New Berkeley Lab Study Identifies Several Demand-Side Decisions That Are Sensitive to High Variable Renewable Energy Futures

We are pleased to announce a new Berkeley Lab report, Impacts of High Variable Renewable Energy Futures on Electric-Sector Decision Making: Demand-Side Effects.

Previous work by the Berkeley Lab describes how high shares of variable renewable energy (VRE) such as wind and solar power could change wholesale electricity price dynamics. These include the timing of when electricity is cheap or expensive, locational differences in the cost of electricity, and the degree of regularity or predictability in those costs. Many decentralized decision-makers on the demand-side may not yet have considered the implications of these possible future changes.

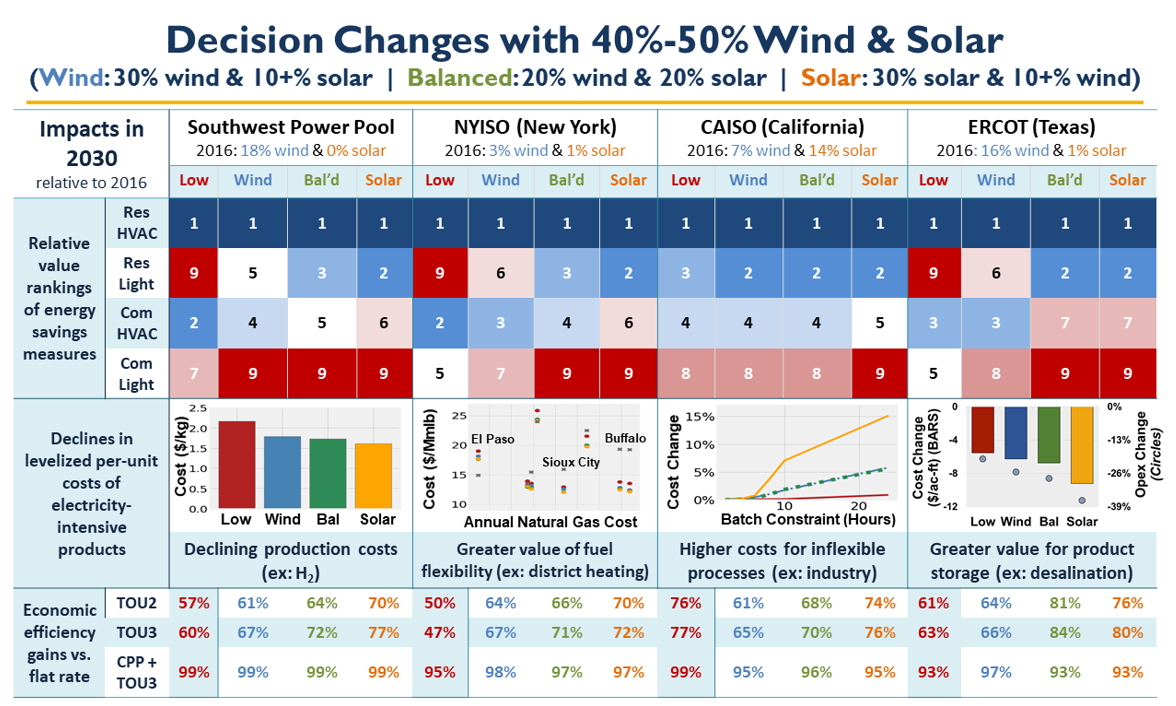

In this report, we evaluate the sensitivity of a set of demand-side decisions to different levels of VRE penetration ranging from a low of 5-20% to a high of 40-50%. The analysis builds on hourly wholesale energy and capacity prices in different VRE scenarios for four wholesale markets in the United States for the year 2030 (CAISO, ERCOT, NYISO, and SPP). The principal question for this exploration is whether private and public electric-sector decisions that are made based on assumptions reflecting low VRE levels still achieve their intended objective in a high VRE scenario with 40-50% wind and solar?

The technical report and accompanying slide deck can be downloaded here. A webinar summarizing key findings will be held on July 14 at 11 am Pacific Time (2 pm Eastern). Register for the free webinar here: https://lbnl.zoom.us/webinar/register/WN_uUYACAvfQ9mF7tCmriTb7Q

This scoping report evaluates the impacts of changing patterns of peak system needs on the benefits of demand reductions by examining the altered value of different energy efficiency (EE) measures. Similarly, we investigate new opportunities for large energy consumers that may arise from periods with very low wholesale electricity prices. We calculate the value of new process investments (e.g., hydrogen production and other generalized electro-commodities), showcase the varying value of new product storage investments (such as reservoir extensions at a desalination plant), and estimate the benefits of increased process flexibility that uses electricity as a process-input in addition to traditional fossil fuels (e.g., district energy systems). Finally, many decentralized decision-makers and end-use customers are not directly exposed to wholesale electricity prices but instead receive price signals from their retail electricity rates. As wind and solar shares increase, we compare the economic efficiency of flat retail rates relative to more dynamic time-of-use tariffs with and without critical peak-pricing events.

Energy Efficiency Program Design

One goal of energy efficiency (EE) program design is to develop cost-effective portfolios that lower overall system costs. An EE program designer's decision is the relative portfolio share of investments in individual EE measures such as residential lighting versus commercial heating, ventilation, and air conditioning (HVAC) efficiency.

We find that the relative ranking of valuable EE measures changes with increasing VRE penetration. In a low VRE environment, investments that provide load reductions during the middle of the day, such as commercial HVAC and commercial lighting EE, are very valuable. As growing solar generation shifts the timing of peak net demand into the early evening, however, their relative attractiveness diminish. The same shift in high prices into the early evening leads to an increase in the relative value of residential lighting measures. On the other hand, residential HVAC programs are highly ranked across all scenarios due to load reductions that span both afternoon peaks in the low VRE scenario and early evening peaks in the high VRE scenarios.

Opportunities for Large Energy Consumers

Increased frequency of very low-price events with high VRE scenarios can make several investments more attractive to large energy consumers assuming they can access wholesale electricity markets (or at least have retail rates that reflect the new price patterns).

We find opportunities for some industries that can use electricity to create new intermediate energy and chemical products. For commodities that use significant amounts of energy and have relatively low capital costs, the levelized cost of the product diverges strongly in low versus high VRE scenarios. In high VRE scenarios, cost optimal production shifts to periods of low electricity prices, enabling substantial savings in per-unit costs at the same time as optimal utilization rates fall. A case study looking at power-to-hydrogen (H2) production, for example, found that optimal utilization fell from 80 percent to only 27 percent in CAISO's high solar scenario resulting in production cost savings of up to 40 percent. Less flexible production processes that require longer consecutive batch runtimes may see lower savings. Similarly, commodities where capital costs represent the dominant share of all-in product costs will not see large changes in levelized cost between low and high VRE scenarios. The decision whether to produce such high capital cost commodities will consequently notsubstantially hinge on the potential pathway of VRE penetration levels. In general, industrial research efforts on lowering capital costs and increasing production flexibility may be more effective in high VRE futures relative to research focused on increasing process efficiency.

Other decisions by large energy consumers can also be sensitive to changing price patterns in high VRE scenarios. Many processes can deploy storage on the product end to manage price variability; perhaps even more cost-effectively than electricity storage, for example, in batteries. A case study examining brackish water desalination in El Paso, Texas, finds that operational savings from investing in additional clean water storage are nearly twice as high with growing VRE shares, especially in the high solar scenario (37 percent relative to about 20 percent in the low VRE scenario), and the optimal storage reservoir size nearly doubles. Finally, existing industrial processes that rely primarily on one or more fossil fuels (e.g., natural gas and oil) may benefit economically from the flexibility to switch the source of input energy to electricity during low price periods in a high VRE scenario.

Retail electricity rates seek a balance between providing transparent price signals to electricity consumers (economic efficiency) and maintaining relatively predictable and simple rate structures that customers can understand and respond to. Dynamic retail rates that reflect wholesale electricity prices with different time-of-use periods tend to be more efficient than flat rates; however, their relative benefit increases dramatically in high VRE scenarios (e.g., from an average factor of 2.8 in a low VRE scenario to 4.3 in a high VRE scenario). Growing wind and especially solar shares also have strong impacts on the best choice of peak versus off-peak periods that are used in time-of-use periods. It is important that dynamic rates be tailored to the VRE scenario. Optimizing high versus low price periods for a low VRE environment and not updating them regularly to reflect changing price patterns can lead to even worse economic efficiency than maintaining flat rates. Appropriately calibrated retail rates that feature, for example a new super-off peak period in the middle of the day, can bring large economic efficiency gains in a high solar scenario.

Lawrence Berkeley National Laboratory | emp.lbl.gov