The Evolution of Solar Finance

The early days of solar investing

The early days of solar investing

It was not that long ago solar energy developers needed to convince a capital partner there was enough sunshine in New Jersey to power homes. The uncertainty of the market, questions about the reliability of the photovoltaic panels themselves, and unfamiliarity with power purchase agreements caused significant challenges to get new projects financed. Over time, as the right policies began to align, projects were built and the cost of solar panels declined. The risks began to mitigate allowing more capital to enter the market and reduce transaction costs. Cheaper deals meant better prices for the power, better prices meant more deals, and the solar marketplace grew exponentially. Today, solar is competing for a share in the $5 trillion renewable energy market projected for 2030. This changing business landscape leads us to the next phase of solar finance.

Policy innovations drive down costs

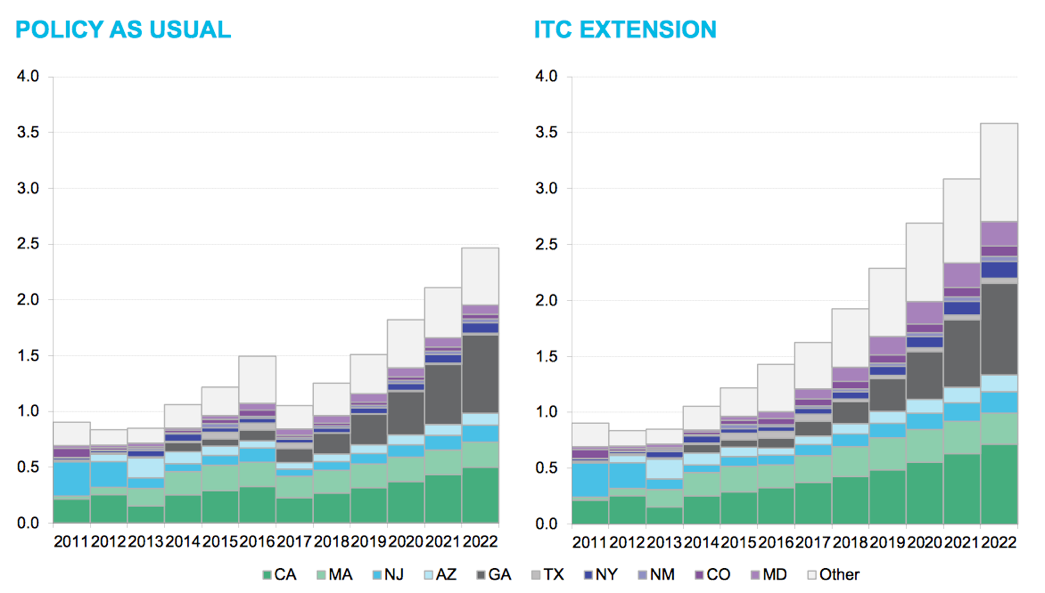

President George W. Bush signed the Energy Policy Act of 2005 which had tremendous bipartisan support and ushered in solar, along with other renewables. It established the Section 48 Investment Tax Credit (ITC), providing a lucrative 30% tax credit for solar projects. Leaders at the time saw this as a transformational tool to allow this nascent technology that had been hanging around for 30 years to compete against traditional energy sources. Over the course of the next few years, other policies aligned at the state level, and then a combination of the ITC and appropriate technology advancements bolstered the solar industry, with the number of solar installations truly accelerating around 2010 and beyond.

Early clean energy investors took on an incredible amount of risk while earning high returns. Today, most of the risk around technology has been mitigated. Better engineering and data analytics can predict power generation capacity and thus the expected returns from a project. Access to clear information makes solar assets even more lucrative for investors.

Solar investing in a post ITC world

Solar investing in a post ITC world

It is also important to note, if developers or owners of these assets utilize the Section 48 Investment Tax Credit, they are restricted by the IRS from transferring ownership for five years. This brings us to today. We are now seeing the first generation of early solar projects being bought and sold in the marketplace post their ITC hold. In recent years, the Yieldcos recognized if they come in on year six of a 20-year Power Purchase Agreement with a strong customer, these projects can be tremendous cash flow yielding assets. The opportunity of high yielding assets

These yields can look tremendously attractive to more conservative investors who are interested in holding long, optimizing assets, and receiving predictable cash flows from the Power Purchase Agreements. While YieldCos have hit a few bumps in the road, they still demonstrate the basics of economics around the long term yields solar projects provide.

Since YieldCos raise money from public markets, even if they make appropriate economic investments in high yields, a panicked market can hurt their stock prices. So there are other ways to address these markets such as the booming financial tech (FinTech) industry which allows accredited investors to purchase direct equity in existing projects or portfolios. This eliminates the public market risk, but still provides access to these yields.

Why solar is such a great investment today

The yields are real. This is the unique opportunity operating, cash-flowing solar projects provide, and they can be a great investment for new investors beyond the traditional, large banks, private equity firms, and tax equity investors. Data models now provide significant clarity on the revenue coming in over the life of these deals. Institutional investors, family offices, or even individuals, who may not like the risk exposure of new build projects, can now get into solar through operating assets. This is the evolution of solar finance.

Clean energy for all: going solar through investment

Clean energy for all: going solar through investment

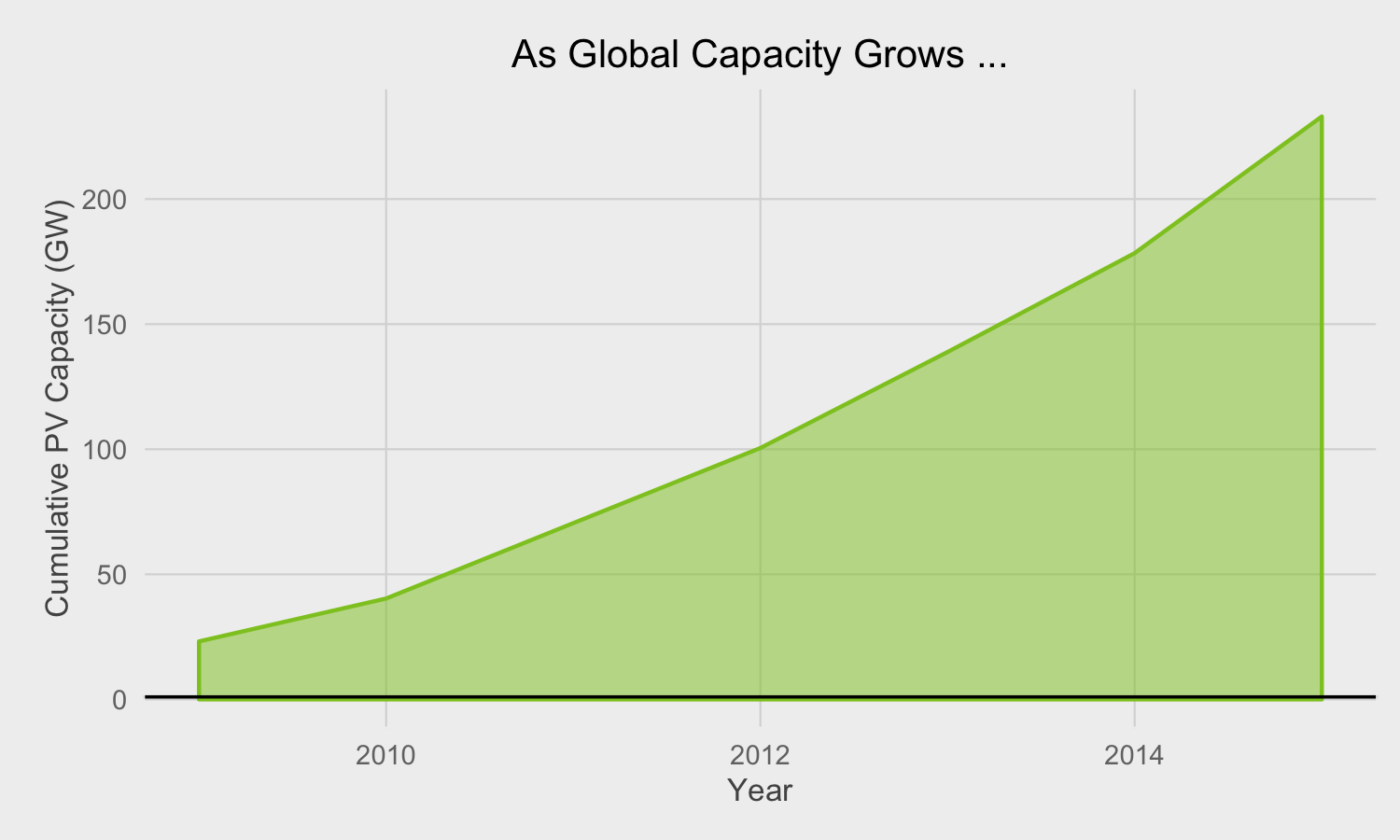

The US solar market is projected to grow by 25-50% this year, and 30% globally. Figure 1 is a great snapshot of this growth, and makes clear the expanding investment opportunity this market presents.

Continued growth means a continued need for new capital to enter into the market. Operating projects provide the gateway to get investors familiar with the asset class and also helps developers exit their current portfolios. These developers, who have a higher risk tolerance, are looking for exit opportunities to access capital and address their future pipeline. More capital coming into the market as a whole will accelerate the continued growth of the industry.

The first million solar panels took over 62 years to be installed, but the next million solar panels will come online in the next 2 years. This market expansion means more assets will mature and become available for investment. Clean energy investments, and solar in particular, have proven to be very reliable. The next generation of clean energy financing will see a reduction in the barriers to marketing these lucrative deals, and an expansion in the pool of potential investors. Millions will have the opportunity to go solar, not only through direct installations at the residential, commercial, and industrial scale, but also through their investment portfolios.

Jon Powers is the co-founder of CleanCapital and former White House federal chief sustainability officer.

Clean Capital | www.cleancapital.com

Image sources: Global Market Outlook 2015-2019. Solar Power Europe; Global Market Outlook for Photovoltaics 2014-2018, European Photovoltaic Industry Association

Volume: 2016 November/December

.jpg?r=2533)

.gif?r=1544)

.jpg?r=7607)