players in the energy sector across the private and public sectors, while establishing consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation.

These tasks, while daunting, are achievable. They require vision, leadership, and action from all stakeholders involved. By adopting a new mindset about how we participate in the energy system and what our obligations are, we can stimulate the rapid progress needed on the road to net zero.

Dr. Tej Gidda (Ph.D., M.Sc., BSc Eng) is an educator and engineer with over 20 years of experience in the energy and environmental fields. As GHD Global Leader – Future Energy, Tej is passionate about moving society along the path towards a future of secure, reliable, and affordable low-carbon energy. His focus is on helping public and private sector clients set and deliver on decarbonization goals in order to achieve long-lasting positive change for customers, communities, and the climate. Tej enjoys fostering the next generation of clean energy champions as an Adjunct Professor at the University of Waterloo Department of Civil and Environmental Engineering.

GHD | www.ghd.com

The Kincardine floating wind farm, located off the east coast of Scotland, was a landmark development: the first commercial-scale project of its kind in the UK sector. Therefore, it has been closely watched by the industry throughout its installation. With two of the turbines now having gone through heavy maintenance, it has also provided valuable lessons into the O&M processes of floating wind projects.

In late May, the second floating wind turbine from the five-turbine development arrived in the port of Massvlakte, Rotterdam, for maintenance. An Anchor Handling Tug Supply (AHTS)

vessel was used to deliver the KIN-02 turbine two weeks after a Platform Supply Vessel (PSV) and AHTS had worked to disconnect the turbine from the wind farm site. The towing vessel became the third vessel used in the operation.

This is not the first turbine disconnected from the site and towed for maintenance. In the summer of 2022, KIN-03 became the world’s first-ever floating wind turbine that required heavy maintenance (i.e. being disconnected and towed for repair). It was also towed from Scotland to Massvlakte.

Each of these operations has provided valuable lessons for the ever-watchful industry in how to navigate the complexities of heavy maintenance in floating wind as the market segment grows.

The heavy maintenance process

When one of Kincardine’s five floating 9.5 MW turbines (KIN-03) suffered a technical failure in May 2022, a major technical component needed to be replaced. The heavy maintenance strategy selected by the developer and the offshore contractors consisted in disconnecting and towing the turbine and its floater to Rotterdam for maintenance, followed by a return tow and re-connection. All of the infrastructure, such as crane and tower access, remained at the quay following the construction phase. (Note, the following analysis only covers KIN-03, as details of the second turbine operation are not yet available).

Comparing the net vessel days for both the maintenance and the installation campaigns at this project highlights how using a dedicated marine spread can positively impact operations.

For this first-ever operation, a total of 17.2 net vessel days were required during turbine reconnection—only a slight increase on the 14.6 net vessel days that were required for the first hook-up operation performed during the initial installation in 2021. However, it exceeds the average of eight net vessel days during installation. The marine spread used in the heavy maintenance operation differed from that used during installation. Due to this, it did not benefit from the learning curve and experience gained throughout the initial installation, which ultimately led to the lower average vessel days.

The array cable re-connection operation encountered a similar effect. The process was performed by one AHTS that spent 10 net vessel days on the operation. This compares to the installation campaign, where the array cable second-end pull-in lasted a maximum of 23.7 hours using a cable layer.

Overall, the turbine shutdown duration can be broken up as 14 days at the quay for maintenance, 52 days from turbine disconnection to turbine reconnection, and 94 days from disconnection to the end of post-reconnection activities.

What developers should keep in mind for heavy maintenance operations

This analysis has uncovered two main lessons developers should consider when planning a floating wind project: the need to identify an appropriate O&M port, and to guarantee that a secure fleet is available.

Floating wind O&M operations require a port with both sufficient room and a deep-water quay. The port must also be equipped with a heavy crane with sufficient tip height to accommodate large floaters and reach turbine elevation. Distance to the wind farm should also be taken into account, as shorter distances will reduce towing time and, therefore, minimize transit and non-productive turbine time.

During the heavy maintenance period for KIN-03 and KIN-02, the selected quay (which had also been utilized in the initial installation phase of the wind farm project), was already busy as a marshalling area for other North Sea projects. This complicated the schedule significantly, as the availability of the quay and its facilities had to be navigated alongside these other projects. This highlights the importance of abundant quay availability both for installation (long-term planning) and maintenance that may be needed on short notice.

At the time of the first turbine’s maintenance program (June 2022), the North Sea AHTS market was in an exceptional situation: the largest bollard pull AHTS units contracted at over $200,000 a day, the highest rate in over a decade.

During this time, the spot market was close to selling out due to medium-term commitments, alongside the demand for high bollard pull vessels for the installation phase at a Norwegian floating wind farm project. The Norwegian project required the use of four AHTS above a 200t bollard pull. With spot rates ranging from $63,000 to $210,000 for the vessels contracted for Kincardine’s maintenance, the total cost of the marine spread used in the first repair campaign was more than $4 million.

Developers should therefore consider the need to structure maintenance contracts with AHTS companies, either through frame agreements or long-term charters, to decrease their exposure to spot market day rates as the market tightens in the future.

While these lessons are relevant for floating wind developers now, new players are looking towards alternative heavy O&M maintenance options for the future. Two crane concepts are especially relevant in this instance. The first method is for a crane to be included in the turbine nacelle to be able to directly lift the component which requires repair from the floater, as is currently seen on onshore turbines. This method is already employed in onshore turbines and could be applicable for offshore. The second method is self-elevating cranes with several such solutions already in development.

The heavy maintenance operations conducted on floating turbines at the Kincardine wind farm have provided invaluable insights for industry players, especially developers. The complex process of disconnecting and towing turbines for repairs highlights the need for meticulous planning and exploration of alternative maintenance strategies, some of which are already in the pipeline. As the industry evolves, careful consideration of ports, and securing fleet contracts, will be crucial in driving efficient and cost-effective O&M practices for the floating wind market.

Sarah McLean is Market Research Analyst at Spinergie, a maritime technology company specializing in emission, vessel performance, and operation optimization.

Spinergie | www.spinergie.com

According to the Energy Information Administration (EIA), developers plan to add 54.5 gigawatts (GW) of new utility-scale electric generating capacity to the U.S. power grid in 2023. More than half of this capacity will be solar. Wind power and battery storage are expected to account for roughly 11 percent and 17 percent, respectively.

A large percentage of new installations are being developed in areas that are prone to extreme weather events and natural disasters (e.g., Texas and California), including high wind, tornadoes, hail, flooding, earthquakes, wildfires, etc. With the frequency and severity of many of these events increasing, project developers, asset owners, and tax equity partners are under growing pressure to better understand and mitigate risk.

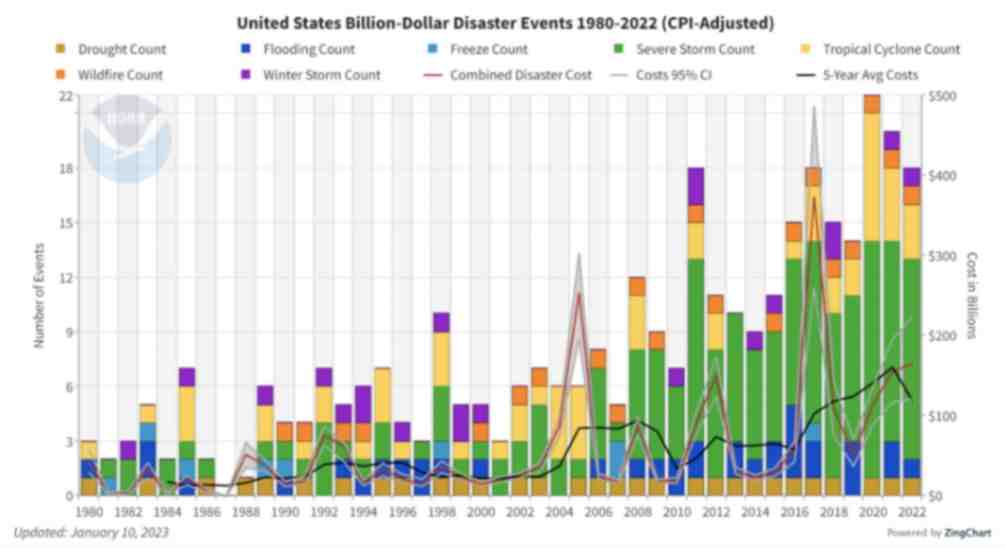

Figure 1. The history of billion-dollar disasters in the United States each year from 1980 to 2022 (source: NOAA)

In terms of loss prevention, a Catastrophe (CAT) Modeling Study is the first step to understanding the exposure and potential financial loss from natural hazards or extreme weather events. CAT studies form the foundation for wider risk management strategies, and have significant implications for insurance costs and coverage.

Despite their importance, developers often view these studies as little more than a formality required for project financing. As a result, they are often conducted late in the development cycle, typically after a site has been selected. However, a strong case can be made for engaging early with an independent third party to perform a more rigorous site-specific technical assessment. Doing so can provide several advantages over traditional assessments conducted by insurance brokerage affiliates, who may not possess the specialty expertise or technical understanding needed to properly apply models or interpret the results they generate. One notable advantage of early-stage catastrophe studies is to help ensure that the range of insurance costs, which can vary from year to year with market forces, are adequately incorporated into the project financial projections.

The evolving threat of natural disasters

Over the past decade, the financial impact of natural hazard events globally has been almost three trillion dollars. In the U.S. alone, the 10-year average annual cost of natural disaster events exceeding $1 billion increased more than fourfold between the 1980s ($18.4 billion) and the 2010s ($84.5 billion).

Investors, insurers, and financiers of renewable projects have taken notice of this trend, and are subsequently adapting their behavior and standards accordingly. In the solar market, for example, insurance premiums increased roughly four-fold from 2019 to 2021. The impetus for this increase can largely be traced back to a severe storm in Texas in 2019, which resulted in an $80 million loss on 13,000 solar panels that were damaged by hail.

The event awakened the industry to the hazards severe storms present, particularly when it comes to large-scale solar arrays. Since then, the impact of convective weather on existing and planned installations has been more thoroughly evaluated during the underwriting process. However, far less attention has been given to the potential for other natural disasters; events like floods and earthquakes have not yet resulted in large losses and/or claims on renewable projects (including wind farms). The extraordinary and widespread effect of the recent Canadian wildfires may alter this behavior moving forward.

A thorough assessment, starting with a CAT study, is key to quantifying the probability of their occurrence — and estimating potential losses — so that appropriate measures can be taken to mitigate risk.

All models are not created equal

Industrywide, certain misconceptions persist around the use of CAT models to estimate losses from an extreme weather event or natural disaster.

Often, the perception is that risk assessors only need a handful of model inputs to arrive at an accurate figure, with the geographic location being the most important variable. While it’s true that many practitioners running models will pre-specify certain project characteristics regardless of the asset’s design (for example, the use of steel moment frames without trackers for all solar arrays in a given region or state), failure to account for even minor details can lead to loss estimates that are off by multiple orders of magnitude.

The evaluation process has recently become even more complex with the addition of battery energy storage. Relative to standalone solar and wind farms, very little real-world experience and data on the impact of extreme weather events has been accrued on these large-scale storage installations. Such projects require an even greater level of granularity to help ensure that all risks are identified and addressed.

Even when the most advanced modeling software tools are used (which allow for thousands of lines of inputs), there is still a great deal that is subject to interpretation. If the practitioner does not possess the expertise or technical ability needed to understand the model, the margin for error can increase substantially. Ultimately, this can lead to overpaying for insurance. Worse, you may end up with a policy with insufficient coverage. In both cases, the profitability of the asset is impacted.

Supplementing CAT studies

In certain instances, it may be necessary to supplement CAT models with an even more detailed analysis of the individual property, equipment, policies, and procedures. In this way, an unbundled risk assessment can be developed that is tailored to the project. Supplemental information (site-specific wind speed studies and hydrological studies, structural assessment, flood maps, etc.) can be considered to adjust vulnerability models.

This provides an added layer of assurance that goes beyond the pre-defined asset descriptions in the software used by traditional studies or assessments. By leveraging expert elicitations, onsite investigations, and rigorous engineering-based methods, it is possible to discretely evaluate asset-specific components as part of the typical financial loss estimate study: this includes Normal Expected Loss (NEL), also known as Scenario Expected Loss (SEL); Probable Maximum Loss (PML), also known as Scenario Upper Loss (SUL); and Probabilistic Loss (PL).

Understanding the specific vulnerabilities and consequences can afford project stakeholders unique insights into quantifying and prioritizing risks, as well as identifying proper mitigation recommendations.

Every project is unique

The increasing frequency and severity of natural disasters and extreme weather events globally is placing an added burden on the renewable industry, especially when it comes to project risk assessment and mitigation. Insurers have signaled that insurance may no longer be the main basis for transferring risk; traditional risk management, as well as site and technology selection, must be considered by developers, purchasers, and financiers.

As one of the first steps in understanding exposure and the potential capital loss from a given event, CAT studies are becoming an increasingly important piece of the risk management puzzle. Developers should treat them as such by engaging early in the project lifecycle with an independent third-party practitioner with the specialty knowledge, tools, and expertise to properly interpret models and quantify risk.

Hazards and potential losses can vary significantly depending on the project design and the specific location. Every asset should be evaluated rigorously and thoroughly to minimize the margin for error, and maximize profitability over its life.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

ABS Group | www.abs-group.com

Throughout my life and career as a real estate developer in New York City, I’ve had many successes. In what is clearly one of my most unusual development projects in a long career filled with them, I initiated the building of a solar farm to help t....

I’m just going to say it, BIPV is dumb. Hear me out…. Solar is the most affordable form of energy that has ever existed on the planet, but only because the industry has been working towards it for the past 15 years. Governments,....

Heat waves encircled much of the earth last year, pushing temperatures to their highest in recorded history. The water around Florida was “hot-tub hot” — topping 101° and bleaching and killing coral in waters around the peninsula. Phoenix had ....

Wind turbines play a pivotal role in the global transition to sustainable energy sources. However, the harsh environmental conditions in which wind turbines operate, such as extreme temperatures, high humidity, and exposure to various contaminants, p....

Wind energy remains the leading non-hydro renewable technology, and one of the fastest-growing of all power generation technologies. The key to making wind even more competitive is maximizing energy production and efficiently maintaining the assets. ....

The allure of wind turbines is undeniable. For those fortunate enough to visit these engineering marvels, it’s an experience filled with awe and learning. However, the magnificence of these structures comes with inherent risks, making safety an abs....

Not enough people know that hydrogen fuel cells are a zero-emission energy technology. Even fewer know water vapor's outsized role in electrochemical processes and reactions. Producing electricity through a clean electrochemical process with water....

In the ever-evolving landscape of sustainable transportation, a ground-breaking shift is here: 2024 ushers in a revolutionary change in Electric Vehicle (EV) tax credits in the United States. Under the Inflation Reduction Act (IRA), a transforma....

The fact that EV charging is currently cheaper than filling up your traditional gas tank has set a precedent that public EV charging will always remain less expensive. This is certainly a good thing to support the adoption of EVs, but the high infras....

Now more than ever, it would be difficult to overstate the importance of the renewable energy industry. Indeed, it seems that few other industries depend as heavily on constant and rapid innovation. This industry, however, is somewhat unique in its e....

University of Toronto’s latest student residence welcomes the future of living with spaces that are warmed by laptops and shower water. In September 2023, one of North America’s largest residential passive homes, Harmony Commons, located....

For decades, demand response (DR) has proven a tried-and-true conservation tactic to mitigate energy usage during peak demand hours. Historically, those peak demand hours were relatively predictable, with increases in demand paralleling commuter and ....