India Poised to Become a Major Player in the EV Arena Forecasts IDTechEx

IDTechEx Analysts review the future of Energy Storage and Electric Vehicles in India. Find out more at the upcoming Business & Technology Insight Forums On Electric Vehicles and Energy Storage, 3 - 4 December 2019 in Stuttgart, Germany, hosted by IDTechEx.

Consumer wealth in India has risen sharply with the growth of industry and urbanization over the past two decades, transforming the way the South Asian country moves. Travelers who used to walk everywhere now zip around on fast and affordable scooters, and, to a lesser extent, private cars (Indiasold 3.4 million cars in 2018, putting it in fifth place globally behind China, the U.S., Europe and Japan).

Unfortunately, this chain of events has also created the perfect 'pollution' storm. In terms of PM2.5 levels, India has seven out of the world's ten most polluted cities: Bhiwandi, Faridabad, Ghaziabad, Gurugram, Lucknow, Noida and Patna. As reported by Greenpeace, such levels contribute to 1.2 million deaths yearly. The result is also a large dependence on oil imports, a national security risk, as India produces only 18% of the four million barrels of oil it consumes daily.

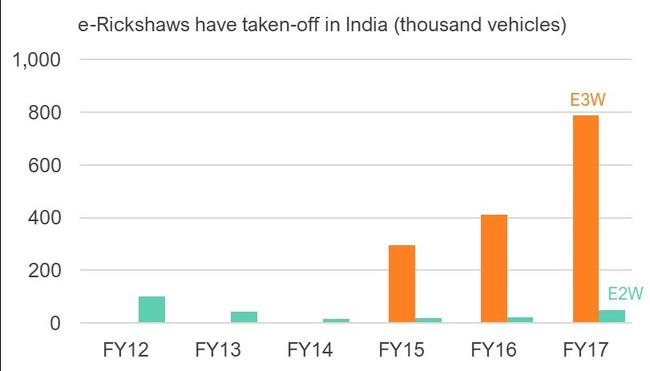

The Indian government is steadily turning to electrification to address these issues. It introduced a subsidy for electric rickshaws, scooters and cars in 2015 called FAME II (FAME I was canceled by 2013), which has since grown the market steadily, as shown in the chart below. There are also plans for an EV mandate, which would send a clear message to OEMs to invest in producing electric models (although such a mandate has not yet been officially confirmed).

The low hanging fruit is certainly two-wheelers: India sold some 20 million petrol scooters in 2017, most under 200cc, accounting for around 80% of vehicle sales in the country and 45% of the global motorcycle market. Electrifying this segment would go a long way towards reducing the country's air pollution. Like traditional motorcycles, electric two-wheelers are also much cheaper than larger vehicles because the most expensive component -- the battery -- is much smaller.

At the other end of the spectrum, buses remain a significant mode of transport in India whilst private cars remain largely unaffordable. Indeed, according to Hero Electric, India's market leader for electric motorcycles, 11.4% of travelers go by bus compared with 2.7% by car and 12.7% by scooter. Therefore, deployment of electric buses is also on the agenda, and recently the Inter-ministerial Committee for Electric Vehicles in India sanctioned 5595 electric buses to be deployed across 65 cities; to help supply this emerging industry with large batteries, India is further planning 40GWh of battery production over the next ten years. At the other end of the spectrum, buses remain a significant mode of transport in India whilst private cars remain largely unaffordable. Indeed, according to Hero Electric, India's market leader for electric motorcycles, 11.4% of travelers go by bus compared with 2.7% by car and 12.7% by scooter. Therefore, deployment of electric buses is also on the agenda, and recently the Inter-ministerial Committee for Electric Vehicles in India sanctioned 5595 electric buses to be deployed across 65 cities; to help supply this emerging industry with large batteries, India is further planning 40GWh of battery production over the next ten years.

IDTechEx | www.idtechex.com

.jpg?r=7690)

.gif?r=5824)

.jpg?r=1424)